Graphite is a key vulnerability in the US-China “electrification war” – Richard Mills

2023.04.15

The electrification of the global transportation system doesn’t happen without graphite. That’s because lithium-ion batteries that go into electric vehicles are composed of an anode (negative) on one side and a cathode (positive) on the other. Graphite is used in the anode.

The cathode is where metals like lithium, nickel, manganese and cobalt are used, and depending on the battery chemistry, there are different options available to battery makers. Not so for graphite, a material for which there are no substitutes.

An average plug-in EV has up to 70 kg of graphite.

Due to its natural strength and stiffness, graphite is an excellent conductor of heat and electricity. It is also stable over a wide range of temperatures.

Hence, graphite is considered indispensable to the global shift towards electric vehicles. It is also the largest component in batteries by weight, constituting 45% or more of the cell. It may surprise some readers to learn that there is nearly four times more graphite feedstock consumed in each lithium-ion cell than lithium and nine times more than cobalt.

Graphite is included on a list of 23 critical metals the US Geological Survey has deemed critical to economy and national security.

According to the USGS, the battery end-use market for graphite has grown by 250% globally since 2018.

Moreover, graphite requires the largest production increase of any battery mineral to meet forecast demand.

It’s thought that battery demand could gobble up well over 1.6 million tonnes of flake graphite per year (out of 2022 mine supply of 1.3Mt).

But the mining industry still needs to supply other graphite end users. Currently the automotive and steel industries are the largest consumers of graphite, with demand across both rising at 5% per annum.

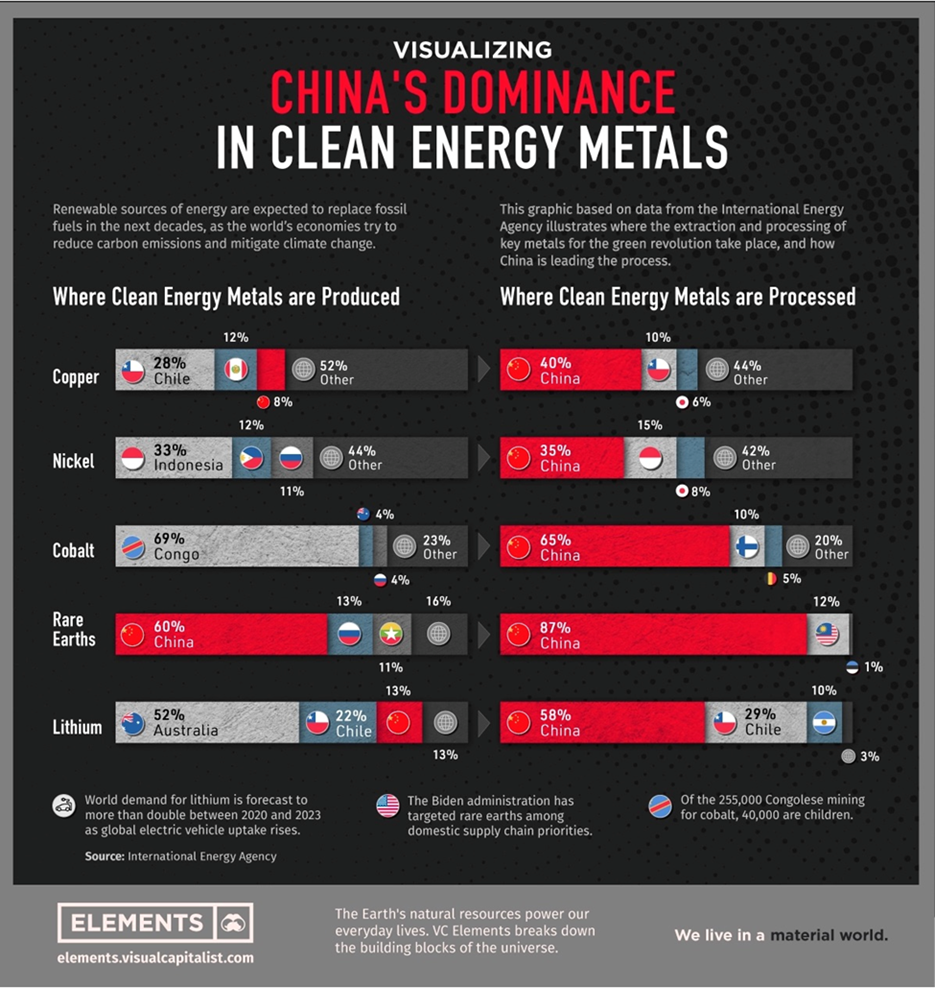

The US could be left in the dust as it continues to play catch-up in the EV race. China is by far the biggest producer about 80% of the world’s graphite production. China also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Madagascar, Brazil and South Korea. The US, on the other hand, produces no graphite, and therefore must rely solely on imports to satisfy domestic demand.

