Markets for rice and wheat tightening – Richard Mills

2023.08.11

The markets for two of agriculture’s staple crops, rice and wheat, are under supply pressure, potentially putting millions that depend on the grains for sustenance at higher risk of hunger and food insecurity.

The prices of both commodities have been volatile over the past year and a half. Wheat hit an all-time high of $1,030 per tonne in May of 2022, weeks after Russia’s invasion of Ukraine, but has since retreated to about $635, mainly due to normalization of Ukrainian wheat shipments through Black Sea ports, owing to the Black Sea Grain Initiative between Ukraine and Russia.

That deal, however, is kaput. On July 17 Russia terminated the agreement, which allowed almost 33 million tonnes of food to be exported from Ukraine since August, 2022 — saying that conditions for the deal’s extension, including an end to sanctions on the Russian Agricultural Bank, had not been fulfilled.

The International Rescue Committee calls the grain deal a “lifeline for the 79 countries and 349 million people on the front line of food insecurity” (Al Jazeera, July 17, 2023). But with shipments of Ukrainian grain effectively stalled, that lifeline is no longer available.

Meanwhile a crisis in rice, the primary food source for over half the world’s population, is mounting, with tight supplies leading to much higher prices.

A May report by Fitch Solutions via Zero Hedge, forecasted this year’s global rice production will log its biggest shortfall in two decades. Last month, Bloomberg quoted a Harvard professor who warned: “There is considerably more reason for concern now that rice prices in Asia could spiral out of control pretty quickly.”

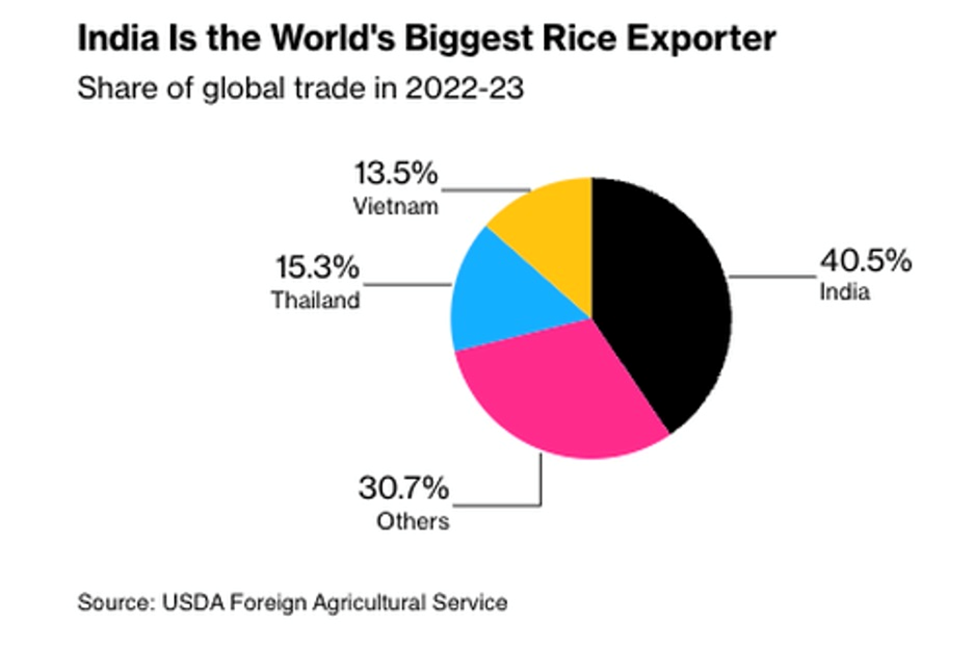

Among the factors supporting that prediction, are India’s move to ban some rice exports to ensure adequate domestic supplies; and Thailand asking farmers to switch to crops that use less water due to drought. India and Thailand are the world’s number one and two rice shippers.

