A moving target: Addressing the global infrastructure deficit in times of rapid climate change, decarbonization – Richard Mills

2023.07.15

Roads, ports & bridges, transmission lines, power plants, airports, dams, buses, subways, rail links, water delivery systems, hospitals, sewage treatment plants, etc. are the building blocks that underpin a country’s, a province’s, a city’s economic and social development.

Infrastructure is critical to a country’s well-being. Nations simply cannot function properly without it, or without it working properly.

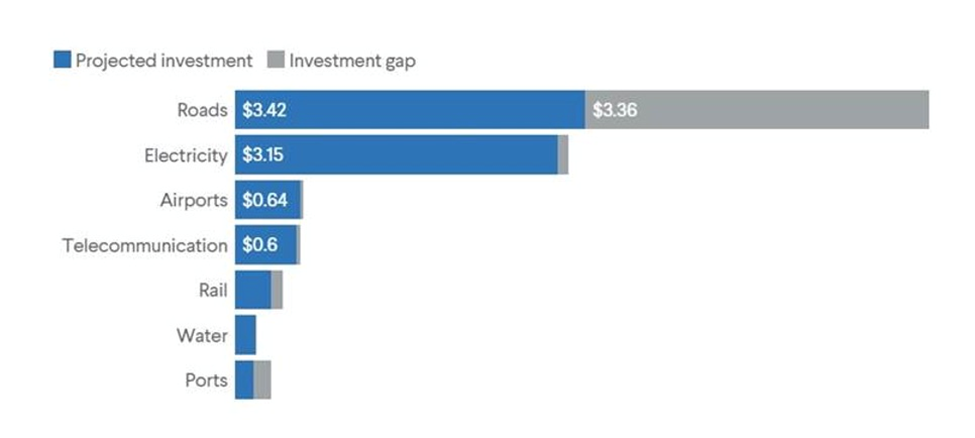

The need for more and better infrastructure around the world will only get bigger over time, widening the trillion-dollar gap that already exists between planned investment and the amount needed to provide adequate global infrastructure.

According to The Atlantic Council, The global infrastructure financing gap is estimated to be around $15 trillion by 2040. To provide basic infrastructure for all people over the course of the next two decades, every year the world would need to spend just under $1 trillion more than the previous year in the infrastructure sector.

In the US, there is a $2.5 trillion infrastructure funding gap during the 10-year period from 2020 to 2029, based on figures provided by the American Society of Civil Engineers (ASCE). Failure to address it is estimated to result in the loss of $10 trillion in GDP by 2039.

The ASCE provides a report card for America’s infrastructure every four years. The latest, in 2021, gave the country a C-. If that sounds bad, it’s slightly better than the D+ given in 2017. A few examples of the problems facing civil engineers:

- An estimated 6 billion gallons of treated water are lost to water main breaks daily, enough to fill over 9,000 swimming pools.

- 43% of public roadways are in poor or mediocre condition.

- There are 30,000 miles of inventoried levies, and another 10,000 miles of levies whose location and condition are unknown.

Transportation will likely require the largest chunk of funding needs. The US Government Accountability Office finds that nearly one in four bridges are in poor condition, with 10% categorized as structurally deficient and 14% identified as functionally obsolete.

The country’s water and energy systems are also under stress. The Environmental Protection Agency estimates that these will require $632 billion in additional investment over the next decade.

Climate change

The full ASCE report, totaling 171 pages, certainly makes for some interesting reading regarding the state of America’s infrastructure. But to me, what stands out is what was omitted. While there is, within each of 17 infrastructure categories, a subhead called “Resistance”, there appears to have been little thought given to how the country’s major infrastructure pieces should be hardened to withstand the increasing number of storms and storm surges, floods, and forest fires that are increasingly part of our reality in a rapidly changing climate.

Three examples are bridges, inland waterways, and energy.

Bridges

According to the report, Many of the country’s older bridges are susceptible to extreme weather events and more prevalent flooding, which can result in overtopping, washout, and other storm-related damage. In fact, nearly 21,000 bridges were found to be susceptible to overtopping or having their foundations undermined during extreme storm events.

