Max Resource technical report confirms two distinct mineralized systems on RT gold property – Richard Mills

2023.07.04

South America-focused junior explorer Max Resource Corp (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) has filed a technical report for its RT gold project in Peru. The report, dated March 8, 2023, was prepared by an independent qualified person in accordance with National Instrument 43-101 standards.

In a press release dated June 29, 2023, Max CEO Brett Matich stated that the technical report “validates the true potential of the two distinct gold-bearing systems” — namely the Cerro bulk-tonnage porphyry zone and the Tablon massive sulfide zone.

He specifically points to new core assays from Tablon that demonstrated the “exceptional near-surface high-grade-gold drill results and associated credits of copper, silver and zinc over substantial intervals.”

“The next step is to conduct an environmental survey in preparation for a drilling program to further expand Tablon and to test the outstanding intrusive target at Cerro which has never been drilled,” Matich said.

Max currently has exclusive rights to earn 100% of the RT project after signing an option agreement in September 2020.

To earn the full interest, the company must make a series of payments totaling $4.5 million by March 20, 2027, of which $750,000 has been paid. Upon acquiring a 100% interest, the vendors will also retain a 2.5% net smelter royalty on commercial production.

RT Gold Project Overview

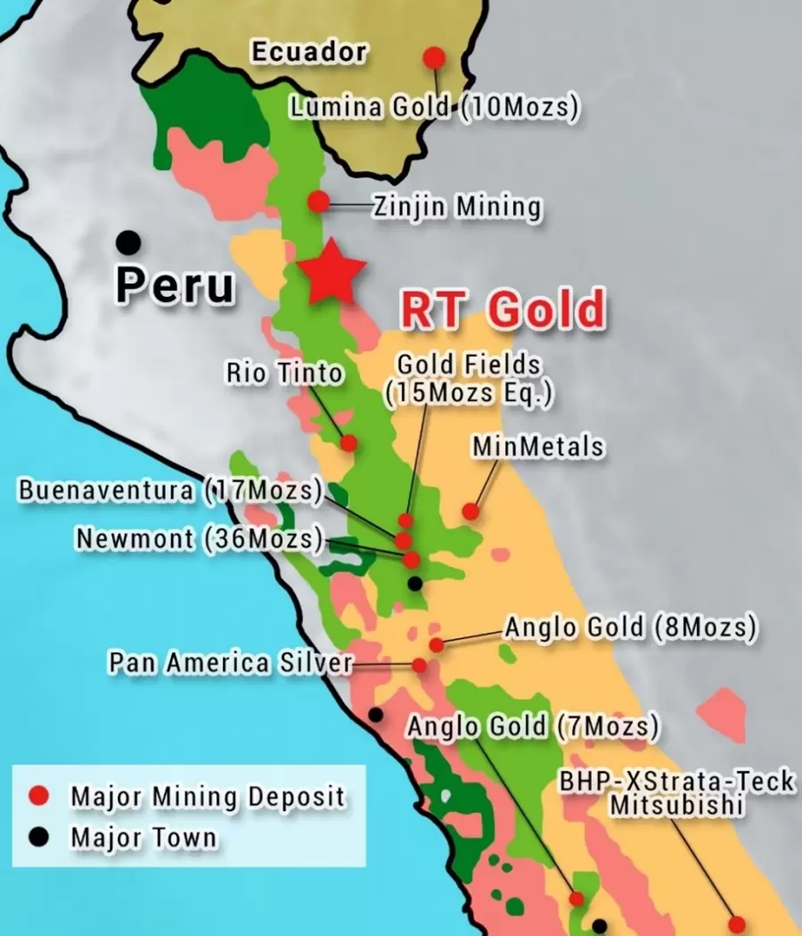

The RT gold project is located 760 km north-northwest of Lima in the district of Tabaconas, in the northern part of the Department of Cajamarca (hence the project is named “Rio Tabaconas”, or simply RT). It consists of two contiguous concessions that cover an area of 980 and 1,000 hectares, respectively.

The property sits along the Cajamarca metallogenic belt, extending north from central Peru into southern Ecuador. This prolific belt hosts a number of world-class deposits (see map below).

