Cashed up with a fresh new look, EGR sets off to make new gold discoveries on familiar grounds – Richard Mills

- Home

- Articles

- Metals Precious Metals

- Cashed up with a fresh new look, EGR sets off to make new gold discoveries on familiar grounds – Richard Mills

2023.06.21

While the recent movement in gold, or lack thereof, has put investors in “sit back and observe” mode, the industry’s stance on the metal remains bullish over the longer term.

In a recent video call, CPM Group’s Jeffrey Christian said he remains very bullish on gold over the medium term, predicting that prices will start to rise as soon as the fourth quarter, and then accelerate in 2024.

The latest analysis by VanEck shows that gold has pretty much formed a new base at the $1,900/oz level, and if that continues to hold, record highs will be within reach.

“Gold is showing resilience despite a strong stock market and recent US dollar strength,” VanEck’s deputy portfolio manager Imaru Casanova wrote in a report last week.

“The $2,075 per ounce all-time high seems well within reach, in our view,” Casanova added. “We see a macro backdrop that continues to be supportive of gold in the longer term.”

The macro backdrop, in this case, mainly refers to the end of rising interest rates as the US Federal Reserve’s tightening cycle draws to a close. Expectations that this past rate hike may be the last one of this cycle supported gold’s rally in early May, when prices came within cents of reaching a new record.

As we previously had established, gold prices and real interest rates tend to move in opposite directions, and a pause in rate hikes would serve as a catalyst for bullion in the second half of this year.

Gold stands in sweet spot between inflation and interest rate “tug of war”

Also factoring into the gold market analysis is the risk of an economic recession, which has been on the back of analysts’ mines for well over a year. JPMorgan recently advised investors to cut exposure to stocks and hold more gold and cash due to the risker macroenvironment.

JPMorgan’s chief global markets strategist Marko Kolanovic said that the “risk-reward for equities is poor due to a number of factors including elevated recession risk, stretched valuations, high interest rates and tightening liquidity and pointed to gold’s safe-haven properties as a hedge against these risks.”

Of course, JPMorgan isn’t the only bank that’s bullish on gold. According to a new survey from the World Gold Council, up to 24% of central banks were looking to raise gold holdings this year.

Global central banks have been one of the main driving forces behind gold’s rising demand in recent years. In 2022, net gold purchases by central banks totaled 1,135 tonnes, representing the highest level in 55 years. Since the beginning of 2023, the big banks are following the same trend, accumulating gold at the fastest pace on record.

At AOTH, we are led to believe that the reason more countries are buying gold may have to do with rising national debt, and holding more gold allows the central bank to cover their losses. Investors, too, tend to buy gold when their governments are drowned in debt, because it drives fear.

What does this mean for gold prices? Historically, the metal’s value has generally trended upward along with the national debt (as shown in graphic above).

As such, there are solid grounds to be bullish on the yellow metal even with prices being subdued over recent weeks.

