The latest developments in nuclear technology – Richard Mills

2023.05.19

Nuclear gets a bad rap but it is bar none the safest form of power generation. The accidents at Three Mile Island, Chernobyl and Fukushima were all due to human error — poor design, poor site placement and poor training. The technology itself is extremely safe.

Where I live in British Columbia, we get most of our electricity from hydroelectric power. Some time ago, I investigated the possibility

of replacing the Site C dam, a $16-billion disaster, with small modular nuclear reactors, which Natural Resources Canada calls the “future of its nuclear industry.” (BC has prohibited nuclear plants and uranium mining, but not provinces like Saskatchewan and New Brunswick.)

Ontario currently gets 60% of its power from nuclear.

Get this: Site C is slated to provide 1,100 megawatts of capacity – enough to power half a million homes. The same goal could be reached by using one large nuclear reactor capable of delivering 1,200 MW (1.2 GW) — at less than half the cost of Site C, or four SMRs, each generating 300 MW, for a quarter of the cost, $4 billion (@ a billion apiece).

Choose thorium-fueled reactors instead of Site C

As I predicted, Germany and Europe were the proving ground for renewable energy, and they have failed.

Inside Germany’s renewable energy boondoggle

Isn’t it about time we stopped seeing solar and wind as the be all end all, and start talking about what is a realistic mix of fossil fuels, nuclear and renewable energy, needed to make the transition to a green economy, one that helps to reduce carbon emissions at a reasonable cost to taxpayers?

The challenge facing nuclear

In a previous article we showed that replacing fossil fuel-generated power — coal, oil and natural gas — 100% with solar and wind is an untenable proposition. Our research showed it would mean building over 60,000 500-megawatt solar plants, or greater than 120,000 wind farms of the same power capacity.

Nor can we bank on natural gas to see us through to a carbon-free future.

Natural gas is mostly methane (CH4), a potent greenhouse gas that the Intergovernmental Panel on Climate Change says is 86 times more damaging than CO2 over a 20-year period.

According to a study by Wood Mackenzie, LNG will be the biggest source of carbon emission growth by 2025 – due to strong demand from Asian buyers.

Regrettably for nuclear proponents, however, conventional nuclear technology is not being pointed to as a way out of the global warming dilemma. Despite continued growth in global carbon emissions and the safe operation of hundreds of nuclear power plants worldwide, the number of reactors is decreasing, not increasing. As a result of the Fukushima disaster, in March, 2011, Germany promised to close all nuclear plants by 2022. The last three nuclear facilities in Germany were shuttered this past April, meaning the country no longer produces any electricity from nuclear.

In a nutshell, this is the challenge nuclear power faces: it is a necessary component of future energy needs, but without a groundswell of public opinion behind it, and billions of dollars in new investment to replace decrepit conventional nuclear facilities, its impact will be limited.

Having said that, there is a concerted effort happening to build new nuclear reactors and replace existing ones. Under the World Nuclear Association’s Harmony Programme, a framework of action for the nuclear industry, 1,000 GWe (gigawatts electrical) of new nuclear capacity is planned by 2050, providing 25% of the world’s electricity from the current 10%.

To put that into perspective, there are currently 437 operable nuclear reactors, with a combined capacity of 391.6 GWe. According to the World Nuclear Association, 13 countries in 2021 produced at least one-quarter of their electricity from nuclear. France gets up to around 70% of its electricity from nuclear energy, while Ukraine, Slovakia, Belgium and Hungary get about half. Japan relied on nuclear power for more than one-quarter of its electricity, prior to Fukushima, and is expected to return to somewhere near that level.

The United States has 93 operable nuclear reactors with a combined capacity of 95.8 GWe, which in 2021 produced 19.6% of the country’s electricity. This is down from a peak of 104 reactors in 2012.

There had been four AP1000 nuclear reactors (see below) under construction, but two were canceled. The WNA says one of the reasons for the hiatus in new nuclear builds in the United States, is due to successful maintenance strategies:

Over the last 15 years, improved operational performance has increased utilisation of US nuclear power plants, with the increased output equivalent to 19 new 1000 MWe plants being built.