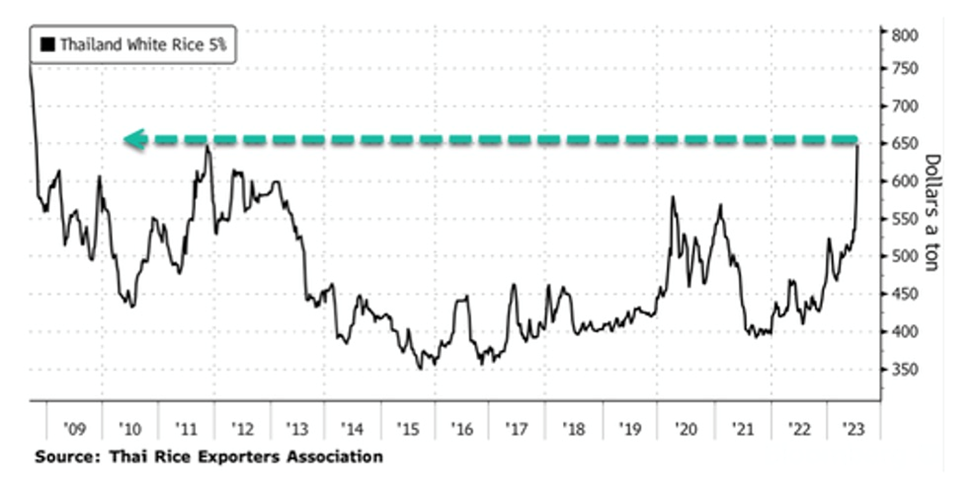

On Wednesday, the Thai Rice Exporters Association revealed that the price of Thai white rice 5% broken, a key Asian benchmark, reached the highest level since the financial crisis. This surge is mainly attributed to increasing fears of a global shortage due to the damaging effects of the El Nino weather phenomenon on Asian farmlands and India’s recent decision to restrict certain rice exports.

Thai white rice 5% broken hit $648 per ton this week, the highest level since October 2008. Prices are up over 50% since the start of 2022…

A tight global rice market is expected to raise food inflation for major rice importers such as Indonesia, the Philippines, Malaysia and Africa.

Meanwhile, according to Zero Hedge, The latest report on global food prices from the Food and Agriculture Organization of the United Nations showed the global food index, which tracks monthly changes in the international prices of globally-traded food commodities, jumped the most in 18 months.

Returning to wheat, the Black Sea Grain Initiative was a deal brokered between Russia and Ukraine by the United Nations and Turkey, that resulted from Ukraine’s exports dropping to a sixth of their pre-war level. Ukraine and Russia are among the world’s largest wheat exporters, and the blockade in the spring of 2022 caused prices to rise dramatically, as the chart below shows.

The accord created a safe corridor for Ukraine’s grain exports from three Ukrainians ports, thus helping to avert famine by injecting more wheat, sunflower oil, fertilizers and other products into world markets, Al Jazeera reported. It also helped to bring down prices.

Now with the deal off, Russia is again restricting grain shipments from Ukraine, and has gone so far as to attack Ukrainian agricultural and port infrastructure.

Tensions have escalated in the Black Sea region as well as at Izmail, Ukraine’s main inland port across the Danube River from Romania.

On Aug. 2, CNBC reported Russia destroyed buildings and halted ships as they prepared to arrive at Izmail to load up on Ukrainian grain, in defiance of the de-facto blockade Russia re-imposed in mid-July.

The port is the main alternative route for grain exports out of Ukraine, because Russia has halted traffic at Ukraine’s Black Sea ports.

The attack caused Chicago wheat prices to climb by nearly 5%.

According to CNBC,

Moscow has described its recent attacks on Ukraine’s grain infrastructure as retaliation for a Ukrainian strike on a bridge to Crimea, used to supply its troops in southern Ukraine…

Kyiv says the goal of the strikes is to reimpose Russia’s blockade by persuading shippers and their insurance companies that Ukrainian ports are unsafe to resume exports…

Moscow says it will treat ships heading to Ukrainian seaports as potential military targets.

Ukrainian officials have said Moscow has hit 26 port facilities, five civilian vessels and 180,000 tonnes of grain in nine days of strikes since quitting the grain deal.

Meanwhile, Russian grain ports are overflowing after two big harvests, causing storage headaches. The country reportedly shipped 4.4 million tons of wheat in July, a monthly record and almost 60% above average.

