Why Graphite One is essential to a green future

2023.06.14

Graphite One (TSXV:GPH, OTCQX:GPHOF) aims to become the first vertically integrated domestic graphite producer to serve the nascent US electric vehicle battery market.

The Vancouver-based company in April, 2022 announced an MOU with Sunrise New Energy Material Company, a China-based lithium-ion battery anode producer.

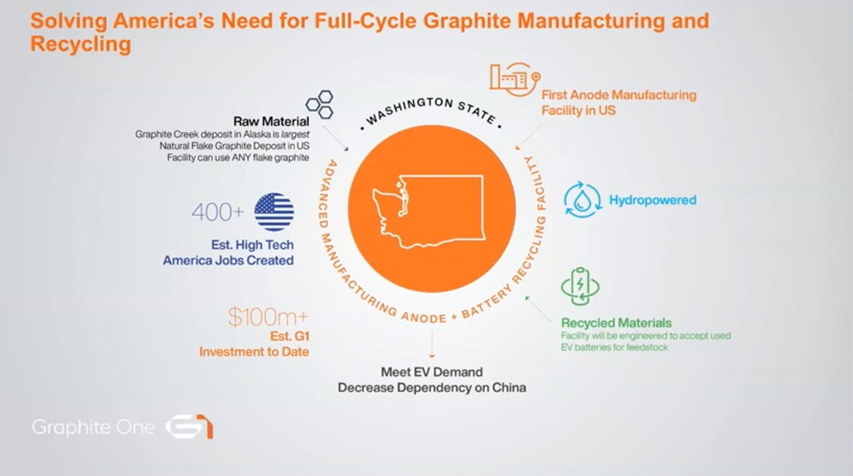

Graphite One intends to share expertise and technology with Sunrise for the design, construction and operation of a proposed graphite material manufacturing facility in Washington State. The source material would come from the company’s Graphite Creek deposit it is developing in Alaska.

In December 2022, Graphite One announced that Graphite Creek concentrate is being used to prepare sample battery anode materials for two major electric vehicle manufacturers, while an artificial graphite anode sample is being prepared for a third EV company.

This was a crucial milestone for Graphite One in proving, a/ that its graphite end product is of sufficient quality to be battery-grade; and b/ that Graphite One is able to tailor its graphite processing to meet the specific graphite anode needs of its potential future clients.

Graphite One then made two more announcements, the first regarding the testing of graphite from Graphite Creek; and the second, the testing of Graphite Creek material “as a potentially critical mineral-rich carbonaceous feedstock.”

These two developments place Graphite One in a stronger position to continue its work in Alaska, where it holds the country’s largest confirmed graphite resource.

Following last year’s success, the company is planning to drill 20,000 meters in 2023-24. The results could help to increase the production capacity for the upcoming Graphite Creek feasibility study (FS).

If all goes according to plan, the FS would move Graphite One’s deposit that much closer to becoming America’s only source of mined graphite, helping to shed its import reliance.

The project already has the backing of the highest levels of government in Alaska, and is expected to qualify for tax incentives under the US Inflation Reduction Act.

Green transformation

Junior resource companies love to talk about what they are doing and how they are doing it, but the rationale for their project(s) is often either not conveyed, or poorly communicated to investors.

The “why” in Graphite One’s case comes down to the green transformation taking place around the world. Despite the plethora of electronic gadgets we have at our fingertips, most people don’t make the connection between the materials that go into them, and the magic of the devices we use.

As for the electrification of the global transportation system, it doesn’t happen without graphite. That’s because the lithium-ion batteries in electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Graphite is thus found in a wide range of consumer devices, including smart phones, laptops, tablets and other wireless devices, earbuds and headsets. Besides being integral to electric car batteries, graphite is found in e-bikes and scooters.

Graphite has the largest component in batteries by weight, constituting 45% or more of the cell. Nearly four times more graphite feedstock is consumed in each battery cell than lithium and nine times more than cobalt.