2016 saw the first new nuclear power reactor enter operation in the country for 20 years.

The United States in 2022 got 35% of its uranium, the material needed to fuel the nuclear reaction, from Kazakhstan, 15% from Canada and 14% from Russia, according to the US Energy Information Administration. However a plan is afoot to ban Russian uranium, for the same reason the US halted imports of Russian oil last year, and imposed a price with other Western countries on sea-borne exports of Russia’s crude and oil products: the war in Ukraine.

Reuters reported the bill passed 18-12 in the House subcommittee on energy, climate and grid security. To become law, it would have to pass both chambers of Congress and be signed by the president.

Canada has 19 reactors, in 2021 generating 14.3% of its power, with all but one located in Ontario. Ten units are due for refurbishment — six at Bruce and four at Darlington — extending their lives by 30-35 years. Similar refurbishment enabled Ontario to phase out coal in 2014.

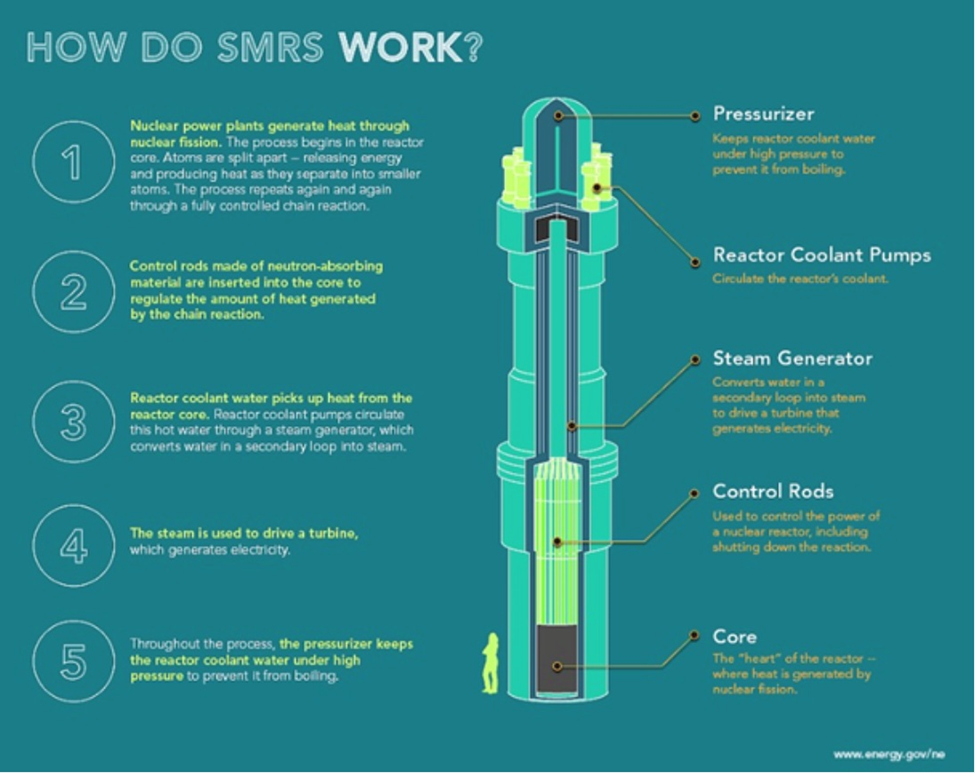

SMRs

Facing stiff emissions reduction requirements, several countries are starting to re-assess nuclear power and are looking at building plants that are not as expensive, risky, or politically unpalatable as conventional nuclear. Two of these technologies are small modular reactors (SMR) and molten salt reactors (MSR), the latter powered by thorium, instead of uranium.

Generally defined as less than 300 MWe, SMRs cost much less and can be built more quickly than large nuclear reactors, which are typically 1,000 MW and occupy large tracts of land. Interest in small reactors is driven by a desire to reduce high capital costs and to provide power away from large grid systems. They provide enough electricity to power about 200,000 homes, which is about the same as 120 wind turbines or 60,000 solar panels.