Yet despite a passing reference to climate change — The great challenge moving forward is to address the hundreds of thousands of existing bridges so they can provide decades of continued, safe service despite a greater frequency in extreme weather events or an increase in design loads — there is nothing in the recommendations about hardening bridges to withstand more powerful and frequent storms.

In Canada, by contrast, the message appears to be getting through to policymakers.

Here in British Columbia, a series of “atmospheric rivers” took out several bridges along the Coquihalla Highway, an important route linking the BC Interior to the Lower Mainland, in the fall of 2021.

The price tag for repairs to major highways damaged during the November 2021 floods, which inundated the Fraser Valley, causing $675M in insured damage, has been estimated at around $1 billion.

The Coquihalla Highway is being built to specifications that conform to a once-in-200-year flood event, BC Transportation Minister Rob Fleming said in 2022, with new flood plains built around new spans.

According to a recent government press release, via Journal of Commerce, upon the completion of repair work opening the fourth permanent bridge along the mountainous route, “All new bridges are built on pile footings to withstand high water levels and feature longer spans than previous bridges to reduce the effects of erosion from changing water paths over time, further improving the long-term resiliency of the Coquihalla to extreme weather events.”

Inland waterways

The United States has a 12,000-mile network of inland waterways, and 11,000 miles of intracoastal waterways operated by the U.S. Army Corps of Engineers. Most of the inland network is comprised of the Mississippi River and connecting waterways. Additional navigable waterways include the Columbia River that makes up the border between Washington and Oregon and the Sacramento and San Joaquin rivers in California.

According to the ASCE report, A changing climate is contributing to less predictable water levels and impacting the efficiency of the waterway system. When water levels are too high or too low, a river shuts down for barge traffic, and shippers are forced to utilize other modes of transport to get goods to market. Traditionally, flood and drought periods were more predictable, but today’s extreme weather incidents are more frequent and more severe. For example, the Mississippi River in Baton Rouge was flooded for 67 days during 2018, which in turn forced hundreds of barges to offload and shippers had to put their goods on trucks.

The pressure on inland waterways from increased flooding events due to a changing climate came into sharp relief last week, when a freak summer storm dumped two months of rain in two days in Vermont and other parts of the US Northeast.

Communities including Vermont’s state capital Montpelier experienced severe flooding, with dozens of roads closed, including Interstate 89, a major highway.

Particularly alarming was the threat of a dam breach, with Montpelier town officials warning that the Wrightsville Dam several miles to the north on the north branch of the Winooski River could exceed capacity, which has never happened before, Al Jazeera reported.

Energy

Electricity delivery in the US depends on an aging and complex patchwork of power generation facilities, 600,000 miles of backbone transmission lines and around 5.5 million miles of local distribution lines that operate within federal, state, tribal and local regulatory jurisdictions. Yet according to the ASCE report,

[W]eather remains an increasing threat. Among 638 transmission outage events reported from 2014 to 2018, severe weather was cited as the predominant cause.

The report goes on to say that climate change has exacerbated the frequency and intensity of these events and associated costs. The Department of Energy found that power outages are costing the US economy $28 billion to $169 billion annually.

The nation’s 8,265 power plants are especially at risk, given they were deliberately sited near shorelines to have access to water. As a result, the report says, when hurricanes strike, power plants face significant flooding damage. During Hurricane Harvey in Houston, Texas, in 2017, wind and catastrophic flooding knocked down or damaged more than 6,200 distribution poles, and 21.4 gigawatts of generation were affected by wind damage, flooding damage, fuel supply issues, or evacuations and shutdowns. As sea levels rise, storm surges would hit further inland, causing more coastal flooding to transmission, distribution, and generation infrastructure.

