Zinc: the essential element in increasingly short supply – Richard Mills

2023.02.10

Zinc is among the most important of base metals, constituting an essential requirement of a country’s industrial development.

The bluish-white metallic element (Zn) is hard, brittle, and a good conductor of electricity. Zinc has relatively low melting and boiling points, at 419.5 degrees C and 907C, respectively.

Zinc is the fourth most common metal in the world, behind iron, aluminum and copper. The base metal is most often alloyed with copper to make brass, but other binary alloy metals include aluminium, antimony, bismuth, gold, iron, lead, mercury, silver, tin, magnesium, cobalt, nickel, tellurium and sodium.

Uses

A high percentage of steel that goes into buildings and automobiles, is galvanized with a zinc coating, making it a highly prized metal.

Indeed, making rust-proof cars could not take place without zinc. The metal is used in many stages of the assembly line, including engine parts, fuel systems and chassis, where components are plated with zinc. Zinc-coated parts are reportedly able to withstand up to 1,000 hours of salt spray testing.

Auto manufacturers in the US have, for the past 25 years or so, been using a zinc-nickel-alloy for plating. The nickel adds to zinc’s anti-corrosive properties, and provides a lustrous sheen.

Zinc alloys including brass are used in corrosion-resistant marine components and musical instruments.

Zinc, of course, is already used in alkaline batteries — a type of battery that gets its energy from the reaction between zinc and manganese dioxide.

Zinc is an essential mineral for the human body and zinc deficiency is a serious condition, remedied by zinc supplements.

Infrastructure

Primarily used to coat and protect steel from corrosion, zinc is unquestionably a staple in a nation’s infrastructure buildout. This includes bridges, public buildings, power stations, dams etc. in the US, much of the developing world, and China’s Belt and Road Initiative, which along with needing billions of tonnes of copper, is going to require a lot of steel containing zinc.

The International Zinc Association (IZA) explains that “galvanized steel is one of the strongest construction materials in existence and has been used for centuries in the building of bridges, buildings and other structures.”