SMRs are constructed with prefabricated modules and can be transported by truck or by rail — making them ideal for remote locations where a conventional reactor would not be feasible. Another important advantage is they are less likely to overheat, because their small cores produce less heat than those of large reactors. They also have fewer moving parts, including coolant pumps, which reduces the likelihood of failures that could cause an accident. The fuel, steam and generator are all in one vessel.

In 2022, the Canadian government announced it would put CAD$970 million in debt financing towards building a commercial small modular reactor — the first such unit in Canada and among the first to be built worldwide.

The reactor would be constructed at Ontario Power Generation’s Darlington Nuclear Generating Station in Clarington, and is expected to begin supplying power to Ontario’s grid by 2028.

According to The Globe and Mail, Ottawa has been providing millions to support Canadian SMR developers, but billions are required to deliver a mature reactor design.

In December 2021, OPG announced it had selected GE Hitachi Nuclear Energy as a partner to build a BWRX-300 small nuclear reactor, capable of providing 300 MW of electricity. By comparison, Darlington’s four reactors each provide 935 MW.

While OPG as of March, 2023, had not made a final decision to build the reactor, it expects to do so by the end of 2024. OPG spokesman Neal Kelly in March reiterated a previously announced schedule in which the reactor would be completed by 2028, and generating power the following year.

In addition to OPG, other utilities including Saskatchewan’s SaskPower and the Tennessee Valley Authority have expressed interest in building BWRX-300s, as have companies in Poland and Estonia, The Globe and Mail reports.

Meanwhile Westinghouse, which built the world’s first commercial pressurized water reactor in Shippingport, PA, recently announced the launch of a smaller version of its flagship AP1000 nuclear reactor. The unit is, like the BWRX-300, able to generate 300 MW of electricity, enough to power 300,000 homes, versus 1,200 MW for the AP1000. It is expected to be available in 2027, at a cost of USD$1 billion per unit — significantly less than the $6.8B estimated to bring an AP1000 online.

Their small size and lower cost compared to large nuclear reactors, makes small modular reactors more versatile, meaning significantly more utilities will be able to use them.

It’s also easier to connect them to the power grid. An AP300 produces roughly the same amount of electricity as a typical coal plant, making the switch-out relatively straight-forward.

In Canada, SMRs are considered ideal for deployment to off-grid, remote locations such as mine sites or the oil sands, as well as communities in northern Canada reliant on diesel-fueled generators for electricity.

Small nuclear reactors are also being eyed by industrial producers as carbon-free sources of heat.

“One aspect of many of the advanced reactor technologies, including high-temperature gas, molten-salt and sodium fast reactors, is they can produce industrial grade heat for non-power purposes or combined heat and power applications for industries such as steel making, chemical production, cement production, and milling and mining among many others,” Jeffrey Merrifield, a nuclear energy lawyer and a former commissioner of the U.S. Nuclear Regulatory Commission, told CNBC.

Alberta, Saskatchewan, New Brunswick, and Ontario have all signed MOUs with the federal government to explore SMR technologies. Some of the most advanced research is being conducted in New Brunswick.

NB Power is currently working with two private-sector partners, ARC Clean Technology and Moltex Energy, to advance Generation IV Plus Grid-sized SMR technology for use in New Brunswick.

The New Brunswick Energy Solutions Corporation, a provincial Crown corporation, committed CAD$10 million in 2018 towards the establishment of an advanced SMR Research Cluster in the Maritime province. Moltex and ARC also each invested $5 million to progress research and development of their technologies.

Last month, the New Brunswick government signed an agreement with the government of Saskatchewan, to further enhance collaboration on the development and deployment of SMRs.

Further afield, France this year announced USD$1.1 billion to develop an SMR design. While no SMRs have yet been built in the United States, the Department of Energy has announced up to $5.5B in funding.

As interest in SMRs picks up, the demand for large nuclear reactors like the AP1000, remains strong.

According to CNBC, the Vogtle nuclear power plant in Georgia is adding two AP1000s at a current cost estimate of over $30 billion.

