PRUD: Advancing ABE gold project within the prolific Middle Cauca gold belt, Colombia – Richard Mills

- Home

- Articles

- Metals Precious Metals

- PRUD: Advancing ABE gold project within the prolific Middle Cauca gold belt, Colombia – Richard Mills

2023.05.02

Colombia continues to be one of Latin America’s most important gold miners, producing 1.96 million ounces in 2021. The only countries ahead of it were, in order, Peru, Mexico and Brazil.

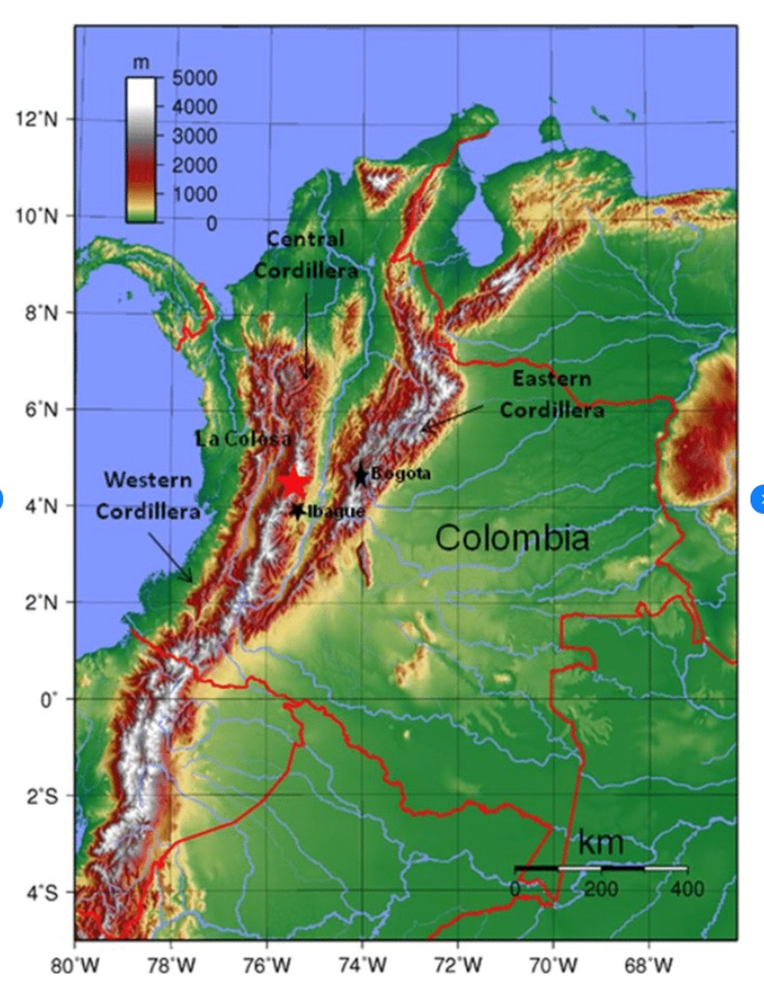

Gold is mainly found in three areas: the Andean region, the Sierra Nevada de Santa Marta Mountains in the north, and the Guyana Shield.

