Getchell Gold: Hitting the sweet spot between in-situ value and exploration upside at Fondaway Canyon – Richard Mills

2023.04.14

At AOTH, we see Getchell Gold Corp. (CSE:GTCH, OTCQB:GGLDF) as an excellent value play in a rising gold price environment characterized by central bank and retail buying, safe-haven demand resulting from current economic and geopolitical conditions, and tighter supplies due to depleted gold reserves and a lack of new discoveries.

Who are behind gold and silver buying

Gold majors wanting to grow their reserves without incurring large capital expenditures are hunting for cheap gold in the ground. Getchell Gold has 2 million ounces at its Fondaway Canyon gold project in Nevada and the outer limits of the deposit have yet to be encountered by drilling.

Getchell has achieved consistent mineralization over three years of drilling. Out of 18 holes drilled, Getchell has yet to miss! The company has been focusing on the Central Area of a 3.5 km east-west gold trend.

This is Fondaway Canyon’s nexus of gold mineralization, with the structures providing not only pathways but traps for gold. Getchell has delineated quite a bit of gold in the ground, but, imo they are really only just getting started.

Getchell Gold, a case study of “gold in the ground”

Nevada

Part of Fondaway’s attraction lies in the fact that it’s in Nevada. With 160 years of gold mining that dates back to the Comstock Lode discovery in 1859, Nevada is one of the best jurisdictions to find gold.

Between 1835 and 2016, Nevada produced a phenomenal 158 million ounces. This is more than any other gold rush, including California’s, which extracted about $2 billion in precious metals from 1849-62, and the Comstock era, 1860 to 1875, which mined around 34Moz, according to research by The Nevada Sun.

The United States’ primary gold producer has an impressive geological endowment. According to the US Geological Survey, if Nevada were a country, it would be among the world’s top four producers. Nevada currently produces around 80% of all the gold in the United States.

The state is home to 23 active gold mines and is consistently ranked as one of the top mining jurisdictions in the world, providing confidence not only to companies advancing their projects, but also for investors in those companies. On an annual basis we are talking about 4.5 million oz of gold produced, worth some USD$8.5 billion.

Nevada rose to prominence in gold production in the late 1980s, but since then there has been a slow decrease in production. This sets the stage for the acquisition of companies with large gold assets, that can help bolster larger companies’ depleted reserves. Getchell Gold and its Fondaway Canyon project is there in the right place at the right time.

History

Getchell Gold was formed about four years ago with a mandate to source out a major flagship project. Acquiring Fondaway Canyon in 2020, Getchell spent about six months delving into the history of the operation. There was 40 years of small-scale mining on surface, and multiple drill campaigns focused mainly on the shallow oxide deposits scattered throughout the 3.5 km-long trend. While previous operators found a lot of gold, they also missed quite a bit, which captured the imagination of Getchell’s management team.

“A lot of the old companies that worked on it were just wanting to take the eyes out of it at the surface and do a hodgepodge of drilling, and so it was very surficially looked at, but what really intrigued me is that there were all kinds of little hidden jewels that indicated that the mineralizing system at Fondaway Canyon was a lot bigger than what people realized,” Getchell Gold’s President Mike Sieb said in an April 9 video presentation.

First five holes

Getchell identified two priority areas to start with, shown as ellipses on the map below. As they started to drill, Getchell kept hitting gold, and continued to hit mineralization in step-out holes. In its first year of exploration, 2020, Getchell outlined three new gold zones: Colorado SW, North Fork and Juniper.

The early wide-spaced drilling demonstrated the presence of high-grade shear veins enveloped in thick bands of mineralization and extended the mineralization model a remarkable 800 meters down dip from surface.

Five drill holes hit substantive zones of mineralization, between 50 and 100 meters thick. The company kept drilling in 2021 and 2022, upping the scale and capitalizing on its discoveries.