In Ecuador, there is the Fruta Del Norte discovery (15.5Moz Au), Mirador (2.7Mt Cu, 2.74Moz Au), and the new discovery by Solaris Resources at its Warintza deposit (2.7Mt Cu, 0.9Moz Au). On the Peruvian side, it has Newmont’s Yanacocha (8.61Moz Au).

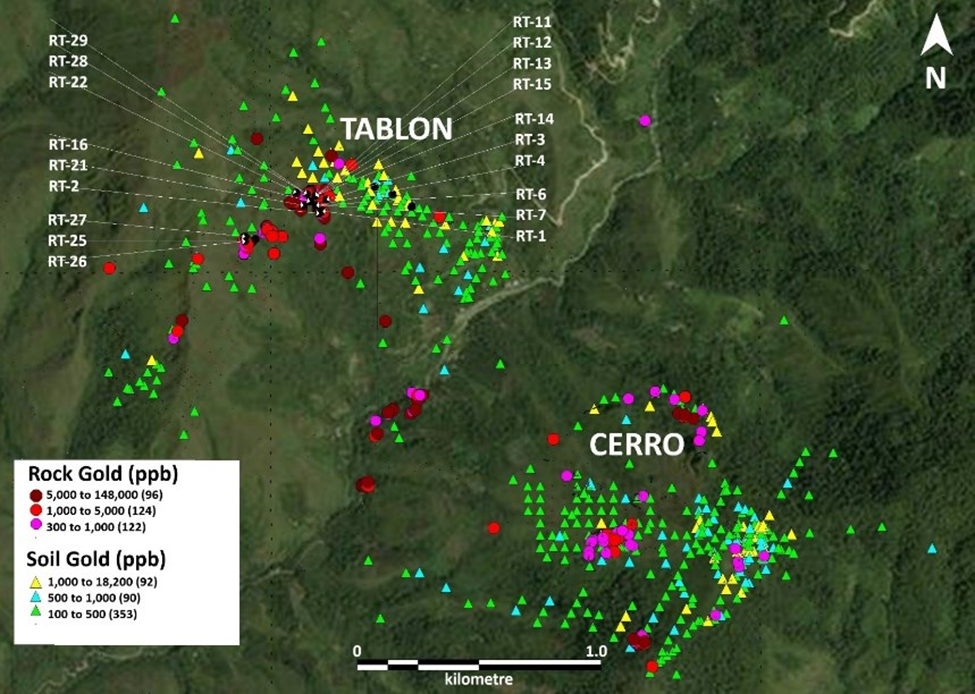

As mentioned, the RT gold project features two primary zones for exploration: Cerro and Tablon.

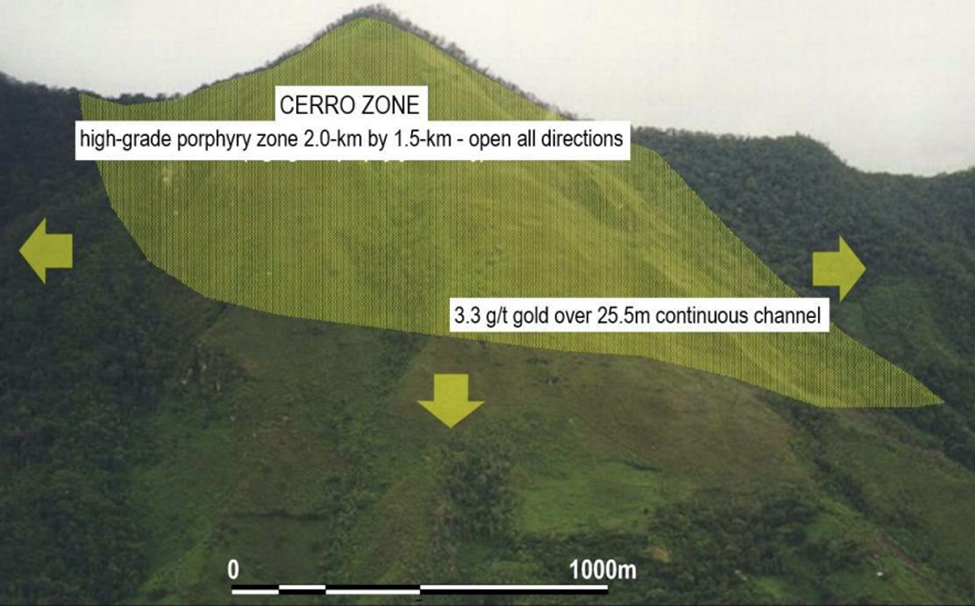

Cerro hosts several mineralized zones. Soil geochemistry has outlined a 2 km by 1.5 km gold anomaly that is open in all directions, with gold values ranging from 0.1 to 4.0 grams per tonne (g/t). The soil geochemistry is coincident with IP chargeability. A continuous channel sample across the zone assayed 3.3 g/t gold over a width of 25.5m.