Needless to say, graphite is indispensable to the EV supply chain. Bloomberg New Energy Finance expects graphite demand to quadruple by 2030 on the back of an EV battery boom transforming the transportation sector.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in graphite demand could see an 8- to 25-fold increase between 2020 and 2040, trailing only lithium in terms of demand growth upside.

Graphite crisis

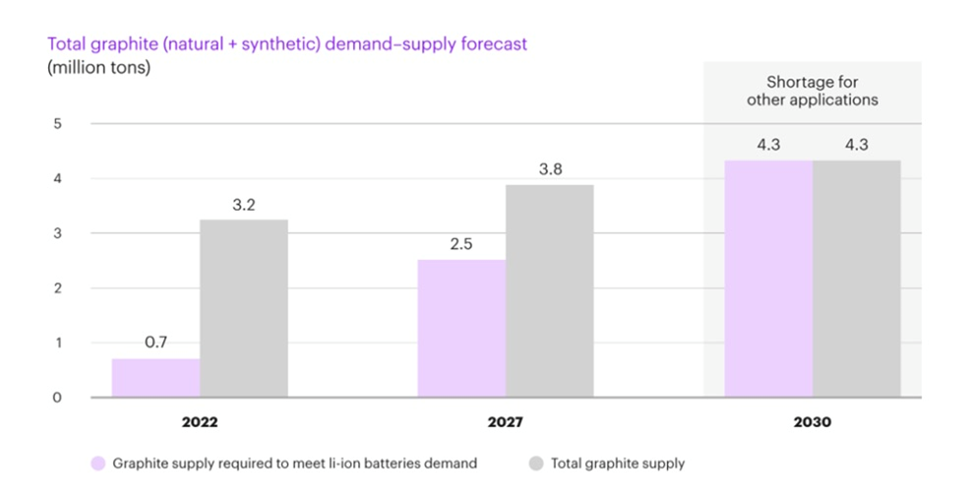

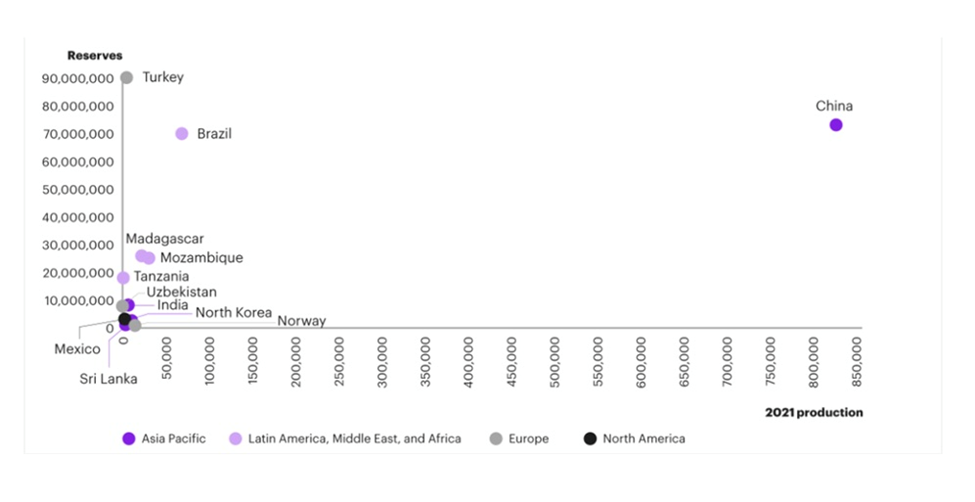

The question then becomes whether we have enough graphite to sustain the demand pressures of the EV revolution. To answer it, consider the slide below:

The United States currently imports 100% of its graphite. Another way of saying this is the US has zero production. With 70% of the world’s graphite supply coming from China, how will the United States compete in these new technologies that are shaping our world? Are we going to own what we need here or buy it from other countries? Current events are teaching us how dangerous it is to rely on foreign sources of supply, in a world where adversaries can use access to materials as an economic weapon.

American manufacturing including equipping the US military with the most advanced weapons systems in the world is untenable without domestic production of graphite and other critical minerals. 95% of the typical battery anode is composed of graphite, none of which the United States currently mines. The World Bank projects that the market for graphite will grow by nearly 500% by 2050; President Biden in his 100-day report said the number is 2,400% by 2040.