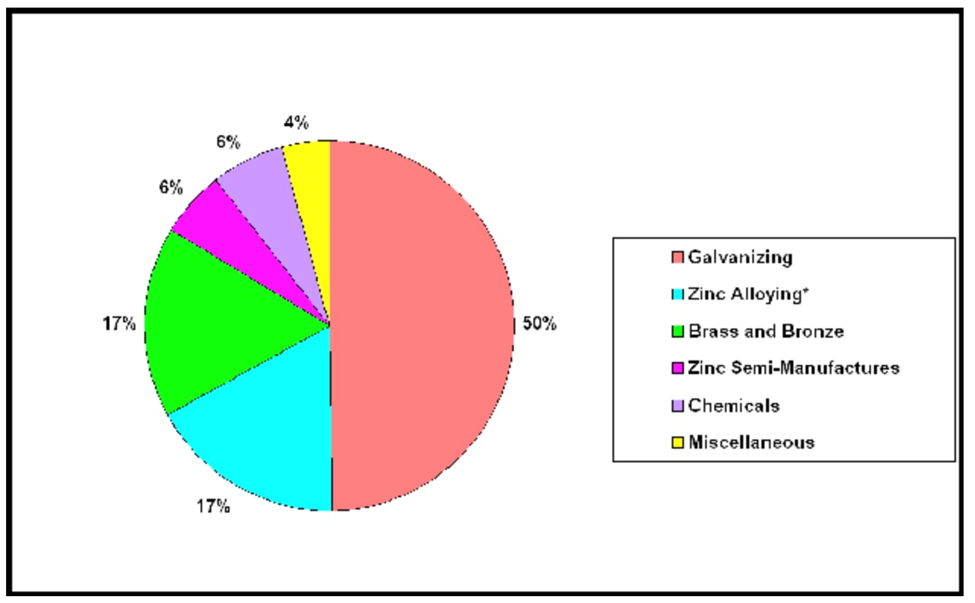

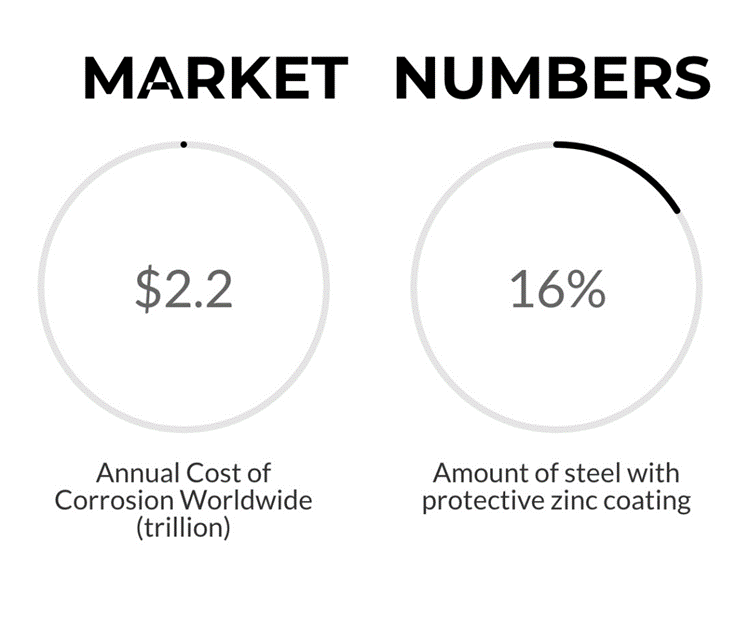

The IZA also says the annual cost of corrosion worldwide is USD$2.2 trillion, representing over 3% of global GDP. The World Corrosion Organization estimates around $400 billion can be saved by applying corrosion control technologies like zinc coatings. Zinc is so important in this role, states IZA, that the coating market represents nearly 60% of total zinc consumption each year. About 16% of steel has a protective zinc coating.

In late 2021 the US Congress passed a trillion-dollar infrastructure package that includes, among other things, money for roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways.

Beyond the United States, there is China’s Belt and Road Initiative (BRI), consisting of a vast network of railways, pipelines, highways and ports that extends west through the former Soviet republics and south to Pakistan, India and southeast Asia. BRI requires millions more tonnes of zinc, along with other key infrastructure metals such as copper, nickel and aluminum.

At Beijing’s behest, local governments have reportedly drawn up lists of thousands of “major projects,” which they are being pressured to see through. Investment in 2022 alone amounted to at least 14.8 trillion yuan (US$2.3 trillion), according to a Bloomberg analysis.

In Europe, post-pandemic spending incudes a “green recovery” pledge worth 550 billion euros. Among the projects that could benefit from the funds, are low-carbon steel production in Sweden (steelmaking represents about half of zinc consumption) and an EV battery factory in Poland.

The bullish case for zinc, then, is clearly bolstered by the green and blacktop infrastructure projects that are just beginning to be rolled out.

Zinc-air batteries

A relatively new use of zinc is the zinc-air battery. Also known as zinc-air fuel cells, zinc-air batteries are metal-air batteries filled with oxygen.

Research shows batteries built around zinc can be a cheaper, safer, and more effective alternative to the lithium-ion battery systems commonly used in electronics and electric vehicles today. This finding could even potentially alter the landscape of the global energy storage market.

According to the International Zinc Association, annual demand for zinc in batteries was 600 tonnes in 2020, but that figure is projected to leap to a massive 77,500t by 2030.

A 2022 article in Power Magazine states that lithium-ion raw materials cannot be produced in sufficient quantities to satisfy demand for EVs and renewable energy storage installations. However, it has also become increasingly apparent that any alternative to lithium-ion would need to adopt standard manufacturing processes to allow for a rapid and low-cost scale-up.

“So far, the zinc-ion battery is the only non-lithium technology that can adopt lithium-ion’s manufacturing process to make an attractive solution for renewable energy storage, particularly for its compatibility along with other advantages,” Power Magazine states.

The Zinc Battery Initiative is a new partnership between zinc-producing members and leading companies in the zinc battery sector.

“The advancement of zinc battery technologies, resulting in low-cost, sustainable, and safe options for key applications represents a disruptive innovation with significant impacts on these markets going forward,” said Andrew Green, executive director of the International Zinc Association, in a February 2021 news release.

The IZA describes zinc batteries as versatile, offering flexible designs with broad operating temperatures, high power discharge, and capable of long-duration storage. The association maintains that zinc has strong supply chains in all major regions, with production in North America, South America, Europe and Asia-Pacific. Zinc batteries also have an excellent safety record.