No love

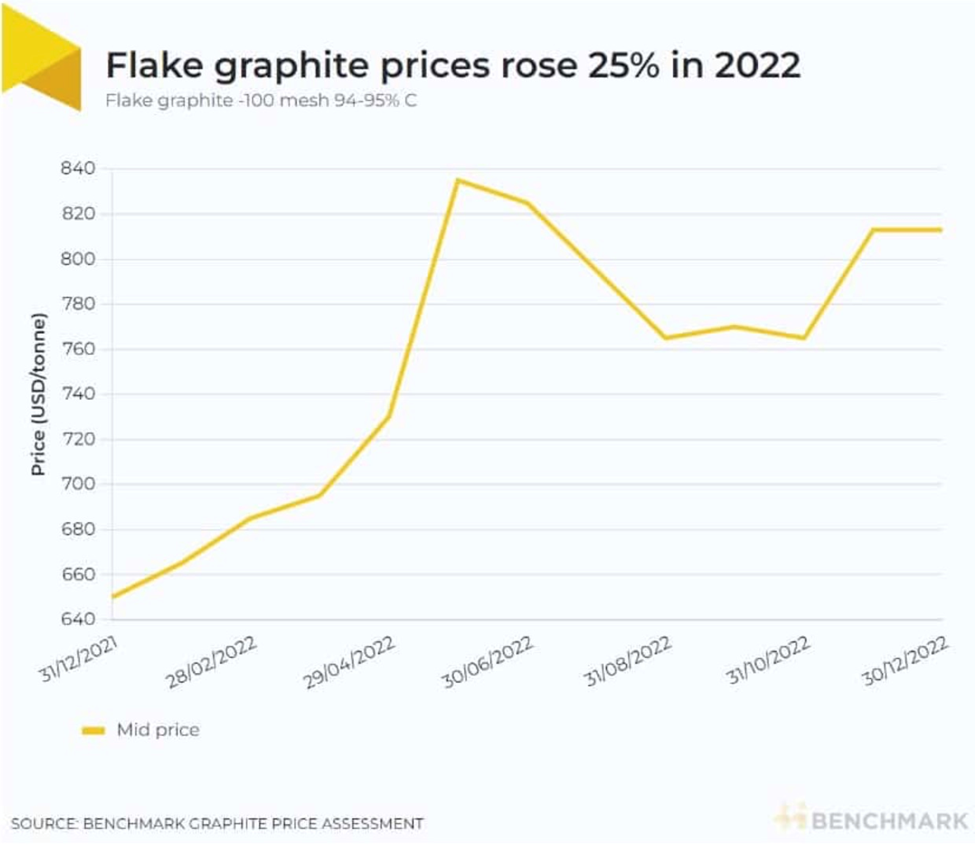

Everybody knows about the need to mine more lithium, which is obviously a requirement for lithium-ion batteries. Graphite on the other hand, has mostly flown under the radar. Last year the price of lithium more than doubled whereas graphite only rose 25%. This despite the fact that both have the same demand drivers, i.e., the increasing adoption of electric vehicles and accommodative government policies towards electrification.

In October 2022, prices for battery-grade lithium carbonate in China hit an all-time high of US$74,457 per tonne. Over two years Chinese prices surged more than 1,300%. Despite coming off recent highs, lithium is still triple its three-year average.

There are a couple of reasons why graphite has not seen the same kind of price appreciation as lithium. The first has to do with steelmaking still being the largest source of graphite demand, along with a return to normal graphite production following pandemic-related lockdowns, especially in China.

According to the OECD, at the end of 2022, the outlook for global steel markets had deteriorated sharply; among the factors were a global economic slowdown, high energy prices and accelerating inflation. Also hindering steel production was the war in Ukraine, supply chain disruptions and a sharp downturn in China due to an ailing real estate sector and strict covid-19 lockdown policies.