More importantly, the extra shipments mean that any military escalation in the Black Sea risks depriving the world of huge amounts of crops it’s counting on. (Bloomberg, Aug. 9, 2023)

Bloomberg also warned that Any escalation in the Black Sea could have big knock-on effects for global grain trade.

Kyiv has sought ways to retaliate against the Kremlin’s efforts to cripple its grain exports. On Aug. 5 a Ukrainian naval drone hit a Russian oil tanker off the coast of Crimea — the second such naval attack in a 24-hour period, after the scuppering of a Russian landing ship on Friday outside the Black Sea port of Novorossiysk. (The Guardian, Aug. 5, 2023)

With Ukrainian grain exports blocked, and shipments from Russia facing storage issues, it falls to the other major grain exporters, including Canada, to take up the slack.

In March, Reuters said that increased crop plantings to counter the impacts of the Russo-Ukraine war on global grain supplies are not enough to ward off further risks of disruption.

While larger-than anticipated Russian wheat exports (not subject to sanctions), and bumper harvests in Australia and Canada helped to offset sharply reduced Ukrainian wheat shipments, the news service also quoted a senior research fellow at the International Food Policy Network saying that global grain stocks remain tighter than normal.

Moreover, according to U.S. Department of Agriculture data, Global wheat stocks are projected to thin to just over a three-month supply by the end of the 2022/23 season, the tightest in eight years.

On the other hand, concerning there being enough food to feed the world, the United States and Canada have roles to play, being the fourth and sixth, respectively, largest wheat producers in the world.

Earlier this year, the U.S. Department of Agriculture said it expects an increase in the US grain harvest this year, which includes wheat, corn and soybeans.

Farm Progress reported that Wheat acres jumped up much higher than the trade was expecting to 49.5 million acres on the heels of a massive winter wheat expansion last fall. If realized, it will be the largest wheat acreage sown since 50.1 million acres of wheat were planted in the 2016 growing cycle.

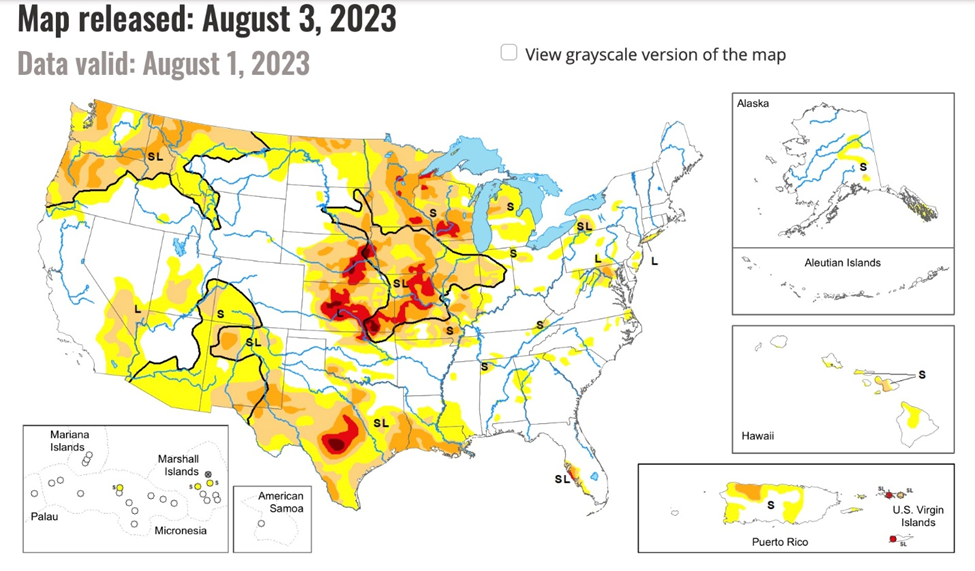

However, the publication admitted, Considering that most of the major hard red winter wheat growing area remains in drought, the wheat yield estimate may be a stretch.

According to NASA Earth Observatory, while Kansas normally produces about a quarter of US winter wheat, that may not happen this year due to a drought that has gripped the state for much of the growing season.