The zinc-air battery is currently used mostly in hearing aids, but its high energy density makes the battery suitable for portable applications such as electric vehicles and laptops. Commercialization could start with these markets.

According to Science Direct, Electric Fuel Ltd. has developed rechargeable zinc-air batteries that power EVs more than 200 km on a single charge. The technology has been road-tested by the German postal system, and a number of universities and institutes are actively researching zinc-air battery technology.

Zinc8 Energy Solutions has been trialing its rechargeable zinc-air battery in New York State. The company was recently approved for $9 million in tax credits, as an incentive to establish its first production facility there.

“Zinc-air batteries have great promise due to the cheapness and abundance of their basic materials along with a relatively high energy density, but until now the technology has been bedeviled by “sluggish” catalytic reactions,” Clean Technica observed in 2013. “Solving that problem could greatly expand the market for wind and solar power, including electric vehicle batteries and utility-scale energy storage.”

The clean energy magazine reports the U.S. Department of Energy is eyeing batteries that provide electricity for 10 hours or more, and that rechargeable zinc-air batteries could fit the bill. It also notes that in 2021, a multi-national team of researchers mapped out a pathway for creating rechargeable zinc-air batteries.

The sector was valued at USD$115 million in 2021, and is expected to grow at a CAGR of 8.5% from 2022, surpassing around $128.5 million by 2030, according to a recent study by Zion Market Research.

Geology

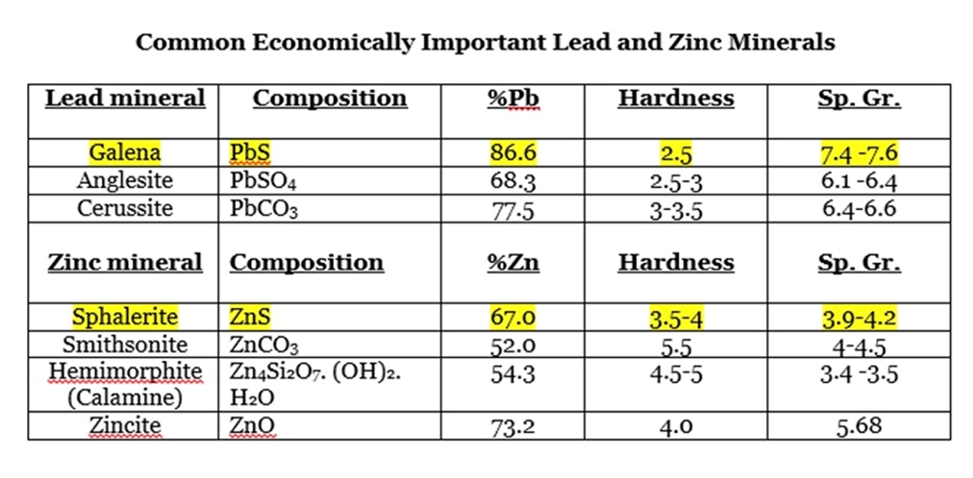

Geological conditions favor the formation of lead and zinc together. Both are often found with other minerals, including copper, gold and silver, resulting in polymetallic base metal deposits.

The most common lead mineral is galena, while for zinc, it’s sphalerite. Other occurring lead minerals are anglesite and cerussite. For zinc they are calamine, hemimorphite, zincite, willemite and franklinite.

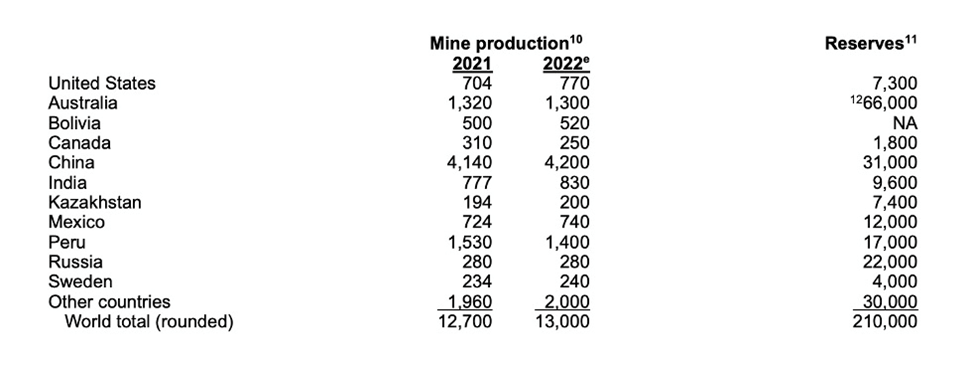

Zinc is mined in over 50 countries, with China the leading producer followed by Peru and Australia. Deposits of zinc-bearing ores are found in most Canadian provinces as well as the Northwest Territories (NWT).