The good news is that electric companies have invested more than $285 billion in transmission and distribution since Superstorm Sandy, partially to harden the energy grid and make it more resilient to future storms, including investing in new and upgraded T&D infrastructure, improving efficiency and reliability, and enhancing protection to enable a more secure, flexible, and resilient electric system, the report states.

We need to take a closer look at so-called rare flooding events. Traditional infrastructure was built to withstand a once-in-100-year flood. That means a flood has only a 1% chance of happening every year. The reality is they are coming much more frequently.

University of Princeton researchers who developed new maps to predict coastal flooding in every county on the Eastern and Gulf coasts, found that 100-year floods could become annual occurrences in New England, and happen every 30 years along the southeast Atlantic and New Mexico shorelines.

In a paper published in the journal ‘Nature Communications’, the researchers reported that coastlines at northern latitudes like New England will face higher flood levels primarily because of sea level rise. Those in more southern latitudes, especially along the Gulf of Mexico, will face higher flood levels because of both sea level rise and increasing storms into the late 21st century. (High Meadows Environmental Institute, Aug. 27, 2019)

2021 was a particularly bad year for flooding. Along with the atmospheric rivers that drenched southern British Columbia, more than 400 people in China and Western Europe died from flash floods, where record rainfall turned streets into fast-flowing torrents strong enough to sweep vehicles away.

A ferocious storm in July that year flooded Interstate 94 and other roadways around the Detroit area, ABC News said, knocking out power to nearly 14,000 customers in Michigan.

Quantifying the link between precipitation and climate change is apparently an area of critical research, the ABC News story states, quoting a doctoral candidate at Stanford University’s Earth System Science program saying, “We’re seeing that climate change increases extreme precipitation and makes the most extreme events bigger.”

Another flooding expert with the US Geological Survey told ABC News the term “100-year event” is expected to change because it is only an estimate based on data, and it’s possible for floods to happen in back-to-back years, though the latter is still something of a mystery.

As for hardening infrastructure to deal with more frequent and more severe storms, floods, forest fires, droughts, and other weather events associated with a warming planet, there are two key challenges.

According to Resilience.org, the first problem is it’s much easier to harden infrastructure when building it from scratch. For example, while some of Louisiana’s electrical grid could be rebuilt from scratch, very little infrastructure outside of the flood-prone state will be rebuilt, because upgrading is far less expensive. The same holds true for water and transportation infrastructure.

The second problem is that climate change is a moving target. We simply don’t know how much the planet will warm and how much money we should dedicate to infrastructure hardening. Resilience.org writes:

So, for those whose job it is to harden the infrastructure the question arises: How much do we harden it? We cannot know in advance exactly how much hardening will be sufficient to prevent the extraordinary damage we’re already seeing from happening in the future…

No matter how much we decide to harden our systems, the cost will be enormous.

True enough. But research suggests it is cheaper than doing nothing.

For example in Ontario, the effects of climate change are projected to cost the Canadian province an extra $1.5 billion per year. This is just to maintain public transportation infrastructure. By 2030, extreme weather will push Ontario’s costs up to a total of $13 billion.

Implementing adaptive strategies to deal with climate change would cost between $1.4 billion and $2.9 billion a year between now and 2100. This compares to an annual cost of $2.2 billion without adaption, rising to $4.1B after 2050, assuming that emissions keep rising.

“While these additional climate-related costs are significant, they are less expensive for provincial and municipal governments than not adapting over the long term,” the Financial Accountability Office wrote.

McKinsey estimates it would take between USD$700 million and a billion dollars for a typical southeastern US utility to prepare for impacts related to climate change, less than current 20-year storm costs of $1.4 billion and far less than projected future storm costs of $1.7B.

Decarbonization

Another layer of complexity gets added to infrastructure hardening in that the priority now is to decarbonize. Governments with limited funds thus face a dilemma: How much to spend on “going green” (electric vehicles, battery plants, solar farms, wind turbines, etc.) versus the amount invested in replacing or upgrading existing infrastructure?

The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. China is the leader but other countries are catching up, as large automakers like Volkswagen, Mercedes-Benz, GM and Ford come out with new EV models and plan new EV manufacturing/ assembly plants in North America and Europe.

