Dolly Varden looks to repeat last year’s exploration success, with initial results returning high silver grades – Richard Mills

2023.08.19

It appears that Dolly Varden Silver Corp. (TSXV: DV) (OTC: DOLLF) could see a repeat of last year’s exploration success at its Kitsault Valley project in British Columbia. The company is already off to a flying start in its 2023 campaign, with initial drilling from the key two key areas (Kitsol and Torbrit) returning high-grade silver mineralization over wide intervals.

Highlighted results from the Kitsol vein in the Torbrit deposit area include the following (Intervals are core length; true widths vary from 64 to 87% of core length interval):

- DV23-334: 297 g/t Ag over 8.32 metres including 1,090 g/t Ag over 0.90 metres at Kitsol;

- DV23-336: 342 g/t Ag over 18.00 metres including 2,270 g/t Ag over 0.50 metres and 995 g/t Ag with 3.6% Pb over 0.60 metres at Kitsol;

- DV23-337: 496 g/t Ag over 9.57 metres including 1,100 g/t Ag over 0.73 metres at Kitsol;

- DV23-348: 334 g/t Ag over 3.50 metres including 672 g/t Ag over 1.34 metres at Torbrit Main, south extension.

Kitsol Vein Extended Closer to Surface

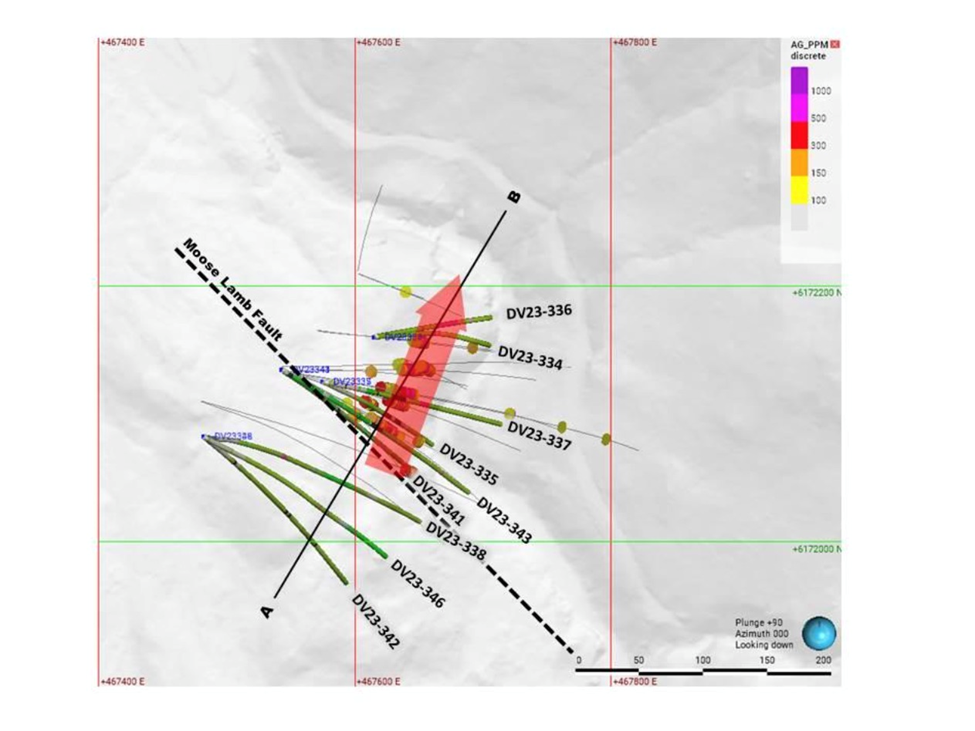

As disclosed in Dolly Varden’s August 8th news release, holes DV23-334 and 336 extended the plunge extent of the wide, high-grade silver mineralization at the Kitsol Vein for an additional 40 metres towards surface. The plunge direction has been extended to over 250 metres from the furthest southwest intercept, down plunge in drill hole DV22-323, as shown in the below figure.

Drilling has identified a consistent, high-grade interval within the wide vein interval, associated with multiple phases of brecciation (such as holes DV23-334 and DV23-336), the company said.

Meanwhile, drill holes DV23-335, 337, 341 and 343 tested the high-grade shoot along strike; hole DV23-337 was a 41-metre step-out, up plunge from DV18-131, confirming the consistent vertical dimension of the shoot to be of 50-75 metres, along the length of the plunge. The remaining holes intersected the Kitsol Vein, either above or below the higher-grade mineralized shoot.

Exploration holes to the west, testing for new structures in the hanging wall of the Moose Lamb fault, encountered a block of the Kitsol Vein in drill hole DV23-338 within a fault splay. The Dolly Varden team believes that further modelling with the new oriented core data will guide targeting of the possible offset of the Kitsol Vein across the Moose Lamb fault.

At the southern end of the Torbrit Main deposit, drill holes DV23-348 and 350 were collared as a 31-metre step-outs testing for the mineralized horizon. DV23-348 intersected mineralization consistent with the lower sequence of the basin fill-style silver zone at Torbrit, within potassic and chlorite altered volcanic tuff.

Expanded Drilling Program

In the same news release, the company also announced that due to drilling success and efficiencies, a fifth drill has been mobilized to site, and the 2023 program has been expanded by approximately 10,000 metres to 55,000 metres of drilling. Over 70 drill holes have been completed to date this season.