Two of the largest zinc mines in North America are the Pine Point Mine in Canada’s NWT, and the Red Dog Mine in Alaska.

In the 1930’s, Northern Lead Zinc Company started work on lead-zinc sinkholes, with company reports indicating over 500,000 tons of reserves. In 1951 Pine Point Mines was established, the pre-cursor of Canadian mining icon Cominco, which built a large mill and a townsite.

By 1981, the mine was producing about 10,000 tons per day, with over $2 billion worth of zinc and lead (at today’s prices), recovered during the 25 years Cominco operated it, according to one source. Low metal prices and high recovery costs forced Pine Point to shut down in 1988.

The mine was closed around the same time that Cominco began developing the Red Dog Mine in Alaska, where combined lead-zinc averages 25%, with a credit of around 90 grams per tonne silver. The mine has the highest annual production and is reportedly the most profitable zinc mine in the world.

The majority of the world’s zinc deposits contain lead, meaning lead and zinc are mined together. Sphalerite is zinc’s main ore and is usually associated with galena, the lead mineral, and chalcopyrite, the most common copper mineral.

Lead-zinc mines output a very important by-product — silver.

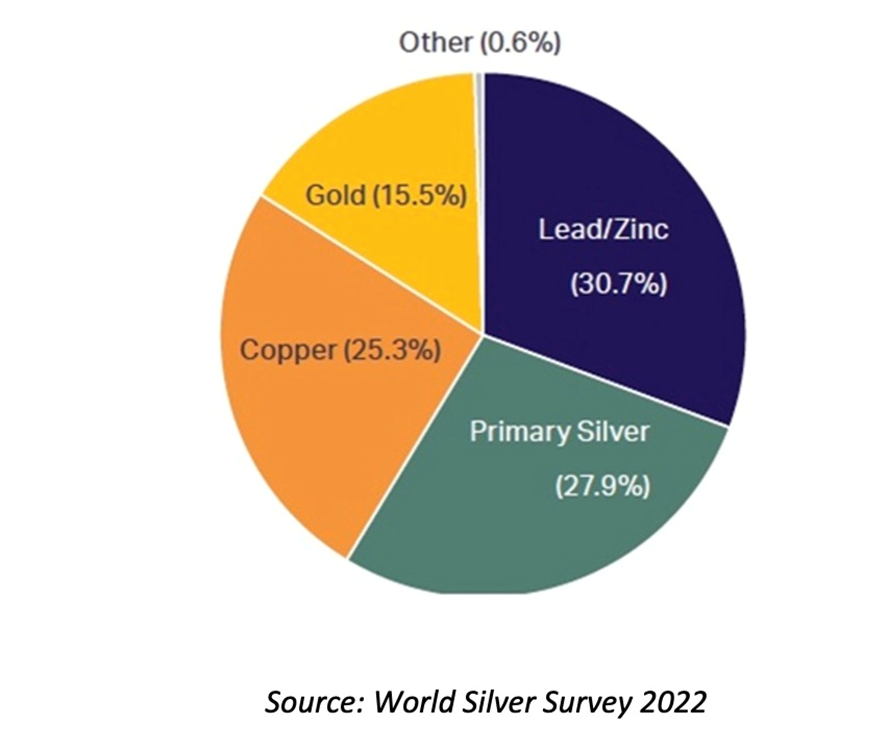

Only around 30% of annual silver supply comes from primary silver mines, with over two-thirds sourced from polymetallic ore deposits, including lead/zinc operations, copper mines and gold mines. As the pie chart below shows, most silver (30.7%) is produced from lead-zinc.

The same goes for cadmium. Silver is closely associated with the galena mineral, while cadmium occurs with sphalerite, making cadmium another important by-product of lead-zinc ores.

Resources

According to data sourced from ‘Ore Geology Reviews’ (2017), there are at least 226.1 million tonnes of lead and 610Mt of zinc within 851 mineral deposits and mine waste projects in 67 countries, at an average grade of 0.44% Pb and 1.20% Zn.

