Renforth resumes drilling at its Surimeau Battery Metals Project – Richard Mills

2023.03.16

A drill crew is back on site at my favorite junior nickel company, Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR).

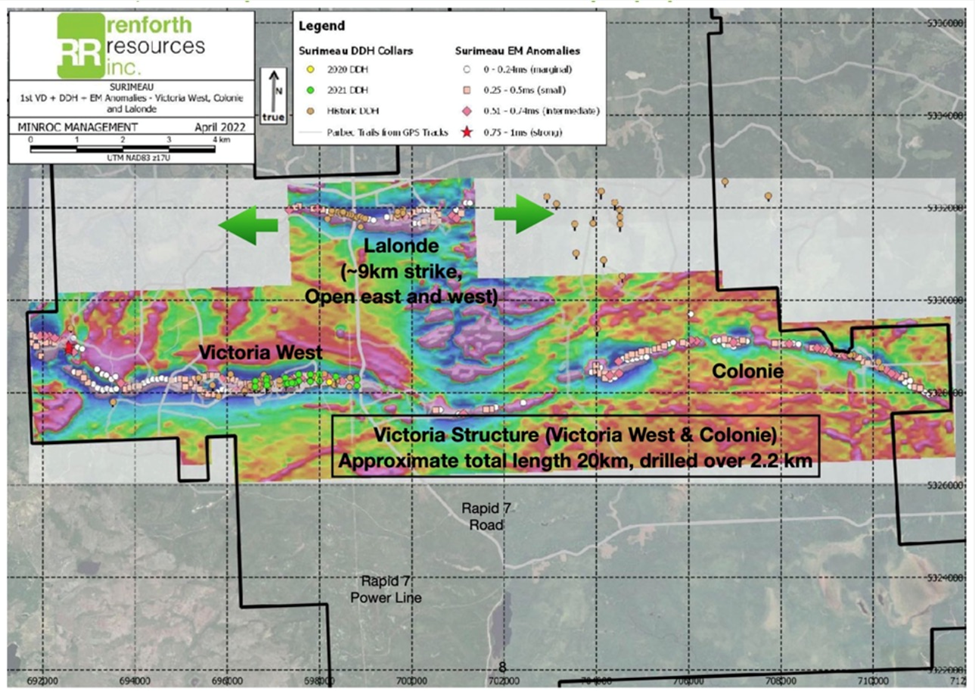

2023 drilling has begun on the approximately 20-kilometer-long, surface nickel sulfide polymetallic (nickel/cobalt/platinum group metals intermingled with zinc/copper/silver/gold) mineralized system named Victoria, on Renforth’s 330 km2 Surimeau property near Malartic, Quebec. Surimeau also hosts the similar Lalonde mineralized system, currently ~9 km long, located about 4 km north of Victoria, along with other mineralized occurrences.

We’ll get more into the drill program below, but first, an update on the fast-growing battery metals supply chain in Canada.

For decades, China has dominated critical minerals, with Canada and the US, among other nations, all too willing to let Beijing do the mining and/ or processing and sell the end-products, such as rare earth oxides, lithium carbonate and battery-grade graphite, back to us.

A recent Bloomberg article reported that China’s efforts to ramp up lithium extraction could see it accounting for nearly a third of lithium supply by the middle of the decade. (China is the world’s second-largest producer of the battery metal behind Australia — USGS 2021 figures)

Swiss bank UBS AG expects Chinese-controlled mines, including projects in Africa, to raise output to 705,000 tons by 2025, from 194,000 tons in 2022. That would lift China’s share of the mineral critical to electric-vehicle batteries to 32% of global supply, from 24% last year, according to a note on Friday…

China’s needs are particularly acute because it’s home to the world’s biggest market for new energy vehicles.

The United States imports hundreds of millions of lithium-ion batteries each year, most of them from China. According to the UN Comtrade Database, via Statista, China accounted for the vast majority of U.S. battery imports last year, with a total trade value of $9.3 billion. South Korea and Japan are also popular sources with batteries worth $1.3 and $1.0 billion imported to the U.S. in 2022. The total import value of lithium-ion batteries nearly tripled since 2020, reaching $13.9 billion last year.

China’s near-complete dominance of ‘green economy’ metals

Asia’s battery metals dominance, however, is beginning to shift.

Last year, the United States government invoked its Cold War powers by including lithium, nickel, cobalt, graphite and manganese on the list of items covered by the 1950 Defense Production Act, or DPA.

To bolster domestic production of these minerals, US miners can now gain access to $750 million under the DPA’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies.

The Biden administration has also allocated $6 billion as part of the $1 trillion infrastructure bill — towards developing a reliable battery supply chain and weaning the auto industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

With an abundance of battery metals and cheap hydroelectric power, particularly in Quebec and British Columbia, Canada is uniquely positioned to become an EV leader, from the mining and processing of metal ores, all the way up to the manufacture and assembly of electric and hybrid vehicles.

The federal government has said it is planning on spending CAD$400 million to build 50,000 electric vehicle charging stations, on top of half a billion Canadian dollars for charging infrastructure through the Canada Investment Bank and $1.7 billion to extend an incentive program for EV purchasers.

According to the president of the Canadian Vehicle Manufacturers Association, Canada will need 4 million charging stations by 2050, 80 times higher than the 50,000 currently targeted.