In the past, the industrial minerals sector has mostly overlooked any potential problems in securing graphite for EV batteries.

After all, graphite is plentiful, with a well-developed supply chain due to longstanding demand from industries such as steelmaking and electronics. It’s also cheaper, with the raw material priced at roughly one-tenth that of lithium. In 2022, graphite made up just 2% of the battery cost, according to consultants at Kearney.

However, what many are forgetting are two important trends concerning graphite: 1. Demand is accelerating at a rate never seen before; and 2. The industry is shifting towards natural graphite.

An analysis of expected demand by Benchmark Mineral Intelligence suggests that graphite has the largest future gap between supply and demand — even more than that of lithium. Graphite demand is likely to grow by a factor of eight by 2030 over 2020 levels (4.2 metric tons over a supply of 3.0), and 25 times by 2040, said Benchmark. That translates into a predicted supply shortfall of 30% for graphite, compared to 11% for lithium (2.4 over 2.1), 26% for nickel (1.5 over 1.1), and 6% for cobalt (0.32 over 0.30).

By then, the world’s graphite supplies will not even be able to cover demand for EVs, let alone all end-use sectors, BMI projections showed.

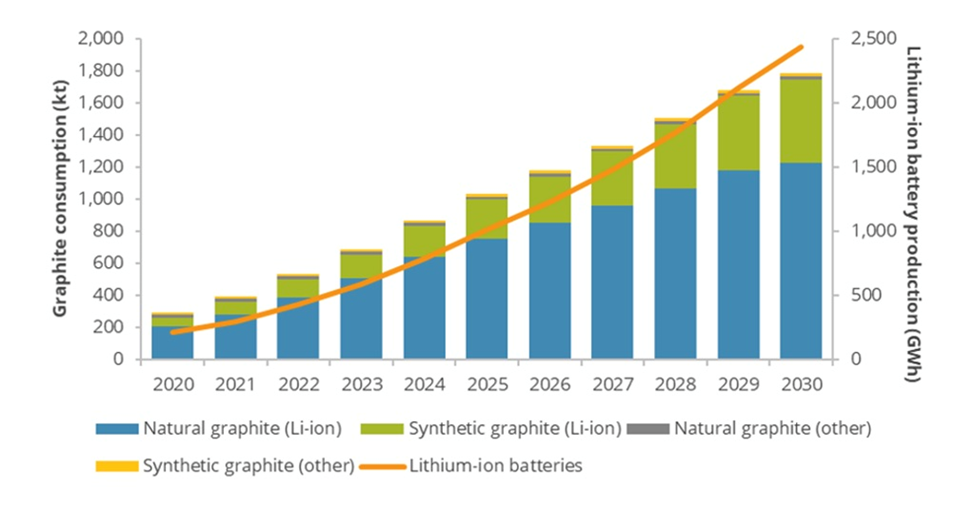

Then there’s the problem with the type of graphite used. For ages, synthetic graphite has held the lion’s share of the battery market (57% of the anode market in 2022, according to BMI), because it performs better in electrolyte compatibility and has fast-charge turnaround and battery longevity. But compared to the natural version, it costs nearly double and has a lower capacity.

Importantly, synthetic graphite is very energy-intensive. BMI estimates that anode production using synthetic graphite can be over four times more carbon-intensive than with natural graphite. Not to mention the pollutants, which make synthetic graphite counterproductive to climate goals.

For these reasons, EV manufacturers are beginning to show a preference for natural graphite, especially as processors have improved the purity. It’s widely expected that the world’s natural graphite production is likely to outpace synthetic yields by 2030 (see below).

