Dolly Varden, a top junior miner pick in current precious metals bull market – Richard Mills

2023.07.21

It may not seem like it, but the precious metals market is still (and has been since the start of the year) in bullish territory, supported by a multitude of economic and geopolitical risks eroding many of the other popular asset classes.

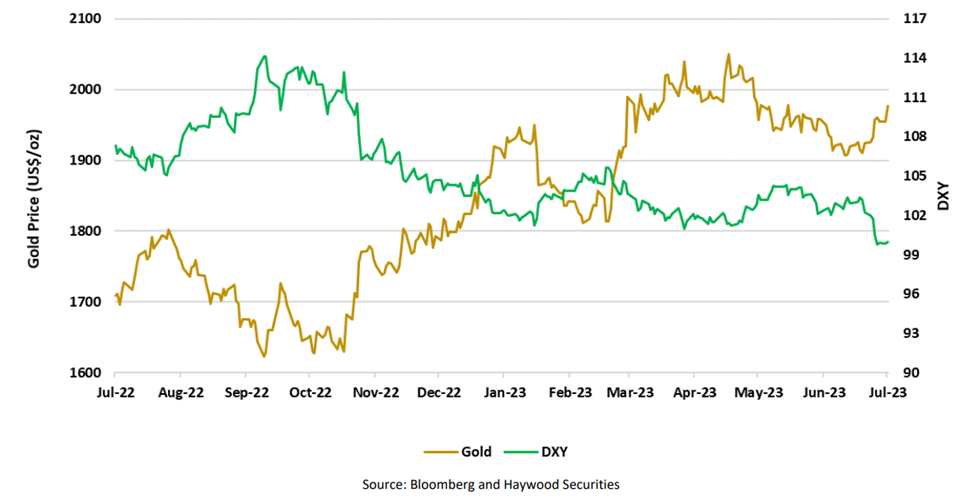

This is the sentiment shared by those at Haywood Capital Markets, noting that volatility still reigns supreme in both equities and the US dollar index given some of the market’s forward-looking aspects, which would in turn support higher gold (and silver) prices.

In the investment firm’s latest precious metals sector report, it highlighted some of the economic readings, like a softening of consumer pricing and manufacturing indices, as market forces commensurate with a downward trend in the dollar. At the same time though, it acknowledged that the resilient US jobs and housing markets make things a bit more uncertain.

What’s also uncertain — and perhaps the most decisive factor of all — is the direction the US Federal Reserve is taking following what’s already the most aggressive rate hike campaign in 40 years.

“These and other data show that we remain in a period of chop where the Fed is in a difficult position that will likely lead to a more defensive strategy (increasing rates in the short term: per market expectations) that in the end culminate in cessation of the rate hiking cycle and an inevitable drop (in the dollar),” Haywood wrote.

“We maintain our stance for continued atrophy of the US DIXIE, albeit buoyed by more protracted volatility than expected, to support precious metals prices,” it added.

