S&P report on copper supply is misleading – Richard Mills

2023.02.11

Copper is one of the most important metals with more than 20 million tonnes consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing.

In recent years, the global transition towards clean energy has stretched the need for the red metal even further. More copper will be required to feed our renewable energy infrastructure, such as photovoltaic cells used for solar power, and wind turbines.

The metal is also a key component in transportation, and with more emphasis on electrification, demand is only increasing.

A major rise in copper demand from new “blacktop” infrastructure (think roads, bridges, airports, etc.), combined with high demand for copper from large-scale efforts on behalf of governments to decarbonize and electrify, is not being met with an adequate supply of the industrial metal. Trillions worth of new projects are thus in danger of falling by the wayside unless much more copper is discovered — more than is currently possible, in my opinion.

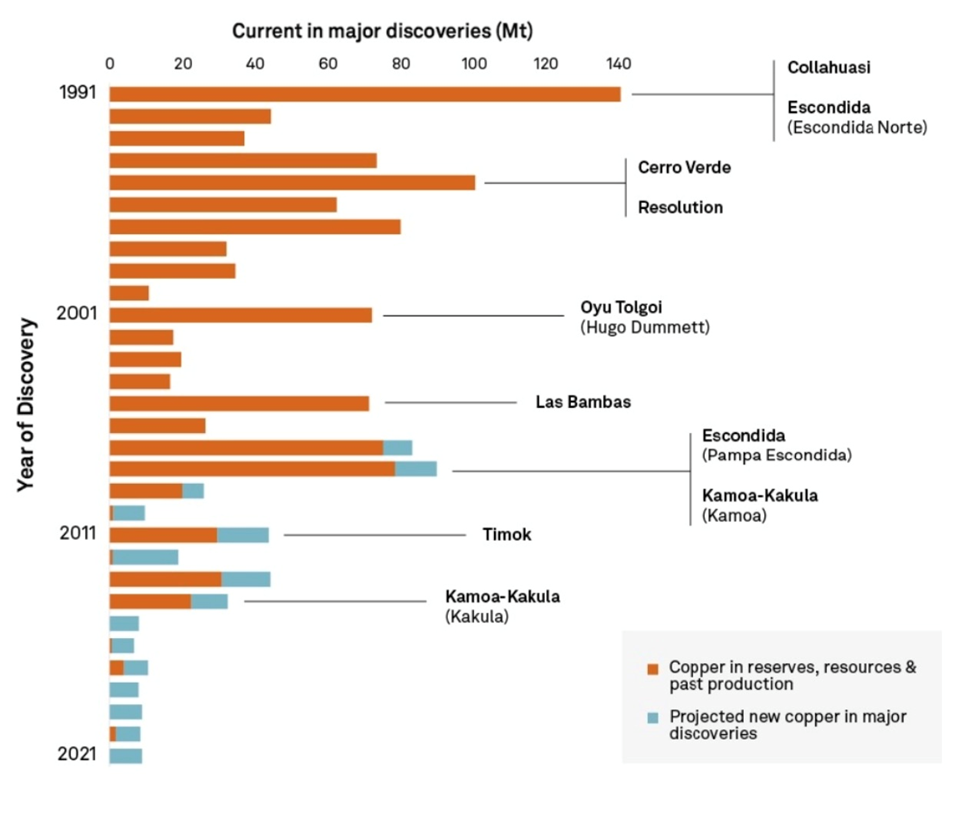

My position is supported by a recent report by S&P Global Intelligence. It says despite copper exploration budgets increasing by 21% last year, the most since 2014, on the back of higher copper prices compared to the onset of the pandemic in early 2020, they have not led to a meaningful increase in the number of recent discoveries.

“While copper reserves and resources have increased by 50 million tonnes compared with our analysis last year,” the authors say, “most of the increase came from assets discovered in the 1990s.”

This statement is significant, because it jibes with the conclusions drawn by Wall Street investment firm Goehring & Rozencwajg Associates, regarding the mining industry’s practice of lowering cut-off grades.

S&P Global Market Intelligence estimates that new discoveries averaged nearly 50Mt annually between 1990 and 2010. Since then, new discoveries have fallen by 80%.

Greenfield and brownfield reserve additions are expected to disappoint through the decade, according to a 2021 report by Goehring & Rozencwajg.

The Wall Street firm believes the number of new world-class discoveries coming online this decade “will decline substantially and depletion problems at existing mines will accelerate.”

