US consumers are getting crushed by high-interest debt and inflation – Richard Mills

2023.03.08

Americans are leaning more on their credit cards and home-equity lines of credit (HELOC) just to make ends meet, a new study finds.

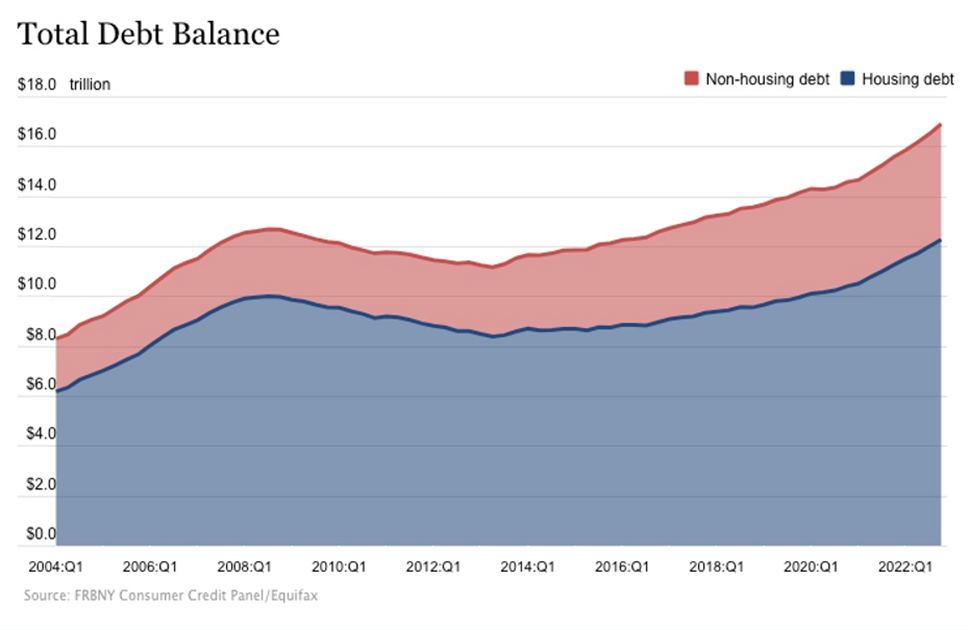

US household debt rose by $394 billion in the last quarter of 2022, making it the biggest quarterly rise in two decades, according to the latest New York Fed Household Debt and Credit report.

Total household debt jumped 8.5% and now stands at a record $16.9 trillion, $2.75T higher than it was before the pandemic.

A study quoted by Global News found Canadians are also becoming more reliant on credit cards, amid higher inflation and despite rising interest on credit cards. Equifax Canada’s survey found the average credit card held by Canadians as of Sept. 30, was a record-high $2,121.

Squeezed

Commodities inflation gets passed through to manufactured goods, resulting in higher prices for goods and services, that must be borne by consumers.

The link between commodities and inflation

How long can this historical anomaly of high inflation and high borrowing costs be tolerated by consumers, many of whom are already highly leveraged with mortgages, loans, lines of credit and credit card debt? Eventually economic growth and consumer spending, which makes up two-thirds of global GDP, will slow, potentially leading the economy into recession.

In an earlier article, we wrote in the first quarter of 2021, interest rates in a sample of 58 rich and emerging economies stood at an average of 2.6%. By the final quarter of 2022, this figure had reached 7.1% (!)

The worsening plight of the global consumer

Higher rates, of course, hike the payments on student and car loans, lines of credit, credit cards and mortgages. For the highly leveraged, this can mean hundreds of dollars more a month.

Mortgage balances grew by nearly $2 trillion in 2022, with balances increasing by $254 billion in Q4 alone. Americans now owe close to $12 trillion in mortgage debt.

The average amount credit card companies charge now sits at 19.91%, with many cards charging over 20%. That obviously translates into higher minimum payments; jacked-up interest charges are costing consumers more to pay off their cards, if they are even able to do that. Many go month to month paying only the minimum, as their debt burden quickly accumulates.