The USGS estimated 210Mt of zinc reserves in 2022, 40Mt less than in 2021, and global identified zinc resources of about 1.9 billion tons.

These resources are found predominantly within sediment-hosted lead-zinc deposits (490.6Mt Pb + Zn + Cu), containing a mix of VMS, skarn, porphyry and epithermal types. Forty-nine percent of the deposits are in Australia, Russia, Peru and Canada.

According to an abstract from Ore Geology Reviews, “the lead-zinc sector hasn’t had a major discovery in over 20 years, leading to concerns over resource depletion occurring faster than for copper, gold or nickel, among others.”

Market

Zinc’s current price of USD$3,130 a tonne is a long way from last March’s record-high $4,896, but physical buyers are still paying high premiums for the metal, due to plummeting warehouse stocks, which have fallen by more than 90% since December, 2021. Registered stocks of 16,225 tonnes are at their lowest since June of 1989.

Earlier this week, historically low zinc stocks were behind a spike in the zinc price for delivery tomorrow on the London Metal Exchange (LME). The premium for buying zinc tomorrow and selling it the day after, a trade known as “tom-next”, reportedly rose to $10 a tonne, Monday, compared to a session low of $1.50/t. Last Thursday the premium rose to $12/t, the most since Oct. 19.

Metal that is priced higher in the near-term versus farther into the future, is said to be in backwardation; the phenomenon is often seen as a sign of underlying market tightness.

“Stocks are heading towards zero and the backwardation hasn’t done the job it was supposed to; create an incentive for people to deliver zinc (to LME warehouses),” a zinc trader quoted by Reuters said.

The current zinc shortages are a combination of a pickup in demand after covid restrictions were lifted, as well as production cuts in Europe resulting from high energy prices, and in China last year because of power shortages.

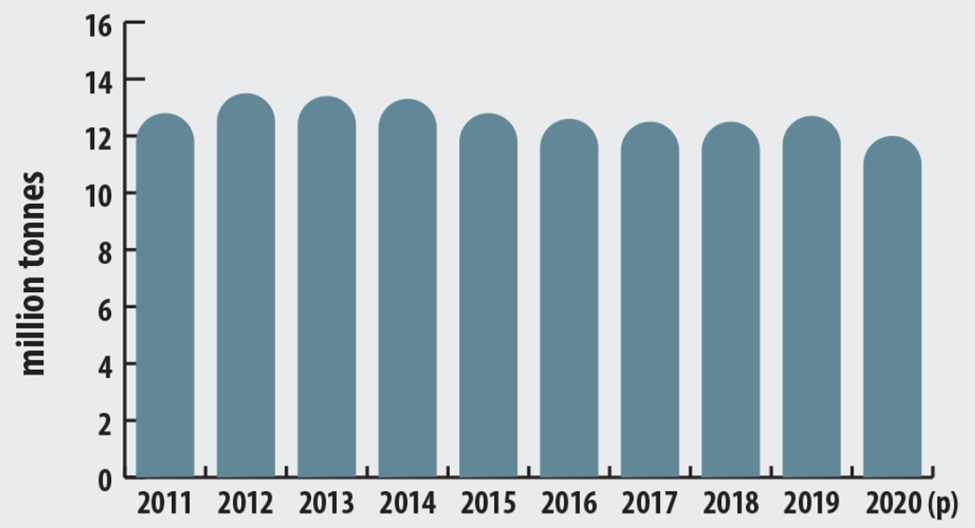

According to the International Lead and Zinc Study Group (ILZSG), global refined lead and zinc markets are likely to be in a deficit in 2022 and 2023. Zinc should be in a 297,000 tonnes deficit in 2022 and 150,000 tonnes short in 2023, states ILZSG.