Westinghouse reportedly has an agreement to build nine AP1000s in Ukraine, has been selected to build three in Poland, and is in the running for another 11 AP1000s throughout Europe.

Merrifield noted that Egypt, Indonesia, Nigeria, the Philippines, Saudi Arabia and the United Arab Emirates are among countries in Africa and Asian showing interest in larger units.

The main advantage of large nuclear reactors compared to small ones is their ability to produce electricity more cheaply.

Fusion

For decades, the holy grail of nuclear scientists has been a commercially viable nuclear fusion power plant, that would replicate the same process that takes place naturally in the Sun.

Unlike fission, the way we produce nuclear energy now, fusion merges atoms together instead of splitting them. It would create many times more energy than fission, without the use of radioactive materials, meaning no nuclear waste is produced (although neutron bombardment would cause a nuclear fusion plant to become slightly radioactive, these radioactive products are short-lived).

However, because nuclear fusion requires more energy than it produces, it has thus far eluded scientists as a viable energy solution.

Recent nuclear fusion news is more about hydrogen bombs than energy-related

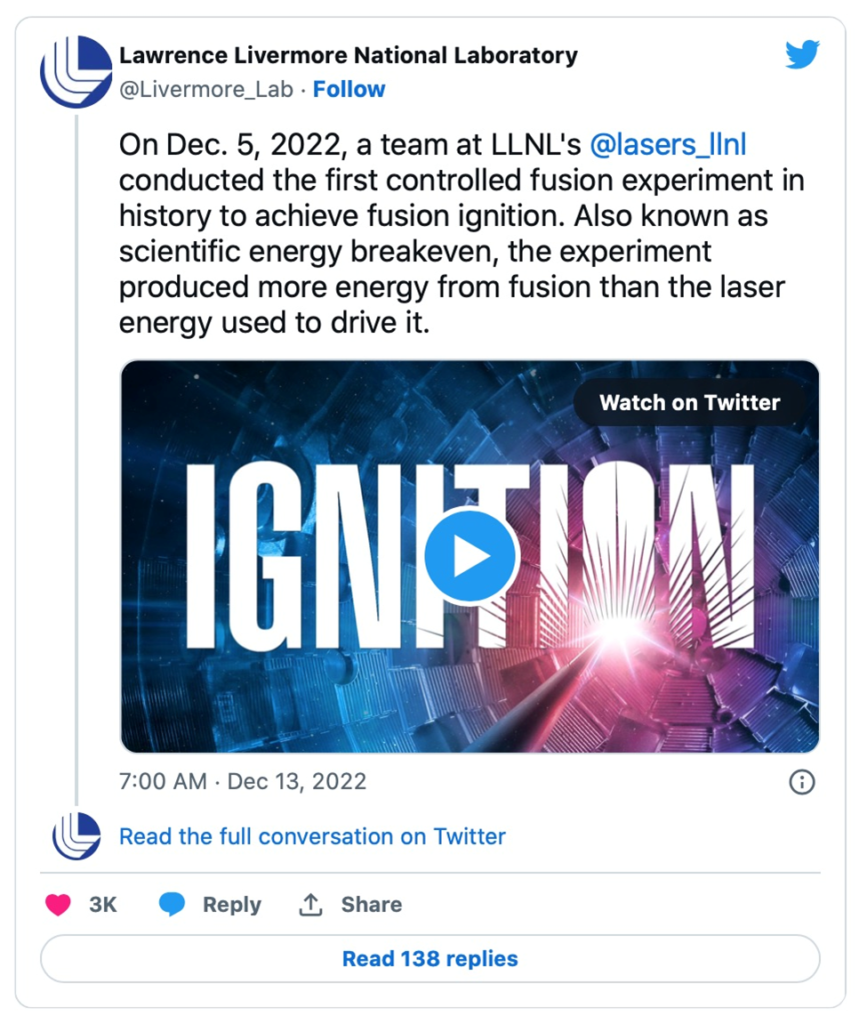

In December, the U.S. Department of Energy made what media outlets called “a historic announcement,” regarding scientists achieving a net energy gain in a nuclear fusion reaction, meaning that more energy was generated than the amount of energy needed to power the reaction. (CNBC, Dec. 13, 2022)

