Hold gold, buy silver – Richard Mills

- Home

- Articles

- Metals Precious Metals

- Hold gold, buy silver – Richard Mills

2023.03.17

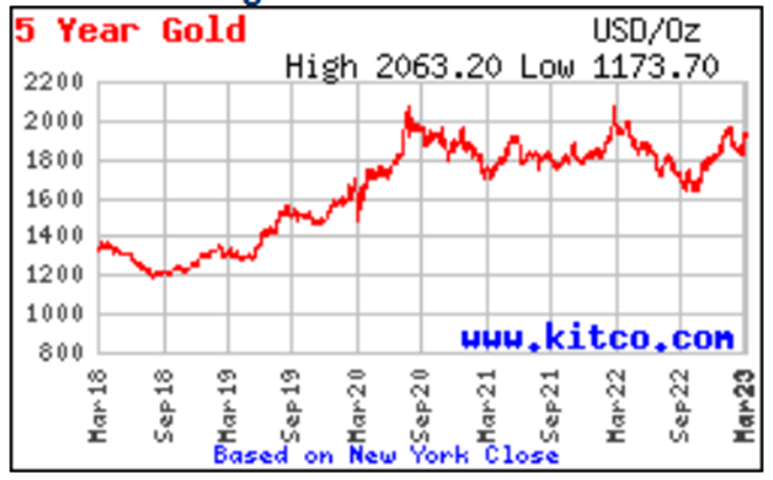

Gold is back in favor this week as a banking crisis that started with the failure of Silicon Valley Bank (SVB), had investors flocking to safe-haven assets including the US dollar, Treasuries and bullion.

Spot gold Wednesday hit an intra-day high of $1,933/oz, as European bank stocks fell. Credit Suisse shares came under intense selling pressure, after its largest investor said it could not provide the Swiss bank with more financial assistance. However, they surged on Thursday after the country’s central bank agreed to lend it up to $54 billion, following the collapse of three US banks — SVB, Silvergate and Signature Bank.

But the real driver of gold prices currently is the Federal Reserve’s decision-making over how much it will continue to raise interest rates, pause them or even lower them as the central bank pores over economic data and weighs the banking crisis ahead of its regular policy meeting next week.

Members of the Federal Open Market Committee will decide on March 22 whether to hike the federal funds rate by 25 or 50 basis points, or leave it at between 4.5 and 4.75%.

Officials have raised rates at each of their last eight policy meetings spanning 12 months, as they try to lower inflation to their 2% target. However, the bank collapses and resulting market turbulence have added a complicating factor for the Fed as it debates its next move on inflation. (Wall Street Journal, March 15, 2023)

Here we look at what it all means for precious metals going forward.

Banks bailed out

Silicon Valley Bank and Signature Bank are among the largest banks in the United States, valued at $209 billion and $110.4 billion, respectively. (JP Morgan Chase, Bank of America and Citibank are the three largest, valued at between $1.7 and $3.2 trillion).

When Silicon Valley Bank collapsed last Friday, it became the second-largest bank failure in US history, behind number one Washington Mutual Bank in September, 2008.

How did it go down?

As the bank grew to be the 16th largest in America, SVB invested their funds in long-term bonds when rates were near zero.

This may have seemed like a good idea at the time, but when interest rates rose, those long-term bond prices fell, cratering their investments.

On Wednesday, SVB announced that it suffered a $1.8 billion after-tax loss and urgently needed to raise more capital to address depositor concerns.

The market reacted sharply and SVB lost over 160 billion dollars in value in 24 hours.

What happened next is familiar to most Americans, especially those who protested against the bank bailouts during the financial crisis.

So the Federal Deposit Insurance Corporation took over SVB on Friday to get depositors access to their money by Monday, and because the bank’s troubles posed a major risk to the financial system…

Before the FDIC stepped in, depositors could only access up to $250,000…

The Federal Reserve, the Treasury Department and the FDIC said regulators took the unusual step of guaranteeing the deposits because SVB presented a major risk for the U.S. economy.

Signature Bank in New York was also closed on Sunday after its customers began withdrawing cash too quickly. State regulators said they took over the bank to stabilize financial systems. Federal regulators said depositors from both banks will get their money.

