Mantaro evaluating resource expansion opportunity at Golden Hill with tailings sampling program – Richard Mills

2023.07.31

Looking to build on the recently announced inaugural resource estimate for its Golden Hill property in Bolivia, Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) has now started a tailings sampling program on the property.

The aim of this program is to quantify the gold content within the estimated 600,000 tons of historical tailings at Golden Hill, with the ultimate goal of evaluating the potential for re-processing via heap leaching and increasing the resource base.

Mantaro says this study will build upon its previous preliminary tailings sampling program completed in 2021, which consisted of 16 samples and yielded an average gold grade of 1.33 grams per tonne with 96% of the gold recoverable via cyanide leaching.

According to the company, the new study is designed to provide a more accurate representation of the quantity of gold contained within the tailings, further assess reprocessing options, and potentially expand on the resource.

The results obtained from this tailings sampling campaign will form a quantitative dataset from which NI-43-101 compliant resource estimates can be calculated — which will in turn feed into a preliminary economic study on Golden Hill, Mantaro adds.

“The results of this tailings sampling campaign will serve as a crucial foundation for future decision-making regarding re-processing strategies of tailing and potential resource expansion opportunities within Golden Hill,” Darren Hazelwood, Mantaro’s CEO, commented in a July 26 press release.

2021 Metallurgical Test

In 2021, Mantaro completed the first ever metallurgical testwork at the Golden Hill property. The test was conducted by SGS Canada at its facility in Lakefield, ON. The preliminary results provided insights into gold grade and distribution, and demonstrated the gold recoveries of both gravity separation and cyanidation of underground material.

As part of the test, Mantaro collected 10 tonnes of mineralized quartz vein material from two production blasts on the -55 m level of the C2 vein at La Escarcha mine (see figure below). Each blast was approximately 5 tonnes.

The entire sample was crushed at site using the first-stage jaw crusher of the existing onsite processing plant. This produced a bulk sample with a nominal 3 to 5 cm fragment size. Seventeen randomized 10 kg sub-samples were taken from the crushed 10-tonne production sample. In total 170 kg of material was shipped to SGS.

To determine the head grade, SGS took a one-kilogram sub-sample from each of the 10 kg samples, which left 9 kg samples that were then composited into a 153 kg master underground sample.

The one-kilogram samples were crushed and pulverized, and two 30 g pulp samples were submitted for gold analysis by fire assay. Assay results ranged from 0.72 g/t Au to 26.6 g/t Au — with an average head grade for all 34 fire assays samples of 53 g/t Au.

Four six-kilogram sub-samples were taken from the 153 kg master underground sample. Each six-kilogram sample was split into one-kilogram, two-kilogram and three-kilogram sub-samples and presented to cyanide bottle roll. The weighted average head grade of the 12 sub-samples submitted to cyanide bottle roll was 96 g/t Au.

According to Mantaro, the purpose of the head grade determination using two different methods was to better understand gold heterogeneity and sub-sampling protocol prior to diamond drilling. The fact that two very different sub-sampling protocols and analytical methods returned very similar weighted average head grades — 5.53 g/t Au by fire assay and 5.96 g/t Au by cyanide bottle roll —suggests that use of a large sub-sample protocol will provide representative grades of planned diamond drill core samples, it says.

A 10 kg sample was also taken from the master underground sample and submitted for gravity separation. Results indicate that 73.6% of gold can be recovered by this method.

In addition to the bulk underground sample, 16 samples each of approximately 5 kilograms, were collected from historical mine tailings at Golden Hill.

Upon arrival at SGS, a 1 kg sub-sample was taken from each of the 16 samples, and submitted for gold analysis by cyanide bottle roll, in order to determine head grade. This methodology allowed a larger sample to be analyzed and should produce a more statistically representative result. The overall cyanidation gold recovery was high with an average of 96% (92.3 to 97.0%), under unoptimized conditions.

Given that the underground bulk sample comprises primary sulphidic mineralization that has not been oxidized, it is extremely encouraging that 73.6% of gold presents to a Knelson Gravity concentrator in a single pass. That cyanide recovers 96% of gold in gravity tailings, and 94% of gold in run-of-mine bottle roll tests, indicates optionality of recovery flow-path, the company said at the time.

Potential to Boost Resource

This year’s tailings sampling program will build on the promising results from 2021, as Mantaro continues to seek opportunities to boost its resource base.

Earlier this month, the company published the inaugural resource estimate for Golden Hill, containing 857,000 tonnes of material in the inferred resource category at a grade of 4.4 grams per tonne (g/t) gold for 121,000 ounces of gold (at a 1.5 g/t gold cut-off grade).