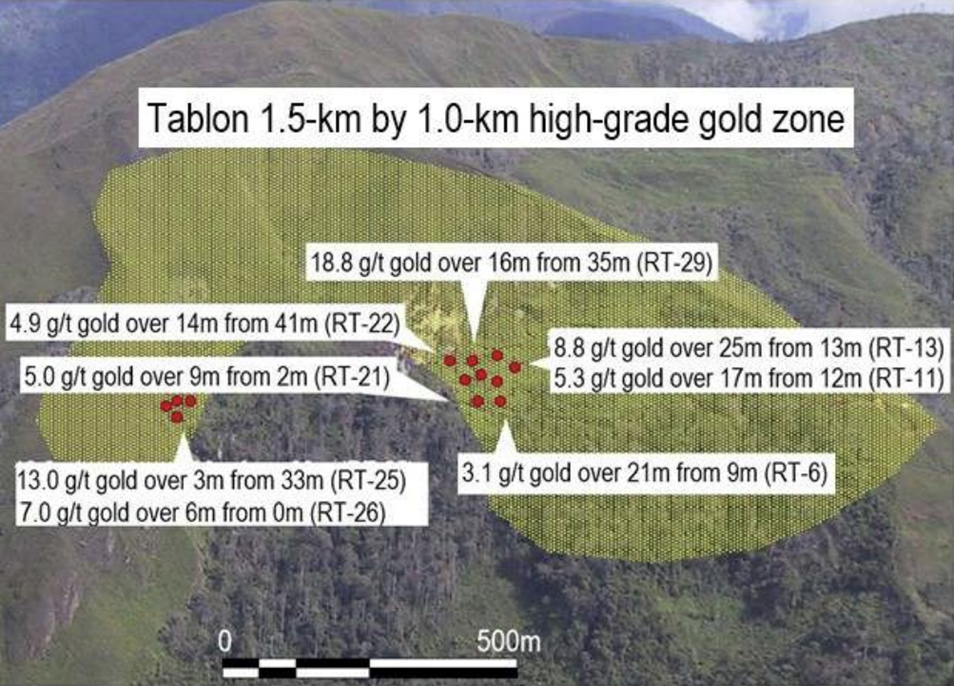

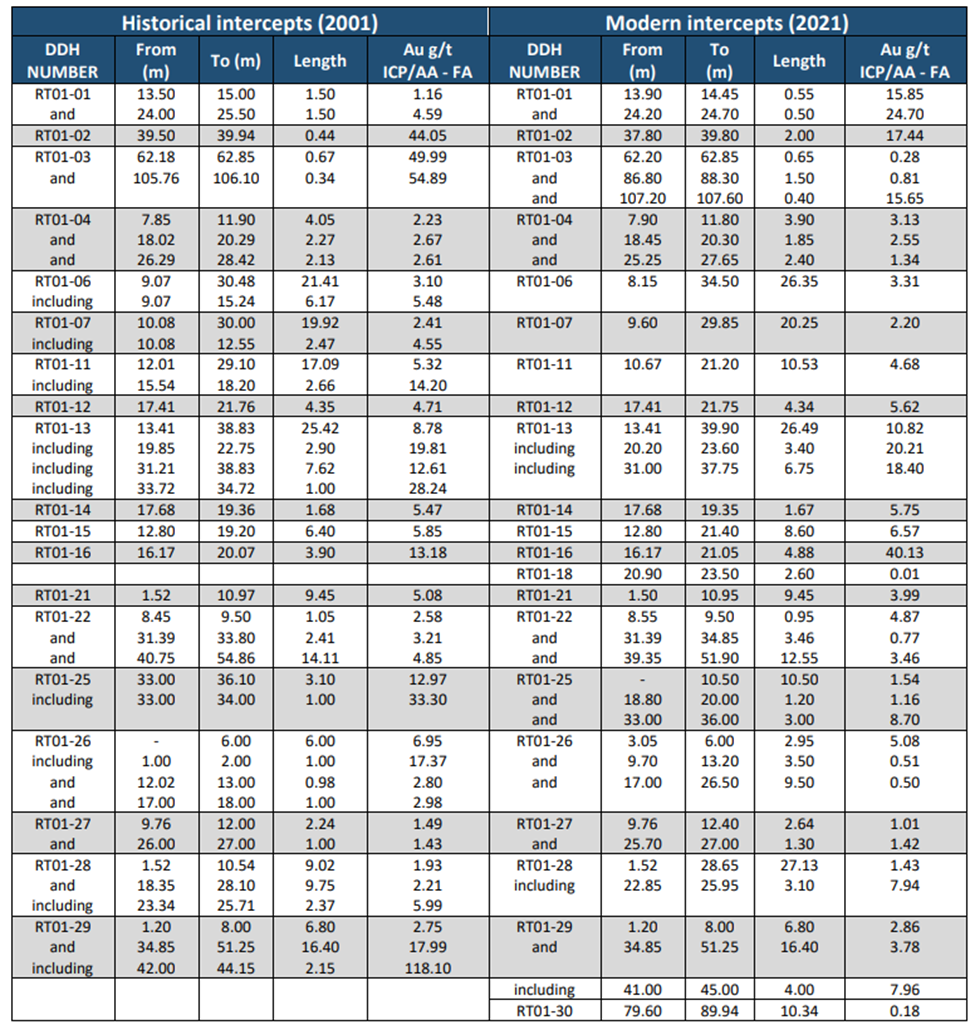

Tablon, located 3 km to the northwest, was drilled in 2001 by Golden Alliance Resources Corp. In February 2021, Max obtained the historic drill core and commenced a re-logging and resampling campaign. The resampling confirmed thickness and grade of the 2001 drill intercepts and reasonably well reproduced the reported grades.

Results included high-grade gold values ranging from 3.1 to 118.1 g/t gold over core lengths from 2.2 to 36.0m. One intercept returned a metallics reassay value of 186 g/t gold over 2.2m, indicating the presence of coarse gold.

In addition, the gold-bearing mineralization is associated with highly anomalous silver and copper values. The multi element suite of data will allow Max to examine metal ratios and zoning patterns for target generation and geological interpretation purposes.

The next step for the project is to start an environmental survey, followed by drilling application.

Property Geology

The RT gold property is underlain by rocks of the Oyotún Formation, the Goyllarisquizga Group, the Chulec – Pariatambo limestone, and has been intruded by massive to porphyritic diorite to granodiorite.

On the west side of the project, in the Huancabamba valley, intermediate to felsic Tertiary volcanic rocks of the Llama, Porculla, and Shimbe (Huambos) formations predominate. The Tertiary volcanics are bounded to the east by a high-angle fault that separates the Tertiary terrain from a belt of Palaeozoic sedimentary and metavolcanic rocks.

The Palaeozoic belt is bordered to the east by Precambrian rocks of the Olmos and Maranon complexes; in the northern half of project, the contact may be an east-dipping thrust fault (Precambrian over Palaeozoic), while in the south it is a high-angle fault.

The eastern or Tamborapa belt of rocks is dominated by volcanic flows, tuffs, and coarse pyroclastic rocks assigned to the Oyotun Formation, of Jurassic age. This formation also includes tuffaceous sedimentary rocks and volcanic sediments with intercalated limestone in the higher parts of the volcanic sequence.

Erosional windows of Palaeozoic metasedimentary rocks, possibly part of the Salas Group, occur locally in the Oyotun cover. Granitic rocks of Cretaceous-Tertiary age intrude all the supracrustal rocks in the region except for the youngest Tertiary volcanic sequences.