Wall Street then ordered several regional banks to cease trading Monday, as their shares plummeted. Shares of First Republic Bank, for example, were stopped after falling 65%.

The Economist notes that rising interest rates have left banks exposed.

The crux of the issue is what happens when a bank is forced to sell bonds, and previously unrecognized losses become real.

As mentioned, at SVB, when interest rates were low and asset prices high, the California bank loaded up on long-term bonds. When the Fed raised interest rates at the fastest pace in four decades, bond prices plunged and the bank was left with huge losses.

Unrecognized losses across America’s banking system totaled $620 billion at the end of 2022. Post-financial crisis regulations sought to limit credit risk by ensuring that banks hold assets that can easily be sold. None fits the bill better than US government bonds.

But as The Economist explains:

Many years of low inflation and interest rates meant that few considered how the banks would suffer if the world changed and longer-term bonds fell in value. This vulnerability only worsened during the pandemic, as deposits flooded into banks and the Fed’s stimulus pumped cash into the system. Many banks used the deposits to buy long-term bonds and government-guaranteed mortgage-backed securities.

[Note this is exactly what happened in 2008. After introducing quantitative easing, the Fed expected the smaller banks to lend more to individuals and businesses to kickstart the economy. Instead, they bought bonds and MBS’s, inflating their profits and handing out obscene CEO bonuses — Rick]

You might think that unrealized losses don’t matter. One problem is that the bank has bought the bond with someone else’s money, usually a deposit. Holding a bond to maturity requires matching it with deposits and as rates rise, competition for deposits increases. At the largest banks, like JPMorgan Chase or Bank of America, customers are sticky so rising rates tend to boost their earnings, thanks to floating-rate loans. By contrast, the roughly 4,700 small and mid-sized banks with total assets of $10.5trn have to pay depositors more to stop them taking out their money. That squeezes their margins — which helps explain why some banks’ stock prices have plunged.

Gold ETF selling

Despite gold rising to within $100 of an all-time high of $2,034 set in the fall of 2020, some investors are dumping the yellow metal.

A stronger dollar and rising bond yields (remember, gold pays neither a dividend not a yield, making the opportunity cost of holding gold higher during periods of high interest rates) led to a 5% decline in the gold price in February.

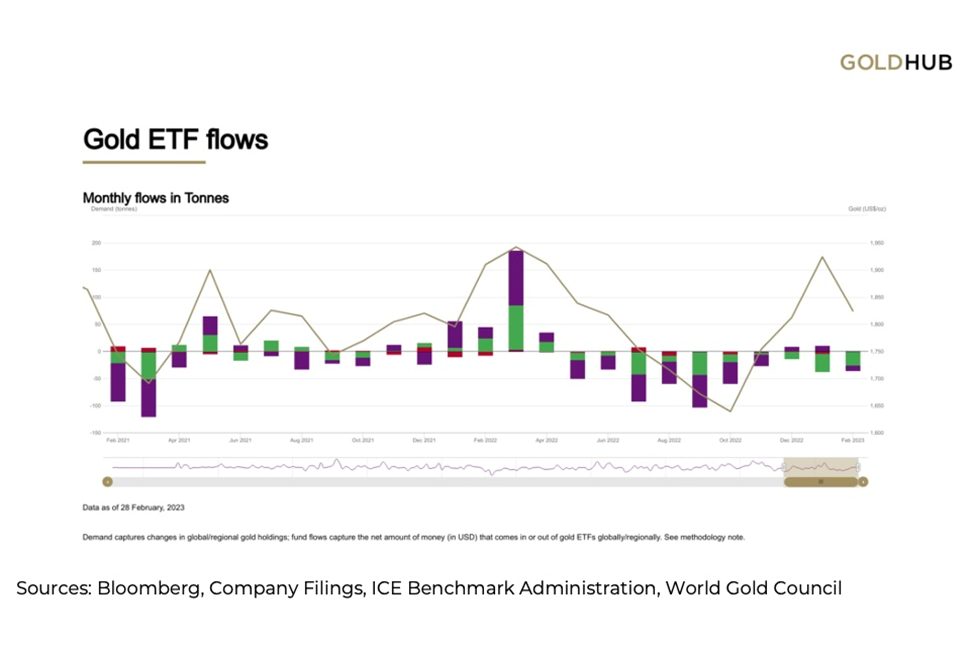

Last month, many investors of gold-backed ETFs decided to liquidate. According to the World Gold Council, gold ETFs lost $1.7 billion in February, marking a 10-month losing streak, the longest since January 2014.