The reaction took place at the DOE’s Lawrence Livermore National Laboratory in California, which houses the National Ignition Facility (NIF). There, a laser system consisting of 192 lasers bombarded a pea-sized capsule of deuterium-tritium, which are isotopes of hydrogen that have, respectively, one and two neutrons in their nuclei in addition to the single proton that is hydrogen’s nuclear characteristic. The capsule was heated to over 3 million degrees Celsius, causing an ignition that briefly simulated the conditions of a star. Light from the ignition can theoretically be picked up by a fluid and used to generate steam that powers a turbine.

It took 2.05 megajoules of energy input for the experiment, which generated 3.15MJ of fusion energy output. The caveat is that it took more than 30 times that amount of energy to run the laser.

Since then, five attempts to repeat the experiment have failed. Indeed the challenge of moving fusion from the R&D stage to something further along, has proved daunting.

In July 2021, ground was broken on assembling the million-component International Thermonuclear Experimental Reactor (ITER), coming shortly after its seven-member nuclear nations successfully installed and assembled the reactor base.

Plugging the fossil fuel energy gap with nuclear

Located in southern France, the 23,000-ton ITER Tokamak is one of a handful of “miniature suns” under development worldwide. Thirty-five years in the making, it will eventually form the planet’s largest “tokamak”, or plasma reactor. In 2025, when the giant assembly project is expected to be completed, with all its core parts installed, fully integrated and ready to produce plasma, the reactor will begin a month-long process of heating up to 150 million degrees Celsius, with a trio of heating elements pulling a combined 50MW of power, enough for about 10,000 homes. That will bring the plasma to a temperature 10 times greater than the sun’s in the doughnut-shaped reactor to generate as much as 500MW of energy for brief bursts, explains Popular Mechanics.

It will take another five years for full plasma generation, expected in 2030.

Dr. Dennis Whyte, a Canadian scientist and engineer who directs fusion research at MIT, is among those who sees a different path forward. As The Globe and Mail’s science reporter Ivan Semeniuk explains, Whyte prodded his students to consider whether the advent of stronger magnets than those used by ITER could make a tokamak that could reach net energy but that was smaller and therefore cheaper to build.

According to the Fusion Industry Association, 33 companies have to date raised roughly $5 billion, and a high percentage of surveyed companies believe that commercial fusion will be a reality by the next decade.

One of the leading lights is Commonwealth Fusion, set up in 2018 as a spinoff from the work being done by Whyte and his students at MIT. At a site an hour’s drive from Boston, Commonwealth is vying to become the first private company with a fusion reactor that achieves “net energy”, like the Livermore lab briefly did in December. So far the company has raised over $5 billion from backers including Bill Gates.

Another company is Vancouver-based General Fusion, which has raised more than $300 million from investors such as Jeff Bezos and Tamasek Holdings, Singapore’s sovereign wealth fund. General Fusion is developing an approach called targeted magnetic fusion, first explored by the US Naval Research Laboratory in the 1970s, wherein hot magnetized plasma is confined inside a spinning vortex of liquid metal. Its demonstration reactor is located in Oxfordshire, England.

The Globe reports that General Fusion has signed a memorandum of understanding with Canadian Nuclear Laboratories in Chalk River, Ont. The research facility is equipped to work with, and test, technologies related to tritium handling that will be needed in a future pilot power plant. First Light Fusion has announced a similar arrangement.

The latter, based in Britain, is seeking to trigger fusion through the rapid compression of specially-designed fuel targets — a similar idea to the one employed by the above-mentioned National Ignition Facility, except that it replaces a laser with a gun that fires projectiles at targets with velocities approaching the speed of sound.

California-based TAE Technologies is developing a system that involves firing plasma into a cylindrical chamber where it forms a smoke-ring-like structure that generates its own self-confining magnetic field. The principle, known as field-reversed configuration, is also favoured by Helion Energy Inc., based in Everett, Wash.