Property Mineralization

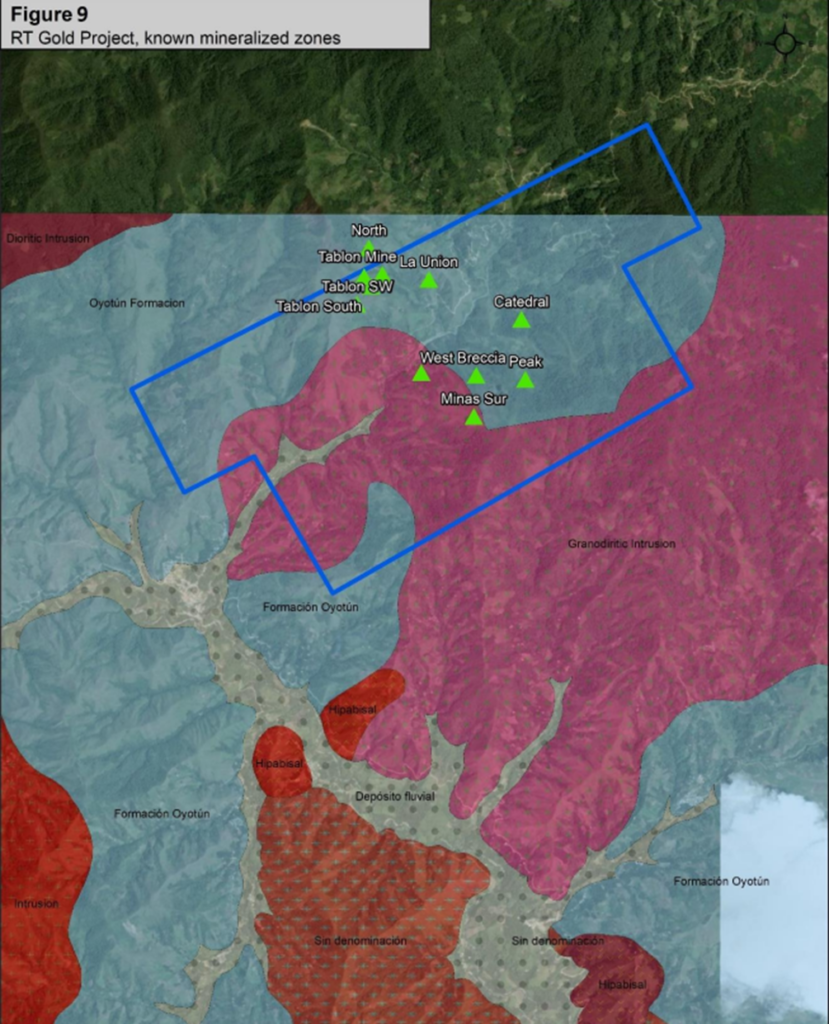

Mineralization at the RT property was discovered at Tablon and Las Minas (also Cerro Las Minas, or just “Cerro”), which correspond to the names of mountain ranges that cover tens of square km. Mineralized zones at Tablon are known as the Tablon Mine, North zone, and Tablon West; adjacent areas with anomalous gold in rocks and soils have been named La Union, Sphalerite Creek, and Tablon Southwest. At Las Minas, zones of gold mineralization are named Peak, West Breccia, La Cathedral, and Minas Sur.

Exploration in other parts of the property is still at a preliminary stage, but gold mineralization is known in the Vega area, 2 km northwest of Tablon, and copper-bearing float has been discovered in the Quebrada de San Francisco, 3.5 km south of Las Minas.

Las Minas/Cerro

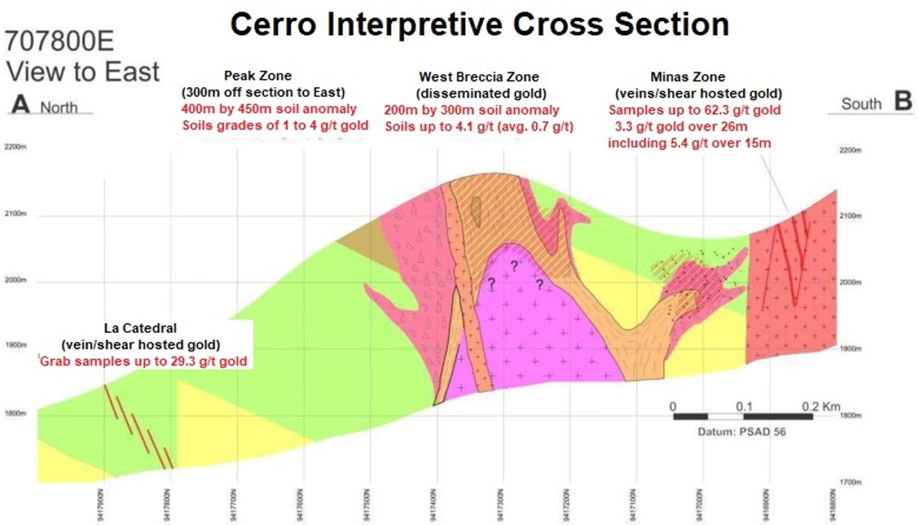

The Las Minas area has four mineralized zones with anomalous concentrations of gold in rock and soil. Three of the four zones (Peak, West Breccia, and Minas Sur) have been mapped, sampled, and tested by geophysical surveys.