Graphite prices have also been left on the back versus the front burner due to the fact that anode manufacturers can use synthetic graphite as an alternative to natural (mined) graphite. According to Benchmark Mineral Intelligence, “Today, synthetic graphite anodes dominate in terms of market share, accounting for approximately 57 percent of the anode market.” Furthermore, in a January 2023 article, BMI states, “Synthetic graphite anode supply grew by more than 30% during 2022, and is anticipated to even surpass that in 2023, given a supply deficit developing for natural graphite feedstock.”

However, the fact that synthetic graphite is derived from petroleum coke, makes it a problem for end users who want to be perceived as “green”. The production of synthetic graphite is said to be four times more carbon-intensive as natural graphite. If battery makers start demanding low-carbon anode material, it would provide a strong boost to prices, since natural graphite would be the only alternative.

Indeed some analysts believe it is a question of when, not if, graphite prices start to rise, as we saw last year with lithium. Beyond the ESG factor, if steelmaking or any other industrial use for graphite returns to historical demand levels, it would quickly put pressure on the growing demand for graphite in battery anodes.

Much depends on the health of the global economy. A return to $100 oil would make synthetic graphite more expensive than natural/ mined graphite, prompting a switch to the latter.

Looming shortfall

Some of the world’s largest auto and battery makers aren’t waiting until that happens. They, and the US government, are racing to secure graphite supplies ahead of a coming supply shortage.

According to BMI, via the Wall Street Journal, by 2030 demand for natural graphite is projected to outstrip supply by about 1.2 million tonnes.

Tesla and Panasonic are among the companies that have signed graphite off-take agreements. Syrah Resources, for example, has an off-take with Tesla to ship graphite from its mine in Mozambique to a processing facility in Louisiana.

Late last year, WSJ said the United States gave grants totaling about $500 million to three graphite producers — Syrah, Novonix and Anovion — to kickstart domestic supply using money from the $1 trillion infrastructure bill.

The Inflation Reduction Act provides US consumers tax credits of up to $7,500 per electric vehicle, provided the parts or materials are sourced from countries with which Washington has a free trade agreement. This increases the focus on graphite and other critical minerals.

(Why the Biden administration is giving away hundreds of millions of dollars to a company in Madagascar, is beyond me. This is not security of supply — Rick)

Critical minerals arms race

As mentioned China mines about 80% of the world’s graphite. The country also makes nearly 100% of graphite anode material.

The fact that the US currently has no domestic graphite production means that graphite could easily become part of the escalating conflict between the United States and China regarding critical minerals.

The United States looks to have taken a giant leap in this arms race in late March with the signing of a cooperation agreement with Japan covering various minerals for electric car batteries.

Under this swiftly negotiated agreement, the US and its Asian ally will refrain from imposing export duties on lithium, cobalt, manganese, nickel and graphite.

Washington is also close to striking a similar deal with the European Union after the two sides entered talks last month, according to reports. A draft of the agreement, as seen by Bloomberg, currently lists cobalt, graphite, lithium, manganese and nickel, mirroring that of the US-Japan deal.

Another country eager to capitalize on the IRA benefits is Indonesia, which is reportedly looking at a limited free-trade agreement for some minerals shipped to the US to help its companies serving the EV battery supply chain. The Southeast Asian nation currently boasts the world’s largest nickel reserves.

China, meanwhile, has made it increasingly difficult for the West to access its raw materials through stringent export restrictions.

These restrictions — most frequently taxes, but also quotes — have increased more than five-fold in the last decade to a point where 10% of the global value of exports is subject to at least one measure, according to an OECD report.

There are already fears that China’s export policy could extend to an outright ban on some minerals, in particular rare earths, of which it is by far the world’s largest producer.

Rumblings of a China ban on rare earth exports first emerged in 2019, which caused angst among Western powers, pushing them to consider other sources of supply and establish new partnerships. And while it has been “all talk, no action” since, China’s threat remains a ticking time bomb.

Things could be heading in a precarious direction, following Washington’s recent decision to impose restrictions on exports of high-end semiconductors to Beijing. Reports are coming out that China is now considering the possibility of banning certain rare earth magnet technology exports.

The motive behind the United States trade strategy is well-documented — to shed itself of dependence on China while loosening the grip its main rival has on the global supply chain of critical minerals.

When it comes to raw materials for the electric vehicle industry, China is undisputedly the most dominant force on the planet.