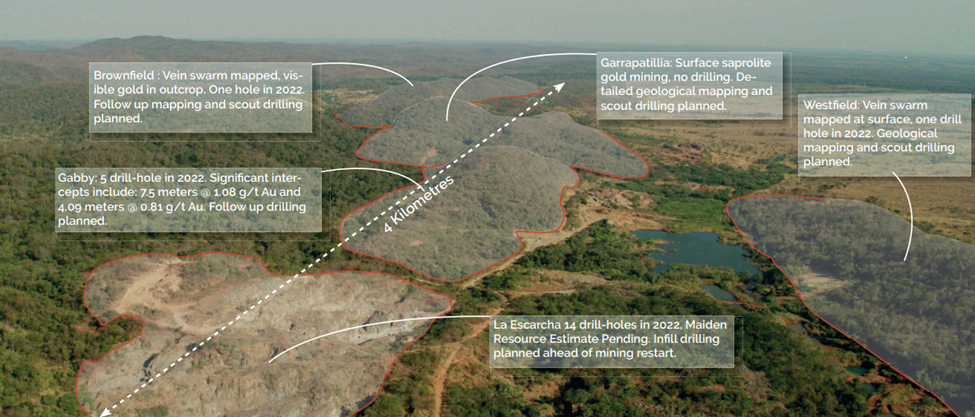

This estimate, however, was only centered on La Escarcha prospect, one of the four vein swarms hosted along a regional shear structure that were historically mined for gold.

Of the initial drill program (> 3,000 m, 21 holes) completed by Mantaro last year, 14 holes totalling 2,405 metres were drilled at La Escarcha, focusing on a strike length of only 400 m to a vertical depth of generally <100 m. The remainder were drilled as scout reconnaissance holes at other prospects.

In addition to the mapped vein swarms, there are an additional 6+ km of untested regional structures that are shedding alluvial gold in many places on the Golden Hill property, Mantaro says.

Highlighted from the initial drill program (as shown in the figure above) include the following:

- 3.57 g/t gold over 14.00 m (including 4.91 g/t gold over 8.80 m) from 105.0 m;

- 8.27 g/t gold over 3.40 m (including 11.82 g/t gold over 2.02 m) from 67.60 m;

- 7.57 g/t gold over 5.00 m (including 10.16 g/t gold over 3.66 m) from 87.00 m;

- 2.70 g/t gold over 15.02 m (including 8.47 g/t gold over 3.10 m) from 64.53 m; and

- 6.46 g/t gold over 4.0 m (including 12.73 g/t gold over 2.00 m) from 76.00 m.

“Drilling to date by Mantaro focused on a very small section of a much larger vein system and targeted the near-surface depth extension of outcropping mineralization to vertical depths of generally <100 m. The maiden resource estimate gives us significant optionality on a go-forward basis. Mineralized zones are generally steeply dipping, up to 13 m wide, and are near surface,” CEO Hazelwood said.