Gold Juniors in Focus

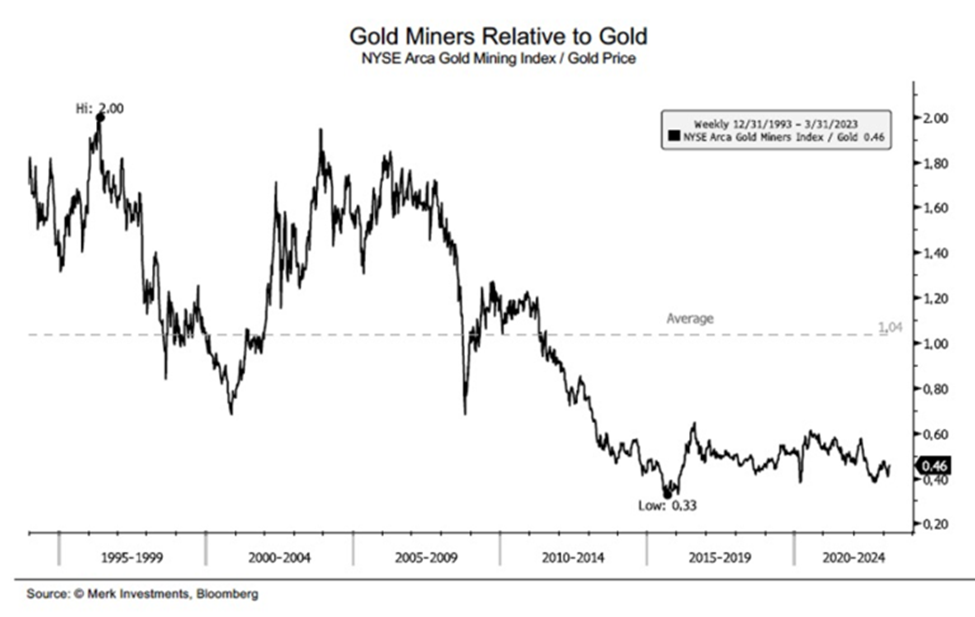

In the meantime, gold miners have significantly underperformed the metal for various reasons, namely a lack of market recognition that gold equities can serve as a great leverage to rising gold prices. In our option, gold mining stocks remain an extremely undervalued financial instrument for investors looking for exposure to bullion.

Gold and silver mining stocks aren’t keeping pace with metals

As VanEck stated in its analysis, the sector’s overall health looks solid, with gold producers remaining committed to disciplined capital allocation, growth, shareholder returns, profitability, and healthy balance sheets.

“They are also responsible operators, running sustainable businesses aiming to deliver benefits to all stakeholders while carefully managing the impact on the environment,” Casanova wrote in the report. “A re-rating of the gold mining equities from historically low valuations at present is well supported by the industry’s strong fundamentals.”

In 2022, world’s gold demand exploded 18% to 4,741 tonnes, almost on par with 2011 – a time of exceptional investment demand, according to WGC data. Meanwhile, total supply only increased 2% to 4,755 tonnes, even with mine production rising to a four-year high.

Making things worse, the rapidly depleting reserves and grades, exacerbated by high grading, will accelerate a fall in gold production – a change of direction from many years of annual increases – perhaps as early as this year, certainly something that is going to happen very near term.

These underlying fundamentals have been largely overlooked by investors for years. The simple matter of fact is that the industry is dangerously close to a supply shortfall, thanks to a lack of investment by the major producers. And as these companies churn through reserves that were discovered 15 – 20 years ago, they would eventually come to the realization that it’s too risky to explore greenfield projects.

The hope, therefore, lies in the junior gold miners. A junior resource company’s place in the industry food chain is to acquire projects, make discoveries and hopefully advance them to the point when a larger mining company takes it over.

Over the past several years, large gold companies have shifted from greenfield (early stage) to brownfield (historic producer) exploration. Whereas in the 1980s, junior gold companies discovered 10-30% of new mines, but after 2000 they have accounted for up to 75%, according to a McKinsey report.

Gold juniors now present an attractive proposition for the large companies, as they can be a cost-effective way for them to replenish their depleted gold reserves with a small financial risk. In fact, juniors effectively own the world’s future mines and are the ones most adept at finding these mines.

Pursuit of Next Gold Discovery

Obviously, the most attractive gold juniors are those with assets in established mining jurisdiction, preferably in close proximity to mines operated by the majors.

One that perfectly fits the profile is Vancouver-based EGR Exploration Ltd. (TSXV: EGR), which is exploring for gold next to the country’s largest gold operation, within a region already hosting multiple multi-ounce deposits.