For example, almost every metal used in EV batteries today likely comes from there, either mined or processed. Thanks to its technological prowess in refining, China has established itself as the leader in the battery metals processing business (see below).

For the US, this poses a great security risk, as China could easily decide to weaponize its market dominance at any point, essentially locking America out of the critical minerals supply chain.

In a February 2022 fact sheet, the White House conceded that: “The US is increasingly dependent on foreign sources for many of the processed versions of these minerals. Globally, China controls most of the market for processing and refining cobalt, lithium, rare earths and other critical minerals.”

Speaking to CNBC earlier this year, Special Presidential Coordinator Amos Hochstein called this “a major concern for the US” and for the rest of the world. “As we are going into a cleaner, greener, an entirely new energy system, we have to make sure we have a diversified supply chain,” he said.

As of now, the United States uses mostly synthetic graphite since it does not mine natural graphite. But for a country with grand ambitions with regard to climate goals and vehicle electrification, that doesn’t seem very sustainable. Eventually, it will need to find sources of natural graphite.

Graphite One

Enter Graphite One (GPH, OTCQX:GPHOF) advancing the Graphite Creek property, situated along the northern flank of the Kigluaik Mountains, Alaska, spanning 18 kilometers.

Located on the Seward Peninsula, Graphite Creek in early 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

In other words, having HPIP means that Graphite Creek will likely be fast-tracked to production.

The US Geological Survey has also cited Graphite Creek as the country’s largest known graphite deposit, and recently extended that status to “among the largest in the world.” (see map below)

Results of 2022 drilling (1,940m) were released by Graphite One earlier this year, confirming that “significant graphite grade” continues 4 kilometers from the pit boundary defined in the 2022 prefeasibility study (PFS). One step-out hole showed significant intervals above mill cut-off grade, with selected intervals totalling 8.2m of 4.18% graphite.

Based on these results, the company then put out an updated resource estimate for Graphite Creek, which showed an increase of 15.5% in measured and indicated tonnage with a corresponding increase of 13.1% in contained tonnes of graphite over the 2022 PFS.

The deposit now has 37.6 million tonnes of M+I resources grading 5.14% Cg (graphitic carbon), for 1.93 million tonnes of contained natural graphite. It also has 243.7 million tonnes of inferred resources at 5.07% Cg, for 12.3 million tonnes of natural graphite.

Graphite One aims to become the first vertically integrated domestic producer to serve the nascent US electric vehicle battery market.

The company in April, 2022 announced an MOU with Sunrise New Energy Material Company, a China-based lithium-ion battery anode producer.

The intent is to develop an agreement to share expertise and technology for the design, construction and operation of a proposed graphite material manufacturing facility in Washington State.

Last year Sunrise started preparing anode materials for sample purposes from Graphite Creek concentrate, and in December 2022, Graphite One announced that concentrate is being used to prepare sample battery anode materials for two major electric vehicle manufacturers, while an artificial graphite anode sample is being prepared for a third EV company. Results are expected this quarter.

This is a crucial milestone for Graphite One in proving, a/ that its graphite end product is of sufficient quality to be battery-grade; and b/ that Graphite One is able to tailor its graphite processing to meet the specific graphite anode needs of its potential future clients.

Graphite One than made two more announcements, the first regarding the testing of graphite from Graphite Creek; and the second, the testing of Graphite Creek material “as a potentially critical mineral-rich carbonaceous feedstock.”

In the first news release, G1 states that the company, through a subsidiary, has entered into a Material Transfer Agreement with Pacific Northwest National Laboratory (PNNL), managed and operated in Richland, Washington by Battelle for the U.S. Department of Energy.

The second news release details Graphite One’s arrangement with Sandia National Laboratories in Albuquerque, New Mexico. The company’s subsidiary Graphite One (Alaska) has provided material from the Graphite Creek deposit to Sandia, as part of Sandia’s green extraction processing work.

Following on last year’s success, the company is about to ramp up drilling in 2023-24 with a planned 20,000 meters. The results could help to increase the designed production capacity for the upcoming Graphite Creek feasibility study.

If all goes according to plan, the FS would move Graphite One’s deposit that much closer to becoming America’s only source of mined graphite, helping to shed its import reliance.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.50, 2023.04.14

Shares Outstanding: 109.8m

Market cap: Cdn$164.7m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.