Dolly Varden Silver primed for discovery in bullish year for precious metals – Richard Mills

2023.05.16

More question marks surrounding the US debt negotiations have left the public wondering if it’s time to prepare for the worst.

The US has never defaulted on its debt, but should the “unthinkable” (as Treasury Secretary Janet Yellen describes it) happen, the economy would surely plunge into a recession, at a faster pace than most anticipated. That makes precious metals, imo, a must-have in the current environment.

Bullish on Silver

While gold usually takes up the spotlight as the go-to safe haven asset during times of economic uncertainty, its sister metal silver features just as prominently.

In fact, it usually starts off slow during bull markets but eventually overtakes gold. Between March and April of this year, silver prices have gone up by more than 20%, easily outpacing gold as well as the S&P 500.

The boost to silver comes as the value of the US dollar, an alternative safe-haven asset, has struggled, down about 10% since a 20-year peak last September.

Even with the recent slump in prices, analysts including those at UBS remain quite bullish on the precious metal. Dominic Schnider, head of global commodities and forex at UBS Global Wealth Management, recently put out a note reaffirming a price target of $29/oz over the next 6-12 months.

This is similar to the projections by Citi analysts led by Maximilian Layton, who last month predicted silver to hit $30/oz in the coming months. “Precious metals, and especially silver, [have] near-perfect conditions for the ongoing bull market,” Layton told Forbes reporters. Additionally, the Citi analysts noted a “distinct possibility” of $34 per ounce in 6 to 12 months.

Janie Simpson, managing director at ABC Bullion, also shared this optimistic outlook for $30 silver. “Silver has historically delivered gains of close to 20% per annum in years inflation is high. Given that track record, and how cheap silver remains relative to gold, it wouldn’t surprise to see silver head towards $30 per ounce this year,” she told CNBC earlier this year.

In Kitco’s 2023 Outlook, author Neils Christensen said that retail investors are expecting to see prices rally more than 50% this year. At the end of 2022, Kitco surveyed 1,482 investors about the price of silver by the end of 2023. “On average, retail investors see silver prices rising to $38 an ounce,” the report revealed.

With economic uncertainty continuously setting the tone, it is not without reason that many are high on silver given its past performance during recessions. For example, silver prices shot up some 400% in the three years following the Great Recession.

Growing Recession Fears

Even before the risk of a US default became a hot topic, the possibility of a recession was already on people’s minds, and those concerns have only intensified with each passing day.

A new report from the World Economic Forum shows while the economic outlook has improved since the start of the year, recession fears are still prevalent. Nearly half of the participants in the WEF’s latest survey said that a recession is likely.

In the US, inflation is still rampant, and the Federal Reserve is continuing to hike rates to quell rising prices, raising the odds of a recession materializing. Then there’s the repeated episode of bank collapses that continue to instigate panic amongst investors.

According to strategists at JPMorgan Chase, investors are likely to favor gold (and by extension, silver) as it provides a buffer against the possibility of a US recession this year, pointing out that recent banking failures could lead to a financial contagion that could wreck the wider economy.

“The US banking crisis has increased the demand for gold as a proxy for lower real rates as well as a hedge against a ‘catastrophic scenario,’” JPMorgan analysts wrote.

Speaking of interest rates, we’ve previously established that real interest rates are what truly determine gold’s performance in longer periods. Should the Fed decide to stop raising interest rates (and eventually trim them down), that would further strengthen gold as it generally displays a negative relationship with real rates.

5 reasons gold and silver will soar

Silver, too, would stand to reap the benefits of heightened safe-haven demand as it had done in the past.

Supply Deficit

Behind silver’s bullish outlook is also the robust market fundamentals supporting higher prices.

For a long time, analysts have been pointing to a “severe shortage” of silver due to the relentless growth in demand for the metal, which is used in many industrial applications such as automotive and electronics.

