Fed’s “Mild Recession” Prediction Will Be As Accurate As Their “Transitory Inflation” One

By Kenny – Quoth the Raven

This is the latest, up to the hour thoughts on the market by my kind friend Kenny Polcari, a 40 veteran of capital markets.

For those who aren’t familiar with Kenny or don’t recognize him from TV, he is Managing Partner of Kace Capital Advisors and Chief Market Strategist at SlateStone Wealth. He started his career on the floor of the New York Stock Exchange (NYSE) as an institutional broker back in the early eighties when the march of electronic trading was already taking its first steps, and the great bull was first learning to run.

Here’s his take on markets heading into the Thursday, April 13, 2023, trading day:

The post has been lightly edited for punctuation and grammar.

CPI came in inline and maybe a hair lighter (softer) or not – but well within expectations – so there was nothing new to see yesterday.

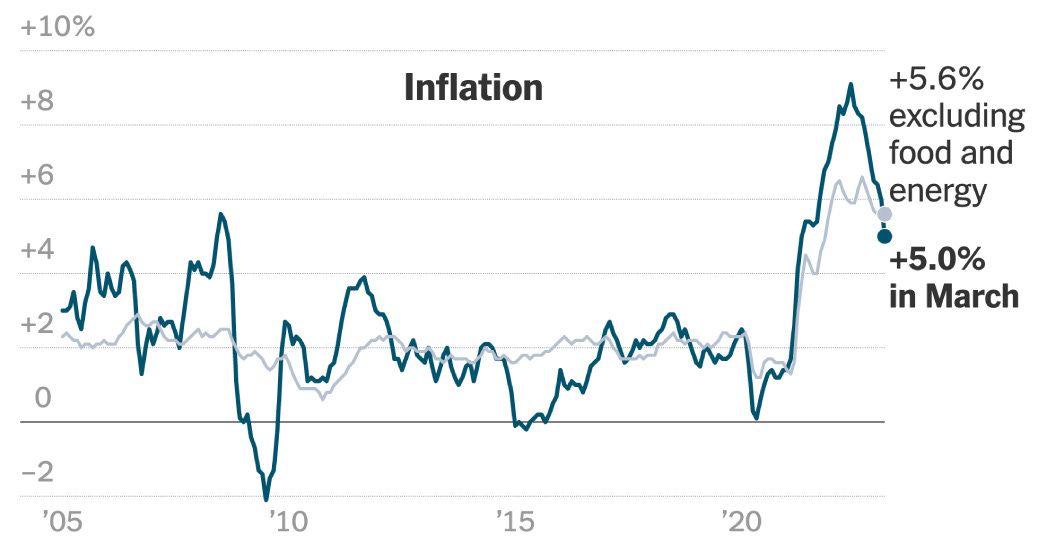

Some saw declining inflation (which is true) while others saw ongoing stubbornly sticky inflation (which is also true). See that? You can ride on both sides of the fence and be right either way. M/M top line was softer at +0.1%, yet ex-food and energy m/m was +0.4%. Y/Y top line came in at 5% yet ex-food and energy, y/y was +5.6%.

You could say there was something in the report for everyone: both the bulls and the bears.

Stocks welcomed the news when it came out at 8:30, sending futures up triple digits. When the bell rang at 9:30, stocks surged with the Dow jumping 206 points and the S&P jumping 26 points, as well as the NASDAQ up 102. The relief was that CPI didn’t surprise to the upside, which would have sent the current Fed narrative into the circular file. The fact that CPI was unimpressive only accentuated the fact that there was nothing new, so the current 25 bps hike remained the “current plan”.

But as morning turned to afternoon, we saw the excitement turn to concern, causing stocks to give back some early gains. This meant only that buyers stopped chasing sellers. They didn’t go away, but they started playing hard to get. By the close, all indices were lower with the Dow down 38 points and the NASDAQ down 102 points.

Remember what I have said: there is a rumor running around Wall Street that the hedgies are building a big short position, expecting a significant decline in the days/weeks ahead. This means they wanted the CPI figure to be hot, and for inflation to rear its ugly head, because it would have forced buyers to step back adn the Fed to talk about raising rates by 50 bps instead of 25 bps.