According to DV, the 15 km long extent of the prospective Hazelton rocks on the property is host to numerous surface occurrences of alteration and silver mineralization that have been prioritized for drill testing.

With the addition of approximately 10,000 metres to the initial 45,000-metre planned program, the extra drilling will be allocated to discovery-focused exploration targets. Efficiencies and excellent drill production have allowed for the additional drilling within the current budget, the company said.

In addition, an MT geophysical survey conducted by Simcoe Geoscience has commenced. The ground survey will be run over post-mineralization sedimentary rocks over the centre of the valley.

Additional surveys will be performed to the area west and north of the company’s Homestake Ridge property, where extensive gold in soil anomalies coincident with strong quartz-sericite-pyrite (QSP) alteration in interpreted to suggest a possible source at depth for the structurally-controlled gold-silver mineralization at Homestake Main and Homestake Silver deposits.

Kitsault Valley Project Overview

Located in the prolific Golden Triangle region of northwestern British Columbia, the Kitsault Valley project represents the amalgamation of Dolly Varden’s original namesake silver property and its newly acquired Homestake Ridge gold-silver property.

This 163-square-kilometre land package is said to host one of the largest undeveloped high-grade precious metals projects in all of Western Canada. Its combined mineral resource is estimated at 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in the inferred category (see table below).

While the resource is already impressive at this stage, the more fascinating aspect of the project is its rich history, which can be traced back to the early 20th century when Scandinavian prospectors first made the silver discovery in what is now the Stewart Complex.

Within the boundaries of the company’s original property are two past-producing silver mines: Dolly Varden and Torbrit, which formed a prolific silver mine camp starting in 1919 that produced more than 20 million ounces in the span of 40 years, with assays as high as 2,200 ounces per tonne.

It should be noted that Dolly Varden was among the most important silver mines in the British Empire during its heyday.

Other historically active mines in the area include North Star and Wolf, which remain underexplored to this day. Together, the four deposits comprise about 90 square kilometres within the Stewart Complex.

While these deposits were already enough to work with, DV always believed that the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits on the same trend such as Eskay Creek and Brucejack (see map below).

Towards the end of 2021, the company further consolidated its position with the acquisition of Homestake Ridge, which occupies the northern half (~75 sq km) of Kitsault Valley. This project features a high-grade gold and silver resource from three known deposits that the company believes can be converted into higher-confidence categories.

Jewerly Box-Style Mineralization

Last year, DV embarked on a comprehensive drill program at Kitsault Valley, specifically aimed to expand the wide, high-grade silver mineralization at Wolf Vein, step out and infill at Torbrit and the nearby Kitsol Vein, and test several other nearby exploration targets on the property.

Results of that program, totalling 37,000 metres of drilling in 108 holes, split equally between resource expansion at Homestake and Torbrit deposits and looking for discoveries along the Kitsault Valley trend, were indeed eye-catching.

In summary, the grade and consistency of silver mineralization from both the Kitsol and Wolf veins indicated the potential for an underground bulk-mineable deposit. Specifically, the Wolf vein area is emerging as a large system that is rivaling the Torbrit deposit, the company said at the time.

Additionally, drilling from the newly acquired Homestake Ridge property also demonstrated the strong continuity of mineralization over wide intervals similar to that of Kitsol and Wolf.

According to the company, not only were the reported gold and silver grades some of the highest from the property to date, but they were also up there with the best of the entire Golden Triangle region during the 2022 drilling season.

Earlier this year, DV saved its best for last, reporting the highest silver assay received to date from the Dolly Varden property. Drilling during the 2022 season at the northern limits of the Wolf deposit returned an 8.77-metre intercept of 1,499 g/t silver, 1.89% lead and 0.46% zinc. Within that intercept was what the company called a “jewelry-box-style” mineralization, grading 23,997 g/t silver, 1.24% lead and 0.34% zinc over a true width of 0.19 metre.

Towards the southern limits of the Wolf vein, drilling in 2022 also encountered 321 g/t silver, 0.84% lead and 0.84% zinc over 12.85 metres, including 664 g/t silver, 1.24% lead and 3.54% zinc over 1.63 metres.

Conclusion

Following a breakthrough year of exploration at the Kitsault Valley project, Dolly Varden is well on its way to another successful drilling season, with initial results already showing high-grade mineralization and extending the Kitsol Vein closer to surface.

The fact the company has added another drill rig to what was already a bigger drill program this year should give shareholders plenty of excitement for the rest of 2023. More encouraging assays, perhaps exceeding those from last year, along with new discoveries should no longer be a surprise.

A report by Haywood Capital Markets noted that under the current precious metals price environment, there is “real value in the non-producers” which are being ignored by the general market. Dolly Varden, interestingly, sits near the top of all exploration companies listed by Haywood.

Haywood’s analysts say the company is in the best position with integrated and collective geological knowledge of the trend to truly test for growth and discovery at a scale. DV currently has over $20 million in cash, which should be more than enough to deploy into its exploration programs.

Also bullish on the company is Research Capital Corp., which reiterated its Speculative Buy rating and a price target of $1.35 per share for Dolly Varden, more than double its current stock price.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.67, 2023.08.17

Shares Outstanding 254.6m

Market cap Cdn$170.2m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.