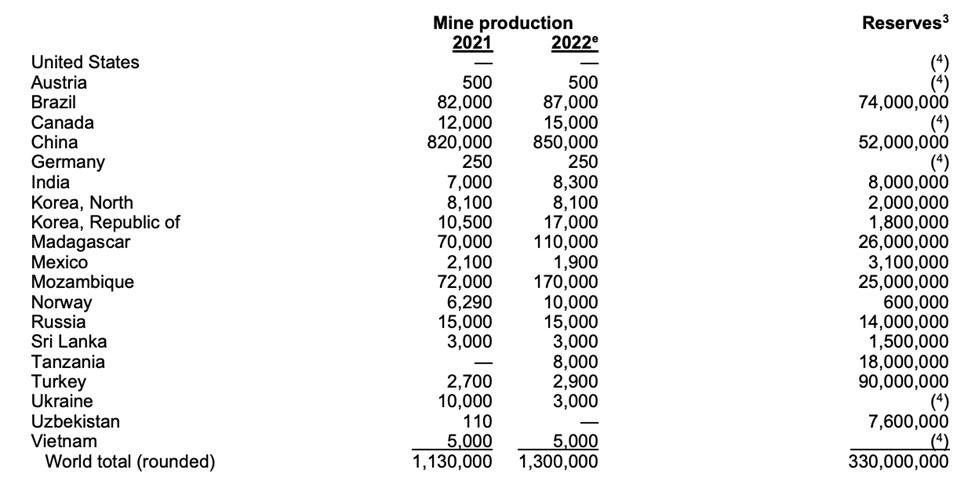

Flake graphite, as the name implies, has a distinctly flaky or platy morphology. Only flake graphite upgraded to 99.95% purity can be used in batteries. Herein lies a bigger problem: natural flake graphite is difficult to source. Only about 20 countries make up the world’s supply, many of which produce insignificant amounts (<10,000 tonnes a year).

Complicating matters is that not all mined material has the required purity for EV battery consumption.

China is currently by far the biggest producer with nearly three-quarters of the world’s graphite production. Due to weak environmental standards and low costs, China also controls almost all graphite processing, establishing itself as the dominant force in every stage of the supply chain.

US import dependence

As much as the United States wants to keep pace with China in the global EV race, it can’t do so without a reliable graphite supply. As mentioned, the US does not mine any graphite, so it is solely reliant on imports.

According to the USGS, in 2022 the US imported 82,000 tonnes of natural graphite, of which 77% was flake and high-purity. The top importers were China (33%), Mexico (18%), Canada (17%) and Madagascar (10%).

But taking into account the fact that EV batteries require run-of-mine graphite to go through purification and coating, a process controlled by China, the US is actually not 33% dependent on China for its battery-grade graphite, but 100%. This is a precarious position to be in should the country want to stay in contention for EV dominance.

This is why graphite is firmly placed on the US government’s critical minerals list, and is identified as one of five key battery minerals that are at risk of supply disruptions. The other four — lithium, nickel, cobalt and manganese — typically form the cathode that decides the capacity and therefore tend to get more attention. But graphite, as the anode material, is probably the most crucial one since it’s far superior to current alternatives.

According to the USGS, the battery end-use market for graphite has already leaped by 250% since 2018. It’s thought that battery demand could gobble up well over 1.6 million tonnes of natural flake graphite per year.

For context, 2022 mine supply was about 1.3 million tonnes, which means we’re very close to entering, if not already, a period of deficits. Benchmark Mineral Intelligence projects natural graphite will have the largest supply shortfalls of all battery materials by 2030, with demand outstripping expected supplies by about 1.2 million tonnes.

And this is just counting EV battery use; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI has said as many as 97 average-sized graphite mines need to come online by 2035 to meet global demand. That’s about eight new mines a year, which at first may seem doable but considering the number of graphite projects worldwide and the time it takes to develop them into mines, we’re really up against it.

Support from government

Thankfully, the US. government has begun to appreciate the current crisis in graphite and other critical minerals it is import-dependent on.

In 2022 the Biden administration invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War.

To bolster domestic production of these minerals, US miners can now gain access to $750 million under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies.

The trillion-dollar infrastructure bill allocates $7 billion to advance domestic projects and renewable energy, supply chains and critical minerals with specific focus on EV batteries.

Graphite One’s production from Graphite Creek is expected to qualify for tax credits under the US Inflation Reduction Act, because it plans to produce both anode materials and purified graphite in the United States, as required by the act.

