Mantaro picking up two new properties in Bolivia – Richard Mills

- Home

- Articles

- Metals Precious Metals

- Mantaro picking up two new properties in Bolivia – Richard Mills

2023.05.05

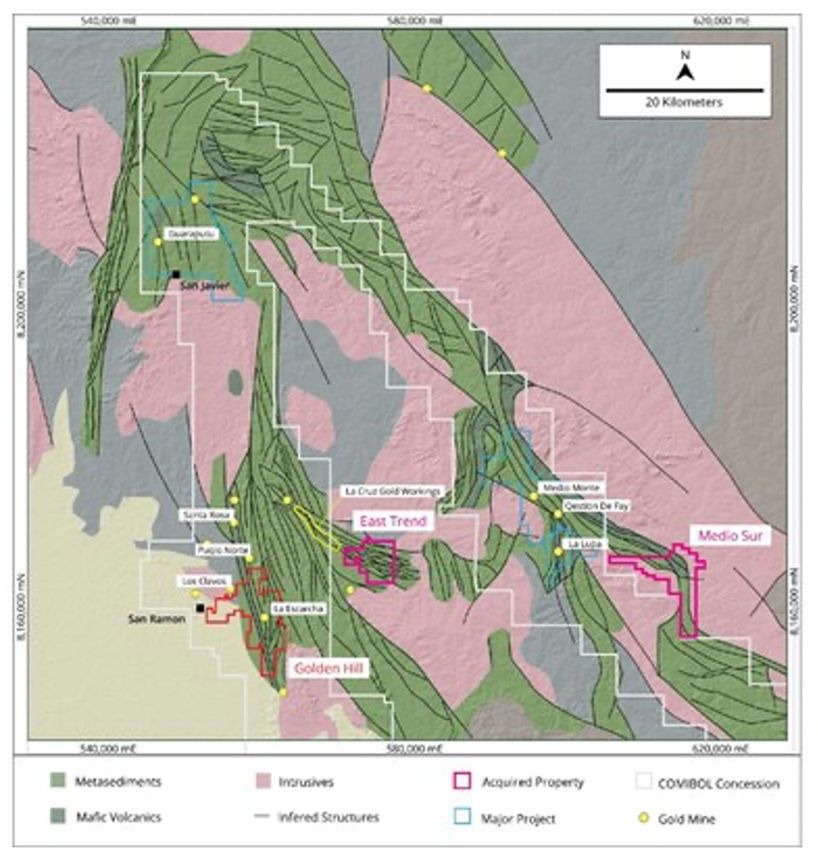

Mantaro Precious Metals (TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ) is strengthening its portfolio of South American gold and silver projects with the addition of two new properties in Bolivia.

The Vancouver-based junior said this week it has entered into a deal to acquire two highly prospective licenses — East Trend and Media Sur.

As per the share purchase agreement, Mantaro will acquire all of the shares of Merenti, a Bolivian company that holds title to the East Trend and Media Sur licenses. In consideration of Merenti, MNTR will issue 2 million shares at $0.05/sh, for a deemed value of $100,000.

“Although our focus continues to be the exploration and development of the Golden Hill property, we will continue to target accretive acquisitions in the underexplored Bolivian Shield,” CEO Darren Hazelwood stated in the May 2 news release, adding: “Our team has reviewed a number of projects in the region. Given the relative close proximity of these properties to Golden Hill, we can optimize exploration work across our portfolio of gold-focused Bolivia properties. We believe these are low-cost, high-upside assets for future exploration work.”

East Trend

Comprised of 2,650 hectares within the San Ramon gold producing district, the East Trend property covers faulted greenstone terrain which forms the eastern extension of the La Cruz Gold trend, a northwest-southeast striking gold mineralized zone that has been mined via a large number of small open pits by small-scale gold miners over 8 kilometers. Recent artisanal mining activity indicates the trend continues to the southeast of the property. East Trend is located 20 km east of the Puquio Norte historical gold mine and Mantaro’s Golden Hill project. According to MNTR, the property, despite its highly prospective geological setting that is analogous to known gold mines and deposits in the area, is significantly underexplored.

Media Sur

Media Sur is centered on the underexplored southern arm of a highly prospective metasedimentary-metavolcanic faulted greenstone belt. The 4,750-ha property is situated along the same structure as two large orogenic gold systems, Medio Monte and La Lupa. The latter, currently in production, is being operated by a local Bolivian company that produces a significant amount of gold using basic gravity circuits. Recent artisanal mining activity suggests that gold mineralization continues to Media Sur.

Work program and ownership

On April 19 Mantaro published a corporate update announcing its 2023 work program.

The explorer is planning a 15-hole, 2,500-meter drill campaign at its 100%-owned Santas Gloria silver project in Peru, and hopes to put out a preliminary economic assessment (PEA) on its flagship Golden Hill gold project in Bolivia in the second quarter. MNTR holds an option to acquire an 80% interest in Golden Hill.

