Mantaro closes Bolivian asset purchases, expects Golden Hill maiden resource by month-end – Richard Mills

2022.06.23

In what has been a busy month for Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ), the company recently dropped two important pieces of news related to its gold exploration efforts in Bolivia.

First, the Latin America-focused junior updated shareholders on the status of its first resource estimate for the Golden Hill property, where a maiden drill program was completed last year. The second was the closing of its previously announced acquisition of two properties in Bolivia to complement Golden Hill.

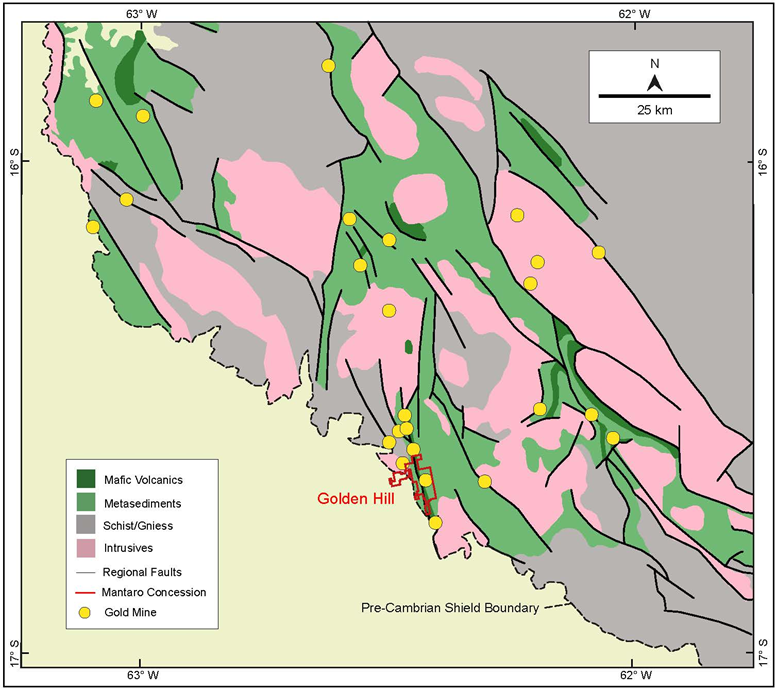

The Golden Hill property is situated in the underexplored Precambrian Shield, comprising a fully permitted, 5,976-hectare mining concession that was mined historically from alluvial drainages along a 6-km trend. It currently hosts at least six significant gold occurrences and deposits (including Golden Hill) along a 25 km strike.

The mineralization at Golden Hill is of greenstone-hosted orogenic gold type. Gold is contained within 1-5m wide sub-vertically dipping quartz shear zones, typically found along faults at the contacts between mafic volcanic and metasedimentary units of pre-Cambrian age.

According to Mantaro, the deposit types found in this region have the potential for kilometres of strike extension and kilometre-depth potential.

The vein system has so far been traced for over 4 km on the property, located in the hanging wall of a regional controlling fault to the west. This style of mineralization can be observed across the region and notably 2 km to the north of the property at the former gold mine, which produced over 350,000 oz between 1997 and 2003.

From a regional perspective and comparison with other greenstone belts worldwide, Golden Hill is, without a doubt, an attractive project, says Mantaro.

The Bolivian Pre-Cambrian shield is larger than the famous Abitibi greenstone belt in Canada, yet it has only produced less than 10 million oz compared to 170+ million oz in the Abitibi from over 100 mines since 1901.

To date, four major gold mineralized zones (La Escarcha, Gabby, Garrapittilia and Brownfields) have been identified across the 4 km strike length. Historical drilling on the property was only limited to the La Escarcha pit area.

Golden Hill Resource Estimate

In the June 7, 2023 media release, Mantaro said an independent qualified person has completed the necessary site visit and data verification necessary to complete the project’s technical report.

Accordingly, the company now expects to have the maiden resource estimate completed by the end of this month.