Golden Hill Project

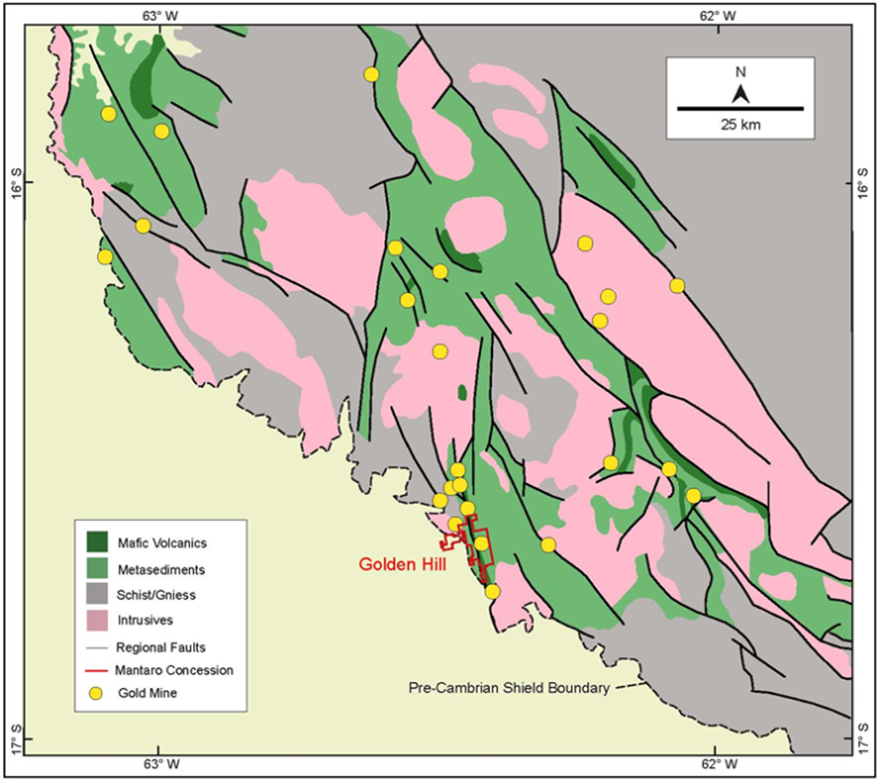

Mantaro’s Golden Hill property is situated in the underexplored Precambrian Shield, comprising a fully permitted, 5,976-hectare mining concession that was mined historically from alluvial drainages along a 6-km trend. It currently hosts at least six significant gold occurrences and deposits (including Golden Hill) along a 25 km strike.

The mineralization at Golden Hill is of greenstone-hosted orogenic gold type. Gold is contained within 1-5m wide sub-vertically dipping quartz shear zones, typically found along faults at the contacts between mafic volcanic and metasedimentary units of pre-Cambrian age.

According to Mantaro, the deposit types found in this region have the potential for kilometres of strike extension and kilometre-depth potential.

The vein system has so far been traced for over 4 km on the property, located in the hanging wall of a regional controlling fault to the west. This style of mineralization can be observed across the region and notably 2 km to the north of the property at the former gold mine, which produced over 350,000 oz between 1997 and 2003.

From a regional perspective and comparison with other greenstone belts worldwide, Golden Hill is, without a doubt, an attractive project, says Mantaro.

The Bolivian Pre-Cambrian shield is larger than the famous Abitibi greenstone belt in Canada, yet it has only produced less than 10 million oz compared to 170+ million oz in the Abitibi from over 100 mines since 1901.

To date, four major gold mineralized zones (La Escarcha, Gabby, Garrapittilia and Brownfields) have been identified across the 4 km strike length. Historical drilling on the property was only limited to the La Escarcha pit area.

As such, the focus of the company’s drilling — and the maiden mineral resource estimate — has been the La Escarcha zone.

The Golden Hill resource is found to be hosted within several closely-spaced, sub-vertical to vertical, gold-mineralized shear zones with true widths of up to 13 metres.

However, this could be easily expanded since the mineralization at La Escarcha is open in all directions, and Mantaro noted it already has a number of high-reward, relatively shallow step-back and step-out drill holes around the resource area.

The deep potential at La Escarcha is also highly prospective, the company added. There are multiple quartz vein targets hosted along the main controlling structure yet to be drill tested, and an additional 6 km of the regional structure shedding alluvial gold that is yet to be mapped and sampled.

“That Mantaro was able to define a maiden mineral resource estimate after only 2,405 metres of angled diamond drilling, is a testament to the technical teams understanding of the mineralized system and deposit, their ability to generate high-reward near-surface drill targets and the exceptional caliber of the deposit,” Dr. Chris Wilson, principal consultant to Mantaro, noted.

Conclusion

While Mantaro gets the Golden Hill tailings sampling program underway, the company is also looking at a bigger drill program of up to 5,000 metres. The goal is simple — to test various drill targets it has identified around the La Escarcha resource area.

The company regards the maiden resource released this month to be only a proof-of-concept, as the depth potential of the La Escarcha open pit has yet to be drill tested. The next phase of drilling will focus on the along-strike extension and deeper extension of mineralization to depths of approximately 300m vertical.

The upcoming drilling will also test the exploration potential of three other mineralized zones: Gabby, Brownfields and Westfield. Sampling could also occur on the over 6 km of unmapped regional structures that have shed alluvial gold into drainages on either side.

Should everything go according to plan, all of the drilling and sampling results will be used to support Mantaro with the next milestone of the Golden Hill project: a preliminary economic assessment (PEA). The PEA is the first signal to the public that a mineral project has potential viability, which generally causes plenty of excitement amongst investors.

Mantaro Precious Metals Corp.

TSXV: MNTR, OTCQB: MSLVF, FSE: 9TZ

Cdn$0.045, 2023.07.28

Shares Outstanding 71.2m

Market cap Cdn$3.2m

MNTR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Mantaro Precious Metals Corp. (TSXV:MNTR). MNTR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of Mantaro Precious Metals Corp.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.