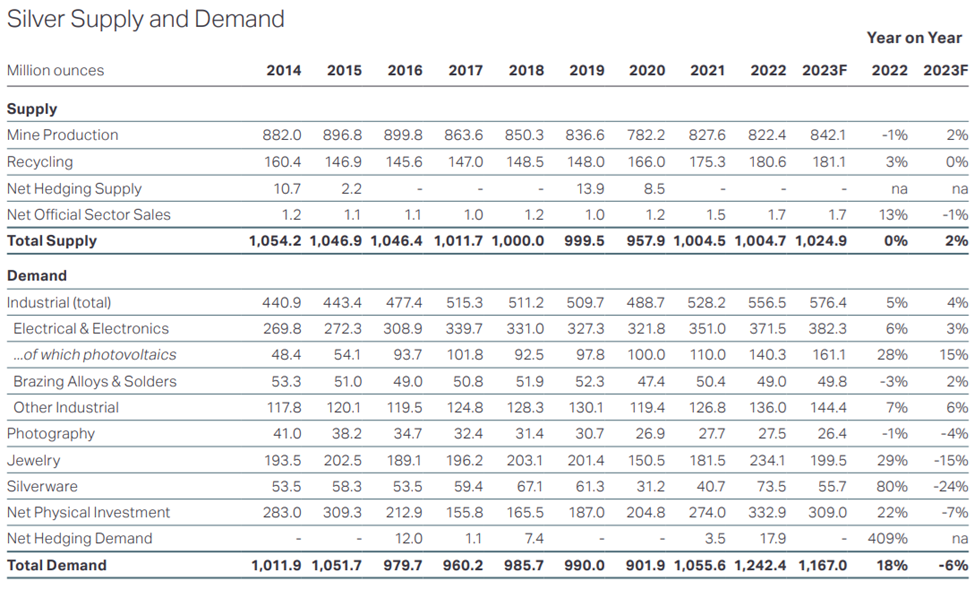

The new industry figures help to paint a clearer picture. Data from the Silver Institute shows that global silver demand has increased by 38% since 2020 as world economies continue to recover from the Covid-19 pandemic.

Last year, demand for silver surged by 18% to a record high 1.24 billion ounces against a stagnant supply, stretching the market deficit to a second straight year, the Silver Institute said in its latest publication.

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

What’s more unsettling is that it took just two years of undersupply — the 2022 deficit and the 51.1 million ounce shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade, and this demand-supply gap is likely to remain for the foreseeable future.

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

“Silver demand was unprecedented in 2022, and we don’t say that to try and be sensational, that is the only way to describe the market,” Newman said in a recent interview with Kitco News.

In 2023, we are most likely going to see a repeat of last year, with solid demand and a slight increase (2%) in mine production.

The Silver Institute is forecasting another 1.17 billion ounces being demanded this year, against a projected supply of 1.02 billion ounces. While this would close the gap to 142.1 million ounces, it would still be the second-largest deficit in over two decades.

“Even if some of the markets are not as strong compared to last year, demand is still expected to be very robust,” Newton told Kitco News.

To satisfy future demands, it’s clear that more silver mines must be developed to reverse this trend. The focus has to be on promising silver explorers and mine developers that could contribute to the future supply chain.

Dolly Varden Silver

One junior miner that we’re keeping an eye on is Canada’s Dolly Varden Silver Corp. (TSXV:DV, OTC:DOLLF), whose flagship project is located in the Golden Triangle of northwestern British Columbia, a region that has generated about $5 billion in M&A activity since 2018.