Midway through its 2022 drill program, Mantaro exercised its option to acquire a 51% majority interest, showing the degree of confidence it has in the advanced-stage orogenic gold property, located in the underexplored Precambrian Shield.

Golden Hill

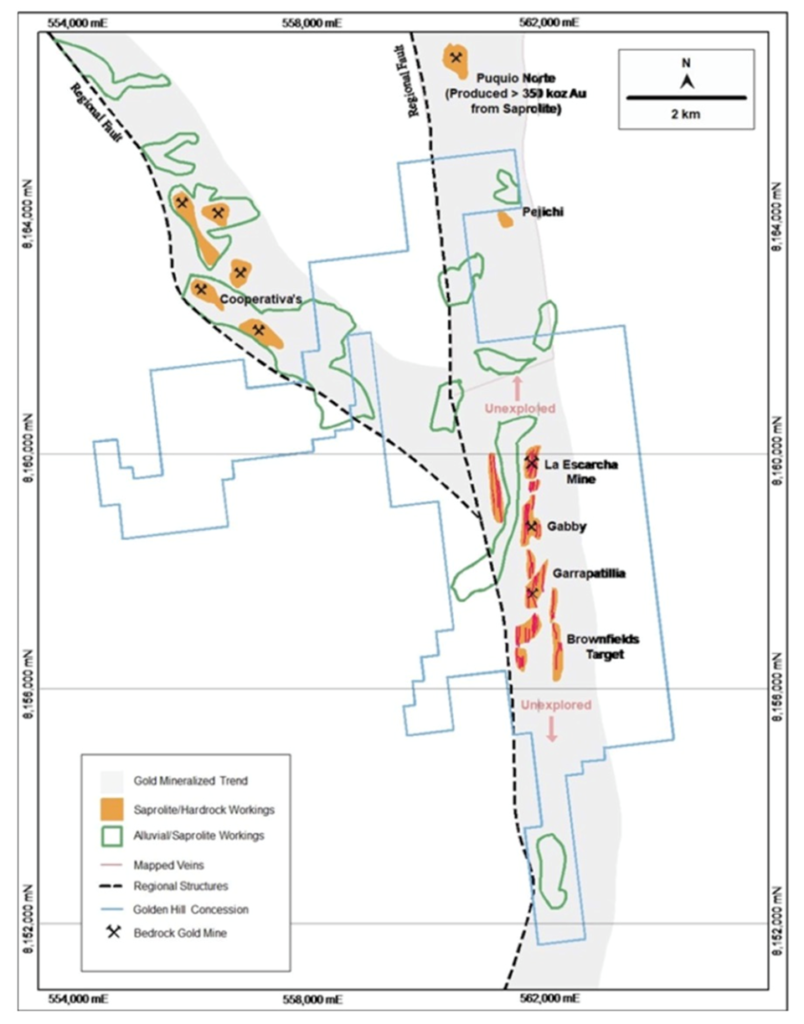

Golden Hill hosts at least six gold deposits along a 25-km-long strike.

The fully permitted, 5,976-hectare mining concession was mined historically from alluvial drainages along a 6-km trend. Shallow open pits were also developed, and targeted near-surface shear-hosted gold mineralization over a 3-km trend from Garrapitillia to La Escharcha. Five sub-parallel veins were mined at La Escarcha through limited underground development to 60m below surface.

Gold mineralization is of an orogenic or greenstone-hosted type. This style of mineralization can be observed across the region and notably 2 km to the north of the property at the Puquio Norte gold mine, which produced over 350,000 oz between 1997 and 2003.

According to Mantaro, these deposit types have the potential for kilometers of strike extension and kilometer-depth potential.

At Golden Hill, maps of underground workings confirmed multiple sub-vertical shear zones exceeding 4-6m true width. A 10-tonne bulk sample taken from the 45m underground level of the C3 vein at La Escarcha confirmed a head grade of 5.53 g/t Au and demonstrated that recoveries of 73.6% are achievable by gravity separation and 94% by cyanidation.