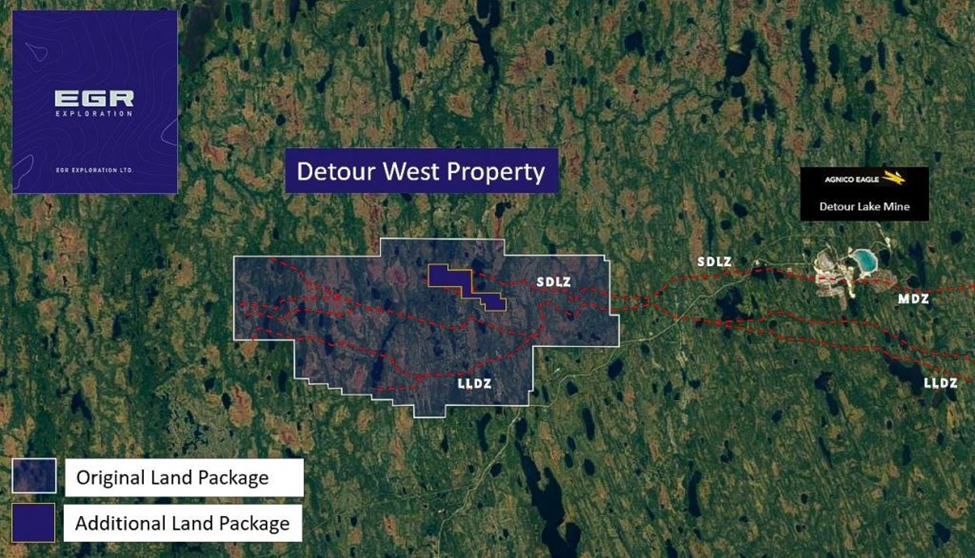

Getting its name from “Everywhere Good Results”, the company is looking to live up to that hype and pronounce the next significant gold discovery at its flagship Detour West property, located approximately 300 km north of Timmins.

The property covers 40,255 hectares of the Abitibi Greenstone Belt, one of the most prospective regions for gold on the planet. Many gold deposits found in the Abitibi area in the past have been considered “world class,” as the average gold deposit grade is higher than the global average.

The Abitibi region now hosts several key players in the gold mining and exploration space, including Canada’s Kirkland Lake Gold and Agnico Eagle, which merged into one company last year, as well as Newmont, the world’s leading gold miner.

The newly consolidated Agnico portfolio includes Canada’s largest gold-producing operation at Detour Lake, which has a mine life of approximately 22 years with expected average gold production of 659,000 ounces per year.

In addition to Detour Lake, Agnico owns the Canadian Malartic mine in northwestern Quebec, which had been the largest open-pit gold operation in Canada prior to 2022. The company is also developing the Macassa and Goldex projects and the LaRonde complex within the Abitibi belt.

Newmont also maintains a significant presence in this prolific greenstone belt with three projects: Éléonore, Porcupine and Musselwhite.

The success many have had in the Abitibi is a big reason why many up-and-coming gold explorers continue to gather in the region to this day. Remember, there are still an estimated 100 million ounces still contained in the ground, and so the idea of making new, exciting discoveries here is quite plausible.

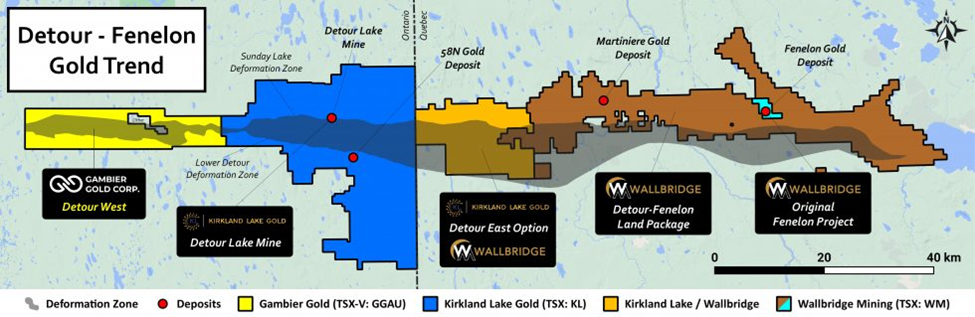

EGR’s property is conveniently located 20 km west of the Detour Lake open-pit (hence the name “Detour West”), and also directly adjoins Agnico Eagle’s holdings along the Detour-Fenelon gold trend. The eastern portion of this trend is being explored by Wallbridge Mining in Quebec (see figure below).

