Dolly Varden plans 40,000-45,000m of drilling in 2023, building on last year’s success – Richard Mills

- Home

- Articles

- Metals Precious Metals

- Dolly Varden plans 40,000-45,000m of drilling in 2023, building on last year’s success – Richard Mills

2023.04.26

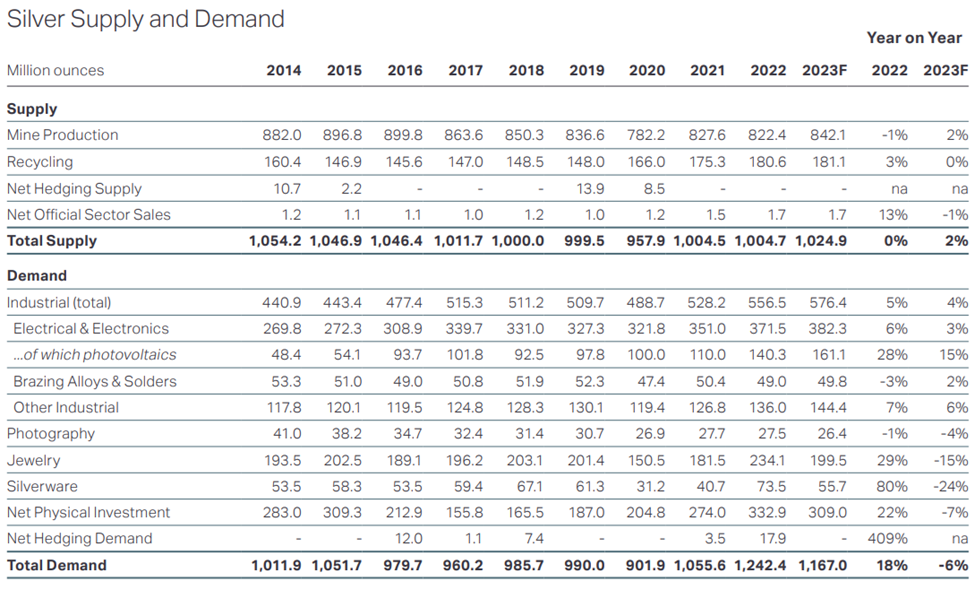

It’s official: the world’s silver supply is in a prolonged period of shortage. In 2022, the precious metal recorded its second straight year of deficits after half a decade of oversupply.

New data from the Silver Institute shows that global demand surged by 18% against a stagnant mine output in 2022, stretching the supply gap to 237.7 million ounces. This figure, says the institute, is “possibly the most significant deficit on record.”

Silver market fundamentals strong as it enters new era of supply deficits

What’s more unsettling is that it took just these two years of undersupply — the 2022 deficit and the 51.1Moz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade.

Looking ahead, a large silver deficit is likely to remain for the foreseeable future. “We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

To meet our future metal demands, it becomes imperative that more silver mines must be developed around the world to reverse this trend. The focus has to be on promising silver explorers and mine developers that could contribute to the future supply chain.