Minas Sur is an isolated rock outcrop that has numerous old adits, open cuts and trenches; the outcrop is essentially an island in a swampy area that is otherwise devoid of rock exposure. Gold is present in a series of relatively narrow veins and shears exposed in a zone approximately 30 m wide. A continuous channel sample across the zone, including vein and wall rock material, assayed 3.3 g/t Au over an apparent width of 25.5 m.

The Peak Zone is a large (350 m by 350 m) area of anomalous gold-in-soil grades (1-4 g/t Au) coincident with chargeability high. The area is primarily underlain by quartzite breccia and massive to flow-banded intrusive rocks that have been extensively sampled but contain only background levels of gold.

The West Breccia zone is an area of strong to intense phyllic alteration and zones of disseminated gold mineralization (1-4 g/t Au), coincident with a chargeability anomaly approximately 200 m in diameter.

Tablon

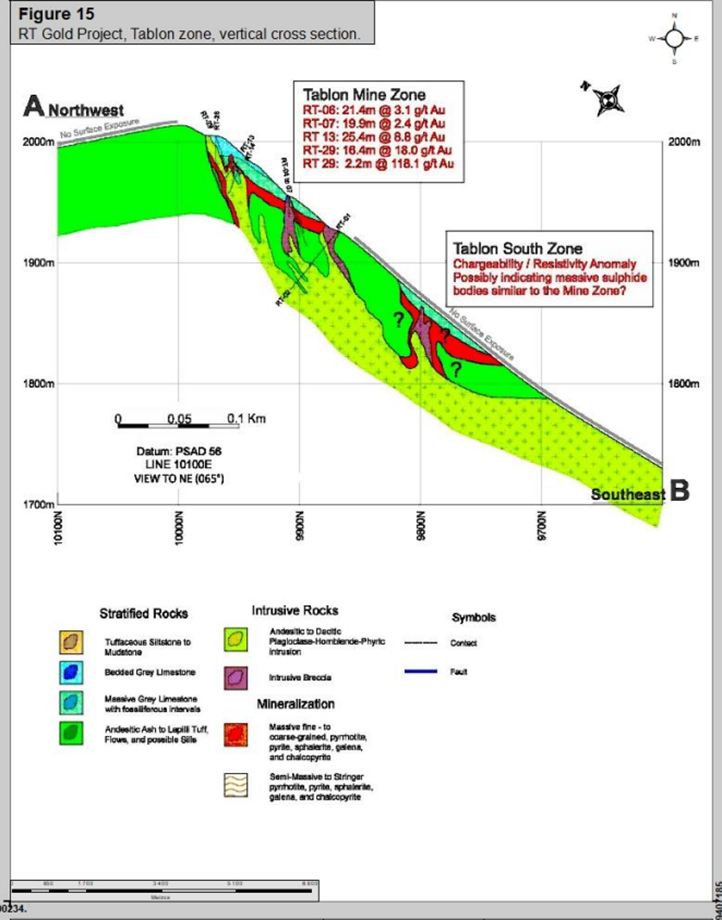

The Tablon Mine area is host to gold-bearing massive sulphide replacement bodies that have significant grades and widths. Geological mapping and detailed drill core re-logging were done in 2002 and 2021 to better define the geologic factors related to the formation of the massive sulphide deposits, and to delineate new exploration targets with potential to host similar mineralization.

The results of this work include a revised stratigraphic model, a detailed model for the mineralization process, the identification of several new areas warranting exploration and a better understanding of the geology and structure of the mineralized zones.