Also, geological constraints surrounding copper porphyry deposits, a subject few industry analysts let alone investors understand, will contribute to the problems, the report said.

Lowering the cut-off grade

Why can’t the large copper miners simply tap into their existing reserves to meet growing demand?

They have been. Instead of sending exploration teams around the world to find the next gigantic copper deposit, the main way copper companies have added reserves is by lowering their cut-off grades as copper prices have increased.

Who owns the world’s future copper supply?

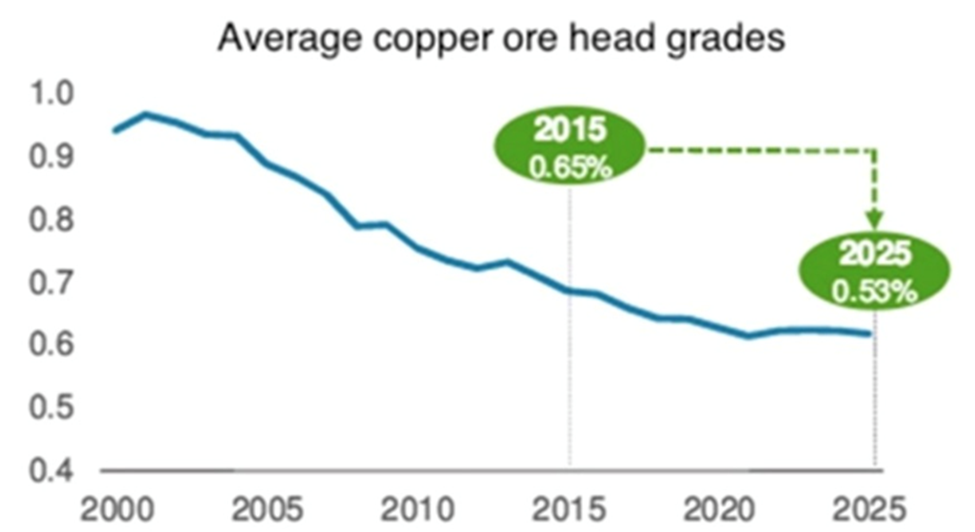

By 2015, the industry’s head grade was already 30% lower than in 2001, and the capital cost per tonne of annual production had surged four-fold during that time — both classic signs of depletion.

According to the Goehring & Rozencwajg model, the industry is “approaching the lower limits of cut-off grades,” and brownfield expansions are no longer a viable solution.

“If this is correct, then we are rapidly approaching the point where reserves cannot be grown at all,” the report concluded.

In other words, the industry can no longer re-classify itself out of its problem. New supplies of copper must be found, to avoid long-lasting structural deficits.

Questionable additions

Admittedly, some new copper mines have been commissioned, including Ivanhoe Mines’ massive Kamoa-Kakula in the DRC. The question is whether their production will be enough to satisfy copper demand going forward. I’m skeptical.

Let’s take a look at some of the mines mentioned by S&P Global Intelligence in their report. The first two started operating last year — Anglo American’s 60%-owned Quellaveco in Peru, and the Timok mine in Serbia, which is 100% owned by China’s Zijin Mining.

Ongoing protests in the southern Andes region threaten to unseat Peru as the world’s second-largest copper producer behind Chile.

Protests and roadblocks have escalated since the impeachment of leftist President Castillo in December, with clashes between demonstrators and security forces leaving 48 dead. Reuters says It is the worst violence in Peru in two decades, and threatens to destabilize [mining], one of the region’s most reliable economies.

Mining itself is not the focus of the demonstrations. Protestors are demanding that the Congress bring forward elections — something it has so far refused to do, having rejected multiple bills — and hold a referendum on a new constitution. The government is corrupt and the people want them out.

Quellaveco, located in the neighboring region of Moquegua, hasn’t yet been affected, but the $5 billion project was threatened by anti-mining protests in 2019.

In Chile, a left-ward shift is a mark against the top copper producer as far as attracting mining investment. Although Chile’s constitutional assembly has rejected plans to nationalize parts of the mining sector, the government is now weighing how much to increase royalties.

Chile’s declining ore grades present a key downside risk to production forecasts. Making matters worse, after more than a decade of drought, freshwater supplies are becoming a big problem in Chile. Copper mines there require lots of water to process sulfide ores, and the lower the grade, the more water must be used.