Bullish Outlook Remains

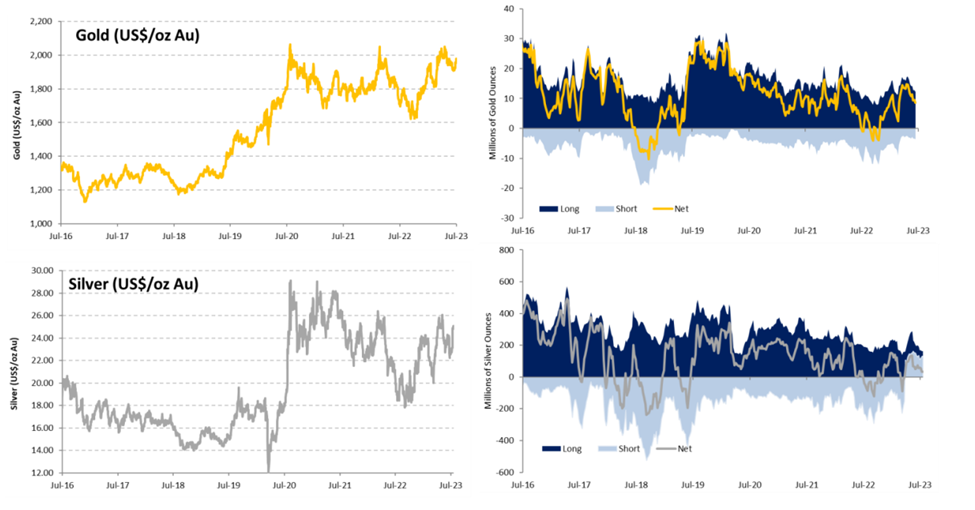

Remaining bullish on the precious metals market, Haywood has set their target gold prices for the near term: $2,025/oz in 2023 and $2,200/oz in 2024. These are respectively 3% and 11% higher than the prevailing prices, and are also above the average market forecasts ($1,924/oz for 2023, $1,913/oz for 2024).

A bullish outlook was kept despite an underperforming second quarter, during which the average gold price was 5.8% below the firm’s forecast. Between its report publications, the metal dropped by a little over 2%.

As Haywood noted in its July 19 report, these performances have been incorporated into its price forecasts to outline its quarterly expectation (see below).

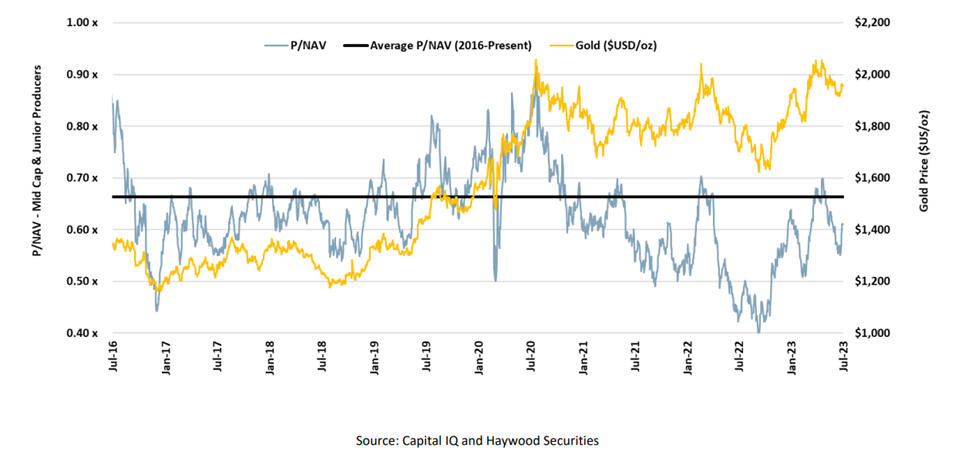

Also affected were gold-related equities, which showed their leverage to the commodity with the GDX and GDXJ dropping more than 6% over that time, and interestingly displayed an asymmetrical association with periods of negative commodity performance, Haywood said.

“With the exception of a few examples, the development and exploration companies in this sector have been met with general market disinterest leading to exceptionally low P/NAV multiples particularly given the context of the prevailing commodity price environment, which has set the stage for asset consolidation and project-level investment/equity participation by the producers on a selected basis,” the firm explained.

“This function of intra-sector investment shows the persistence of real value in the non-producers that are otherwise being ignored by the general market.”

Haywood analysts also noted that many gold mining companies are now trading at comparatively modest valuations against forward cash flow projections for such producers within periods of commodity elevation around these levels (e.g., Seniors: EV/CF23: 8.99x; Mid-tier: EV/CF23: 5.95x).

This is particularly amplified by the fact that these producers now have better balance sheets and operating margins than they have typically enjoyed for any sustained period historically, leading to delivery of competitive yields averaging ~2.48%, they added.

Prized Pick: Dolly Varden Silver

Focusing on organic growth in the precious metals mining sector, Haywood has selected a handful of exploration companies as their prized picks. Near the top of the list is Dolly Varden Silver (TSXV:DV, OTC:DOLLF) — a British Columbia-focused junior miner on the precipice of another year of discovery success.

The company is coming off an outstanding 2022 drilling season, during which it surpassed expectations and demonstrated the growth and discovery potential of its flagship asset, Kitsault Valley.