According to the report, credit card balances increased by $61 billion in Q4, nearly doubling the $38B debt load in Q3. By the end of 2022, Americans had run up a whopping $986 billion in credit card charges, more than the pre-pandemic high of $927B.

According to Bankrate, the share of credit card users who carry a balance has increased to 46% from 39% a year ago from January. The average credit card user last fall was carrying a balance of USD$5,474, up 13% from 2021.

For some jaw-dropping stats about the state of debt in America, read this Yahoo Live article. The one that jumped out at me? Nearly half of Americans depend on credit cards to cover essential living expenses. At 20% interest.

Car loans grew by $28B to $1.55 trillion, as did student loan balances, which in Q4 were $1.6T, $21B higher than Q3.

Those lucky enough to have a HELOC are using it. Balances on home equity lines of credit rose by $14B in the fourth quarter, the third consecutive quarterly increase and the largest in more than a decade.

Other forms of debt, including retail cards and consumer loans, were up $16 billion. Factoring in other credit accounts, total revolving credit by the end of 2022 hit nearly $1.2 trillion, the report said.

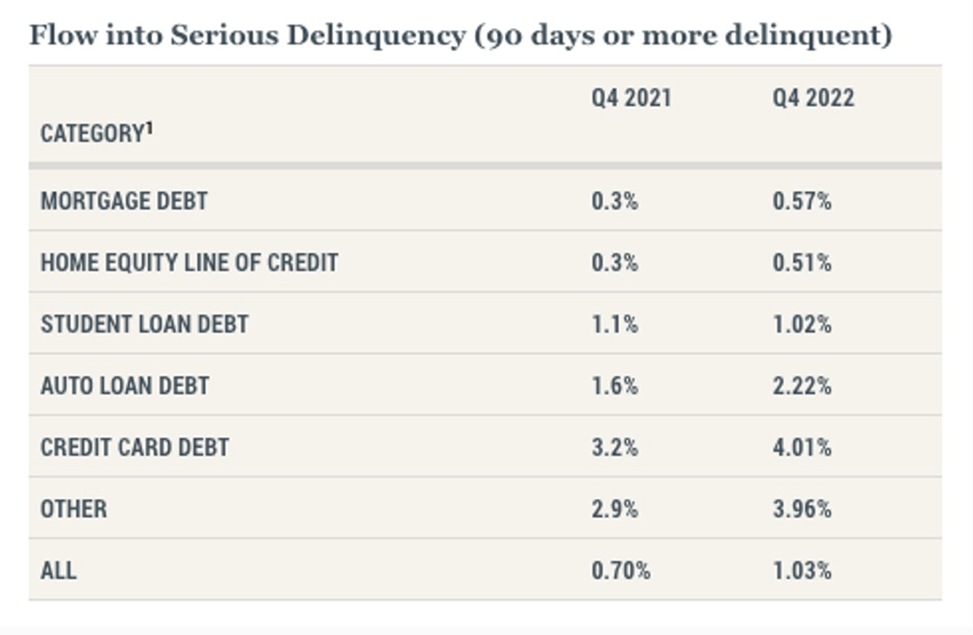

Perhaps the most frightening number to come out of the report is the rise in delinquent debt. This is debt that is no longer being serviced. According to the report, the share of debt becoming delinquent increased in the fourth quarter for nearly all debt types. This bucks a two-year trend of historically low delinquency transitions.

What are they spending the money on?

“Contrary to popular opinion, it’s not usually a vacation or shopping spree,” senior industry analyst Ted Rossman of Bankrate, told NPR. “It’s usually something pretty practical that gets you into credit card debt. But unfortunately, it’s easy to get in and hard to get out.”

Meanwhile inflation continues to erode most Americans’ already-skimpy paychecks, making them save whenever and wherever possible.