The Tablon Mine zone has numerous exposures of massive and semi-massive sulphide bodies, which were explored in the past by means of several adits and workings (the Tablon Mine). This zone was the primary focus of the 2001 drill program, which was designed to test the showings of sulphide mineralization in the vicinity of the Tablon Mine and along strike to the Tablon West area.

In 2002, a new zone named Cliff was discovered approximately 150 m to the southeast of Tablon West. It is situated at the contact between feldspar-hornblende porphyry and massive limestone and is approximately 60 m stratigraphically lower than the sulphides at Tablon West.

Other areas of interest include: Tablon South, a geophysical anomaly located approximately 250 m downslope (south) from the main Tablon zone; Tablon Southwest, a 100 m by 150 m area located southwest of Tablon west and south of the Tablon Fault; La Union, which has a large gold-in-soil anomaly that could have several bedrock sources; and the North zone located approximately 300 m northwest of the main Tablon zone, where rock chip sampling returned 6.1 g/t Au over 1.0m width.

Deposit Type

Mineralization of economic interest at RT is polymetallic (Au-Ag-Cu-Zn-Pb), but gold is the main commodity. The principal zones of gold mineralization are in the Tablon and Las Minas areas in the north-central sector of the property.

Exploration has focused on two distinct deposit types; at Tablon the exploration targets are massive, intensely quartzcarbonate altered bodies containing patchy to massive pyrrhotite and pyrite, with minor chalcopyrite, sphalerite, galena and native gold. There are gold-bearing quartz-sulphide veins and stockworks associated with the sulphide-bearing bodies. The lenticular to tabular sulphide-bearing bodies are mainly hosted by calcareous tuff and limestone, but their origin is uncertain.

The gold mineralization found on surface at Las Minas is primarily related to structures and occurs in quartz-sulphide veins, tectonic and hydrothermal breccias, shear zones and fracture-vein stockworks. There are also gold occurrences associated with phyllic alteration in brecciated volcanic rocks.

Gold and gold-polymetallic mineral deposits with similarities to those at RT that are known to be associated with Tertiary-age copper-bearing porphyry deposits and prospects in Cajamarca that have peripheral epithermal alteration zones are Las Huaquillas, Michiquillay, El Galeno (Hilorico zone), as well as Mirador in Ecuador, Magistral in Ancash, and Antoro in Huancavelica.

Adjacent Properties

The small mineral concessions immediately adjacent to Max’s property are not registered in the names of individuals or registered companies. Gold is mined sporadically and informally from gravels of the Tabaconas River and the lowermost parts of its tributaries, where these streams have cut the old gold-bearing gravel terraces left by the Tabaconas River.

Geochemical sampling traverses in these tributaries have established that there are no mines in the upstream sections. Stream sediment samples taken during these traverses returned anomalous gold grades near the mouths of the tributaries, but the samples from the upper reaches of these streams reported low gold grades.

There are two well-known mineral properties in the region; one is named Rio Blanco, and the other is called Las Huaquillas. Rio Blanco is a porphyry-style Cu-Mo deposit located approximately 40 km northwest of the RT property and contains a significant JORC copper-molybdenum resource. It is owned by Rio Blanco Copper SA, which is held 51% by Zijin Mining Group.

Las Huaquillas lies 25 km north-northeast of RT and is 100% owned by Rial Mineria SAC. Las Huaquillas host several gold targets along the 2.2 km long Los Socavones zones and the Centenario and San Antonio porphyry copper-gold targets. It is held by Fidelity Minerals Corp.

Exploration History

As far as the RT gold project is concerned, there are no official records of exploration or mining in the property area before the late 1980s. However, there is abundant evidence of historic and recent artisanal mining within the Tabaconas district. Local place names such as Cerro Las Minas and Quebrada Las Minas are testimony to the mining history of the area.

The first recorded modern exploration of the area of the RT property was

conducted in the late 1980s, when a government-funded Peruvian-German consortium reopened the old Tablon mine workings and carried out experimental geochemical studies in the area. Based on this work, the consortium optioned three concessions in 1997, two of which are now held by Max.

From the early 2000s, the RT project area was subject to intermittent exploration activity, including a property-wide prospecting and geochemical sampling program that located gold mineralization at Tablon and Las Mina. Various mapping and sampling programs eventually led to a 1,600-metre, 33-hole diamond drilling program that was completed in the Tablon mine area in 2001. This was followed by IP-resistivity and magnetic surveys at Tablon and Las Minas.