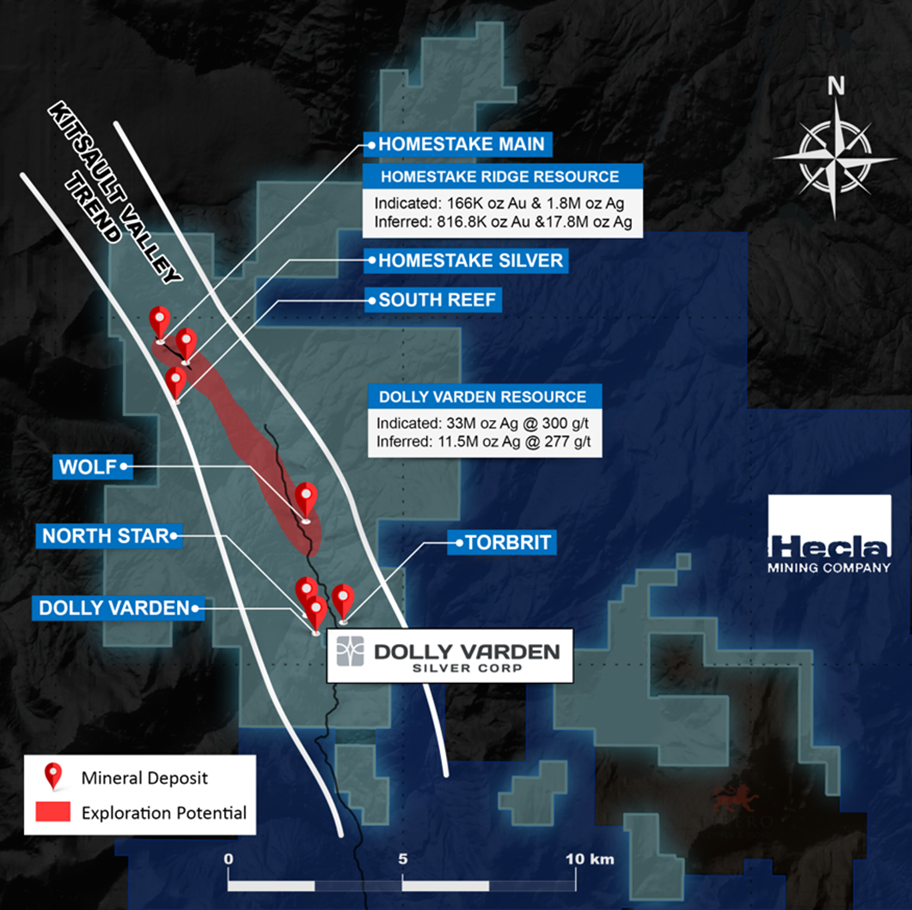

The company’s Kitsault Valley property covers 163 square kilometres of this prolific mining region. It represents the amalgamation of the high-grade silver and gold resources of Dolly Varden’s namesake project, which it has been exploring for about a decade, and the newly acquired Homestake Ridge project.

The combined mineral resource of this project is currently estimated at 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in inferred.

These resources are contained within multiple outcropping deposits, which makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in all of Western Canada.

While the resource is impressive, the more fascinating aspect of the project is its rich history, which can be traced back to the early 20th Century when Scandinavian prospectors first made the silver discovery in what is now the Stewart Complex.

Within the boundaries of the company’s original property are two past-producing silver mines: Dolly Varden and Torbrit, which formed a prolific silver mine camp starting in 1919 that produced more than 20 million ounces in the span of 40 years, with assays of ore as high as 2,200 ounces per tonne.

It should be noted that ‘Dolly Varden’ — named after the heroine in Charles Dickens’ Barnaby Rudge by the original prospectors — was amongst the most important silver mines in the British Empire during its heyday. Interestingly, the mine’s manager between 1919-1921 was none other than Herbert Hoover, who went on to become the 31st US President.

Other historically active mines in this area include North Star and Wolf, which remain underexplored to this day. Together, the four deposits comprise about 90 sqkm within the Stewart Complex.

While the existing deposits are already enough to work with, DV believes the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits on the same trend such as Eskay Creek and Brucejack.

In late 2021, DV consolidated its position in this region with the acquisition of the Homestake Ridge project, comprising the northern half (~75 sqkm) of Kitsault Valley. The project features a high-grade gold and silver resource from three known deposits that the company believes can be converted into higher-confidence categories.

Drilling Success

Last year, DV embarked on a comprehensive drill program at Kitsault Valley. The goal was to upgrade the current inferred mineral resources to the measured and indicated classification, as well as to expand the known deposits and discover new silver-gold mineralization along the Kitsault Valley trend.

Specifically, the objective was to expand the wide, high-grade silver mineralization at Wolf vein, step out and infill at Torbrit and the nearby Kitsol vein, and test several other nearby exploration targets on the Kitsault Valley property.

Over 37,000 metres of drilling in 108 holes were completed, split equally between the resource expansion and upgrading at Homestake and the Torbrit deposits and looking for discoveries along the Kitsault Valley trend.

The results, which have all been released, were quite eye-catching. In summary, the grade and consistency of silver mineralization from both the Kitsol and Wolf veins indicated the potential for an underground bulk-mineable deposit. Specifically, the Wolf vein area is emerging as a large system that is rivaling the Torbrit deposit, CEO Shawn Khunkhun said at the time.