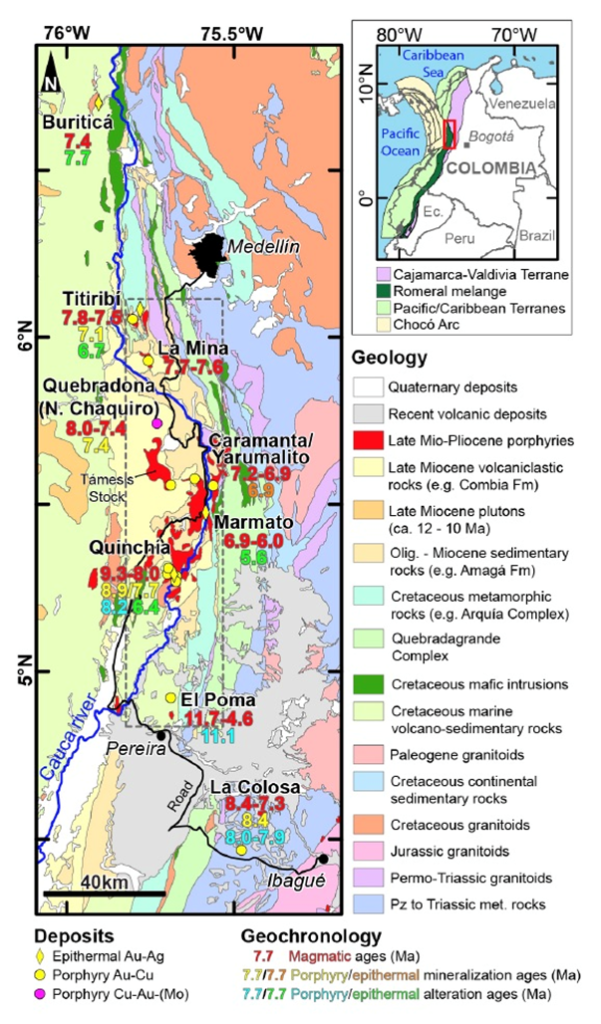

The Andean is divided into three Cordilleras (Central, Occidental and Oriental, in Spanish). A lot of early Colombian gold was mined in the Central Occidental, located in the department of Antioquia. It is here that four gold belts run north-northeast: the Choco belt, Middle Cauca belt, Segovia belt and California-Angostura district.

The country is South America’s biggest coal producer and the third-largest oil producer after Venezuela and Brazil. It also hosts major gold, nickel and copper deposits, along with emeralds. The two top mining sectors are gold and coal, but there has been a lot of interest in copper in the last few years, due to its role in electrification.

Colombia was the largest gold producer in South America before Peru and Brazil took over, with average annual output between 1990 and 2020 of 1,150,448 oz, or over 100 million ounces to date. Gold majors such as AngloGold Ashanti, Newmont and B2Gold have been operating in Colombia for decades.

AngloGold made two discoveries, La Colosa and Gramalote. It was previously thought that Gramalote, a joint venture between B2Gold and AngloGold, could be the latter’s first operating gold mine in Colombia, but it was put up for sale in November, 2022. La Colosa, meanwhile, is the largest greenfield discovery made by AngloGold.

Newmont purchased a 19.9% share of Continental Gold to jointly develop the Buriticá gold project. However in 2019, Continental was bought out by China’s Zijin Mining, in a transaction valued at 1.4 billion Canadian dollars.

Newmont has also invested in Orosur Mining, to explore the Canadian junior’s Anzá project along with Agnico Eagle; and the Denver-based firm has an option on Miranda Gold’s Lyra project.

GCM Mining, formerly Gran Colombia Gold, is the country’s largest gold and silver producer, with 208,775 ounces mined from its underground Segovia and part-owned Marmato operations in 2021.

According to one source, the mining sector accounts for approximately 2.4% of GDP and generates close to US$2 billion in taxes and royalties.

The country wants to reduce its dependence on oil and gas exports as it shifts to clean energy. Petro has vowed to stop awarding oil exploration contracts, and has said that Colombia needs to leave 80% of its coal reserves underground if it wants to fulfill a global pledge to keep warming below 1.5 degrees C.

The former Bogota mayor and guerilla wants coal-producing states La Guajira and Cesar to expand solar and wind projects, for which copper and silver are necessary metals.

Prudent Minerals

One of the most interesting companies exploring for gold in Colombia is Prudent Minerals (CSE:PRUD). Its ABE gold project is located 70 kilometers south of Medellin in the department of Antioquia.

ABE covers about 4,500 hectares, including the Purimac gold mine.

A December, 2022 technical report on its flagship property identifies exploration target estimated to be up to 6.3 million tonnes, with potential grades of 5 to 15 grams per tonne gold.

The project lies adjacent to the Romeral Fault system and the Middle Cauca Metallogenic Belt of north-central Colombia, which hosts several large-scale gold and copper-gold deposits, including: La Colosa (+28Moz), Marmato (+17Moz), Buritica (+11Moz), and the Segovia District, which has over 3 million ounces.

The reports states the ABE project is located on the western side of the Central Cordillera within a belt of metamorphic rocks known as the Cajamarca Complex. This complex surrounds the Antioquia Batholith, which, along with a group of smaller granitic batholiths and stocks, are host to a multitude of gold deposits. The geological setting is analogous to that in the Berlin-Rosario Gold District located approximately 150 km northwest, in similar metamorphic rocks surrounding the batholith.