2022

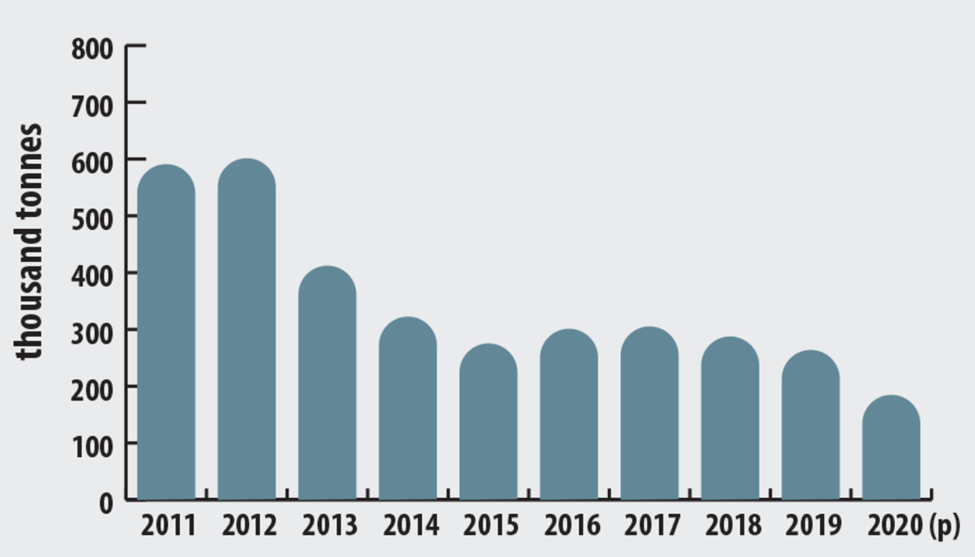

According to preliminary data recently compiled by the ILZSG, the global market for refined zinc metal was in deficit by 118,000 tonnes over the first 10 months of 2022, with total reported inventories decreasing by 125,000t. World zinc mine production fell by 3.1%, mainly as a result of reductions in Australia, Burkina Faso, Canada, China, Ireland and Peru.

For the full year, output was predicted to be lower in China, Ireland, Greece and Namibia, but to increase in India, Pakistan, South Africa, the United States and Portugal, the latter due to the completion of an 80,000 tonne per year expansion at Lundin Mining’s Neves Corvo operation in southern Portugal.

World mine production of zinc

Global supply of zinc concentrates in 2022 was negatively impacted by significant reductions in Australia, Peru and Burkina Faso, where operations at the Perkoa mine were suspended last April due to a severe flooding event.

Canadian output was also expected to fall substantially, mainly as a result of the suspension of activities at Trevali’s Caribou operation in New Brunswick, and permanent closures of the Matagami (Quebec) and 777 (Manitoba) mines due to reserves depletion. Hudbay’s Flin Flon, Manitoba smelter, which operated for more than 25 years, was also shuttered in September.

Lower refined zinc metal production in Europe, where output at a number of smelters has been negatively impacted by the sharp rise in the price of electricity, was the main driver behind an overall decrease worldwide of 3.2%. Production also fell in China, Canada, Kazakhstan and Mexico but rose in India.

Nyrstar suspended operations at its 300,000 tonne per year Budel smelter in the Netherlands in September and Glencore recently announced the temporary closure of its Nordenham smelter. In Italy, primary production at the Portovesme facility was discontinued in early 2022 and in France, activities at the Auby plant were suspended for two months in the first quarter, last year. Production has also been curtailed during peak times of the day at the Balen and Asturiana plants in Belgium and Spain.

2023

According to the ILZSG, world demand for refined zinc metal was forecast to fall by 1.9% to 13.79Mt in 2022, but rise by 1.5% to 13.99Mt in 2023.

Usage is anticipated to increase in India, Japan, South Korea and Mexico, and to remain flat in Europe and the United States.

Global zinc output will benefit from an anticipated growth of 3.8% in China this year. The recent commissioning of Nexa Resources’ new Aripuanã mine will be the main driver of an expected rise in Brazilian output in 2023. Increases are also forecast in Australia, Ireland, Mexico, Peru, Portugal and India, where further expansions at Hindustan Zinc’s mines are expected. In Canada and the United States, however, production is anticipated to fall this year.

In January, it was reported that Nexa halted production at its Atacocha San Gerardo open-pit zinc mine in Peru, due to a local community blockading a road. The company faced two road blockades at the same site last year. The first one in March, which cost the miner 300 tonnes of zinc production, and another one in August (Mining.com).

Resource nationalism

Ongoing protests in the southern Andes region of Peru threaten to unseat Peru as the world’s second-largest zinc producer. The country is also number 2 in copper mine production, behind Chile.

