Anticipating 2,500m drill program, Mantaro builds 10 drill pads at Santas Gloria, Peru – Richard Mills

2023.06.03

Vancouver-based Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) is planning a 15-hole, 2,500-meter drill campaign at its 100%-owned Santas Gloria silver project in Peru, and has constructed drill pads in preparation.

Santas Gloria is located in the Miocene epithermal gold-silver belt of Peru, southwest of the Toromocho mine containing some of the country’s largest copper reserves.

Mineralization is described as intermediate-sulfidation style over-printed by a gold-rich sulfidation phase. Many of the larger silver-base metal mines in this part of Peru are epithermal (shallow) deposits containing steep (over 600m) ore shoots containing high silver-base metal grades.

Santas Gloria is no exception. The property is known for very high silver grades over 10,000 grams per tonne (352 oz/t) in underground channel samples, and gold grades up to 56 g/t in surface channel samples.

Mantaro has re-sampled mine workings from two of the veins, enabling them to define drill targets based on the locations of the highest-grade shoots. The property has yet to be drill-tested despite the presence of over 12 km of half-meter to 5-meter wide epithermal veins, several of which have strike lengths over 2 km.

To illustrate, the Tembladera vein system has a cumulative strike length of 4 km, the San Jorge vein’s total strike length is 3 km, the Paquita vein crops out in the north of the property over almost 1.25 km of strike, and the Maribel vein outcrops over a strike length of nearly 1.3 km.

Grades from previous underground channel sampling range from less than 5 g/t silver to 10,000 g/t, with surface channel sampling returning <5 g/t Ag to 2,500 g/t.

Because Santas Gloria is a silver-base metal vein system, otherwise known as Cordilleran silver-base metal type, the exploration targets are likely to be characterized by high grades with excellent depth.

According to Mantaro, the project, only a 100 km from Lima, has excellent access, is at a relatively low altitude of 3,300m, and has a community access agreement valid until 2028.

This week, the company announced the completion of 10 drill pads, ahead of an expected 15 to 20-hole drill program, which subject to a future financing, is expected to start this summer.

“After several months of extensive geologic work and preparation, the Mantaro team is excited to have completed drill pad construction leading up to its maiden 2,500-meter drill program on the Santas Gloria Property,” CEO Darren Hazelwood stated in the June 2 news release. He added: “Santas Gloria presents us with a rare opportunity to be the first company to drill test an extensive, high-grade, gold-silver mineralized intermediate sulfidation epithermal system in central Peru, where small-scale historical mining has demonstrated underground silver-base metal grades.”

Drilling will initially target the strike and depth extensions of high-grade gold-silver-base metal mineralized segments of the Tembledara, San Jorge, Paquita and Maribel veins, which have been defined by channel sampling of surface veins and underground workings.

Most of the pads are located at 40-meter step backs from the veins, to target near-surface depth extensions beneath areas of highest surface silver and gold geochemistry. One pad is positioned at an 80-meter step back to enable drill testing beneath high-grade shoots identified by underground channel sampling at the San Jorge mine.

Four drill pads were built at San Jorge, a multi-phase, silver-rich intermediate sulfidation epithermal vein system, that is up to 6 meters wide at the surface and has been mapped over 2 strike kilometers.

One drill pad has been built at Tembledara to test the downdip and strike extensions of the vein, where underground channel sampling returned grades of >10,000 g/t Ag, >20% Pb and up to 9.1% Zn.

In the north of the project area, three pads are planned to target the down-dip extensions of the high-grade, gold-silver mineralized Paquita (Figure 3) and Maribel veins.

Mantaro confirms there are no archeological impediments to drilling, its environmental application and water permits have been accepted, and it has been authorized by the regulator to drill from up to 20 pads.

In its June 2 news, the company says it elected to initially construct only 10 of the possible 20 pads, to allow optionality for a second round of drilling. While 15 to 20 holes are planned from the first 10 drill pads, it is possible to fan out and drill multiple holes from each pad, so that additional meterage could be drilled without building new pads. The company estimates it could drill between 40 and 50 holes from the first 10 drill pads, and a similar number from the next 10 drill pads.