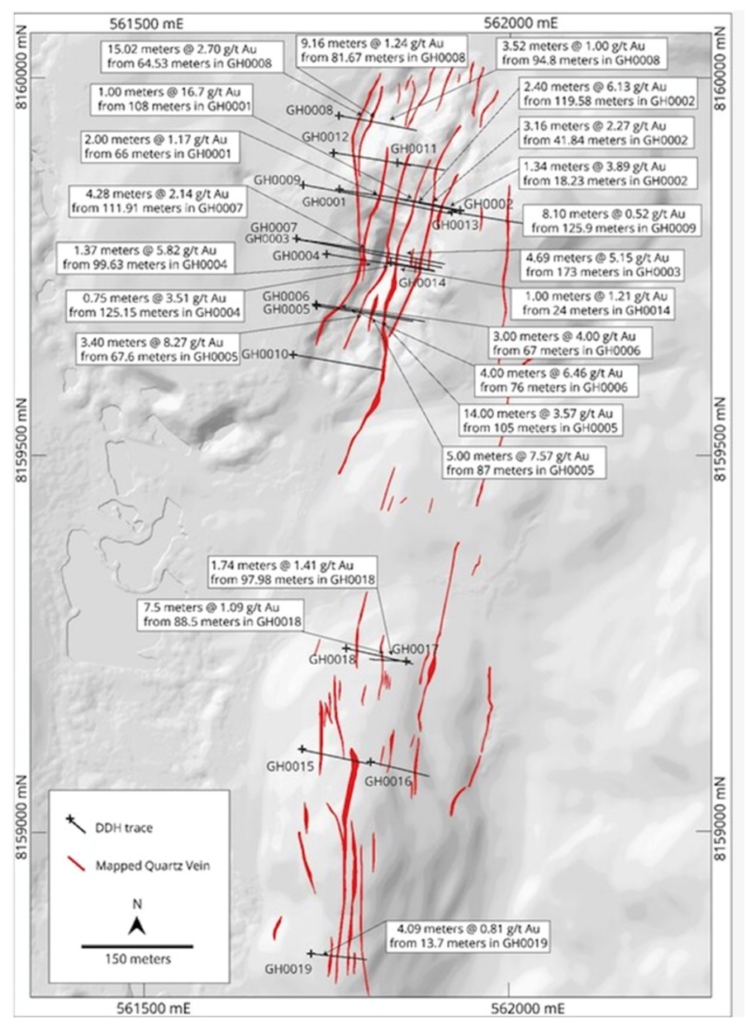

In 2022, the company completed a maiden 21-hole diamond drill program totaling 3,009m. Fourteen holes were drilled at La Escarcha along strike of historical workings. The other seven were scout exploration holes drilled at Gabby, Brownfields and Westfields. According to Mantaro, these holes intersected multiple high-grade shear zones over true widths of between 1 and 11.5 meters.

Intercepts of 11.82 g/t in hole GH0005 and 12.73 g/t in GH0006 within a broader halo of more than 4 g/t, are consistent in width and grade with greenstone-hosted gold discoveries worldwide.

Of the five scout holes drilled at Gabby over a 450-m strike, three hit gold mineralization, highlighted by 7.5m @ 109 g/t from 88.5m down hole, at vertical depths of 10-65m. Further drilling is warranted.

Significantly, only 350m of strike at La Escarcha was drill-tested to vertical depths of 75-100m. The system remains open in all directions. (see the Jan. 12 news release for full results of the initial drill program)

The Golden Hill team has obtained a new environmental license covering the entire property, allowing open pit, underground and alluvial mining for an indefinite term.

The company is currently preparing a resource estimate for Golden Hill due out sometime in Q2, and is undertaking a petrographic study using mineralized core from the drill program. The study will assist Mantaro in better understanding the gold grains, assist with modeling the mineralization, and provide input into the design of gravity-recovery flow paths.

The junior is also looking to re-process the tailings on site or sell them to a third party. Sixteen samples at 5 kg apiece were previously taken for metallurgical test work. The tailings head grade ranged from 0.31 to 7.83 grams per tonne gold, for an average head grade of 1.33 g/t. Gold recovery by cyanidation averaged 96%.

It shouldn’t go un-noticed how far advanced the Golden Hill property is, with a significant amount of prior exploration and loads of potential upside. To date, four major gold mineralized zones (La Escarcha, Gabby, Garrapittilia and Brownfields) have been identified across the 4 km strike length. Historical drilling on the property was limited to the La Escarcha pit area.

Furthermore, Mantaro has the opportunity to sell the tailings, or produce gold from tailings re-processed on site, conferring a cash-flow advantage not often seen in such an early-stage junior.

Santas Gloria

Mantaro’s other project, Santas Gloria, is located in the Miocene epithermal gold-silver belt of Peru, southwest of the Toromocho mine containing some of the country’s largest copper reserves.

Mineralization is described as intermediate sulfidation style over-printed by a gold-rich sulfidation phase. Many of the larger silver-base metal mines in this part of Peru are epithermal (shallow) deposits containing steep (over 600m) ore shoots containing high silver-base metal grades.

