Four drills turning at Dolly Varden’s Kitsault Valley – Richard Mills

2023.06.06

Dolly Varden Silver (TSXV:DV, OTC:DOLLF) has begun its 2023 exploration program with four diamond drill rigs operating at Kitsault Valley, the company’s silver and gold project located within the Golden Triangle region of northwestern BC.

The land package, which includes the Dolly Varden silver property and the Homestake Ridge gold-silver property, hosts one of the largest undeveloped high-grade precious metals projects in Western Canada.

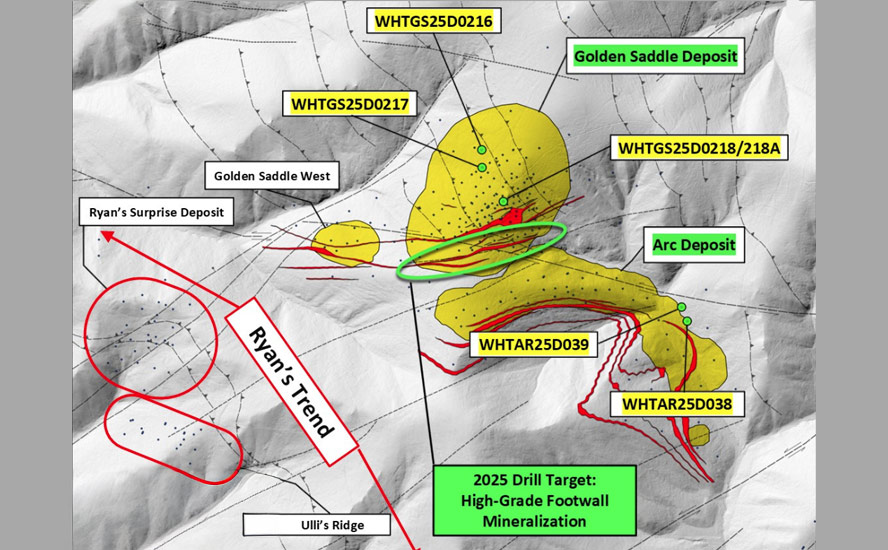

Last year, DV embarked on a comprehensive drill program at Kitsault Valley. The goal was to upgrade the inferred mineral resource to the measured and indicated classification, to expand the known deposits, and to discover new silver-gold mineralization along the Kitsault Valley trend.

Specifically, the objective was to expand the wide, high-grade silver mineralization at the Wolf Vein, step out and infill at Torbrit and the nearby Kitsol Vein, and test several other nearby exploration targets.

Over 37,000 meters of drilling in 108 holes was completed.

In summary, the grade and consistency of silver mineralization from both the Kitsol and Wolf veins indicated the potential for an underground bulk-mineable deposit. The Wolf vein area has also emerged as a large system rivaling the Torbrit deposit.

Drilling from the newly acquired Homestake Ridge property demonstrated strong continuity of mineralization over wide intervals, similar to that of Kitsol and Wolf.

According to the company, not only were the gold and silver grades some of the highest from the property, they were also up there with the best of the Golden Triangle’s 2022’s drilling season.

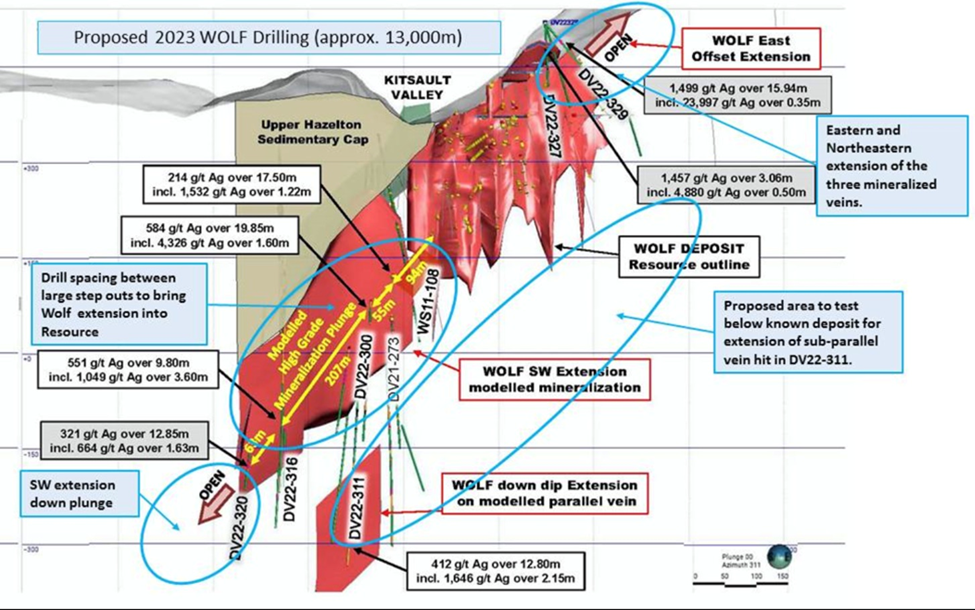

Drilling at the northern limits of the Wolf deposit returned an 8.77-meter intercept of 1,499 g/t silver, 1.89% lead and 0.46% zinc. Within that intercept was what the company called “jewelry-box-style” mineralization, grading 23,997 g/t silver, 1.24% lead and 0.34% zinc over a true width of 0.19 meters.