It could be food. Or rent. Dollar stores are reportedly becoming a more affordable destination for essentials including perishable and non-perishable goods.

Another article said consumers are cutting back on discretionary items like toys, clothing and housewares.

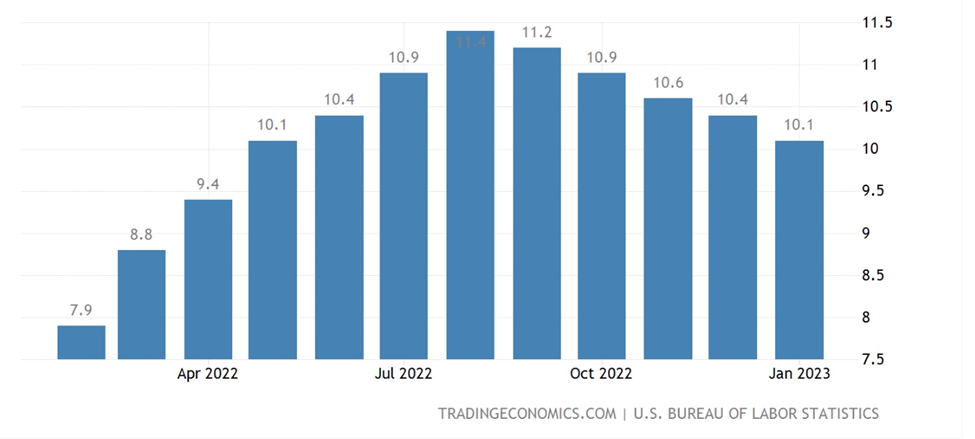

US food inflation rose 10.1% in January, and while that is less than the 10.4% rise in December, remember that inflation is cumulative; it compounds month to month. Labor Department data showed the average cost for food consumed at home climbed 11.3% in January from a year earlier.

Also, food insecurity is set to rise in the United States following the end of a food-stamp program called SNAP emergency allotments. The program provided a boost to recipients during the pandemic, but it expired at the end of February, with final allotments distributed in March. Cutting off the monthly benefit will result in an average $82 less per family, or over $200 for some seniors.

“You’re looking at a senior on a fixed income that’s not going to increase — there’s no way they can make up that difference,” Jason Riggs of Roadrunner Food Bank in New Mexico told Business Insider. “A lot of people aren’t really thinking in terms of that, that this is really, really going to hurt some of the most vulnerable populations.”

US rents in 2023 are expected to stay elevated, with the two main drivers being the rising cost of home ownership forcing many would-be homebuyers to keep renting; and a chronic shortage of housing.

“My expectation is that rent growth will slow, but we may not see it go back to what was typical before the pandemic,” said Realtor.com’s chief economist Danielle Hale, in a recent CBNC story.

Conclusion

The New York Fed’s figures on household debt and credit paint a different picture of the economy than the US Federal Reserve’s, which decides how high interest rates, that have a direct bearing on consumers’ ability to pay their debts, will go.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Fed Chair Jerome Powell dryly told the Senate Banking Committee, Tuesday. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Oh. Really? What kind of data is Powell looking at? Admittedly the unemployment numbers are low, leading some people to conclude that a robust job market is giving consumers the confidence to buy on credit. That’s missing the point. If their paychecks were high enough, they wouldn’t have to use their credit card! Or they would pay it off monthly, something precious few are doing. Instead, way too many Americans are living paycheck to paycheck and using their credit cards for essentials, while carrying a balance and paying interest that is frankly usurious.

Reading a spreadsheet and coming to a decision is different from deciding what to do based on what’s happening in the real economy. Perhaps if Powell and his gang of central bankers were to actually see people lining up at food banks, or read somebody’s credit card statement, knowing how little they take in each month, they might have a better sense of the devastation continual interest rate hikes, together with rampant inflation, particularly on food and fuel, is having on the American consumer.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.