Kitsault Valley is located in the Golden Triangle of northwestern BC, a region that has generated about $5 billion in M&A activity since 2018. DV’s property covers 163 square kilometres of this prolific mining region.

The land package, which combines the company’s original Dolly Varden silver property and the newly acquired Homestake Ridge gold-silver property, is said to host one of the largest undeveloped high-grade precious metals projects in Western Canada.

The combined mineral resource of this project is estimated (as of now) at 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in the inferred category.

While the resource is already impressive at this stage, the more fascinating aspect of the project is its rich history, which can be traced back to the early 20th Century when Scandinavian prospectors first made the silver discovery in what is now the Stewart Complex.

Within the boundaries of the company’s original property are two past-producing silver mines: Dolly Varden and Torbrit, which formed a prolific silver mine camp starting in 1919 that produced more than 20 million ounces in the span of 40 years, with assays of ore as high as 2,200 ounces per tonne.

It should be noted that Dolly Varden was amongst the most important silver mines in the British Empire during its heyday.

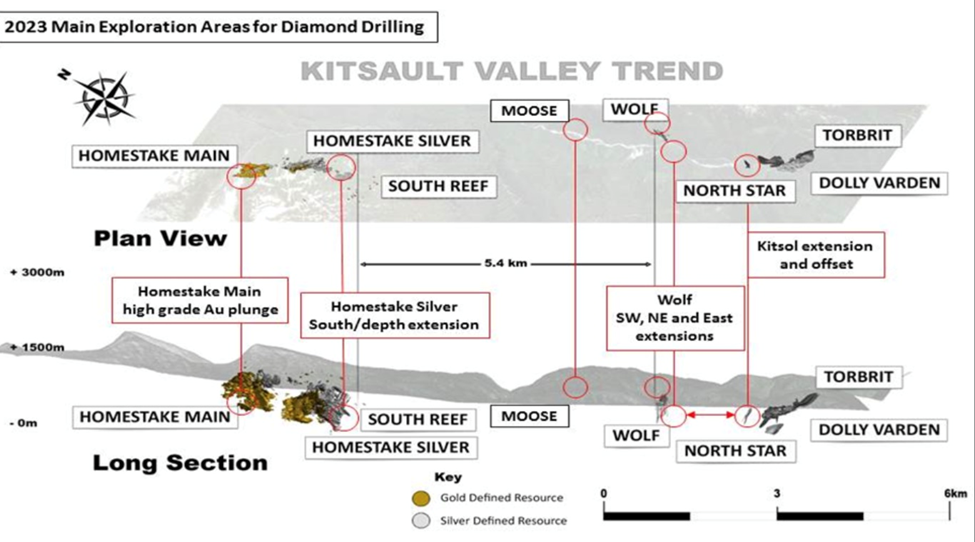

Other historically active mines in this area include North Star and Wolf, which remain underexplored to this day. Together, the four deposits comprise about 90 sqkm within the Stewart Complex.

While these deposits were already enough to work with, DV always believed that the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits on the same trend such as Eskay Creek and Brucejack (see map below).

Towards the end of 2021, the company further consolidated its position in this region with the acquisition of the Homestake Ridge project, which now occupies the northern half (~75 sqkm) of Kitsault Valley. This project features a high-grade gold and silver resource from three known deposits that the company believes can be converted into higher-confidence categories.

2022 Drilling Success

In 2022, DV embarked on a comprehensive drill program at the Kitsault Valley project.

The goal was to upgrade the inferred mineral resource to the measured and indicated classification, to expand the known deposits, and to discover new silver-gold mineralization along the Kitsault Valley trend.

Specifically, the objective was to expand the wide, high-grade silver mineralization at the Wolf Vein, step out and infill at Torbrit and the nearby Kitsol Vein, and test several other nearby exploration targets.

Over 37,000 metres of drilling in 108 holes were completed, split equally between the resource expansion and upgrading at Homestake and the Torbrit deposits and looking for discoveries along the Kitsault Valley trend.

The results were quite eye-catching, to say the least.

In summary, the grade and consistency of silver mineralization from both the Kitsol and Wolf veins indicated the potential for an underground bulk-mineable deposit. Specifically, the Wolf vein area is emerging as a large system that is rivaling the Torbrit deposit, CEO Shawn Khunkhun pointed out.