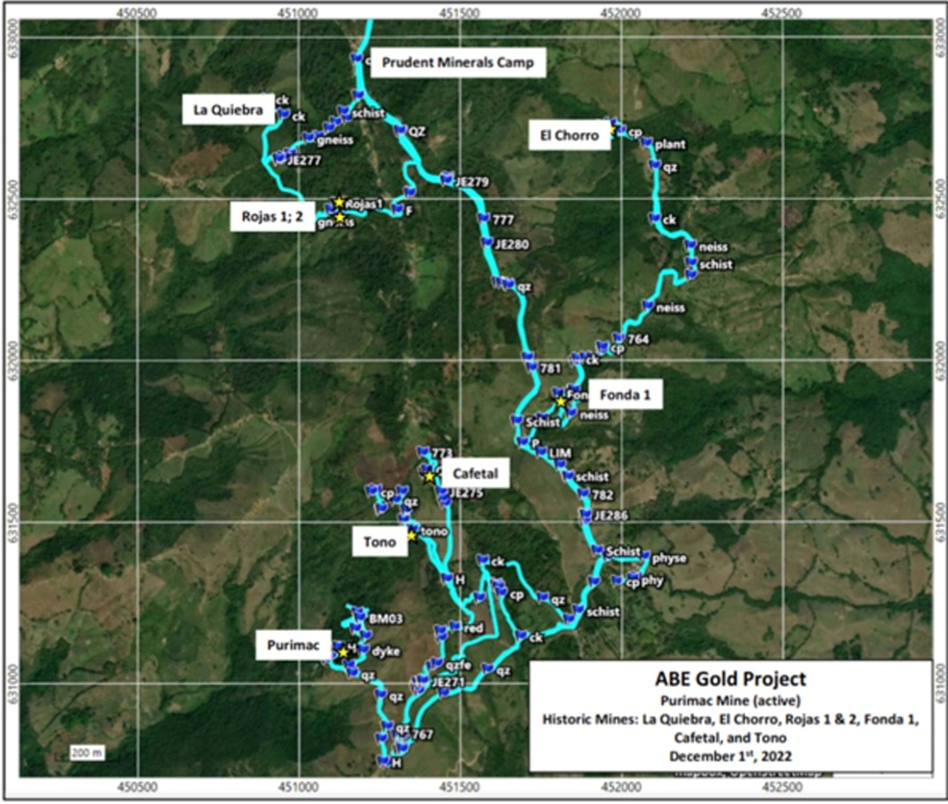

Exploration by Berlin Precious Metals included mapping at the Purimac mine, LIDAR, and geochemistry over 119 hectares within the ABE mining concession, identifying gold targets in parallel and sub-parallel geologic structures and seven historical gold mines. Highlight gold values of 3.4 g/t in surface soil samples and 6.61 g/t in historical mines have been recorded. Berlin has reportedly spent over $0.5 million in exploration over the past two years.

So far, exploration has been designed to enhance the understanding of the gold mineralization currently exploited at the Purimac gold mine. Rock sampling at the mine has shown that the quartz veins host gold mineralization with values exceeding 100 g/t over 1.8m.

This mineralization, located along a 30-meter-wide structural corridor, has been traced for over 2 km, and mined underground over 17 levels and the historical gold mines span over 2 km along strike; it remains open in all directions. The mined mineralized shoots averaged 26 g/t Au, with highlight muck grab samples of 96 g/t.