Some of these issues could affect production at Teck Resources’ Quebrada Blanca 2; also, the project has twice run afoul of Chilean regulators. Last year, it was reported that Canada’s largest diversified miner faced eight charges for failing to comply with measures to avoid the mine’s impacts on vegetation and animals. In 2019, similar allegations led SMA, the regulator, to impose a $1.2 million fine on Teck, for violations related to the handling of mining waste.

Chile and Peru account for 37% of global copper supply.

Meanwhile, our analysis has shown that in four of the five mines where new copper supply is concentrated, there are offtake agreements either in place or implied, with non-Western buyers. This means that copper mined by these operations will not feed into global copper supply; it will be “locked-up” in offtake agreements. This is the case for the Timok copper mine in Serbia mentioned by S&P Global as starting last year; the mine is 100% owned by China’s Zijin Mining.

In the case of Kamoa-Kaukula, which started in 2021, 100% of initial production will be split between two Chinese companies, one of which owns 39.6% of the joint venture project. Nearly half of Cobre Panama’s annual production goes to a Korean smelter under a 2017 offtake agreement. Escondida and Quebrada Blanca are both partially owned by Japanese companies — one can assume that a corresponding percentage of production from current expansions will be going there.

Rio Tinto’s Oyu Tolgoi Block Cave in Mongolia, mentioned in the S&P Global report as a source of new supply, continues to be beset by delays and cost over-runs. The underground section is expected to lift production from 125,000–150,000 tonnes in 2019 to 560,000 tonnes at peak output, which is now expected by 2025 at the earliest.

With these new projects, S&P Global sees a market surplus over the next three years, turning to a 400,000-tonne deficit in 2026. Like I said, about the surplus, I have my doubts.

Fox Business News agrees, reporting on Feb. 7 that A growing copper deficit could impact the market for years to come as mining setbacks in South America mount.

BloombergNEF predicts that by 2040, the mined-output gap (mines currently produce about 21Mt annually) will reach 14Mt, a shortfall that, without new supply, will have to be filled by recycling metal.

Goldman Sachs says that mining companies will need to spend about $150 billion in the next decade, to address an 8-million-ton deficit.

Chilean state-owned Codelco is also predicting an 8Mt gap, but the world’s biggest copper miner thinks it will come a year earlier, in 2032, as soaring demand continues to exceed new mine supply.

If that isn’t enough to convince you it isn’t just me, pointing out problems with future copper supply, consider that CEOs at some of the world’s largest mining companies are saying the same thing.

Glencore’s Gary Nagle said in December that, while some people assume the industry will just increase supply as it’s done previously when copper demand picks up, “this time is going to be a bit different.”

He presented estimates showing a cumulative gap between projected demand and supply of 50 million tons between 2022 and 2030. That compares with current world copper demand of about 25 million tons a year.

“There’s a huge deficit coming in copper, and as much as people write about it, the price is not yet reflecting it,” Nagle said, via Bloomberg.

In fact spot copper has shot up from $3.44/lb at the end of October, to its current $4.08, a gain of 18%, on the back of China’s post-covid economic reopening, and reduced inflation setting up market hopes of lesser interest rate hikes.

At a mining conference last fall, BHP’s Chief Executive Mike Henry said he believes the market will be in “a little bit oversupply” in the next few years before tightening up at the end of the decade, due to difficulties accessing ore and as mining becomes more complicated.

Richard Adkerson, CEO of American copper miner Freeport McMoran, said at the conference that copper prices don’t reflect a “strikingly tight” physical market. (Bloomberg, Oct. 21, 2022)

Inventories plundered

On Jan. 28 we reported copper inventory at less than four days, meaning that combined refined copper stocks in LME, SHFE and bonded Chinese warehouses was only four days worth of global consumption. The indicator is normally measured in weeks. LME copper warehouse inventories plummeted from 180,000 tons last May, to the current 65,000t.

Goehring & Rozencwajg, the Wall Street firm, published a chart of copper warehouse inventories showing a four-year down-trend from around April, 2018 to July, 2022. Inventories then rose for about a month, before declining again in October. The long-term trend is down, as the 5-year chart below shows.

We’ve also reported on the problems facing domestic (North American) mining companies trying to bring more copper to market.

Anti-mining decisions could slam the brakes on US electrification plans

In Canada and the United States, there is a lot of anti-mining sentiment and politicians are beholden to these pressure groups. It can take up to 20 years to build a mine, after all the stakeholders (including indigenous peoples and greens) have been consulted and the many permitting requirements, at the federal level in both countries, and the states and provinces have been satisfied. Overall it is getting harder, and taking longer, for new projects to be green-lit.