Gold ETF assets under management (AUM) declined by 1% to $200 billion, WGC data showed. In tonnage terms, February’s decline saw global ETF holdings fall by 34 tonnes to 3,412t.

European funds drove outflows as the region’s central banks continued to deliver outsized rate hikes, while North American gold ETFs lost just over half a billion dollars, the first monthly outflow in 2023 after two consecutive months of inflows, the WGS said.

However as we observed in a previous article, the gold price continues to stay lofty, despite a high US dollar and elevated government bond yields (the latter saw some volatility this week and last). The dollar and gold normally move in opposite directions.

The link between commodities and inflation

Central bank buying

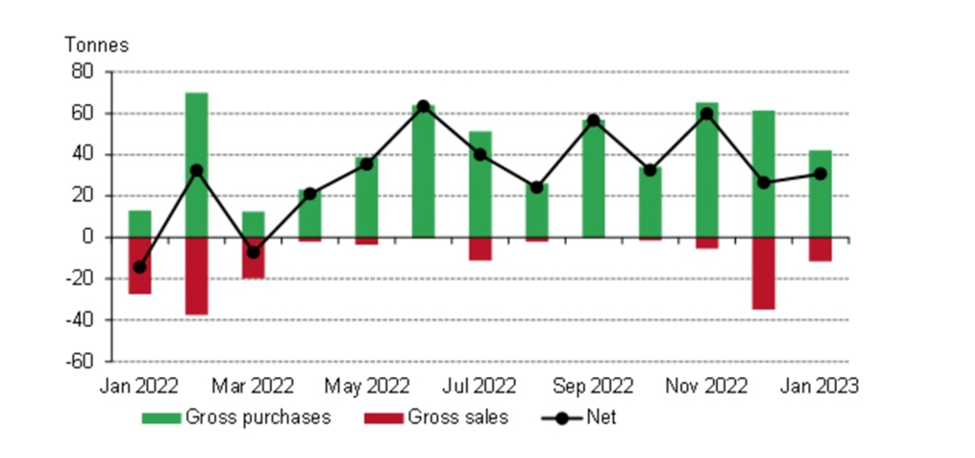

Central bank buying is one reason why gold has held its own over the past few months.

Central bank gold demand has reportedly seen a continuation from 2022’s record year of purchases, with CBs adding 31 tonnes to global gold reserves in January, the World Council said earlier this month.

The largest buyer was the Central Bank of Turkey, followed by the People’s Bank of China and Kazakhstan’s national bank.

January’s central bank gold haul was 16% higher than December. The WGC sees the trend continuing throughout this year.

“We see little reason to doubt that central banks will remain positive towards gold and continue to be net purchasers in 2023,” the report said. “The healthy January data we have so far gives us little reason, at this time at least, to deviate from this outlook.”

Last year, central banks purchased 1,136 tonnes — the most on record and a more than 150% increase from 2021. (Kitco News, March 2, 2023)

When will the Fed pivot?

The Fed’s high-interest rate policy has broken the banks, and there are signs of a cooling US economy — February’s economic data showed a decline in retail sales and easing price pressures. Is everything broken enough for the Fed to stop raising rates, the so-called Fed pivot?

I’m sticking to my earlier (correct) prediction, that we would see rate increases fall from 75 basis points to 50bp, and then rates would be held at +0.25% increases for awhile, before a pause and a return to lowering by the end of this year.

The banking crisis doesn’t change my way of thinking. According to Reuters, the markets have put a 57% chance on the Fed holding its benchmark rate at current levels at its March 22 meeting. I personally don’t think a pause is merited this soon; with inflation still way above the Fed’s targeted 2%, I see another 0.25% raise in March and potentially a few more. There are six FOMC meetings left in 2023 after March’s gathering.