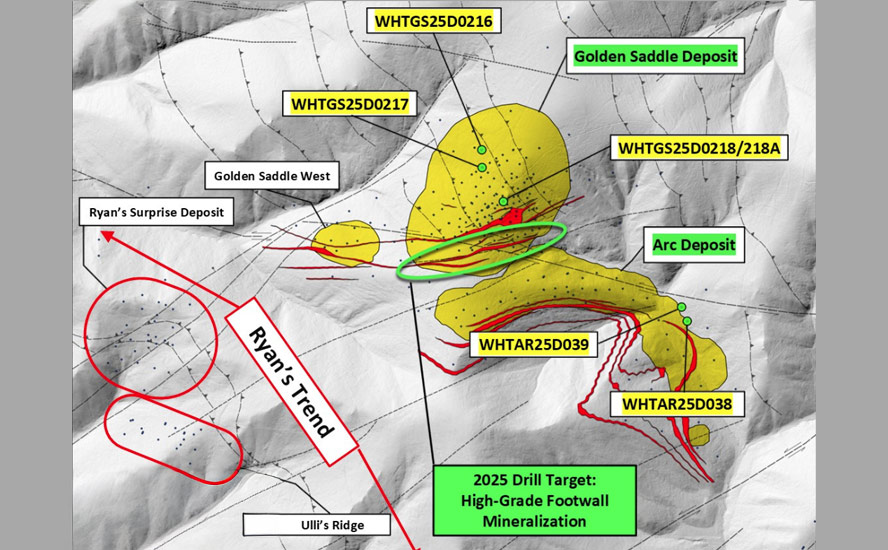

Golden Hill

Mantaro’s other project, Golden Hill in Bolivia, is situated in the underexplored Precambrian Shield. The fully permitted project is located on a crustal scale structure which hosts at least six other significant gold occurrences and deposits.

The mineralization at Golden Hill is of greenstone-hosted orogenic gold type. Gold is contained within 1 to 5-meter-wide, sub-vertically dipping quartz shear zones, typically found along faults at the contacts between mafic volcanic and metasedimentary units of pre-Cambrian age.

According to Mantaro, these deposit types have the potential for kilometres of strike extension and kilometre-depth potential.

The vein system has so far been traced for over 4 km, located in the hanging wall of a regional controlling fault to the west. This style of mineralization can be observed across the region and notably 2 km to the north of the property at a former gold mine, Puquio Norte, which produced over 350,000 oz between 1997 and 2003.

From a regional perspective and comparison with other greenstone belts worldwide, Golden Hill is, without a doubt, an attractive project.

The Bolivian Pre-Cambrian shield is larger than the famous Abitibi greenstone belt in Canada, yet it has produced less than 10 million oz compared to 170+ million oz in the Abitibi from over 100 mines since 1901.

To date, four major gold mineralized zones (La Escarcha, Gabby, Garrapittilia and Brownfields) have been identified across the 4 km strike length. Historical drilling on the property was only limited to the La Escarcha pit area.

In 2022, Mantaro completed 21 diamond core drill holes at Golden Hill for over 3,000 meters of drilling. The best assays include 5m at 7.57 g/t gold from 87m downhole; 3.4m at 8.27 g/t gold from 67.6m downhole; and 14.0m at 3.57 g/t gold from 105m downhole.

Following this initial drill program, Mantaro will now work to understand the controls on the high-grade zones within the mineralization, as well as conduct preliminary modeling with a view to targeting a resource estimate.

Mantaro Precious Metals Corp.

TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ

Cdn$0.04, 2023.06.02

Shares Outstanding 69.8m

Market cap Cdn$2.7m

MNTR website

Richard (Rick) Millsaheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Mantaro Precious Metals Corp. (TSX.V:MNTR). MNTR is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MNTR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.