Beyond new funding, Graphite One has the support of high-ranking US politicians, including Alaska Governor Mike Dunleavy, Alaska Senator Lisa Murkowski, who has elevated G1 and critical minerals issues in the Senate, junior Alaska Senator Dan Sulllivan, and recently elected Congresswoman Mary Peltola — all of whom understand the importance of resource development.

Graphite Creek

Graphite One is advancing its Graphite Creek property, situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process. In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The US Geological Survey has cited Graphite Creek as the country’s largest known graphite deposit, and one of the biggest in the world.

Prefeasibility study

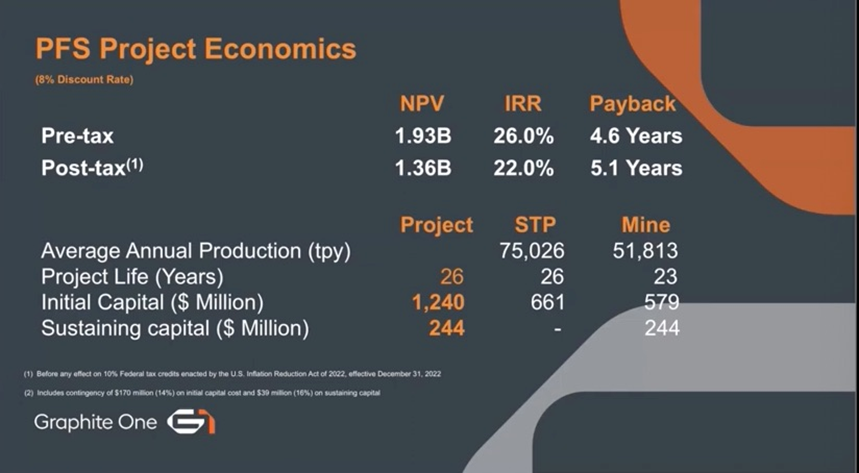

Last fall Graphite One underwent a major de-risking event with the release of the prefeasibility study (PFS).

The PFS portrays the Graphite One Project as highly profitable, with expected costs of $3,590 per tonne measured against an average graphite price of $7,301 per tonne.

The mine would produce, on average, 51,813 tonnes per year (tpy) of graphite concentrate for its projected 23-year mine life. The company itself would produce about 75,000 tpy of products, of which 49,600 tpy would be anode materials, 7,400 tpy purified graphite products, and 18,000 tpy unpurified graphite products.

The prefeas, which has a pre-tax net present value (NPV) of $1.9 billion, is based on exploration of only one square kilometer of the 16-km deposit, meaning G1 could easily crank up production by a factor several times the current (proposed) run rate of 2,860 tonnes per day. Drill results to date indicate the resource remains open down dip and along strike to the east and west.

Graphite One expects a recent net smelter return (NSR) purchase will have a positive impact on the NPV and the internal rate of return (IRR) in the upcoming feasibility study.

Under the terms of the NSR Purchase Agreement, published this week, the company will issue 456,000 shares to Ronald C. Sheardown, at USD$1.10/sh, for a total consideration of $500,000. The NSR applies to future production from 133 Alaska state claims owned or leased by Graphite One.

The purchase of a 1% NSR brings Graphite One’s total purchases to 3% NSR. Two NSRs on the Graphite Creek property remain outstanding: a 5% and a 2.5% NSR applicable to certain Alaska state claims, of which 2% of each NSR can be purchased for a total of US$4 million, leaving a 3% and 0.5% NSR on their respective claims.

2022 drilling increased the measured and indicated tonnage by 15.5%, with a corresponding 13.1% increase in contained graphite. Measured and indicated resources now stand at 37.6 million tonnes at 5.14% graphite with an inferred resource of 243.7Mt @ 5.07% graphite.

The deposit has proven and probable reserves of 22,490,000 (diluted) tonnes at grade of 5.6% Cg, yielding 1,258,000 tonnes of contained graphite.

Circular economy

G1 plans to simultaneously develop a battery anode materials manufacturing facility in Washington State and the Graphite Creek mine in Alaska. These are the first two parts of its strategy, known forthwith as the Graphite One Project.