Additionally, drilling from the newly acquired Homestake Ridge property also demonstrated the strong continuity of mineralization over wide intervals similar to that of Kitsol and Wolf.

According to the company, not only were the reported gold and silver grades some of the highest from the property to date, but they were also up there with the best of the entire Golden Triangle region during the 2022 drilling season.

In February 2023, DV saved its best for last, reporting the highest silver assay received to date from the Dolly Varden property. Drilling during the 2022 season at the northern limits of the Wolf deposit returned an 8.77-metre intercept of 1,499 g/t silver, 1.89% lead and 0.46% zinc. Within that intercept was what the company called a “jewelry-box-style” mineralization, grading 23,997 g/t silver, 1.24% lead and 0.34% zinc over a true width of 0.19 metres.

Towards the southern limits of the Wolf vein, drilling also encountered 321 g/t silver, 0.84% lead and 0.84% zinc over 12.85 metres, including 664 g/t silver, 1.24% lead and 3.54% zinc over 1.63 metres.

“Results from the Wolf vein continue to exceed expectations, returning the highest-grade silver assay yet received, more than doubling the strike length of the deposit through step-outs to the north and south as well as returning wide, robust silver and base metal grades at depth,” Khunkhun said in a news release.

Upcoming Plans

Building on last year’s drilling success, DV recently laid out its 2023 exploration plans for the Kitsault Valley project.

This year’s program encompasses 40,000-45,000 metres of drilling through further step-outs following the high-grade silver and gold mineralization at the Wolf and Homestake Ridge deposits.

“2022 was a breakthrough exploration season at Dolly Varden Silver’s Kitsault Valley project. It hosts one of the largest, undeveloped high-grade precious metals projects in Western Canada,” Khunkhun said in an April 24 update.

As disclosed previously, the priority of the 2023 exploration program is to connect the Wolf deposit with the Kitsol deposit, located 1,400 metres apart.

Drilling allocated to the Wolf deposit expansion (approx. 13,000 metres) will focus on both infill drilling of the wide-spaced intercepts from 2022, as well as further step-out holes in several directions where high-grade silver mineralization remains open. Similar step-out drilling will follow up on high-grade silver mineralization at the Kitsol vein.

The 2023 drilling at Homestake is influenced by the structural information gained from the infill drilling at the Main deposit, where two main plunge directions have been identified. The planned drilling will target the down plunge extensions of higher-grade and wider zones of gold mineralization. Drilling at Homestake Silver will prioritize step out holes where 2022 expansion drilling had success at the southern extent.

Conclusion

While DV has been exploring its district-scale holdings for years, it’s only since February 2020, when Khunkhun took over the reins, that the company really started to evolve.

In an interview with The Northern Miner earlier this year, Khunkhun noted that the key was pivoting towards a better-defined strategy to de-risk the project, expand the existing resources and grow the business.

Speaking on the importance of the newly acquired Homestake deposits, Khunkhun said this acquisition was “crucial for solidifying the company’s position in the prospective Kitsault trend and added critical mass to the combined Kitsault Valley project.”

“Our goal is to either groom this project into a saleable asset in the next 36 months or to have it ready for a construction decision for ourselves. If someone like Hecla Mining were to acquire us today, we’d comprise about 15% of their total resource base,” Khunkhun said in the interview.

By the way, Hecla, the largest primary silver producer in the US, already owns shares in the company, and so does Canadian billionaire Eric Sprott. This makes DV’s shareholder registry one of the strongest in the junior mining space.

Of the key factors that determine the success of a project, whether it be management, size, location and past production, Kitsault Valley seems to tick every single box. And the results so far from one year of drilling are pointing to more than just a “saleable asset”, with at least one conceptual bulk mining operation envisioned at the Wolf vein.

“Torbrit represents a 50 million ounce silver deposit, which after depletion over the years currently sits at around 35 million oz. left in the ground. I want to find another Torbrit, and I suspect we are finding that in Wolf,” Khunkhun told reporters earlier.

This makes Dolly Varden a story to follow as the company embarks on an even bigger program in 2023.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.84, 2023.05.15

Shares Outstanding 254.6m

Market cap Cdn$213.9m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.