In July 2020, EGR — under its previous name Gambier Gold — entered the Detour West project after signing an option agreement on the property, which at the time was less than half the current size (approximately 32 km long and 6 km wide).

Following a period of “trial and error” with its initial exploration, EGR has since decided to use the exact same exploration methods that have been successful for Agnico at the Detour Lake mine.

Following Detour Lake’s Path

A recent review of the Detour Lake 2018 technical report indicated that a successful pre-drilling exploration approach, especially south of the Lower Detour Deformation Zones (LDDZ), involved Induced Polarization (IP) surveys on 200 m line spacing and Mobile Metal Ions (MMI) geochemical survey to assist in ranking of the geophysical IP anomalies.

Back in 2010-2011, Detour Lake Mines collected 10,000 MMI samples at 50 m spacing on lines 400 m apart along 30 km of the LDDZ. The samples were collected at depths of 10 to 25 cm and a 25 g split from each sample was analyzed. Between 2011 and 2017, the miner completed 838.4 line km on mainly 200 m line spacing principally along the LDDZ, with detailed 100 m line spacing around the Zone 58N gold deposit.

EGR has started a similar two-phase program along an 8 km stretch of the western interpreted extension of the Saturday Lake Deformation Zone (SLDZ), starting approximately 1 km to the southeast of the A series RS drill holes.

The initial phase would be MMI sampling along the 8 km length on 400 m spaced lines, to be followed by IP survey over initially the highest MMI anomalies to define drill targets. The drilling will be done by a combination RC-diamond core drill allowing for both till and rock core sampling.

To maximize its chance of success, EGR further increased its landholding earlier this year and consolidated the entire 40,255-hectare Detour West project area (see below).

Interpretation of the existing magnetics data over the newly acquired claims shows the potential for segments of the Sunday Lake Deformation Zone (SDLZ), Massicotte Deformation Zone (MDZ), and secondary splays from them, to extend onto the property, EGR said.

The company then carried out an airborne magnetic survey totaling 4,620 line km on a line spacing of 75 m at the Detour West project. The survey will cover approximately two-thirds of the property investigating the extensions of the Sunday Lake, Massicotte and Lower Detour Lake deformation zones known to be associated with gold mineralization along the Detour-Fenelon trend, which hosts Agnico’s Detour Lake mine.

Data obtained from this airborne magnetic survey, which has now been completed, will provide what EGR considers to be a “superior and consistent dataset” that will form the basis for target refinement of future till and top of bedrock sampling and reverse circulation drill programs.

A field program will be implemented afterwards to follow up on a previous Lidar survey, investigate outcrops identified from the survey, and plan access and drill pad locations for drilling.

Should everything go according to plan, EGR will initiate the till sampling program in mid-December 2023, which is expected to continue through the winter. The goal will be to test for gold in glacial till and identify potential gold grain dispersion trains emanating from gold mineralization associated with the extensions of known deformation zones.