That would have caused stocks to plunge and the retreat would have left a vacuum in prices – which would allow stocks to fall – something that the shorts want to happen. But I also said that if that did not happen and markets did not collapse and Fed commentary did not change, shorts would have to “run to cover” – which means they become buyers.

Nothing says they all caved, but you can be sure that some did (thus the initial surge). Others are playing tough, waiting for Fed minutes and today’s PPI data and the start of earnings season (tomorrow) before changing their minds.

PPI is also expected to show a decline in price pressures. The key theme here is ‘expected’, so if it is what it is expected – then – we could see another ‘relief rally’. Again it would be relief that it wasn’t hotter than the expectation.

At 2 pm yesterday we got the FOMC mins from the March meeting and what did we learn that was new? Absolutely nothing.

The headline made it sound as if the scaling back of the hike expectations was a surprise – it was not. The 50-bps hike went out the window when SVB collapsed – we knew that. They settled on 25 bps even as the banking crisis remained an issue – we knew that too. Some members had cautioned and thought about pausing, but then didn’t – and we knew that too. I think the only thing that you could argue was new – is the fact that the FED now sees a ‘mild recession’ and since these are the same guys that saw ‘transitory inflation’ the algos decided that where there is smoke there is fire. That is when stocks did a 180 and sold off.

Now, in the end – the minutes revealed that they will hike again, take the terminal rate to 5% – 5.25% and then try to stop the drama. They just need to get the markets and investors used to the idea that we will not see 3 rate cuts this fall, because unless we get hit with a black swan event (which is completely possible), I just don’t see how the Fed can justify ‘stimulating’ the economy, when inflation is still running well ahead of the target. Can you? Exactly!

Oil spiked higher on Wednesday, gaining 2.1% or $1.70 taking oil up to $83.25/barrel and is up another 25 cts at $83.50. Now, why you ask? Well, the talking heads (in the oil industry) would like you to believe that yesterday’s CPI report now supports LOWER interest rates in the fall, easing any worry that higher rates would send us into a deeper recession which would destroy demand!

Come on! How many times have we discussed this? Demand for energy is not going away anytime soon. The truth is that the dollar index fell after the CPI report – again on the idea that the FED will lower rates in the fall, and a weaker dollar will help support commodity prices and the last time I checked. Oil is a commodity, so the weaker dollar yesterday helped to send oil up. And like I also said yesterday – oil is above all 3 trendlines with the 200 DMA now acting as support, and that support is at $79.90, while resistance is the November 2022 high of $87.50. And if they continue to make you believe that rate cuts are coming, then that will cause the dollar to decline further and that will send oil higher….capisce?

The dollar index is now trading back at the lows of the year, at 101.344 – down 4% off the March high when rumors were running rampant of 50 bps hikes and the country was in the middle of the SVB crisis. During that same time frame we saw oil trade higher by 30%. A good 13% was because of the OPEC/Saudi production cut news, but the balance can be attributed to the drop in the dollar index and improving demand.

And speaking of commodities, gold shot higher as well (think weaker dollar), rising initially by $22 dollars taking it to a high of $2,043 before backing off to end the day at $2,023. This morning gold is up again, rising $17 to $2,040. Gold has rallied nicely, rising 11.5% off the March low during the same time frame that saw the dollar decline….are you seeing the pattern?

What is interesting is that some money moved into longer duration bonds, sending prices up while sending yields lower. The 2 yr. ended the day down 4 bps at 3.98%, the 10 yr. lost 1 bps to 3.40% while the shorter duration 3 month bill ended the day yielding MORE than when it started at 5.05%, and the 6 month down 1 bps at 4.98%. What does that really mean? People are confused…period.

Tomorrow starts the beauty pageant: JPM, WFC, BLK, C, PGR and UNH all on the docket for earnings. Remember both JPM and UNH are DOW members – so their results will have an outsized impact on how the Dow reacts. Remembering that the Dow is only 30 stocks while the S&P is 500 stocks, the Nasdaq is 100 stocks, the Russell is 2000 names (unless of course you’re looking at the Russell 1000 or Russell 3000).