To wit, the Biden administration recently canceled two major copper projects: Antofagasta’s Twin Metals property in Minnesota, one of the largest undeveloped copper-nickel deposits in the world; and the huge copper-gold mine being developed by the Pebble Limited Partnership, a subsidiary of Northern Dynasty Minerals, in Alaska. Northern Dynasty has been seeking to mine in the area for roughly two decades.

Similarly, Rio Tinto has been trying for over 25 years to launch Arizona’s Resolution copper project, one of the world’s largest underground copper reserves that reportedly has enough metal for 275 million electric vehicles.

However, despite spending $2 billion, Rio Tinto and minority partner BHP have little to show for it. In 2021, the project was put on hold due to opposition from native American groups and environmentalists. For an all-sides view of Resolution, read this New York Times article.

It is extremely tunnel-visioned of politicians, who promise billions of dollars in subsidies and tax relief to build electric-vehicle battery plants and invite foreign “green” investment, yet have seemingly no concept of the metals needed for this transition. The fact that without copper, there is no electrification/decarbonization shift.

No new blood

Even if somehow, miraculously, we managed to find enough mines to make a dent in the supply deficit, and fast-tracked them to production without being sabotaged by greens and indigenous, it looks like we will have a hard time finding people to run them.

In the latest twist to the copper shortage saga, it’s been reported that the mining industry is bracing for a wave of retirements, with few new skilled workers interested in replacing them.

The numbers are shocking, to say the least.

According to a survey by the Society for Mining, Metallurgy and Exploration (SMME), enrolment in US mining engineering programs dropped 46% between 2015 and 2020. Another study says over half of miners are over the age of 45, and 20% are older than 60 and closing in on retirement. The same problem is afflicting major mining countries such as Canada, South Africa and Australia, Reuters states.

Less mining engineers and geologists means the industry will face major skills shortages, especially among middle management, just as demand for green economy metals, and new mines, is going bonkers.

Well that’s just perfect. And then there’s this:

Meanwhile, the China University of Mining and Technology — considered that country’s best mining school — enrolled more mining engineering students in 2020 than the entire United States, largely to supply China’s growing coal sector, according to the SMME survey.

Conclusion

In an earlier article we wrote about China “eating the West’s breakfast, lunch and supper.” We weren’t watching, we weren’t paying attention, we were asleep when China in 2010 cornered the rare earths market. We were also blind to the Chinese locking up global supplies & processing capabilities for nickel, cobalt, graphite and lithium.

Canada’s weak politicians preferred to export raw materials, mostly to China, meanwhile the US and EU went all “NIMBY.” Donald Trump’s solution was to slap China with hundreds of billions worth of tariffs, which did nothing to end China’s metal monopolies, and then along came “sleepy Joe” Biden who claimed Americans need to invest more in infrastructure, sourcing the raw materials from Canada, and a whole host of other much less friendly places, to avoid China “eating our lunch”. Well Joe, the Chinese long ago ate your breakfast, your lunch and your dinner too.

Then you look at what’s happening in four of the world’s largest copper-producing countries, Chile, Peru, Zambia and the DRC, all of which are rising threats for resource nationalism, making the required ramp-up in copper production to meet expected demand from electrification/ decarbonization all that much harder, if not impossible.

Why don’t we just do the mining ourselves? Well good luck with that.

A huge hypocrisy is apparent in United States’ mining policy.

The country is going all-in to electrify, but the first thing the Biden administration does is close its mines! What on Earth are they thinking?

Now compare the cluster&%#4 that is mining in North America, to the clear-eyed, focused approach that China has taken — not only in ensuring that it has the metals it needs for the future, but the people to find, build and run the mines.

China has worked relentlessly over the past decade to lock up the world’s metals with off-take agreements, creating import dependencies for a number of key minerals in the US and other Western countries. Meaning the west has NO security of supply for many of these metals, we must find and build mines and smelters and refineries to reduce our dependence.

China’s near-complete dominance of ‘green economy’ metals

China understands that mining is the lynchpin, that enables an economy to move from low-tech producer of inexpensive goods for export, to high-tech manufacturer of goods and services the future world economy needs. Because they have the raw materials.

It won’t be long before Westerners wake up to the fundamental truth that who controls the resources, controls the world. When the realization sets in, that we’ve been snookered, the mad rush to secure what’s left will surely ignite a fire under metals prices.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.