China’s metal export controls give impetus for US to develop its own graphite supply – Richard Mills

2023.07.08

China has certainly picked an interesting time to escalate the trade war with its Western rivals.

On Monday, hours before America kicked off its July 4th celebrations, China announced that it will impose export restrictions on gallium and germanium, two metals key to the manufacturing of semiconductors, electric vehicles and telecommunications equipment.

The new regulations — imposed on grounds of national security — will require exporters to seek a license to ship gallium and germanium compounds starting August 1, China’s commerce ministry said in a statement.

Such a move is part of an intensifying global battle for technological supremacy. According to a European Union study on critical raw materials this year, China has established itself as the world’s leading source of as many as 20 critical minerals.

Many view this move as a form of retaliation by the Asian powerhouse for the US curbs on technology sales to China, as well as the recent Dutch ban on sensitive chip equipment exports. The announcement also comes just as US Treasury Secretary Janet Yellen is preparing to visit China later this week, further raising eyebrows on its timing.

Paul Triolo, senior vice president for China at strategy firm Albright Stonebridge, told Reuters that the restrictions are likely to target companies in the semiconductor and defense industry, and it could help China gain more bargaining power.

“It’s clearly timed to send a not-so-subtle message to the Biden administration that China holds significant cards when it comes to inputs to the semiconductor, aerospace, and automobile industries, and can and will increasingly be willing to inflict pain on US companies.”

The two targeted minerals — gallium and germanium — are also important to the European Union’s highly prioritized digital and green transitions, given their roles in making items like semiconductors, 5G base stations and solar panels.

“The decision by China … [regarding] export of gallium and germanium clearly shows that the Communist Party will put on its economic boxing gloves sooner rather than later,” Nicola Beer, a vice president of the European Parliament, said when interviewed by Politico.

This is not the first time that China has put the clamps on exports of minerals whose supply chain it dominates.

In 2010, China restricted exports of its rare earths to Japan following a territorial dispute. And while China eventually was found to have violated World Trade Organization rules, this episode made Japan, the European Union and the US realize that it’s simply too risky to rely on China for key minerals.

Hence, the critical minerals strategies and collaborations between Western nations today are mostly aimed to “de-risk” from China.

Graphite: Area of Vulnerability

As long as the China tech war remains in the headlines, speculations will continue as to what and when the next strike is, and what other sectors could be potentially impacted.

For a while, we have talked about graphite as being at the forefront of the global race toward vehicle electrification dominance. At AOTH, we believe this is a mineral to watch out for should Sino-US relations worsen.

The reason is simple: vehicle electrification just doesn’t happen without graphite. It’s the only material in the world that conducts electricity other than metals, and the only one that can be used in the anodes of EV batteries.

In fact, it is the largest component in batteries by weight, constituting 45% or more of the cell. There is nearly 4x more graphite feedstock consumed in each lithium-ion cell than lithium and 9x more than cobalt.

An average plug-in EV nowadays can contain up to 70 kg of graphite.

The battery anode material — known as spherical graphite — is manufactured from either flake graphite concentrates produced from mineral deposits, or from synthetic/artificial graphite. Automakers prefer the former because natural graphite is cheaper and environmentally friendly, but only flake graphite upgraded to 99.95% purity can be used in EV batteries.

Therefore, a reliable EV supply chain does not only require domestic production of graphite, but also the capacity to process the raw material into battery-grade, which is why a fully integrated supply chain, for any major auto market, is so important.

So why should the US be worried? Well, for a nation that aspires to lead the global EV race, it produces no natural graphite from the ground and is 100% reliant on imports.

China’s Graphite Dominance

China is by far the biggest producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US, as mentioned, produces absolutely no graphite production at all, and therefore must rely solely on imports to satisfy domestic demand.

According to the USGS, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that EV batteries require run-of-mine graphite to go through purification and coating, a process controlled by China, the US was actually not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should the country want to stay in contention for EV dominance.

It’s entirely possible that one day, the Chinese government just decided to restrict sales to the West, even if its mine owners still like to keep selling. In a recent letter to shareholders, JP Morgan Chase CEO Jamie Dimon pointed out that:

“China, using subsidies and its economic muscle to dominate batteries, rare earths, semiconductors or EVs, could eventually imperil national security by disrupting our access to these products and materials.”

This is why graphite is firmly placed on the US government’s critical minerals list, and is identified as one of five key battery minerals that are at risk of supply disruptions. The other four — lithium, nickel, cobalt and manganese — typically form the cathode that decides the capacity and therefore tend to get more attention.

But graphite, as the anode material, is probably the most crucial one since it’s far superior to its current alternatives.