Last year the amount of money invested in decarbonizing the world’s energy system surpassed a trillion dollars for the first time. 2022 was also the first year that the $1.1 trillion which poured into the energy transition matched the $1.1T global investment in fossil fuels.

While a trillion is obviously megabucks, it’s not enough to meet net-zero requirements by 2050. To get there, the world would need to immediately triple this $1.1 trillion spend — and add hundreds of billions of dollars more for the global power grid, according to a Bloomberg story.

Two dominant investment themes and the metals required for each

Minerals demand

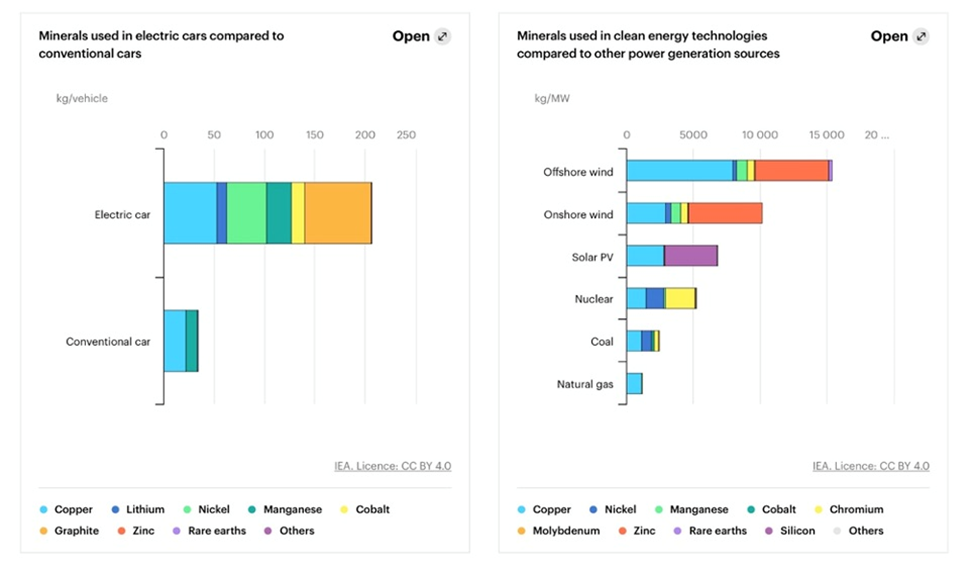

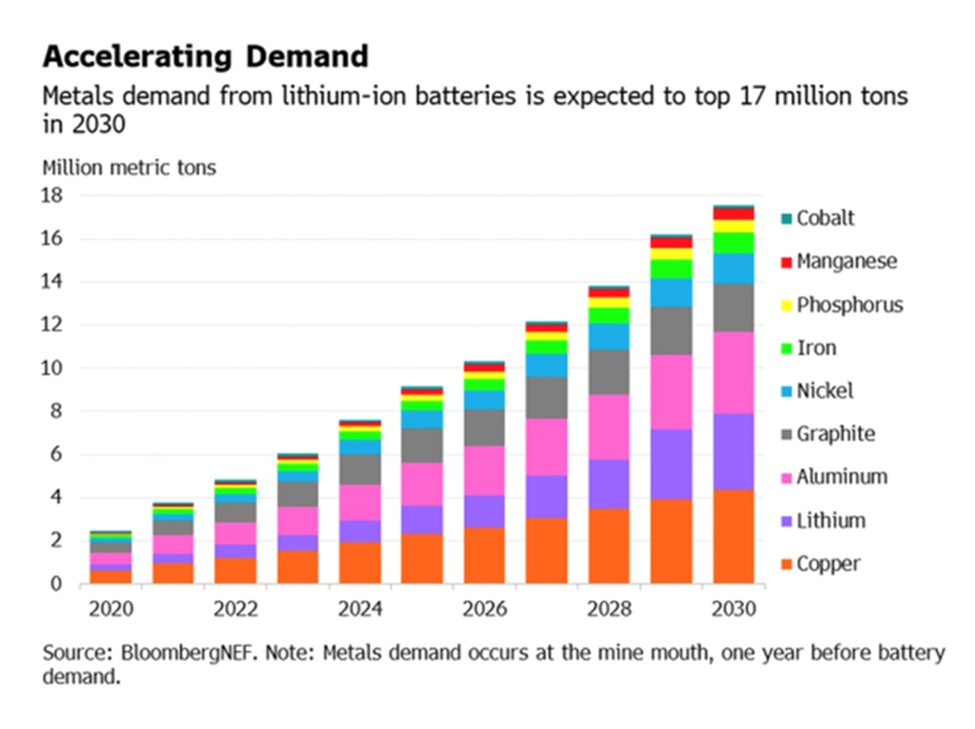

The International Energy Agency forecasts minerals demand for use in EVs and battery storage will grow at least 30 times by 2040. Lithium should see the fastest growth, with demand growing by over 40x in its Sustainable Development Scenario by 2040, followed by graphite, cobalt and nickel (around 20-25 times). The expansion of electricity networks means that copper demand more than doubles over the same period.