The qualified person, Juan Manuel Morales-Ramirez (BSc, MSc, P.Geo), is a highly seasoned geologist with over 40 years of experience in most commodities and deposit types throughout North, Central and South America. He has experience with gold mineralized bulk and vein-style gold systems from grassroots exploration through resource definition to prefeasibility study.

The independent technical report will be co-authored by P&E Mining Consultants Inc., which has successfully completed over 350 geological and mine engineering consulting reports, mineral resource estimate technical reports, preliminary economic assessments, and pre-feasibility studies.

The mineral resource estimate for Golden Hill will be centered on La Escarcha prospect, one of the four vein swarms hosted along a regional shear structure that were historically mined for gold.

Of the initial drill program (> 3,000 m, 21 holes) completed by Mantaro last year, 14 holes totalling 2,405 metres were drilled at La Escarcha, focusing on a strike length of only 400 m to a vertical depth of generally <100 m. The remainder were drilled as scout reconnaissance holes at other prospects.

In addition to the mapped vein swarms, there are an additional 6+ km of untested regional structures that are shedding alluvial gold in many places on the Golden Hill property, Mantaro says.

Highlighted drill results (as shown in the figure above) include the following:

- 3.57 g/t gold over 14.00 m (including 4.91 g/t gold over 8.80 m) from 105.0 m;

- 8.27 g/t gold over 3.40 m (including 11.82 g/t gold over 2.02 m) from 67.60 m;

- 7.57 g/t gold over 5.00 m (including 10.16 g/t gold over 3.66 m) from 87.00 m;

- 2.70 g/t gold over 15.02 m (including 8.47 g/t gold over 3.10 m) from 64.53 m; and

- 6.46 g/t gold over 4.0 m (including 12.73 g/t gold over 2.00 m) from 76.00 m.

“Drilling to date by Mantaro focused on a very small section of a much larger vein system and targeted the near-surface depth extension of outcropping mineralization to vertical depths of generally <100 m. The maiden resource estimate gives us significant optionality on a go-forward basis. Mineralized zones are generally steeply dipping, up to 13 m wide, and are near surface,” Mantaro’s CEO Darren Hazelwood commented in the news release.

Hazelwood also noted that previous bench-scale testing of a 5.6 g/t Au underground bulk sample demonstrated excellent gold recovery by gravity and cyanide, a promising sign for the company’s operations.

So far, Mantaro has obtained a new environmental license covering the entire property, allowing open pit, underground and alluvial mining for an indefinite term.

New Property Acquisitions

On June 13, Mantaro also completed its recently announced acquisition of two highly prospective licenses, being the East Trend and Media Sur properties, located in the San Ramon Greenstone belt of Bolivia (see map below).

The East Trend property comprises 2,650 hectares within the San Ramon gold district. The property covers faulted greenstone terrain forming the eastern extension of the La Cruz gold trend, which has been mined via a large number of small open pits by small-scale gold miners over 8 strike km. Recent activity by these miners indicates the gold mineralized trend continues to the southeast towards the East Trend property.

The property is located 20 km east of the historical Puqio Norte gold mine and the company’s Golden Hill property. According to Mantaro, the East Trend property is significantly underexplored, despite its highly prospective geological setting, which is analogous to known proximal gold mines and deposits.

The Media Sur property covers 4,750 hectares and is centered on the underexplored southern arm of a highly gold prospective metasedimentary – metavolcanic faulted greenstone belt. The project is situated along the same broad structure as two large orogenic gold systems, Medio Monte and La Lupa.

The latter is currently in production and is operated by a local Bolivian company that produces a significant amount of gold using basic gravity circuits. Recent artisanal mining activity suggests that gold mineralization continues to Media Sur.

“Although our focus continues to be the exploration and development of the Golden Hill property, we will continue to target accretive acquisitions in the underexplored Bolivian Shield,” Hazelwood stated earlier this month.