Relentless Graphite Demand

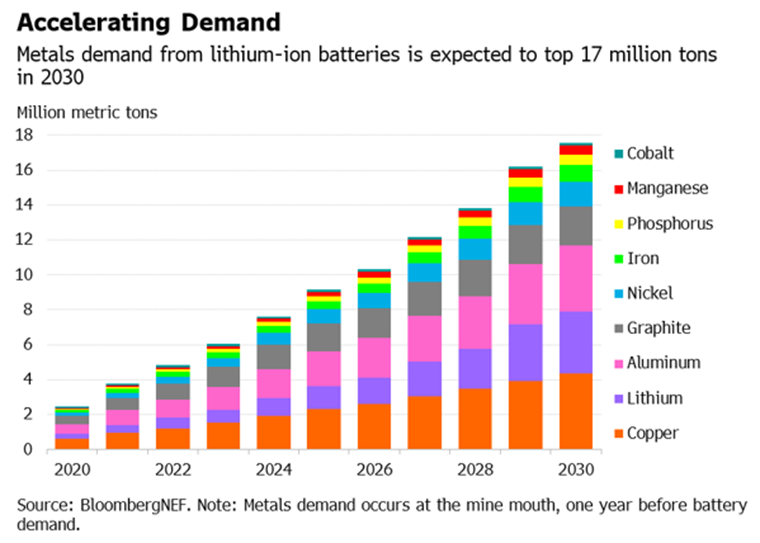

Things get worse for the US (and other net importers) when you factor in the rapidly growing demand for critical minerals like graphite.

With electric vehicles gaining popularity in recent years, the world’s consumption of graphite has skyrocketed. According to the USGS, the battery end-use market for graphite has grown by 250% globally since 2018.

According to the World Bank, graphite accounts for 53.8% of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4% of total demand.

BloombergNEF forecasts graphite demand to quadruple by 2030 on the back of an EV battery boom. The International Energy Agency (IEA) goes 10 years further out, predicting that graphite demand could see an 8- to 25-fold increase between 2020-2040, trailing only lithium in demand growth upside.

As for natural graphite, it’s thought that battery demand could gobble up well over 1.6 million tonnes of output per year. However, this figure will likely grow each year as expected, posing a serious threat to the global supply chain as the material is already used in a variety of industries.

For context, the 2022 mine supply was about 1.3 million tonnes, which means we’re very close to entering, if not already, a period of deficits.

Benchmark Mineral Intelligence projects that natural graphite will have the largest supply shortfalls of all battery materials by 2030, with demand outstripping expected supplies by about 1.2 million tonnes.

And this is just counting EV battery use only; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year, which at first may seem doable but considering the number of graphite projects worldwide and the time it takes to develop them into mines, we’re really up against it.

Road to America’s First Graphite Mine

Without any domestic production, the US is already falling way behind the pack. So far, the government has only identified 10 sites that include mineral regions, mineral occurrences, and mine features that contain enrichments of graphite.

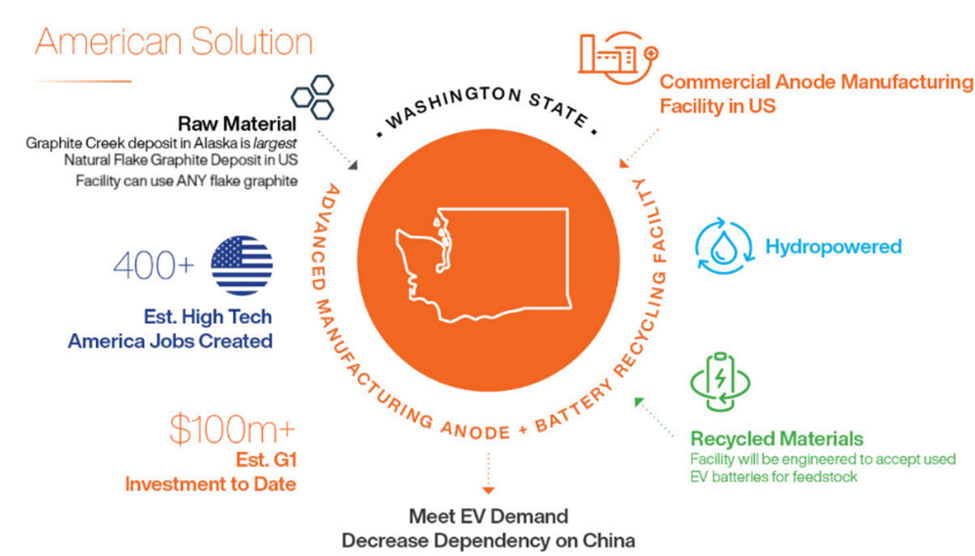

The largest of those, as determined by the USGS, is the Graphite Creek deposit in Alaska, containing a measured and indicated resource of 37.6 million tonnes grading 5.14% Cg (graphitic carbon) for 1.93 million tonnes of natural graphite. It also has 243.7 million tonnes of inferred resources at 5.07% Cg, for another 12.3 million tonnes of natural graphite.

The deposit is being developed by Vancouver-based Graphite One (TSXV:GPH, OTCQX:GPHOF) as part of its Graphite Creek property situated along the northern flank of the Kigluaik Mountains, spanning a total of 18 km.