The IEA says solar plants, wind farms and electric vehicles generally require more minerals to build than their fossil fuel-based counterparts. A typical electric car requires 6x the mineral inputs of a conventional car and an onshore wind plant requires 9x more mineral resources than a gas-fired plant.

To reach net-zero, demand for these key metals needed for the deployment of energy transition technologies such as solar, wind, batteries and electric vehicles will grow fivefold by 2050, Bloomberg New Energy Finance adds.

Base metals shortage

Over the last decade or so, ESG (environmental, social and corporate governance) pressures have placed a lot of downward pressure on mining capital expenditures. According to a recent report, Environmental and related permitting issues have made both greenfield and brownfield mine development projects extremely difficult to bring into production.

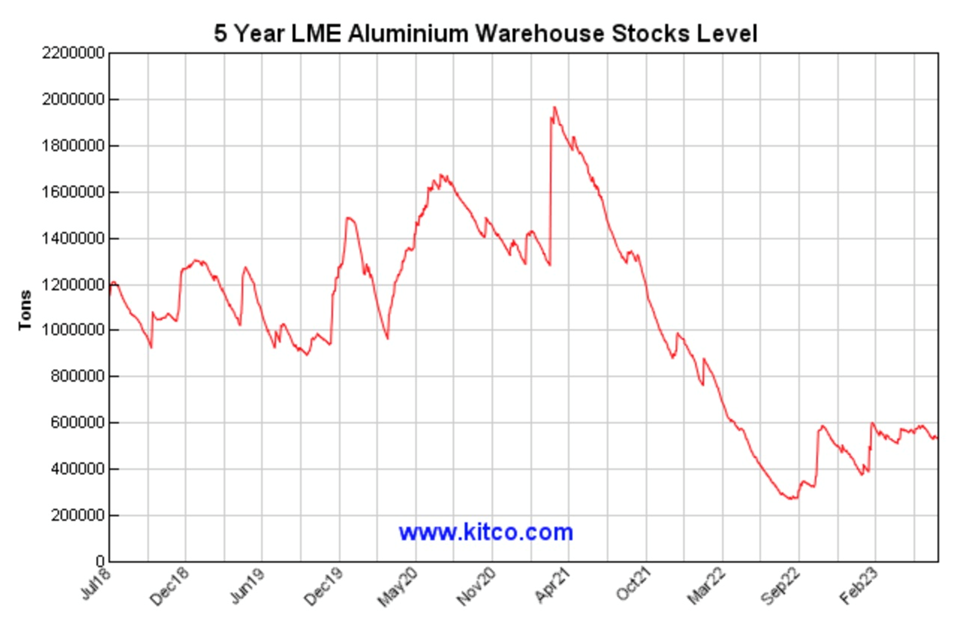

The report by Wall Street commodities investment firm Goehring and Rozencwajg found that, since peaking at 9 million tonnes in the first quarter of 2013, base metals inventories have drawn down steadily and, as of the fourth quarter, 2022, were down 90%.