Dolly Varden Silver

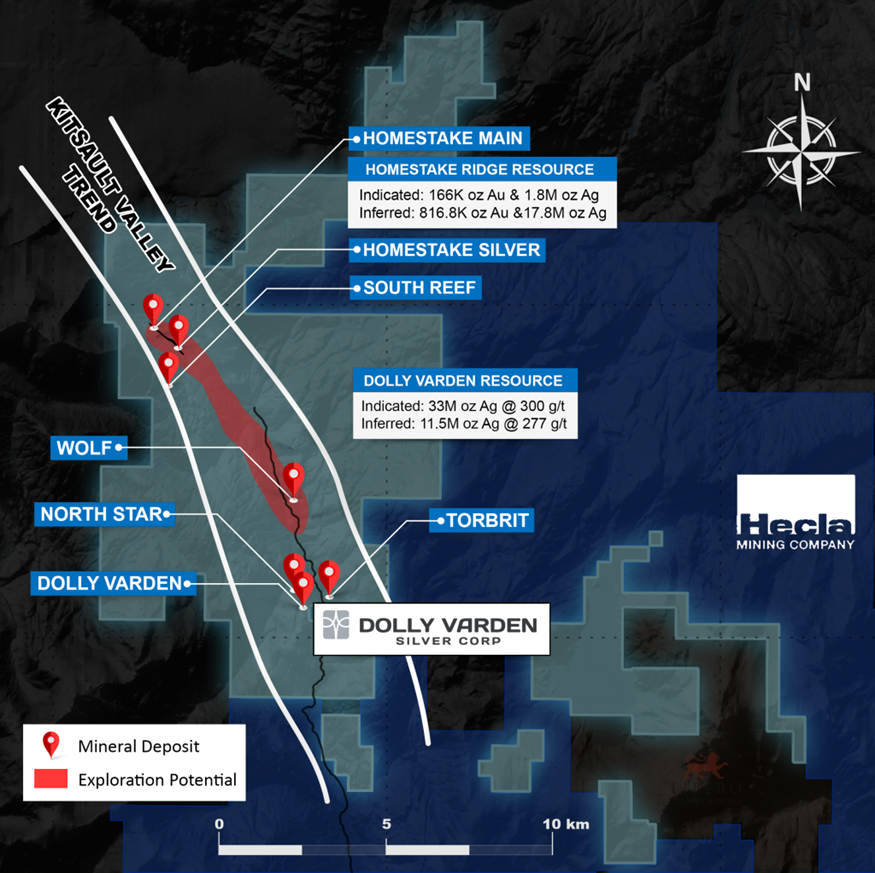

One junior explorer that could help mitigate the silver market imbalance is Canada’s Dolly Varden Silver Corp. (TSXV:DV, OTC:DOLLF), which is advancing its Kitsault Valley project located in the Golden Triangle of northwestern British Columbia.

The 163-square-km property represents an amalgamation of the high-grade silver and gold resources of Dolly Varden’s namesake project and the Homestake Ridge project it acquired in early 2022.

The combined mineral resource of 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in inferred, within multiple outcropping deposits, makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in all of Western Canada.

Within the boundaries of Dolly Varden’s original project are the past-producing Dolly Varden and Torbrit silver mines, which together produced more than 20 million oz of high-grade silver between 1919 and 1959, with assays of ore as high as 2,200 oz (over 72 kg) per tonne.

Notably, Dolly Varden was amongst the most important silver mines in the British Empire during its heyday, and the mine’s manager between 1919-1921 was none other than Herbert Hoover, who went on to become the 31st US President.

Other historically active mines in this area include North Star and Wolf, which remain underexplored to this day.

The newly acquired Homestake Ridge project comprises the northern half (75 sqkm) of the Kitsault Valley project, featuring a high-grade gold and silver resource from three known deposits.

While the existing deposits are enough to work with, DV believes the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack.

Therefore, the company has implemented a strategy of not only expanding on the current resources, but also testing for new exploration targets for discovery, with the ultimate goal of realizing the true potential of its precious metals resource in the highly prospective Golden Triangle region.

2022 Drilling Recap

Last year, DV embarked on a comprehensive drill program at Kitsault Valley. The goal was to upgrade the current inferred mineral resources to the measured and indicated classification, as well as to expand the known deposits and discover new silver-gold mineralization along the Kitsault Valley trend.

Specifically, the objective was to expand the wide, high-grade silver mineralization at Wolf vein, step out and infill at Torbrit and the nearby Kitsol vein, and test several other nearby exploration targets on the Kitsault Valley property.

Twenty holes for 9,994 metres were completed at Wolf Vein, 18 holes for 3,524 metres at the Torbrit deposit, eight holes for 2,900 metres of infill and step out drilling at the Kitsol vein, and six holes for 2,196 metres in additional exploration. Another 18,448 metres in 56 holes were completed at the newly acquired Homestake Ridge deposits, for a total of 37,062 metres in 108 holes.