Understand that bank earnings are expected to up on an annualized basis – Refinitiv tell us that JPM estimates have annual earnings up 30%, C +16%, WFC +28%, GS +20%, MS +13%. Things to pay attention to? Investment banking revenues and what I think is more important are LOAN LOSS RESERVES (LLR). The big boys are expected to set aside $100 million more each, on top of their already increased provisions last quarter.

To put it in perspective, JPM (one of my favorites) posted a $2.3 billion loan loss reserve last qtr: a 49% increase. So, what does this tell you about what Jamie expects? What will he allocate to LLR this quarter? And then how will investors react? JPM has been trading in a tight range, $125/$128, and $125 is a key level, the 200 DMA. A failure to hold on an earnings miss could send JPM down $10, or about 8% over a couple of sessions. Good news could see traders take it up to $135, or about a 5% advance.

This morning US futures are up (slightly). Dow futures up 40 pts, S&P’s up 15, Nasdaq up 65 and the Russell up 8. Everyone had a chance to digest and dissect the economic data and the FED minutes. They are betting on a weak PPI report and the Fed’s ‘mild recession’ commentary? Remember, I am NOT in that camp at all. Who is kidding who? Mild? Soft? Transitory? Not happening – which only means you set yourself up defensively. Focus on the core, stick to the biggies, collect your divvy’s and put some money into short duration bills. Make your shopping list – don’t get dragged into the fray, don’t’ make emotional decisions and stick to the plan. “Talk to me – Goose!”

The S&P closed at 4091 – down 17 pts…. after trading in the 4086/4134 range…. leaving it closer to the low vs. the high…. but 4134 did break the prior near term intraday high on April 4th, before failing to hold it. It feels like a struggle…. but it also feels like the market is at a crossroads…. not sure what to do….but maybe today’s PPI will give us a reason to either go all in or remain patient – If the number is as weak or weaker than expected – then expect stocks to trade higher and the higher they go, the more the shorts get squeezed which will cause some of them to throw in the towel and ‘buy to cover’….which will do what? Yes sir, will get the algos all excited and it’s off to the races….and if you are invested – sit back…you’re participating….Now you know that JJ does NOT want to see stocks trade up (makes people feel wealthier) so I’m betting that they are going to repeat the mild recession story….to try and take some wind out of the sail….…..If the market backs off, I suspect it will find plenty of support at the trendline at 4030 and if it advances it will find plenty of resistance at 4200. So, for now – we remain in the 4030/4200 trading range.

Take good care,

Kenny

You can Tweet Kenny at him @kennypolcari on Twitter, visit Kace Capital Advisors, connect on LinkedIn, or check out his blog at kennypolcari.com.

Kenny’s Disclaimer:

The information contained in this post and on Kenny’s websites are provided for informational purposes only, and should not be construed as financial advice, nor are they intended as a source of advertising or solicitation. The transmission and receipt of information contained on this Web site, in whole or in part, or communication with Kace Capital Advisors via the Internet or email through this website does not constitute or create a fiduciary relationship between us and any recipient. You should not send us any confidential information in response to this webpage. Such responses will not create a fiduciary relationship, and whatever you disclose to us will not be privileged or confidential unless we have agreed to act as your financial consultant and you have executed a written engagement agreement with Kace Capital Advisors. The material on this website may not reflect the most current developments. The content and interpretation of the topics addressed herein is subject to revision. We disclaim all liability in respect to actions taken or not taken based on any or all the contents of this site to the fullest extent permitted by law. The information in this website should not be viewed as an offer to perform services in any jurisdiction other than those in which Kace Capital Advisors is licensed to practice. No past results serve in any way as a guarantee of future results.

QTR’s Disclaimer:

I have no business relationship with Kenny or Kace. I post his opinions with his permission because I believe his experience makes him a voice worth hearing from. As usual, I am not a financial advisor and this is not advice. I get shit wrong a lot. I may have positions in names mentioned in this article and may buy, sell or transact in them at any time.

I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.