New discovery

At the end of 2021, Getchell made a new discovery, a very high-grade zone that was running 10 grams per tonne over 25 meters near surface. Substantive mineralization in four holes was highlighted by hole FCG21-08, the most northwestern hole, intersecting the Colorado SW zone extending for over 200 meters down hole, and hole FCG21-10, intersecting the North Fork zone extending 82 meters down hole. The latter interval, hosting the highest-grade gold intercept in the 40+ year drilling history at Fondaway Canyon, and reporting 47 g/t Au over 1.5m, is a prime example of the structures that promote the high-grade concentration of gold at the project.

Doubling the resource

Partway through the 2022 drill program, an open-pit model mineral resource estimate was commissioned and published. Eighteen drill holes doubled the previous resource, with 550,000 ounces of gold in the indicated category and an additional 1.5 million ounces inferred, all at comparatively excellent gold grades for active Nevada operations (1.56 g/t Au indicated, 1.23 g/t inferred).

Note, however, that this RE is already out of date. There are nine holes that haven’t been included in the resource estimate because they missed the cut-off date, and Getchell plans to do a lot more drilling on its wide-open deposit in 2023.

Note also that Getchell hit mineralization in all 18 holes (no misses!), which is practically unheard of in mineral exploration.

Expansion potential

The gold mineralization has been traced for a half a kilometer on surface and half a kilometre down dip. It remains open as the drilling has yet to encounter any limits, with the potential size and ultimate scale of the mineralization unknown.

“We’ve doubled the reported mineralization in a short 2.5 years and I don’t know how big this is going to get to,” Sieb told Proactive Investors earlier this month, explaining that the large footprint on surface is shallowly dipping, making for a perfect open-pit model.

The two main zones Getchell has been concentrating on, seen on the map above, are Colorado SW and North Fork. What is incredible is how much GTCH has accomplished with so little work, and how much lies ahead for the company.

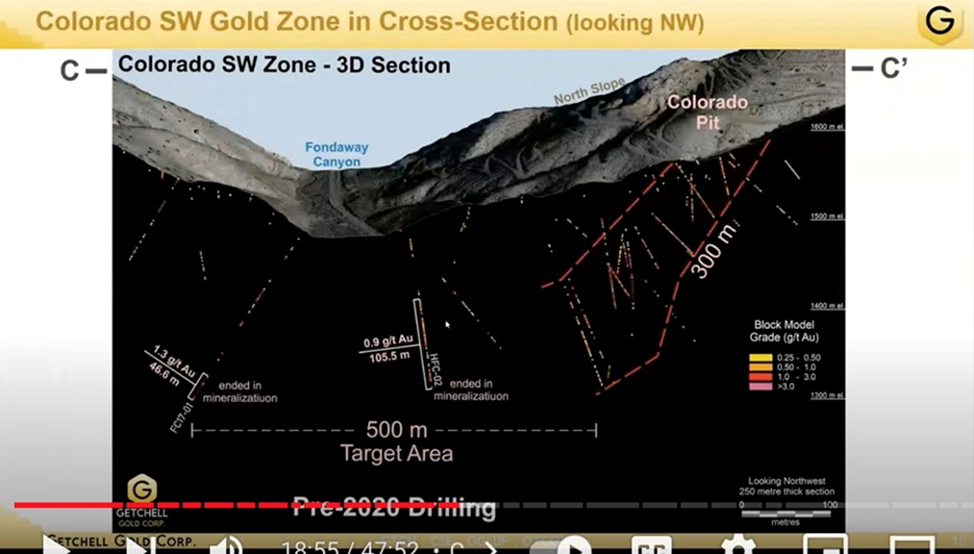

Below is what the Colorado SW section looked like when Getchell acquired the project in 2020. The majority of drilling is seen under the words “Colorado Pit”. It runs for a 300-meter extent.

Highlighted in the next slide are two drill holes. HFC-02, drilled in 1985, intersected about one gram over 100 meters, which is a fairly significant intercept. Another 300 meters along on this section there was a hole drilled in 2017 that went past its target zone and ended in mineralization 1.3 grams over 46.6m. “When we looked at the section we targeted this 500-meter stretch that was sort of ripe for discovery and it definitely didn’t fail us,” says Sieb.

