Mantaro Precious Metals – Richard Mills

- Home

- Articles

- Metals Precious Metals

- Mantaro Precious Metals – Richard Mills

2023.05.20

Mining companies are hoping to build on Bolivia’s rich mining history by focusing on the more than half of the country that remains unexplored. Among them is Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ).

The Vancouver-based junior has strategically positioned itself in two Latin American nations that have historically been among the top producers of gold and silver.

In Peru, the company currently has a 100% interest in the Santas Gloria silver property, while in Bolivia it has the option to acquire up to an 80% interest in the Golden Hill orogenic gold property.

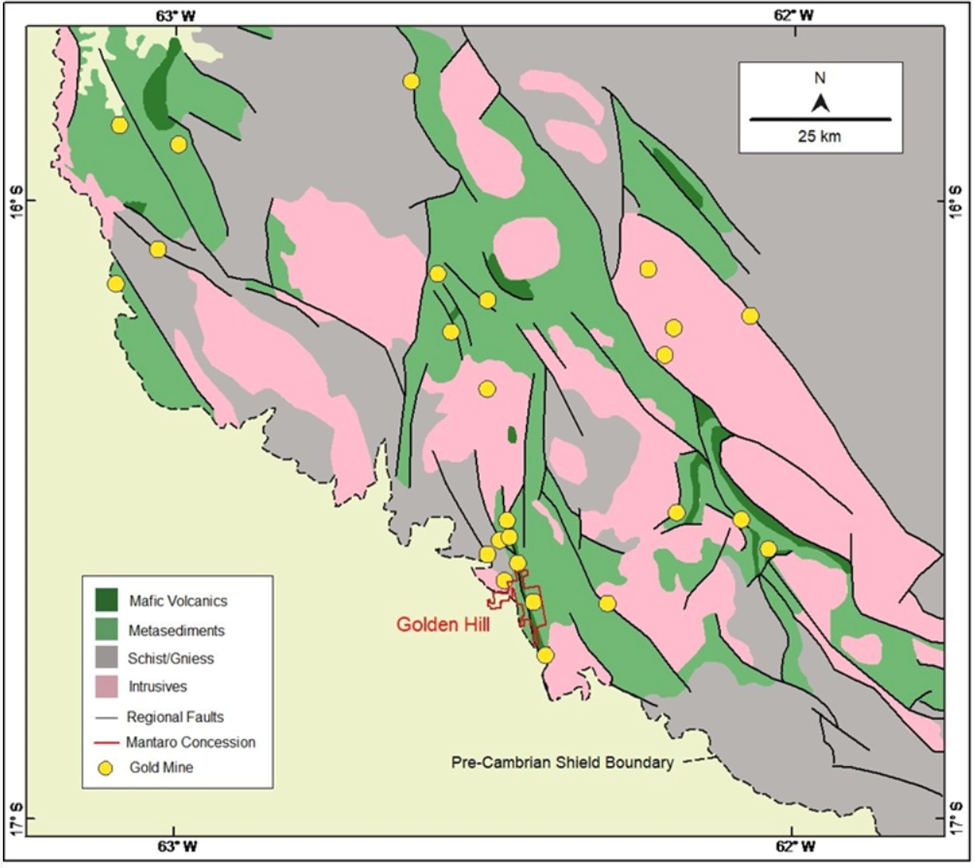

Golden Hill, is situated in the underexplored Precambrian Shield of Bolivia. It is a fully permitted project located on a crustal scale structure which hosts at least six other significant gold occurrences and deposits.

The mineralization at Golden Hill is of greenstone-hosted orogenic gold type. Gold is contained within 1-5m wide sub-vertically dipping quartz shear zones, typically found along faults at the contacts between mafic volcanic and metasedimentary units of pre-Cambrian age.

According to Mantaro, these deposit types have the potential for kilometres of strike extension and kilometre-depth potential.