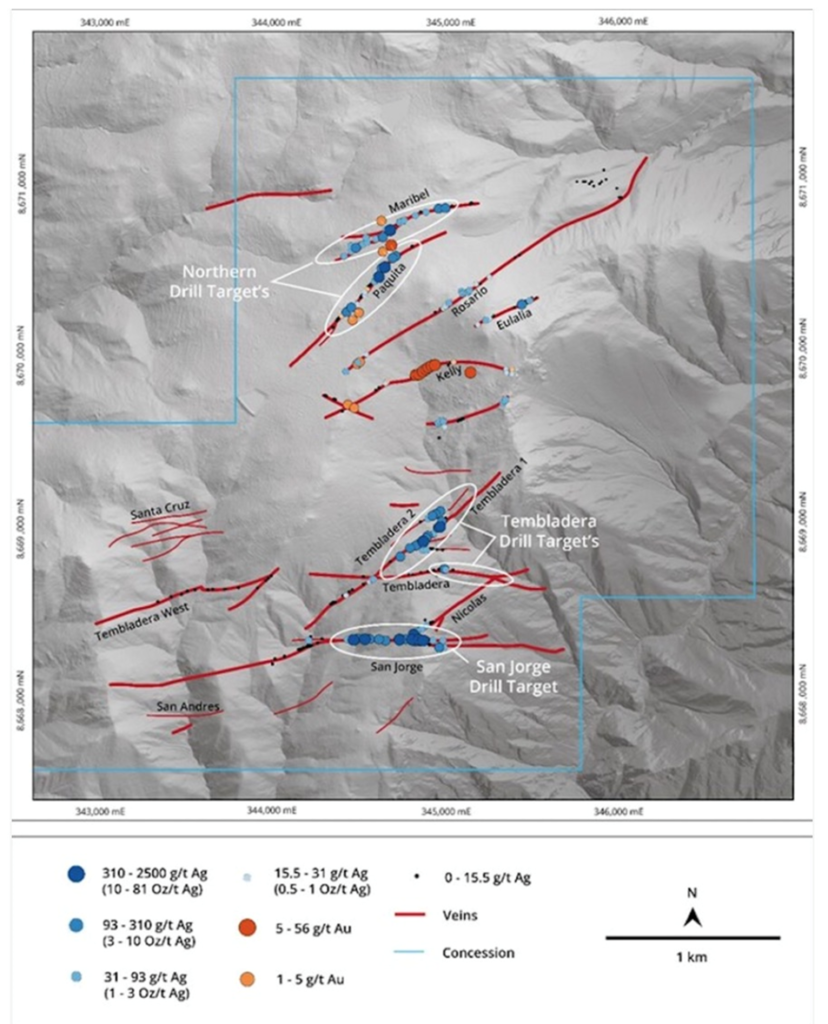

Santas Gloria is no exception. The property is known for very high (i.e. off the charts) silver grades over 10,000 grams per tonne (352 oz/t) in underground channel samples, and gold grades up to 56 g/t in surface channel samples.

Mantaro has re-sampled mine workings from two of the veins, enabling them to define drill targets based on the locations of the highest-grade shoots. The property has yet to be drill-tested despite the presence of over 12 km of half-meter to 5-meter-wide epithermal veins, several of which have strike lengths over 2 km.

To illustrate, the Tembladera vein system has a cumulative strike length of 4 km, the San Jorge vein’s total strike length is 3 km, the Paquita vein crops out in the north of the property over almost 1.25 km of strike, and the Maribel vein outcrops over a strike length of nearly 1.3 km.

Grades from previous underground channel sampling range from less than 5 g/t silver to 10,000 g/t, with surface channel sampling returning <5 g/t Ag to 2,500 g/t.

Because Santas Gloria is a silver-base metal vein system, otherwise known as Cordilleran silver-base metal type, the exploration targets are likely to be characterized by high grades with excellent depth.

According to Mantaro, the project 100 km from Lima has excellent access, is at a relatively low altitude of 3,300m, and has a community access agreement valid until 2028. The company has been authorized to drill from 20 pads and its applications for environmental and water permits have been accepted.

Mantaro expects to re-start drill pad construction at the end of the wet season this month, after which a 15-hole, 2,500m drill program will commence, subject to financing. “The program will target the strike and depth extensions of the extremely high grades defined in surface channel sampling and underground workings at the Tembledara, San Jorge, Paquita and Mirabel veins,” Mantaro states in its April 19 news.

Conclusion

A junior can be successful not only by exploring mining properties but acquiring new licenses in close proximity, thus expanding the overall land package and providing new opportunities for discovery. Mantaro appears to be following this strategy with its flagship project in Bolivia. Between a PEA on Golden Hill and a drill program starting soon at Santas Gloria in Peru, I’m expecting plenty of news flow for shareholders.

Mantaro Precious Metals Corp.

TSXV:MNTR, OTCQB:MSLVF, FSE:9TZ

Cdn$0.04, 2023.05.04

Shares Outstanding 69.8m

Market cap Cdn$2.79m

MNTR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Mantaro Precious Metals Corp. (TSXV:MNTR). MNTH is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MNTR

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.