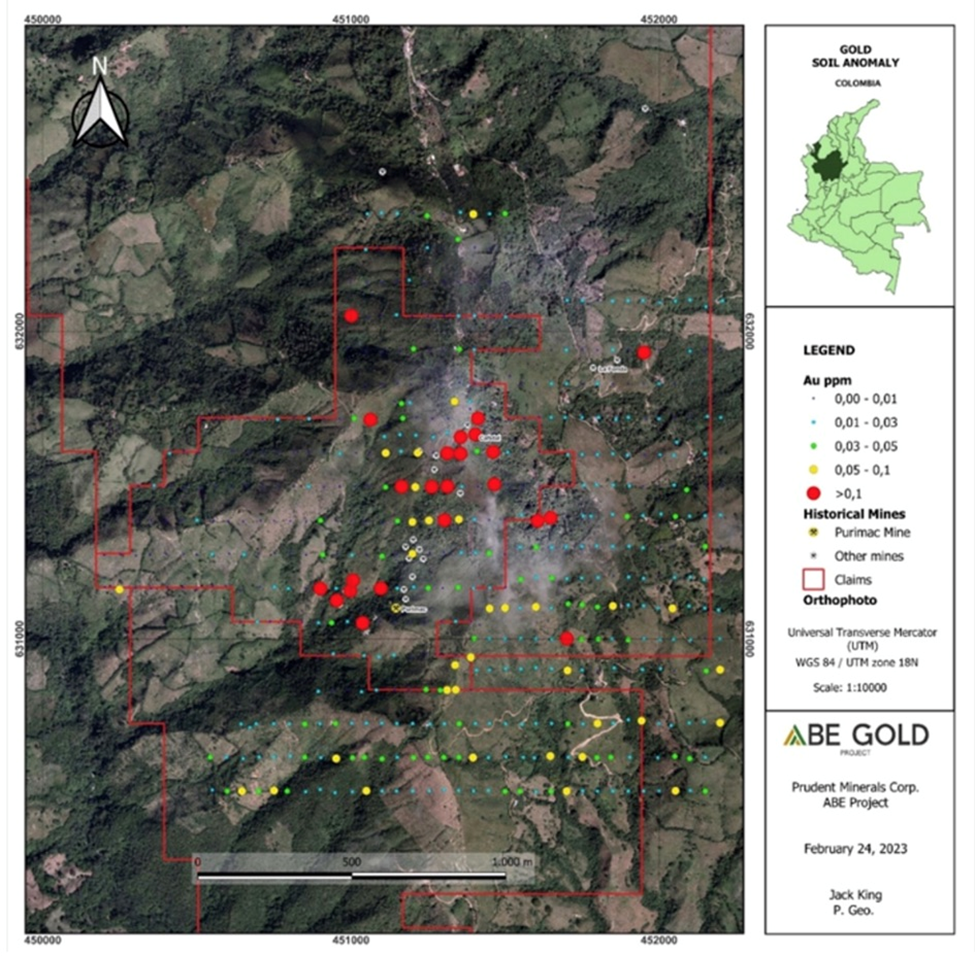

The Purimac veins appear continuous and are projected with orientations that are coincidental with seven historical workings (Figure 2), soil geochemistry, ground magnetics and induced polarization resistivity responses. This trend extends over 1,600m, spans a width of approximately 680m, and is open in all directions.

Prudent has identified an exploration target from work to date and the results of underground rock sampling. According to the technical report, the assumptions are based on the size and extent of the historical workings, which occur between 1,600 and 1,350 meters above sea level. The targeted quartz veins hosted in the Purimac shear outlined by the coincidental northeast trending magnetometer and IP resistivity, suggest a strike length of 1,600 meters, however for the report, 800 meters was used. The four quartz veins identified in the underground workings have widths ranging from 1 to 3 meters and estimated true widths of 0.90 to 2.90 meters. A specific gravity of 2.72 is estimated for the quartz.

Using these parameters, the Purimac vein set represents an exploration target of 2,000,000 to 6,300,000 tonnes, with potential grades of 5 to 15 grams of gold per tonne.

“Prudent is very pleased to acquire the ABE gold project with the independent technical report outlining an impressive exploration target of up to 6.3 million tonnes with potential high grades up to 15.0 g/t gold, clearly demonstrating the large-scale potential,” Prudent President Brett Matich said in the March 2 news release. He added:

“Prudent is currently focused on defining the strike potential and continuation of the Purimac gold vein system from the underground mine to surface, initially through an extensive soil geochemistry program, also advancing delineation of drill targets.”

Sampling is underway over the 1,600m by 680m zone, with the objective of extending the underground Purimac vein system and delineating drill targets (Figure 3).

Mapping of the +1500m of the Purimac and historic mines are well in progress. These workings connect to even older historical mine workings dating back to 1751. The Purimac mine contains four shoots of mineralization, of which three have been intensely mined above the main level and are untouched below the main level. Newly discovered Shoot 4 is open above, below and to the north of the currently advancing drift.

A ground-induced polarization (IP) survey is now completed showing a southern strike length extension of the known Purimac Mineralized Shear Zone. The survey consisted of 27 line kilometers, with lines spaced 100m and 200m apart.

According to Prudent, the geologic model indicates that the Purimac Mineralized Shear Zone has multiple veins containing high-grade mineralized shoots. The model will be used to pick high-potential drill targets.

Prudent has the right to earn 100% of the ABE project through the acquisition of Berlin Precious Metals, which is anticipated to close within the next fiscal quarter.

The land on which the project sits is owned by a co-operative of regional landowners who are currently operating the Purimac mine through a mix of hand-mining and small-scale mechanization.

Prudent Minerals Corp.

(CSE:PRUD)

Cdn$0.07 2023.05.01

Shares Outstanding 24.9m

Market cap Cdn$1.7m

PRUD website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.