The manufacturing plant would pelletize and thermally purify the material to at least 99.95% Cg, before the majority of it is air-milled, turned into spheroid-shaped particles, coated and graphitized.

Also, under an earlier MOU with battery materials recycler Lab 4 Inc. of Nova Scotia, Canada, GPH and Lab 4 will design and build a recycling facility for end-of-life EV and lithium-ion batteries.

The recycling facility will be next to the Washington manufacturing facility and engineered to accept used EV batteries for feedstock.

Between the mine, the manufacturing facility and the recycling plant, Graphite One plans to execute a “circular economy” strategy as it goes about building a US-based graphite supply chain.

The idea is that the Graphite One Project increases North American supply of high-purity coated spherical graphite that meets or exceeds current requirements for electric vehicle battery anodes, and other critical applications at a time when demand for graphite is skyrocketing.

Milestone moment

Earlier this year, G1 announced it has received active anode material samples produced by Sunrise — the Chinese lithium-ion battery anode producer — using Graphite Creek graphite.

These samples, along with specification data, were then provided to PNNL, the U.S. Department of Energy lab, for additional testing.

Samples were also sent to a leading EV manufacturer for evaluation.

“This is a milestone moment for Graphite One,” said Graphite One’s founder and CEO Anthony Huston, in the April 26 news release. “Being able to provide anode material manufactured from our Graphite Creek feedstock — to both a major EV maker and a U.S. national lab — is a major step in our strategy to build a 100-per-cent-U.S.-based advanced graphite supply chain.”

The company produced two types of active anode material samples from its graphite concentrate: coated spherical natural graphite (CSG); and secondary particle natural graphite. A fast-charging artificial graphite anode material sample was also produced for North American EV battery companies.

The samples were produced in Sunrise’s commercial-scale anode material manufacturing plant.

Portions of all three samples have been sent to PNNL for independent verification. Two samples were sent to a leading EV manufacturer, and specification data was sent to other end-users.

Surely there is no better proof of concept than to send battery-suitable graphite products directly to Graphite One’s potential customers.

Conclusion

I see Graphite One taking a leading role in loosening China’s tight grip on the US graphite market, using feedstock from its Graphite Creek mine in Alaska, and shipping it to Washington State for manufacture into coated spherical graphite for electric-vehicle batteries.

Indeed the company could supply a major portion of North America’s graphite demands.

“If they, Graphite One, were able to open tomorrow, the US could go from being fully reliant on foreign countries for our graphite to Graphite One being able to supply nearly all our graphite demand,” Sen. Lisa Murkowski has said.

But if there’s one thing we’ve learned from the trade war with China, and then the pandemic, it’s that securing access to 21st century tech materials is not just about supply, it’s about supply chains.

G1’s CEO Anthony Huston sees the current focus on supply chains as “a teachable moment,” telling a recent investment conference “it’s a reminder in this global economy of ours thatwe need to know about the stuff our stuff is made from, where it’s made, and what happens to us if we don’t have it? I can tell you it’s a hard lesson in the resource world. It’s not enough to discover and develop a deposit, and pull critical minerals out of the ground, you’ve got to transform those raw materials into the advanced materials America needs to complete and maintain a modern 21st century tech economy.”

“And you have to do it right here in the United States,” he adds, noting that having just one missing link in a supply chain where it’s necessary to import from a country that is a current competitor and/or a potential adversary, “and supply risks and national-security vulnerabilities come right back at us.”

“That’s why G1 has evolved a fully supply-chain solution from graphite Creek to our planned advanced anode material plant in Washington State where hydro power, green energy to make a green tech material will give us the economics we need to make this work. And to complete the circular economy, the recycling component we’re adding to reclaim and reuse graphic material from spent batteries which would become a very important feedstock as we move past 2030.”

“I’m convinced that Graphite One is truly integral to the transformation taking place in the world around us and the green future,” Huston concludes, and I agree.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.34, 2023.06.13

Shares Outstanding: 121.1m

Market cap: Cdn$168.5m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.