And the results, which have now all been released, certainly did not disappoint.

Kitsol vein

The company first teased us with results from the Kitsol vein target in August, which featured a 25m step-out hole along strike and down dip of the high-grade silver mineralization zone. The Kitsol structure is a vein-hosted, high-grade silver system located immediately west of the Torbrit mineral resource and historic mine.

The step-out drill hole returned an 18m interval at an average grade of 414 g/t silver, including 15m averaging 646 g/t silver; 74m averaging 658 g/t silver, and 34m averaging 801 g/t silver.

Some of the assays were even higher. Within the mineralized interval, three 0.5m long samples had silver assays of 2,910 g/t, 2,390 g/t and 2,500 g/t respectively, indicating the possibility of multiple mineralizing events.

Given the grade and consistency of the silver mineralization, DV believes Kitsol fits the criteria of a potentially underground bulk-mineable deposit.

Follow-up results announced in November confirmed this bulk minerability, with one hole intersecting 12.51m averaging 442 g/t silver, including 1,367 g/t silver over 1.50m, as an up-dip infill hole from previous high-grade intercepts.

Wolf vein

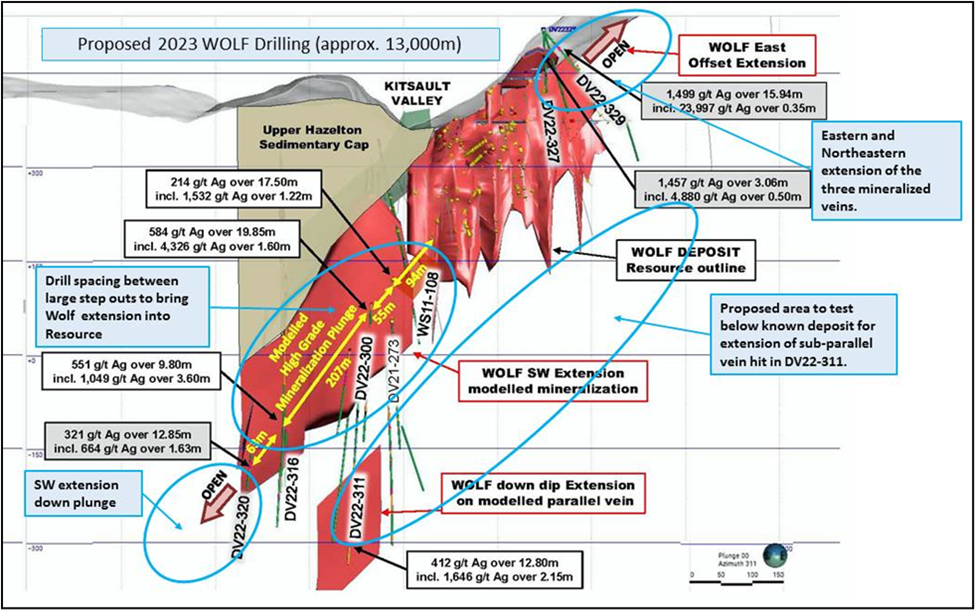

Drilling in 2022 also returned impressive results from the Wolf vein, where step-out drilling first returned a significant high-grade silver intercept: 19.85m averaging 584 g/t, including bonanza-grade silver mineralization of 4,326 g/t.

The Wolf vein is a steep dipping, high-grade silver vein deposit that’s part of the current mineral resource estimate at DV’s Kitsault Valley trend. In 2021, geological modelling of the deposit showed expansion potential along strike to the southwest.

Follow-up drilling has since defined the high-grade silver mineralization to a depth of 500m below surface and extended the zone over 350m down plunge from historic drilling and over 500m from the historic underground workings.

“With an increase in vein intensity and silver grades, the Wolf Vein area is emerging as a large system, rivaling our Torbrit deposit,” stated Shawn Khunkhun CEO at the time, adding that the significant widths make the Wolf vein potentially amenable to bulk underground mining, just like the Kitsol vein that is 1,400m away.