Data from U.S. Drought Monitor indicated about two-thirds of the Kansas wheat crop faced extreme or exceptional drought conditions for much of 2023.

Source: U.S. Drought Monitor

Prior to harvest, the USDA Economic Research Service projected the state’s farmers would produce 191 million bushels of wheat 2023, the smallest crop since 1961.

Canada showed it is more than capable of replacing Ukraine as a source of wheat to Indonesia, for example. According to The Western Producer, Ukraine shipped 345,600 tonnes of wheat to Indonesia in the first half of 2022-23, down from 2.7 million tonnes a year ago. Meanwhile, Canada increased its sales to the Asian country by 66%.

As for whether Canada can grow more wheat, the answer is clearly yes. Canadian farmers harvested 28.38 million tonnes of non-durum wheat in 2022, a 46% improvement over 2021, a drought year.

The farmers also told Statistics Canada they intend to plant 19.4 million acres of spring wheat in 2023, 7.5% more than last year. The Western Producer says total wheat plantings including durum and winter wheat are forecast at 27 million acres, the biggest crop since 2001.

Compare this to Ukraine’s dismal wheat harvest, with Citi Research forecasting just 16.5 million tonnes this year, half of what was grown in 2021 before the war.

Taking a longer view, however, the propensity for Canadian wheat production to increase markedly is limited by the amount of land being taken out of agricultural usage designations.

CBC News reports the amount of land suitable for crops, so-called arable land, is rapidly diminishing, with the country losing the equivalent of three farms a day.

The story quotes the Census of Agriculture, which found that total farm area is down 8% in the last two decades, from 68 million hectares in 2001 to 62 million in 2021.

Most of the arable land is being lost to cities, such as the “Golden Horseshoe” around Toronto.

There has not only been a decline in total farm area, but in the number of individual farms — down 23% over a 20-year period. Ontario is losing an average of nine family farms a week.

Instead, farms are getting bigger and consolidating. While in 2001, the average Canadian farm was 274 hectares, in 2021 it was 327. In 2016, giant Prairie farms larger than 2,000 ha owned nearly a third of all farmland, states a report from the Canadian Centre for Policy Alternatives.

Finally, farmland is becoming much more expensive. A report from Farm Credit Canada shows the average price per hectare quadrupled in 20 years, meaning it is increasingly difficult for young Canadians to gain access to farmland and make farming a career choice.

Conclusion

The United Nations has warned of a potential food crisis and hunger in the world’s poorest countries because of Russia’s decision to abandon the Black Sea Grain Initiative.

The latest report from the UN’s Food and Agriculture Organization showed food prices rose the most in 18 months.

Russia is back to restricting wheat exports from Ukraine, and has carried out attacks on Kyiv’s agricultural and port infrastructure. In retaliation, Ukraine has attacked Russia ships in the Black Sea, escalation tensions on this vital shipping route.

Wheat prices are down considerably since their peak in the spring of 2022, but they are on their way back up. Storage problems at Russian grain ports and drought conditions in the United States are two other reasons the wheat market is getting tighter.

Global wheat stocks are projected to thin to just over a three-month supply by the end of the 2022/23 season, the tightest in eight years.

The same thing is happening to the rice market. A May report by Fitch Solutions forecasted this year’s global rice production will log its biggest shortfall in two decades. Major causes include flooding in rice-producing nations like China and Pakistan, and India’s export ban on non-Basmati white rice — a staple food item for about half of the world’s population.

Top destinations for Indian rice include Bangladesh, China, Benin, and Nepal. Other African countries also import a large amount of Indian rice.

According to the 2023 Global Report on Food Crises, last year saw a 33% spike in the number of people facing hunger, up from 193 million in 53 countries and territories in 2021. 2022 was also the fourth consecutive year that an increasing number of people experienced Phase 3 food insecurity, says the report, written by the Global Network Against Food Crises and the Food Security Information Network.

Unfortunately, the situation is unlikely to improve in 2023, due to several intertwining factors: rising input costs due to inflation, supply chain disruptions, and extreme weather i.e., flooding and droughts.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.