The next slide shows what Getchell’s drill pattern at Colorado SW looks like today.

Sieb continues: “This is a marked difference from what it looked like it in 2020. We’ve increased not only the length of the mineralization from surface but also the thickness as well, right now we’ve modeled an extent about 550 to 600 meters down dip, the mineralization is still continuing on strong. Our last drill hole hit close to 90 meters of solid mineralization and as you can see here we’ve only walked halfway through our original 500m target zone, that one 2017 drill hole that ended in mineralization is still another 250 meters away so if there is one section that really speaks to the potential or the completely untested, untapped potential at Fondaway Canyon it’s this slide right here.”

Putting it more simply, the upside potential of Fondaway Canyon is evident from the fact that Getchell just continues to find more gold.

“We’ve delineated an area that’s at least 600 meters wide and 600 meters down dip that is robust with mineralization. Our resource model is robust,” Sieb said during an interview at PDAC in March.

“Our most northwesterly drillhole there’s no drilling beyond it on strike, it intersected 200 meters of mineralization and our deepest drill hole to date intersected 87.5m of mineralization as strong as you see at 600 meters away on surface. So this is a very spectacular deposit and I don’t even see the end of the of the mineralization.”

The possibility of finding more gold on the property now seems obvious, but if Getchell chooses to, it can also start exploring public lands beyond the existing boundaries.

A boon to Getchell’s operation is a piece of legislation signed at the end of 2022 by President Biden. It releases a 45-year land freeze on the neighboring area, opening up Getchell’s ability to grow, unfettered.

Gold space heating up

The gold price has seen a recent dramatic increase and is trading at near-record highs, over $2,000 an ounce.

One of the biggest forces behind gold’s rising demand is central banks, which hold gold bullion as part of their monetary reserves. For the last decade, CBs have stacked up on gold to meet their financial obligations. Bloomberg reported that central banks have been buying the most gold since the United States abandoned the gold standard in 1971, with total purchases setting a new 50-year record in 2022.

Recent World Gold Council data shows central banks added another 125 tonnes during the first two months, the strongest start to a year since becoming net buyers in 2010.

On top of massive gold-buying by central banks, we also have the gradual diminishment of the US dollar and many countries’ need for it. “De-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

Retail investors, meanwhile, have been snapping up physical metal out of concern that inflation may be more persistent than professional money managers believe, according to WGC. With respect to gold-backed ETFs, after 10 straight months of capital outflows, investors are beginning to shift back to these products following the recent banking crisis. New WGC data shows global gold-backed ETFs saw inflows of $1.9 billion (32 tonnes) last month on heightened safe haven demand.