In November, the company dramatically extended the limits of the Wolf vein silver mineralization through wide-spaced step-out drilling. One hole returned 412 g/t silver over 12.80m, including 2.15m grading 1,646 g/t silver, and another hit 551 g/t silver over 9.80m, including 3.60m grading 1,049 g/t silver.

These results more than doubled the strike length of the Wolf deposit, as well as extended high-grade silver mineralization to over 750m in dip extent.

Homestake Ridge

Towards the end of 2022, DV completed a trifecta of exploration success with high-grade silver and gold results coming from the Homestake Ridge project, which it acquired from Fury Gold Mines in February 2022.

Two precious metal deposits — Homestake Main and Homestake Silver — were the focus of the 2022 program. The objective of drilling was to expand multiple, sub-parallel mineralized zones and to upgrade inferred resources.

Highlights of the first batch included 27.44 g/t gold and 463 g/t silver over 9.16m, including 75.13 g/t gold and 2,337 g/t silver over 1.77m, and 0.5m of 216 g/t gold, 113 g/t silver and 0.48% copper.

“These intercepts demonstrate strong continuity of mineralization over wide intervals, similar to the recently announced high-grade results at the Wolf and Kitsol deposits, located 6 km to the south,” chief executive Shawn Khunkhun said.

DV followed that up with more high-grade results in January 2023, highlighted by 46.31 g/t gold, 70 g/t silver and 0.19% copper over 25m, including 1,145 g/t gold, 826 g/t silver and 0.51% copper over 0.48m, from Homestake Main; and 2,500 g/t silver, 15.04 g/t gold and 0.17% copper over 1.20m from Homestake Silver.

“Dolly Varden Silver’s initial drilling at the Homestake Main deposit has returned consistent mineralized intervals with some of the highest grades of gold with silver reported from the property to date, but also the entire Golden Triangle during the 2022 drilling season,” Khunkhun commented.

Latest Updates

In February of this year, DV saved its best for last, reporting the highest silver assay received to date from the Dolly Varden property.

Drilling during the 2022 season at the northern limits of the Wolf deposit returned an 8.77m intercept of 1,499 g/t silver, 1.89% lead and 0.46% zinc. Within that intercept was what the company called a “jewelry-box-style” mineralization, grading 23,997 g/t silver, 1.24% lead and 0.34% zinc over a true width of 0.19m.

Towards the southern limits of the Wolf vein, drilling also encountered 321 g/t silver, 0.84% lead and 0.84% zinc over 12.85m, including 664 g/t silver, 1.24% lead and 3.54% zinc over 1.63m.

“Results from the Wolf Vein continue to exceed expectations, returning the highest-grade silver assay yet received, more than doubling the strike length of the deposit through step outs to the north and south as well as returning wide, robust silver and base metal grades at depth,” Khunkhun stated in a February 6 release.

Elsewhere, high-grade assays continued to flow in from the Kitsol vein, highlighted by 301 g/t silver, 0.23% lead and 0.56% zinc over 15m, including 434 g/t silver, 0.41% lead and 0.69% zinc over 5.9m.

A new copper discovery was also made at the Red Point target, with results of 8.10 g/t gold, 244 g/t silver and 5.16% copper over 1m, and 17.20 g/t gold and 1.65% copper over 1.15m.