Additionally, drilling from the newly acquired Homestake Ridge property also demonstrated the strong continuity of mineralization over wide intervals similar to that of Kitsol and Wolf.

According to the company, not only were the reported gold and silver grades some of the highest from the property to date, but they were also up there with the best of the entire Golden Triangle region during the 2022 drilling season.

Drilling at the northern limits of the Wolf deposit returned an 8.77-meter intercept of 1,499 g/t silver, 1.89% lead and 0.46% zinc. Within that intercept was what the company called “jewelry-box-style” mineralization, grading 23,997 g/t silver, 1.24% lead and 0.34% zinc over a true width of 0.19 metres.

Towards the southern limits of the Wolf Vein, drilling encountered 321 g/t silver, 0.84% lead and 0.84% zinc over 12.85 metres, including 664 g/t silver, 1.24% lead and 3.54% zinc over 1.63 metres.

“Results from the Wolf Vein continue to exceed expectations, returning the highest-grade silver assay yet received, more than doubling the strike length of the deposit through step-outs to the north and south as well as returning wide, robust silver and base metal grades at depth,” Khunkhun said in the Feb. 6 news release.

2023 Campaign Starts

Building on this success, DV kicked off its 2023 exploration campaign last month, starting with four diamond drill rigs. Two rigs will target the Wolf Vein, and two will be at Kitsol. A fifth rig is available as the 45,000-metre program progresses.

“We have hit the ground running with four drills on our fully funded 2023 exploration drilling program. We have already completed several drill holes at Wolf and Kitsol, where aggressive step-outs in 2022 significantly expanded silver mineralization along strike to the north and south as well as down-dip,” CEO Khunkhun said in the June 5 news release.

“The company is in a ripe position to springboard from this substate in the current program,” which is even larger than the one in 2022, said Haywood in its report.

As disclosed previously, the priority of the 2023 exploration program is to connect high-silver-grade areas between the Wolf and Kitsol deposits, located 1,400 metres apart.

Drilling allocated to the Wolf deposit expansion (approx. 13,000 metres) will focus on both infill drilling of the wide-spaced intercepts from 2022, as well as further step-out holes in several directions where high-grade silver mineralization remains open. Similar step-out drilling will follow up on high-grade silver mineralization at the Kitsol vein.

In addition to step-out holes and exploration drilling at the Wolf and Kitsol veins, several new targets will be tested, including the projection of the Moose vein under the sediment cap, the company said.

In several weeks, the drills will be moved up the valley to the Homestake Ridge deposits.

Here, 2023 drilling is influenced by structural information gained from infill drilling at the Main deposit, where two main plunge directions have been identified. The planned drilling will target the down plunge extensions of higher-grade and wider zones of gold mineralization. Drilling at the Silver deposit will prioritize step-out holes where 2022 expansion drilling had success at the southern extent.

Conclusion

DV’s drilling success to date is perfectly summed up in this excerpt from Haywood’s report: the results have shown “radical extensions to known mineralized systems, but via asset consolidation we’re afforded the first look at an integrated and enhanced knowledge of the tectonogenesis of the Kitsault trend.”

Haywood’s analysts say the company is in the best position with integrated and collective geological knowledge of the trend to truly test for growth and discovery at a scale. DV currently has over $20 million in cash, which should be more than enough to deploy into its exploration programs.

It’s tough to get the market’s attention these days, but DV is one of the few junior resource companies to have done so. From just 36 cents a share at the end of September 2022, DV’s stock price more than tripled to a five-year high of $1.23 on April 10, 2023. A pullback to around the current $0.75 level presents a good entry point for those wanting to capitalize on another strong set of drill results, with more exciting news to come.

The junior miner is also another way for investors to gain exposure to precious metals, which most within the investment community concur is still in a bull market. Some, like Wall Street research firm Goehring & Rozencwajg, think “that gold has entered into a new phase of this bull market.”

Historic evidence suggests that gold-related equities, in particular the juniors and intermediates, tend to lag behind the metal prices, meaning there’s value to be had in them.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.75, 2023.07.20

Shares Outstanding 254.6m

Market cap Cdn$198.6m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.