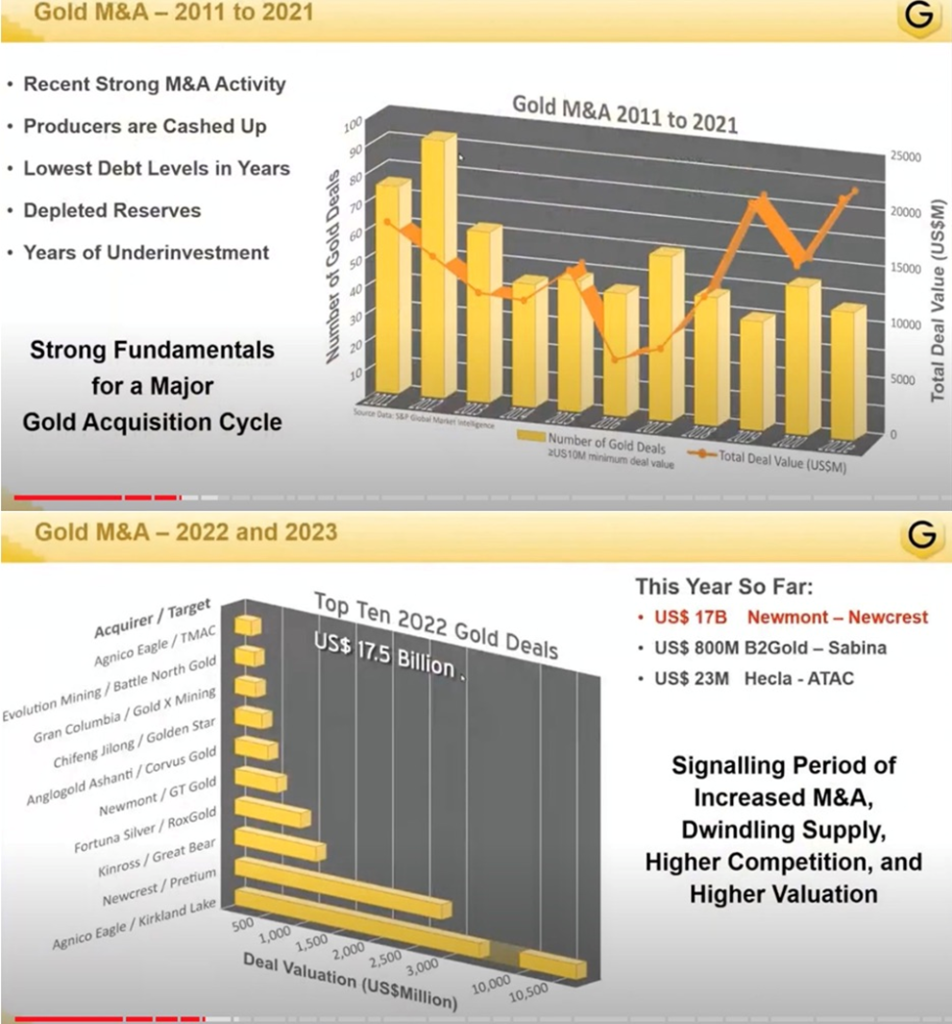

“The gold space is heating up, gold producers are cashed up, are reporting their lowest debt levels in years, and have depleting reserves from years of underinvestment that need to be replaced. Altogether this leads into a major and protracted gold acquisition cycle that will reward gold companies controlling leading assets, of which Getchell Gold Corp. is one such company and the Fondaway Canyon gold project is one such asset,” Sieb said in another recent video presentation.

The slide below shows that starting in 2019, there has been a major uptick in gold M&A, with a large number of transactions as well as the total dollar value of the deals. In 2022, the top 10 gold deals equated to $17.5 billion, topping a record set in 2021. So far in 2023, the industry has seen close to $18B in acquisition offers, the most prominent being Newmont’s offer to buy Newcrest.

What’s next

The hot gold market is perfect timing for Getchell Gold, as the company works to expand its resource estimate through drilling. Preparations for a much larger drill program than previously are underway; a steady stream of results are expected throughout 2023 and into next year.

Getchell plans to keep on expanding the mineralization, drawing it along strike and down dip, thus enlarging the conceptual open pit.

“We’ve been increasing the drill meterage into the ground from 2020 through 2022 and this year we’re targeting two drills turning all year long to continue to expand and increase the resources at Fondaway Canyon and also perform just enough infill drilling to take all that inferred and put it into the indicated category,” Sieb says.

The CEO added the market can expect an updated resource estimate and the completion of Getchell’s next major milestone, a preliminary economic assessment (PEA), in the first half of 2024.

“We’re moving up the tiers of de-risking and adding confidence to the project as we go,” he said.

Over the past three years Getchell Gold has increased the mineralization substantially, decreased risk significantly, and demonstrated that there is a lot of upside left to grow the resource at its Fondaway Canyon project.

In a rising gold price environment, ripe with M&A, AOTH sees Getchell Gold as an excellent value play. Shares are trading near a two-year low and provide a very attractive entry point.

“Anybody who’s been following the market knows we are at a highly attractive entry point, we’ve increased the project valuation, the technical aspect of it, the gold in the ground over the last three years, we’re triple the company we were three years ago and so if you look at our share price relative to what we have and what’s going forward, I can’t sell this point enough that you should you should own Getchell,” says Sieb.

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.30, 2023.04.13

Shares Outstanding 105m

Market cap Cdn$32.4m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Richard owns shares of Getchell Gold Corp. (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.