Exploration in Quebec

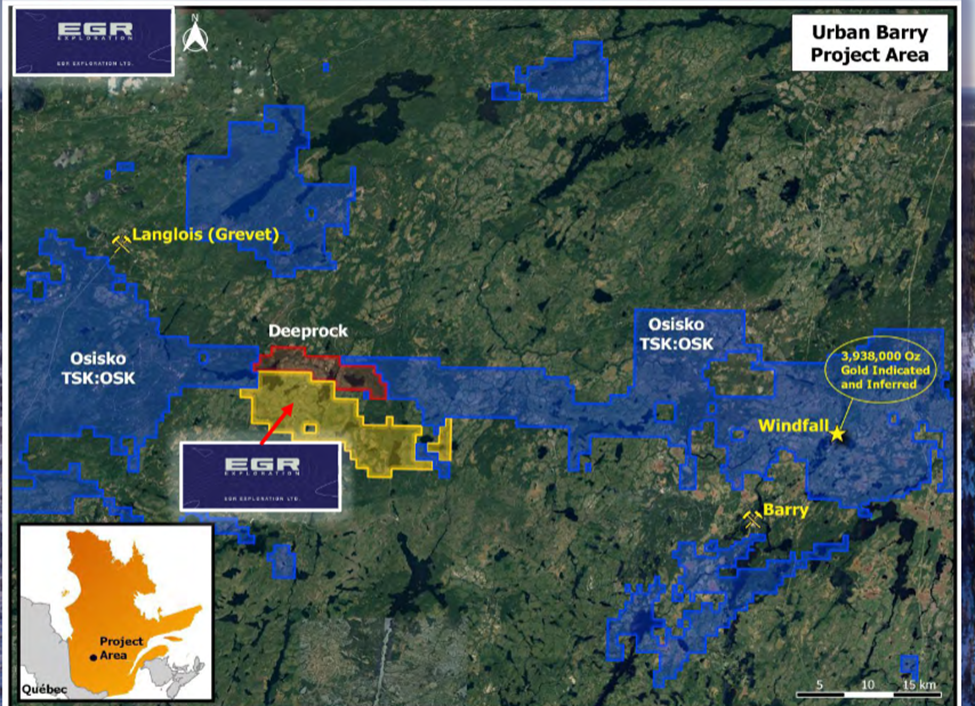

In addition to Detour West, EGR is also looking to explore the Quebec side of Abitibi belt. The company’s Urban Barry project is located in the James Bay region, near Osisko’s Windfall deposit which holds nearly 4 million oz. of gold resources.

The Urban Barry property encompasses an area of approximately 10,762 hectares and directly adjoins Osisko’s property, with the Langlois base metal-silver-gold mine located approximately 30 km to the northwest.

From November 2019 to March 2020, EGR flew an airborne drone magnetic geophysical survey over the property. Results from this survey confirm the presence of the northwest extension of rock units and fault structures hosting the nearby Windfall gold deposit.

The company is currently reviewing all historical data on its Urban Barry property and is in the process of planning future field programs.

Conclusion

Under the current market environment, junior miners are a great value proposition for those looking to leverage the bullish outlook on gold, without having to own the metal. For years, gold mining stocks have been severely undervalued, but sooner or later they will catch up.

When it comes to investing in gold juniors, the potential returns of investing then versus now can be night and day; timing matters in this sector.

While there’s still a way to go before EGR fully executes its exploration plan, the simple fact that its main project is sitting in the same area as multiple world-class gold deposits, says enough. Remember, the Abitibi belt has some 100 million ounces yet to be mined.

It should be noted that the company is basically starting from scratch at its Detour West project after trying its own method, but is now using a successfully proven approach applied to what is now Canada’s largest open-pit mine at Detour Lake.

It’s also worth mentioning that the Detour Lake operation, now under Agnico’s ownership, is still expanding. The Canadian gold major plans to develop two new pits to the west of Detour Lake along with extending the existing pit in the same direction.

As the West Detour project advances, could EGR’s large property come into the foray? It’s certainly possible.

And finally, we have to consider that even without any actual drill results to date, EGR has had no shortage of investor interest. Since December 2022, the company has closed two rounds of financings at $950,000 each, with active participation by insiders — a sign of confidence for its new management team and what they’ll deliver in 2023 and beyond.

EGR Exploration Ltd.

TSXV: EGR

Cdn$0.07, 2023.06.20

Shares Outstanding 40.2m

Market cap Cdn$2.81m

EGR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard does not own shares of EGR Exploration Ltd. (TSXV: EGR). EGR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of EGR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.