“Given the relative close proximity of these properties to Golden Hill, we can optimize exploration work across our portfolio of gold-focused Bolivia properties. We believe these are low-cost, high-upside assets for future exploration work.”

Summer Exploration in Peru

In addition to gold exploration in Bolivia, Mantaro is also looking to make silver discoveries at its Santas Gloria property in Peru.

The Santas Gloria property is located 40 km southwest of the Casapalca-Toromocha camp, comprising three concessions totalling 1,100 hectares. Silver is the main target commodity. The property has strong community support, with an access agreement in place until 2028.

Mineralization at Santas Gloria is of an intermediate sulphidation epithermal type — as is typical of many of the underground mines in the area such as Austria Duvaz, Argentum, Yauliyacu and Casapalca (see below).

As many as 16 veins and major vein splays have been defined on the property to date, with a cumulative strike extension of at least 12 km. None of them have been drill tested. An estimated 2 km of underground workings have exploited only two small areas of San Jorge and Tembladera veins.

Surface sampling of approximately 30% of the known outcrops has defined robust silver and gold grades along parts of the San Jorge, Tembladera, Tembladera 1, Kelly, Pacquita and Maribel veins (refer to figure below).

Silver grades are generally high above the historical San Jorge underground workings over a strike length of approximately 450 m. The Tembladera 1 and 2 veins are significantly silver anomalous over a cumulative strike length of at least 500 m.

Below surface, underground workings have also provided access to some parts of the San Jorge and Tembladera veins, allowing Mantaro to conduct underground channel sampling. A large number of these samples assayed above 150 g/t Ag, and a significant number of those assayed above 450 g/t Ag. One sample even assayed above 10,000 g/t Ag.

Because Santas Gloria is a silver-base metal vein system, otherwise known as Cordilleran silver-base metal type, the exploration targets are likely to be characterized by high grades with excellent depth, and it’s up to Mantaro to prove that with drilling.

Earlier this month, the company completed drill pad construction at the project site in preparation for a 15-hole, 2,500-metre drill campaign, set to begin this summer subject to a financing.

Drilling will initially target the strike and depth extensions of high-grade gold-silver-base metal mineralized segments of the Tembledara, San Jorge, Paquita and Maribel veins, which have been defined by channel sampling of surface veins and underground workings.

Most of the pads are located at 40-metre step backs from the veins, to target near-surface depth extensions beneath areas of highest surface silver and gold geochemistry. One pad is positioned at an 80-metre step back to enable drill testing beneath high-grade shoots identified by underground channel sampling at the San Jorge mine.

According to Mantaro, there are no archeological impediments to drilling, its environmental application and water permits have been accepted, and it has been authorized by the regulator to drill from up to 20 pads.

Conclusion

Mantaro’s recent updates basically tell us that we can expect some major news coming out of the company later in the year; the first being the initial resource estimate for the Golden Hill property, hopefully followed by drilling results from Santas Gloria.

Just by looking at the progress the company made on these two properties, it has the makings of a successful junior miner operating in two separate precious mineral-rich regions.

In an era where exploration assets are continuously being sized up by the gold majors, its Golden Hill property should at least get plenty of interest, given the number of deposits hosted and its geologic resemblance to world-class districts like Canada’s Abitibi. Most important of all, much of Bolivia is still vastly underexplored to this day!

Also worth pointing out is that the company originally held an option on 80% of the Golden Hill project, but decided to exercise a 51% majority stake even before finishing last year’s drilling, showing its confidence. With the high-grade results yielded from that program, we can see why.

Mantaro Precious Metals Corp.

TSXV: MNTR, OTCQB: MSLVF, FSE: 9TZ

Cdn$0.08, 2023.06.21

Shares Outstanding 69.8m

Market cap Cdn$5.6m

MNTR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Mantaro Precious Metals Corp. (TSXV:MNTR). MNTR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MNTR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.