The large spending package is part of the government’s plan to require that 20% of new light-vehicle sales in Canada be zero-emissions by 2026. After 2026, the government’s mandate will require that at least 60% of sales are zero-emission by 2030 and 100% by 2035. The Liberals’ stated goal is to phase out gasoline-powered cars by 2040.

In December, 2022, the Canadian government and General Motors announced the opening of Canada’s first electric-vehicle manufacturing plant in Ingersoll, Ontario. The plant will make electrified delivery vans and is expected to manufacture 50,000 EVs by 2025.

The provincial and federal governments each invested CAD$259 million towards GM’s $2 billion plan for the Ingersoll plant and to overhaul its Oshawa, ON plant to make it EV-ready, Global news reported.

Quebec has also attracted EV investment. In March, 2021, Quebec-based Lion Electric announced it will build a battery pack manufacturing plant in its home province. The $185 million factory, funded by the Quebec and federal governments who each committed $50 million, will build lithium-ion battery packs capable of electrifying 14,000 medium and heavy-duty vehicles annually.

The latest EV investment into Canada is by Volkswagen. The German automaker has reportedly chosen Canada to build its first battery plant outside of Europe, with the site in St. Thomas, ON, to begin production in 2027.

According to Bloomberg, the decision is strategic:

VW is part of a wave of European companies looking to cash in on President Joe Biden’s climate law, which stipulates that 50% of the battery components of an EV must be made in North America to qualify for EV tax credits of as much as $7,500.

The carmaker [and Mercedes-Benz] in August signed an accord with Canada to cooperate on the supply chain for batteries with a focus on material such as lithium, nickel and cobalt.

Canada first policy

But it isn’t just car manufacturing that is getting Ottawa’s ear.

Facing criticism of “going too easy” on China, the Canadian government recently passed legislation making it harder for foreign state-owned firms to invest in Canadian critical-minerals companies.

Transactions involving investments by state-owned firms into these companies will now only be approved on an “exceptional basis”.

Canada’s protectionist stance triggered action in October, when Chinese firms were ordered by governments to divest from three small battery metals explorers, including Calgary-based Lithium Chile.

Canada has also joined the Minerals Security Partnership, aimed at securing the supply of critical minerals as global demand for them rises. Other members include the United States, Australia, Finland, France, Germany, Japan, South Korea, Sweden, the United Kingdom and the European Commission. Note who is not in the club: China and Russia.

Recently it was reported that Canada and Japan are collaborating on building strong supply chains for battery metals, with a public-private mission led by Japan’s Ministry of Economy, Trade and Industry, and including 16 companies that work with batteries, visiting Canada for talks last week.

Batteries are key for Japan as it strives for carbon neutrality by 2050. The country will host a ministerial meeting on climate, energy and environment in Sapporo on April 15-16, ahead of a G7 summit in Hiroshima on May 19-21, to promote what it calls a realistic energy transition. (Reuters, March 14, 2023)

Renforth Resources

Into this extremely positive environment for battery metals, with all kinds of announcements being made recently, may we present Renforth Resources (CSE:RFR, OTCQB:RFHRF, FSE:9RR).

Renforth is a tiny but increasingly visible junior exploration company, developing its Surimeau battery metals project in Quebec.

Surimeau hosts several areas prospective for gold/silver and battery/ industrial metals (nickel, copper, zinc, lead, cobalt, lithium and manganese). It is located south of the Cadillac Break, a major regional gold structure.

As mentioned at the top, Renforth has just resumed drilling at Surimeau, closely following the drill program in December, 2022.

According to the March 14 news release, the drill program will take place near the western property border, about 4 km west of the previous drilling on the Victoria structure, which has been drilled over a 2.2-km length within the 20-km-long mineralized system.

Why this location? An airborne electromagnetic (EM)/ magnetic (mag) survey interprets the western end of Victoria as showing an interesting curvature, possibly representing folding which may have resulted in mineralized fluid entrapment. Surface sampling has identified mineralization within ultramafic rocks, with bands of calc-silicates typical of the Victoria system. Except for Renforth’s prospecting, the area of the curvature has not been previously explored or drilled.

In a note to shareholders, Renforth’s President & CEO Nicole Brewster said the drilling under surface mineralization, known as undercutting, is “a huge 4km step out on strike from where we last drilled (that means we are moving the drill a huge distance, to the west actually). That is exciting, as, while we have been talking about a mineralized structure that is ~20km long, which we see in our mag survey, and which has measured EM anomalies along its entire length, and which we have surface sampled all along (we call that ground truthing), there are some people who will not take this seriously until it is drilled. So, we have “only” drilled off 2.2 km of the length, we are jumping 4km to the west and will drill again, right under surface mineralization, within the anomaly which gives us the strongest magnetic measurement coincident with the highest measured EM anomaly.”

Conclusion

Nascent battery supply chains in Canada and the United States will continue to grow. It was recently reported that global demand for lithium-ion batteries is expected to increase five-fold by 2030.

The electrification of the global transportation system doesn’t happen without lithium-ion batteries, that require sulfide nickel in the battery cathode, along with cobalt, manganese, aluminum, or lithium iron phosphate, depending on the battery chemistry.

Companies like Renforth are well-placed to benefit from the global electrification and decarbonization trend.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.035; 2023.03.15

Shares Outstanding 325m

Market cap Cdn$11.4m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.