Exchange metal inventories in Q4 covered only 2.7 days of daily consumption, reaching lows last seen 35 years ago, in 1988-89.

The charts below show that while some base metals (aluminum, zinc) are seeing inventories re-stocked, others (copper) continue to decline.

G&R’s report notes that, in response to inventory tightness, base metal prices from 1998-90 surged, with zinc rocketing 230%, copper rising 75% and nickel multiplying 700%.

In the mid-2000s, robust metal demand from China again drew base metals inventories down to dangerously low levels, and just like in the late 1980s, base metal prices took off. From the end of 2004 to the beginning of 2006, copper, nickel, lead, and zinc prices advanced between 300% and 400%.

The report concludes that, given we are well past the tightness levels experienced in 2005-06, and given the strength worldwide of base metals demand and supply constraints, we believe it’s only a matter of time before shortages in various metals reach detectable levels, with potentially tremendous resulting upward price pressure.

The authors cite S&P Global’s Commodity Insights paper last summer on the future of copper, which warned of an “unprecedented and untenable” copper shortfall of 10 million tonnes as suppliers grapple with copper demand that will double by 2035.

In fact, G&R sees S&P Global’s outlook as too optimistic, maintaining that the copper market will become the first base metals market to display severe shortage characteristics, and that we believe this is going to be the decade of shortage across multiple commodity markets.

Conclusion

Where are we going to find the metals needed to accomplish both electrification & decarbonization, and the hardening of key infrastructure at risk of failure due to worsening climate change?

Zinc, for example, is unquestionably a staple in a nation’s infrastructure buildout. This includes bridges, public buildings, power stations, dams, etc.

More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power and wind turbines.

The metal is also a key component in transportation, and with increasing emphasis on electrification, demand is only going to increase, as EVs use about four times as much copper as regular internal combustion engine vehicles.

The grim reality is we dithered for too long with respect to taking action on climate change, and now we are forced to deal with the consequences. We see it in bubbling lakes full of methane, a greenhouse gas far worse than CO2; in torrential rains that cause catastrophic flooding, not once in a century but now every few years; in atmospheric rivers that inundate farmlands, destroying livelihoods; in forest fires so hot and fast-moving they raze entire towns; in punishing droughts; and in annual heat waves that claim hundreds of lives, in Western countries, mostly the elderly lacking air conditioning.

Winters are getting shorter, summers are starting sooner and ending later. The warmer the air, the more moisture it holds, creating the conditions for massive storms that now pummel the United States on a regular basis. The oceans are turning acidic and coral reefs are dying.

I’ve said it before and I’ll say it again: the Earth has been warming for a very long time, with human-causing warming only a small, relatively recent part of the geological time sequence going back thousands of years. There’s nothing we can do to stop it. The planet will continue to warm until it cools, which won’t happen until long after we’re dead.

In the meantime, there is much we can do to harden key infrastructure to minimize the worst effects of rising temperatures. Yet our priorities appear to be in the wrong place. Last year we spent $1.1 trillion on the energy transition, cracking a trillion dollars for the first time and matching the global investment in fossil fuels, also a first.

Governments seemingly have their foot on the accelerator to slow the warming, but to me, the smarter course of action would be to fix what is currently at risk of failure in a warmer world.

Infrastructure maintenance and new construction deficits are global, longstanding and massive. Spending small leads to infrastructure gaps, yet the attention is on electrification and decarbonization — ridding ourselves of fossil fuels.

It’s time to wake up! What we’re fighting is already here — immutable and unstoppable global warming. Unless we switch tack, we are going to pay a heavy price. Our battle against climate change is misdirected, too little, too late, and totally unsuccessful. We need to recognize that, step up and prepare for the consequences, by rebuilding and improving the infrastructure we already have and will need in future.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.