In early 2021, Graphite Creek was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC), which is responsible for the environmental review and authorization process for certain large-scale critical infrastructure projects.

The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

Last fall, Graphite One underwent a major de-risking event with the release of a prefeasibility study (PFS), which portrays the Graphite One project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite price of $7,301 per tonne.

Once up and running, the mine would produce, on average, 51,813 tonnes of graphite concentrate per year during its projected 23-year mine life. The company itself would produce about 75,000 tonnes of products a year, of which 49,600 tonnes would be anode materials, 7,400 tonnes purified graphite products and 18,000 tonnes unpurified graphite products.

The PFS is based on the exploration of only one square kilometer of the 16-km deposit, meaning that it could easily crank up production by a factor several times the current (proposed) run rate of 2,860 tonnes per day. Drill results to date indicate the resource remains open down dip and along strike to the east and west.

Given its significant graphite resource, which the USGS now places amongst the world’s largest, and the exploration upside, the company has the foundation to achieve its goal of becoming the first vertically integrated producer to serve the domestic EV battery market.

Results of 2022 drilling (1,940m) were released by Graphite One earlier this year, confirming that “significant graphite grade” continues 4 kilometers from the pit boundary defined in the 2022 prefeasibility study (PFS). One step-out hole showed significant intervals above mill cut-off grade, with selected intervals totalling 8.2m of 4.18% Cg (graphitic carbon).

Based on these results, the company then put out an updated resource estimate for Graphite Creek, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite over the 2022 PFS (see below).

The deposit now has 37.6 million tonnes of M+I resources grading 5.14% Cg, for 1.93 million tonnes of contained natural graphite. It also has 243.7 million tonnes of inferred resources at 5.07% Cg, for 12.3 million tonnes of natural graphite.

Vertical Integration Strategy

Anchored by this resource, Graphite One aims to become the first vertically integrated domestic producer of natural graphite to serve the nascent US electric vehicle battery market.

To do that, the company entered an MOU in April 2022 with Sunrise New Energy Material Company, a China-based lithium-ion battery anode producer. The intent is to develop an agreement to share expertise and technology for the design, construction and operation of a proposed graphite material manufacturing facility in Washington State.

The Washington facility represents the second link in Graphite One’s advanced graphite materials supply chain. A recycling facility to reclaim graphite and other battery materials is also being planned, to be co-located at the Washington plant, completing the third link.

Following the MOU, Sunrise subsequently started preparing anode materials for sample purposes from Graphite Creek concentrate, and in December, it was revealed that the concentrate is being used to prepare sample battery anode materials for two major electric vehicle manufacturers, while an artificial graphite anode sample is being prepared for a third EV company.

Earlier this year, Graphite One announced it had received the active anode material samples produced by Sunrise. These samples, along with specification data, were then provided to PNNL, the US Department of Energy lab with which it has a material transfer agreement, for additional testing. They were also sent to a leading EV manufacturer for evaluation.

Latest Developments

In Mid-June, the company entered into a teaming agreement with Vorbeck Materials Corp., a global leader in graphene production and advanced graphene applications based in Jessup, Maryland.

The purpose of the agreement is to evaluate the industrial potential of Graphite One’s product beyond the EV and renewable energy sectors.

“We are excited to team with Vorbeck Materials, a recognized leader in advanced graphite and graphene applications,” said Anthony Huston, founder and CEO of Graphite One, in a news release.

“While the majority of Graphite One’s production will serve the electric vehicle battery and energy storage systems markets, we understand that the versatility of graphite and graphene offers opportunities to develop entirely new markets in both the commercial and defense sectors.”

In the same week, Grphiate One also bought back a 1% net smelter production royalty which was retained by the seller following the June 2015 sale of mining claims to the company. The two remaining royalties (5.0% and 2.5%) applicable to certain Alaska state claims can still be partially repurchased (2.0% for each).

Conclusion

While China’s latest export restrictions are not targeted at any of the key minerals in EV batteries, the fact the country has a commanding influence on the supply chain means the threat is always there.

For the US and its allies, the best strategy is to accelerate the trend of supply diversification, thus cutting their reliance on Chinese minerals. This begins with developing their own source of production (i.e. build more mines).

A recent assessment by the Department of Energy listed six minerals that are considered “critical” in the short term, one of which is graphite. Graphite is also one of four critical minerals that are essential to all six industrial sectors screened by the USGS.

This is because America does not produce any graphite at all and is 100% dependent on foreign supply, an area that happens to be dominated by China.

This is where Graphite One and its large mineral deposit in Alaska come in. The company also seems to have a processing method that can turn its mined product into anode material. Its goal of becoming the first fully integrated producer of graphite is quite possible, and the news put out by the company over the past two years confirm that.

The next milestone to look out for is the Graphite Creek feasibility study, which would put the mine a step closer to production.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.31, 2023.07.06

Shares Outstanding: 125.8m

Market cap: Cdn$164.8m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.