Exploration work was then suspended in 2011. This decision was made in response to the local community expressing concerns about mineral exploration activities. As a result, the consortium declared force majeure, as allowed in its option agreement.

Modern exploration at RT kicked off with the execution of Max’s option agreement in September 2020. In December 2020, Max reported the recovery and securing of the historic drill core from the 2001 campaign. Re-sampling and logging of the historical drill core were carried out in February 2021.

A summary of the drill intersections from resampling campaign juxtaposed with the historic intercepts are show below:

The aim of the resampling program was to validate the grade and thickness of historical intercepts, as well as to analyze for a larger suite of elements for lithogeochemical analysis, as historical data is limited to gold, silver, copper, lead, and zinc.

Report Findings

The historical exploration campaigns, including diamond drilling, were successful in finding significant mineralization on the property, the author of the technical report writes.

To date, some targets have been identified. Gold mineralization, locally of very high grade, occurs in replacement zones of massive and semimassive sulphides and in associated with sulphide veins on the northeast side of Tablon.

On the northwest side of Las Minas, anomalous gold and silver are present in weakly silicified and sericite-clay-silica alteration zones in felsic intrusions, tuffaceous volcanic rocks, and tuffaceous sediments in the Peak and West Breccia zones. High-grade gold and silver occur in quartz-sulphide veins at Minas Sur and La Cathedral.

Geochemical and geological evidence indicates that the diverse styles of mineralization at Tablon, Las Minas, and possibly at Vega are interrelated. These differences may reflect variations in the lateral position and level of emplacement of each type relative to the overall geometry of the hydrothermal mineralizing system.

The wide variety of host rock formations, each of which exerts its own lithological and structural controls, is also an important factor.

The author believes that the geological, geochemical, geophysical, and diamond drilling work completed in the past programs have both confirmed and enhanced the exploration potential of the RT gold project.

What’s Next?

The natural next step for the RT gold project is an environmental survey, a prerequisite for drilling.

The technical report states that two phases of exploration program are recommended: Before initiating the exploration program, Max needs to get authorization from the landowners for prospection such as geological mapping, soil sampling and other relevant exploration work.

For drilling the project, the company will need approvals from both the Ministry of Energy and Mines and the Ministry of Culture. The application process has already been started. In addition, the land where drilling will be carried out needs to be formally secured (though purchasing, renting, or some formal contract with the owners).

Once the land rights have been secured, the company will be in a position to initiate the drilling permit and water permit processes. The permitting process in Peru is time consuming and it can take 4- 6 months from initiating the environmental approval process and social engagement field work to obtaining the drilling and water permits.

Conclusion

The next stage of exploration should reveal more about Max’s RT gold project and its potential, which, as far as we know, could well be world-class, given it is sitting along a world-class mineral belt that features the Fruta del Norte, one of the highest grade, lowest costing gold mines in the world.

Worth mentioning, though, is that RT is not the only project that the company is advancing. Its flagship project is the CESAR copper-silver project in northeastern Colombia. This district-scale property features three major mineralized zones individually located along a 90 km long belt.

Max’s exploration strategy at CESAR revolves around the two primary depositional models being used for the project: Red-bed/Kupferschiefer-style stratiform copper mineralization to the north (AM zone), and Central African Copper Belt as well as structurally controlled mineralization to the south (the URU and Conejo zones).

Max is currently taking a two-pronged approach to exploring CESAR, the first being to evaluate and prioritize existing targets within the 188 km² of mining concessions for drill testing; and the second to continue its regional sampling and prospecting program to identify additional copper-silver targets along the 90-km long belt.

The 2023 exploration campaign focuses on six priority targets across the three zones. The goal is to determine which geophysical techniques best identify the copper mineralization based on the two deposit models.

For over two years, CESAR has been Max’s absolute priority, but the RT technical report reminds us that there’s another high-potential project in the making, one with exposure to gold. The company has already attracted plenty of interest, as evidenced by its existing co-operation agreement with Endeavour Silver, a mid-tier precious miner operating four mines in Mexico.

Could the RT project be also of interest to gold mining majors? We will find out.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.13 2023.06.30

Shares Outstanding 161.9m

Market cap Cdn$21.4m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSXV:MAX). MAX is a paid sponsor on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.