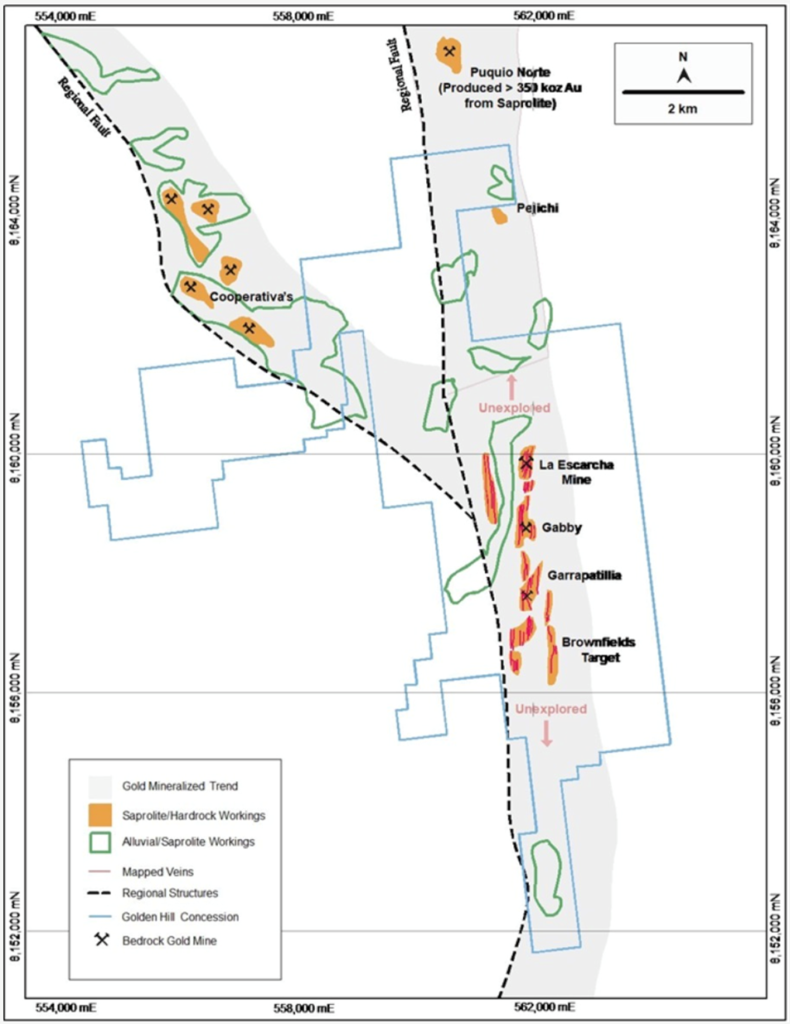

The vein system has so far been traced for over 4 km on the property, located in the hanging wall of a regional controlling fault to the west. This style of mineralization can be observed across the region and notably 2 km to the north of the property at the a former gold mine, which produced over 350,000 oz between 1997 and 2003.

From a regional perspective and comparison with other greenstone belts worldwide, Golden Hill is, without a doubt, an attractive project.

The Bolivian Pre-Cambrian shield is larger than the famous Abitibi greenstone belt in Canada, yet it has produced less than 10 million oz compared to 170+ million oz in the Abitibi from over 100 mines since 1901.

Similarly, the gold endowment of the West African shield, the greenstone belts of northeast South America and Western Australia were much greater than equivalent areas of the Bolivian shield, as the latter remains largely underexplored to this day.

As with other greenstone belts and mineralized provinces worldwide, mineralization in the Bolivian shield is hosted along major crustal structures which juxtapose different lithologies against each.

Regional-scale structures serve to focus mineralizing fluids, while rocks of different competency, provide a regime for both ductile and brittle deformation and thus creation of space for deposition of quartz, pyrite and gold.

Mafic volcanics are especially favourable hosts due to the high iron content which reacts with sulphur in mineralizing fluids to form pyrite — causing gold to precipitate from the mineralizing fluids.

As for Golden Hill, the mining concession is centered on a broadly north-south trending regional structure that hosts the La Escarcha underground mine and Gabby, the Garrapatillia and Brownfields workings, and gold-bearing vein occurrences in its western hanging wall.

The same structure hosts numerous saprolite gold and hard rock gold deposits to the north and south of the Golden Hill concession over a strike length of at least 25 kilometres, underpinning the significant control the structure exerts on gold mineralization.

Prior to Mantaro entering the project in 2021, one of the main quartz veins at La Escarcha was being mined at a rate of up to 25 tonnes per day to a depth of 60 metres. The mine permit at Golden Hill allows for production to be increased subject to the company completing its own economic studies on the project and sufficiently funding any upgrades.

To date, four major gold mineralized zones (La Escarcha, Gabby, Garrapittilia and Brownfields) have been identified across the 4 km strike length. Historical drilling on the property was only limited to the La Escarcha pit area.

In 2022, Mantaro completed 21 diamond core drill holes at Golden Hill for over 3,000 metres of drilling. The best assays include 5 m at 7.57 g/t gold from 87m downhole; 3.4 m at 8.27 g/t gold from 67.6m downhole; and 14.0 m at 3.57 g/t gold from 105m downhole.

Following this initial drill program, Mantaro will now work to understand the controls on the high-grade zones within the mineralization, as well as conduct preliminary modelling with a view to targeting a resource estimate.

To support its continued exploration efforts, Mantaro recently closed a private placement for total proceeds of $365,370. This financing was slightly oversubscribed, and had the backing of company insiders.

A large portion of funds will be used to advance its Santas Gloria property in Peru, for which drilling authorization was obtained in November. Drilling will initially target four high-grade silver and/or gold vein systems.

In Bolivia, the Golden Hill property, with its high grades and the forthcoming resource estimate, is also one to watch. Shortly after the 2022 drilling had started, Mantaro acted quickly to exercise its option for a 51% majority interest, showing the degree of confidence it has in the project.

Earlier this month, Mantaro Precious Metals strengthened its portfolio of South American gold and silver projects with the addition of two new properties in Bolivia. The company entered into a deal to acquire two highly prospective licenses — East Trend and Media Sur.

As per the share purchase agreement, Mantaro will acquire all of the shares of Merenti, a Bolivian company that holds title to the East Trend and Media Sur licenses. In consideration of Merenti, MNTR will issue 2 million shares at $0.05/sh, for a deemed value of $100,000.

“Although our focus continues to be the exploration and development of the Golden Hill property, we will continue to target accretive acquisitions in the underexplored Bolivian Shield,” CEO Darren Hazelwood stated in the May 2 news release, adding: “Our team has reviewed a number of projects in the region. Given the relative close proximity of these properties to Golden Hill, we can optimize exploration work across our portfolio of gold- focused Bolivia properties. We believe these are low-cost, high-upside assets for future exploration work.”

Mantaro Precious Metals Corp.

TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ

Cdn$0.04, 2023.05.19

Shares Outstanding 69.8m

Market cap Cdn$ 3.1m

MNTR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

This article is issued on behalf of MNTR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.