Towards the southern limits of the Wolf Vein, drilling encountered 321 g/t silver, 0.84% lead and 0.84% zinc over 12.85 meters, including 664 g/t silver, 1.24% lead and 3.54% zinc over 1.63m.

“Results from the Wolf Vein continue to exceed expectations, returning the highest-grade silver assay yet received, more than doubling the strike length of the deposit through step-outs to the north and south as well as returning wide, robust silver and base metal grades at depth,” Khunkhun said in the Feb. 6 news release.

It’s tough to get the market’s attention these days, but Dolly Varden is one of the few junior resource companies to have done so. From just 36 cents a share at the end of September, 2022, DV’s stock price more than tripled to a five-year high of $1.23/sh on April 10, 2023. A pullback to around $0.85 presents a good entry point for shareholders wanting to capitalize on another strong set of drill results.

Dolly Varden: Wolf and Kitsol Veins

In kicking off its 2023 drill program, the Vancouver-based company said two rigs will target the Wolf Vein, and two will be at Kitsol, with a fifth rig available as the 45,000-meter program progresses.

“We have hit the ground running with four drills on our fully funded 2023 exploration drilling program. We have already completed several drill holes at Wolf and Kitsol, where aggressive step-outs in 2022 significantly expanded silver mineralization along strike to the north and south as well as down-dip,” Shawn Khunkhun, President and CEO of Dolly Varden Silver, said in the June 5 news release.

“The team is excited to test numerous new target areas beneath the sediment cap with the objective of connecting these two wide and high-silver-grade areas,” Khunkun added.

As disclosed previously, the priority of the 2023 exploration program is to connect the Wolf deposit with the Kitsol deposit, located 1,400 meters apart.

Drilling allocated to the Wolf deposit expansion (approx. 13,000 meters) will focus on both infill drilling of the wide-spaced intercepts from 2022, as well as further step-out holes in several directions where high-grade silver mineralization remains open. Similar step-out drilling will follow up on high-grade silver mineralization at the Kitsol Vein.

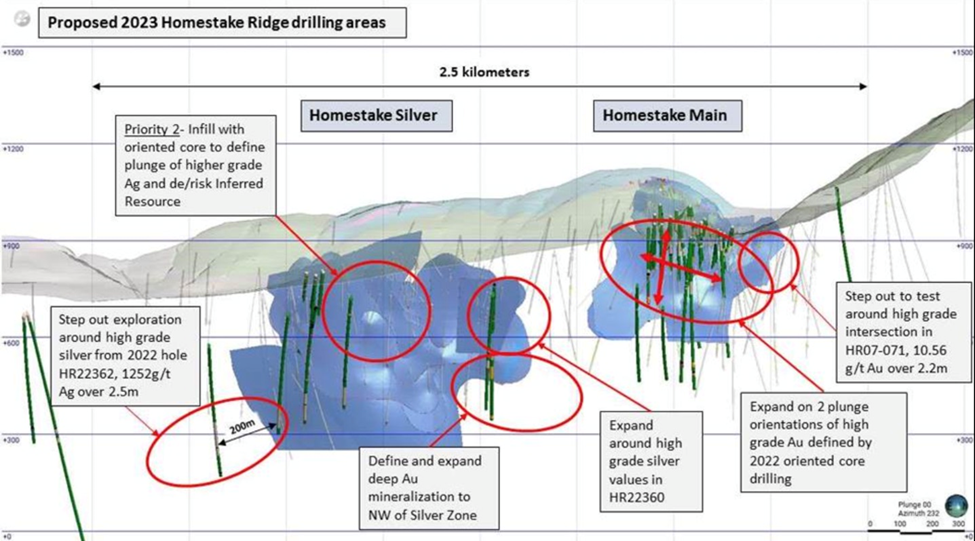

Homestake Ridge: Main and Silver

In several weeks, the drills will be moved up the valley to the Homestake Ridge deposits. Here, 2023 drilling is influenced by structural information gained from infill drilling at the Main deposit, where two main plunge directions have been identified. The planned drilling will target the down plunge extensions of higher-grade and wider zones of gold mineralization. Drilling at the Silver deposit will prioritize step-out holes where 2022 expansion drilling had success at the southern extent.

Geology crews have been on site since early May, completing a program of additional sampling of core from 2022 Homestake Main drilling where assay results revealed an extensive low-grade gold (>0.1 g/t Au) envelope to high-grade mineralization.

Conclusion

Dolly Varden’s 2022 success at the drill bit pointed to at least one potential bulk mining operation, at the Wolf Vein, and showcased some mind-blowing grades.

CEO Shawn Khunkhun has told reporters that Torbrit represents a 50-million-ounce silver deposit, which after depletion currently has about 35Moz left in the ground. Khunkhun and the Dolly Varden team want to find another Torbrit and they think they’ve found it in Wolf.

What else is Dolly going to discover, as it embarks upon an even bigger drill program in 2023?

The 163-square-kilometer project already hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge, along with the past-producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley project also contains the Big Bulk property, which is prospective for porphyry- and skarn-style copper and gold mineralization, similar to other such deposits in the region, such as Red Mountain, KSM and Red Chris.

As summer exploration in the Golden Triangle gathers pace, I expect Dolly Varden Silver to be one of the most exciting juniors to watch.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.85, 2023.06.05

Shares Outstanding 254.6m

Market cap Cdn$216.4m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.