2023 Exploration

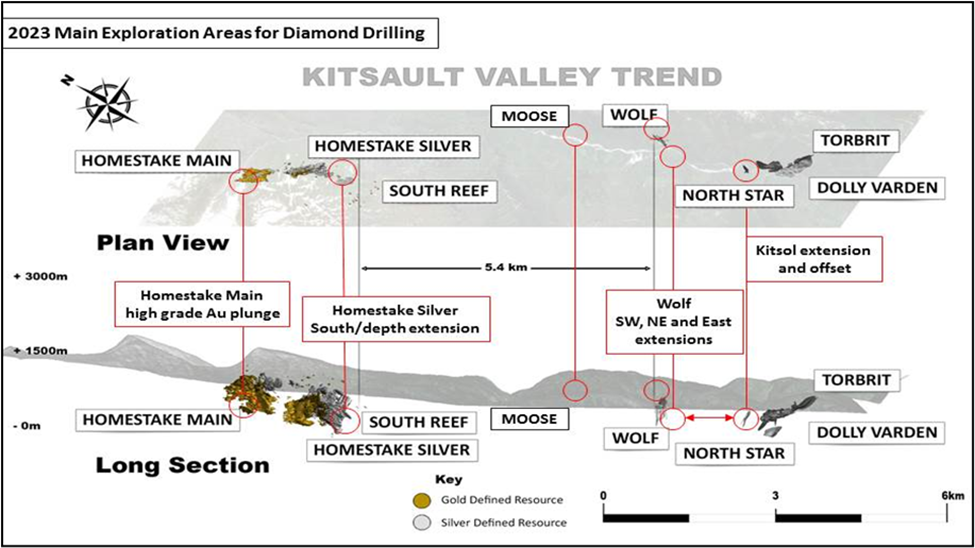

Building on last year’s drilling success, this week Dolly Varden laid out its 2023 exploration plans for the newly combined Kitsault Valley project.

The company has earmarked 40,000 to 45,000m of drilling through further step-outs following the high-grade silver and gold mineralization at the Wolf and Homestake Ridge deposits, as well as appropriately spaced exploration holes to allow the inclusion of new mineralization drilled over the past three drilling programs to be included in an updated resource estimate.

“2022 was a breakthrough exploration season at Dolly Varden Silver’s Kitsault Valley project. It hosts one of the largest, undeveloped high-grade precious metals projects in Western Canada,” president and CEO Shawn Khunkhun said.

“With the wide, high-grade silver intercepts in significant step-out holes from the Wolf and Homestake silver deposits, coupled with the highest-grade gold intercepts drilled in all of the Golden Triangle in 2022 from the Homestake Main deposit, we eagerly await the start of this season’s drilling.”

As disclosed previously, the priority during the 2023 exploration program will be to connect the Wolf deposit with the Kitsol deposit, located 1,400m apart.

Drilling allocated to the Wolf deposit expansion (approx. 13,000m) will focus on both infill drilling of the wide-spaced intercepts from 2022, as well as further step-out holes in several directions where high-grade silver mineralization remains open. Similar step-out drilling will follow up on high-grade silver mineralization at the Kitsol vein.

The 2023 drilling at Homestake is influenced by the structural information gained from the infill drilling at the Main deposit, where two main plunge directions have been identified. The planned drilling will target the down plunge extensions of higher grade and wider zones of gold mineralization. Drilling at Homestake Silver will prioritize step out holes where 2022 expansion drilling had success at the southern extent.

Another 2023 exploration target is the Moose vein, where DV plans to test a historic prospect with small exploration adit from the 1920s. It is located 1,500m north of the Wolf deposit within the Potassic alteration halo associated with the Torbrit, Dolly Varden and Wolf silver deposits to the south.

Conclusion

“We are continuing our successful strategy of expanding current resources, while also testing new exploration targets for discovery,” Khunkhun commented on Dolly Varden’s 2023 plans, adding that the company has over $26 million in the treasury, which positions the exploration team with “a tremendous opportunity to create value with the drill bit.”

Since the 2022 program, Dolly Varden has completed $22.6 million in financings, which included a $1.9 million investment from Hecla Mining’s Canadian subsidiary to keep its 10.21% ownership in the company.

This level of fundraising is almost unheard of in the junior mining space, and the continuous backing of Hecla, the top silver producer in the US, just goes to show the level of confidence the market has in the Kitsault Valley project.

Now, we await what the 2023 exploration program brings.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$1.13, 2023.04.24

Shares Outstanding 254.3m

Market cap Cdn$274.7m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of DV

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.