Helion made headlines when it signed a deal last week with Microsoft to sell electricity from a fusion reactor, starting in five years.

The energy-purchase agreement commits Helion to supply the tech giant with 50 MW from 2028. According to Singularity Hub,

The company has already built six prototype plants and says its latest test reactor, which will come online next year, will demonstrate the ability to generate electricity. And by 2028 it plans to have a 50-megawatt commercial plant up and running…

Helion is also relying on a somewhat unconventional approach to nuclear fusion. The result achieved at LLNL worked by firing high-energy lasers at a tiny piece of fuel. Most other fusion experiments over the years have used tokamaks—doughnut-shaped vessels that use powerful magnets to contain plasma, which is then heated up to fusion temperatures.

The approach Helion is taking is called a “pulsed non-ignition fusion system,” according to MIT Tech Review. It also relies on magnets to contain a super-heated plasma, but rather than heating it further to fusion temperatures, the magnets are used to smash two rings of plasma together at a million miles an hour to trigger a fusion reaction.

Helion has attracted some of the biggest backers in tech, including a $375-million investment from Sam Altman, the CEO of Open AI. Microsoft has reportedly invested $10-billion in OpenAI, the maker of ChatGPT.

Finally in Japan, a consortium of public- and private-sector groups is investing in a startup working to commercialize fusion power. Nikkei Asia reports that the 16 companies, including Mitsubishi Corp, Kansai Electric Power, and a government-affiliated fund, will plow around 10 billion yen (USD$72.2 million) into the startup, created at Kyoto University and called Kyoto Fusioneering.

The company uses advanced plasma-heating equipment to develop gyrotons, which are key components in creating nuclear fusion reactions. The technology won Kyoto Fusioneering an award from the U.K. Atomic Energy Authority.

According to Nikkei Asia, In 2024, a small-scale experimental fusion reactor plant will be built in Japan to determine whether gyrotrons and other devices can perform over extended periods…

The technology is moving toward commercialization, possibly in the 2030s.

Conclusion

Will nuclear fusion be the solution to the world’s energy dilemma? The no-carbon answer to the need to transition away from fossil fuel sources?

The work done so far is encouraging. There are over 30 companies racing to develop a workable fusion reactor, with billions of dollars being spent on R&D from both the public and the private sector. Some of the tech sector’s richest people, including Bill Gates, Jeff Bezos and Sam Altman, have placed big-dollar bets on fusion.

Yet as exciting as it will be if the commercial players reach their goals, it is unlikely that fusion reactors will have significant presence on power grids before 2040, let alone deliver the world from carbon by 2050, states science reporter Ivan Semeniuk, who has done a lot of research on the topic for The Globe and Mail.

The International Energy Agency doesn’t expect electricity from fusion to be produced until the second half of the century, and as difficult as it is to control sun-hot plasma, it’s been equally hard to control the cost of making it. (CNN, May 12, 2023)

Indeed, even if fusion is commercialized, bringing the cost per kilowatt hour down to a level that can compete with natural gas and renewables, is likely to be a huge challenge.

In the meantime, we have traditional fission-based nuclear reactors, both large and small, that despite opposition from some anti-nuclear groups, are in high demand, particular in Africa and Asia.

Remember, 1,000 GWe of new nuclear capacity is planned by 2050, providing 25% of the world’s electricity from the current 10%.

The development of small, modular nuclear reactors is an interesting development, especially given the potential for SMRs to be used in industrial applications. The units can produce industrial-grade heat for non-power purposes or combined heat and power applications for industries such as steel making, chemical production, cement production, and milling and mining.

The Site C dam is slated to provide 1,100 megawatts of capacity – enough to power half a million homes. The same goal could be reached using four small nuclear reactors, each capable of delivering 300 MW, at a fraction of the cost ($4 billion versus $16 billion).

Imagine employing an SMR in the Canadian oil sands, or at big US oilfields like Midway-Sunset and Belridge. The “waste heat” used in thermal oil recovery — where steam is injected into an oil formation to recover the oil and pump it to surface — could be worth billions.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.