Clearly I’m not alone in this prediction. “A pause now would send the wrong signal about the seriousness of the Fed’s inflation resolve,” the Wall Street Journal quoted Michael Feroli, chief US economist at JPMorgan Chase, the country’s largest bank.

And how about this for backing my forecast of a rate cut by year-end? According to WSJ, The uncertainty over the Fed’s rate path led trading in futures markets to imply expectations that the central bank could start lowering rates by July. On Wednesday, markets saw a nearly 70% chance that by year’s end, the Fed would cut rates to below 4%.

Ratio favors silver

As for what this means for gold and silver, let’s take a look at what we know. The banking crisis along with other normal gold price drivers, like central bank buying, and tight supply due to a lack of new discoveries, pushed gold to within a hundred dollars of its all-time high this week.

At around $21, silver has yet to break out.

Gold ETFs have been massively selling off, understandably due to the more attractive returns from high bond yields, yet central banks continue to hoard gold, especially in the East, like China and Turkey.

If gold is good enough for central banks, even @ $1,900, why are retail investors selling it?

Well, the economy is inflating at the same time as central bank banks are raising interest rates. Gold’s price appreciation is therefore limited by higher rates and bond yields. Why invest in gold, with offers neither interest nor a dividend, when you can get a decent return on a government bond, or just by stuffing a bunch of cash into a savings account that nowadays pays around 3%?

Personally I wouldn’t be buying physical gold right now because it’s expensive, especially in Canadian dollars, but I certainly wouldn’t be selling it either. I am buying shares in gold and silver focused Junior’s, there are bargains galore out there. Consider that gold jumped to within spitting distance of $2,000 with the failure of three banks. What’s going to happen to gold if we get a recession? Or if one of four hot spots in 2023 — the war in Ukraine, Iran protests, US-China trade relations, and North Korea — flares up? Historically precious metal focused juniors offer the best leverage to rising gold and silver prices.

By the end of the year, as I’ve said, I see interest rates coming down and the dollar weakening, mostly because of a softer job market and a slowdown in consumer spending. So for me smart move is to hang onto my gold, and gold shares, at least until the end of the year. A lot has still to be decided and it is only March.

The information sector shed 25,000 jobs in February, factories laid off 4,000 workers and the transportation and warehousing industry cut 22,000 positions. The monthly unemployment rate increased from 3.4% to 3.6%. It’s probably still too low to change the Fed’s mind on rate hikes, but give it time.

Commodities inflation gets passed through to manufactured goods, resulting in higher prices for goods and services, that must be borne by consumers. How long can this historical anomaly of high inflation and high borrowing costs be tolerated by consumers, many of whom are already highly leveraged with mortgages, loans, lines of credit and credit card debt?

US consumers are getting crushed by high-interest debt and inflation

Consumer spending, which makes up two-thirds of global GDP, is going to slow, drastically.

When economies around the world go soft, and the Fed decides they’ve done enough to “kill the consumer” and the job market with high interest rates, the US dollar will plunge and precious metals, gold and silver, will, imo, soar.

In the meantime I also buying silver.

We use the gold-silver ratio to find out how silver prices compare to gold. The ratio is the amount of silver one can buy with an ounce of gold. Simply divide the current gold price by the price of silver.

Current indications show that silver is way undervalued. Right now, Friday morning on the 17th of March the gold-silver ratio is 88:1, meaning it takes 88 oz of silver to buy one ounce of gold.

See the chart below and linked commentary showing that Historically, when the spread gets [above 80], silver doesn’t just outperform gold, it goes on a massive run in a short period of time. Since January 2000, this has happened four times. As this chart shows, the snapback is swift and strong.

Conclusion

It’s really quite simple.

When precious metals rallied in 2020, on the back of lockdowns, interest rates slashed to zero, QE, and general market fear, silver’s gain was double that of gold. The price ran up 43% from January to December, 2020, compared to gold’s mere 20.8% rise. Earlier in the year, as gold punched above $2,000 an ounce, a 39% gain, silver rallied to nearly $30 an ounce, a 147% increase.

Meanwhile, the silver-gold ratio fell from over 100:1 to just over 64:1.

It could easily happen again.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.