Protests and roadblocks have escalated since the impeachment of leftist President Castillo in December, with clashes between demonstrators and security forces leaving 48 dead. Reuters says It is the worst violence in Peru in two decades, and threatens to destabilize [mining], one of the region’s most reliable economies.

Mining itself is not the focus of the demonstrations. Protestors are demanding that the Congress bring forward elections — something it has so far refused to do, having rejected multiple bills — and hold a referendum on a new constitution.

However, mining was targeted by Castillo, who came to power about a year and a half ago promising to increases taxes on the mining industry to fund social programs. Peru’s Congress shelved the plan last August amid lower metal prices, high inflation and slowing growth.

Resource nationalism is the tendency of governments to localize the mining industry and to increase the extraction costs to foreign miners.

Countries rich in minerals are frequently looking at ways to get more money from miners, the most common tactic being to hike royalty payments.

Governments have also gone beyond taxation in getting more out of the mining sector with requirements such as mandated beneficiation/export levies and limits on foreign ownership:

- Mandated beneficiation/export levies – Governments are imposing steep new export levies on unrefined ores. Minerals processed in-country capture more of the value chain as the products achieve higher prices.

- Increasing state ownership – Miners are easy targets because mining is a long-term investment and one that is especially capital intensive. Mines are also immobile, so miners are at the mercy of the countries in which they operate. Outright seizure of assets happens using the twin excuses of historical injustice and environmental or contractual misdeeds. There is no compensation offered and no recourse.

With much of the “low-hanging fruit” already picked, there is a need to go further afield and dig deeper to find metals at the grades needed to mine them economically. This usually means riskier jurisdictions that are often ruled by shaky governments, with an itchy trigger finger on the resource nationalism button. Recent examples include Chile, Peru, Indonesia, the DRC and even the United States.

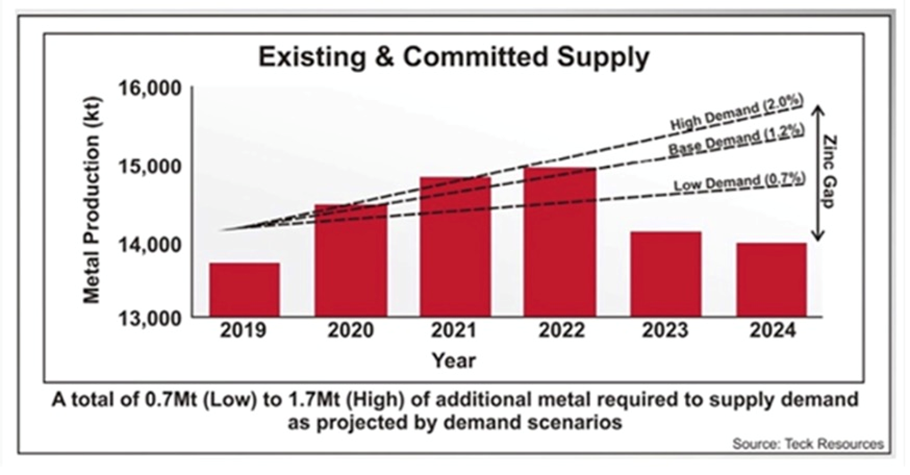

Zinc demand may be outrunning supply but getting new mines to fill the gap is a big ask.

Conclusion

Governments around the world are securing supplies of zinc amid global instability and a move away from China, which currently produces about a third of the world’s zinc. The base metal also plays a key role in transitioning to a low-carbon economy. Zinc is used to protect iron and steel from rusting, and it is an important raw material for wind turbines, solar panels and electric vehicles.

According to Lucintel.com, via the Globe and Mail, “The future of the zinc market looks promising with opportunities in the construction and infrastructure, transportation, consumer goods, and industrial machinery sectors. The global zinc market is expected to reach $74.4 billion in 2027. The major drivers for this market are increasing demand for galvanized steel and infrastructure development. Furthermore, growing demand from niche applications like smartphones, electric vehicles, mild hybrid engines, and power grid storage will drive the global zinc market.”

While demand remains robust, zinc supply is showing signs of extreme market tightness. Physical buyers are paying high premiums for the metal, due to plummeting warehouse stocks. Registered inventories of LME zinc are at their lowest point since 1989. The lead-zinc sector hasn’t had a major discovery in over 20 years, leading to concerns over resource depletion.

The current zinc shortages are a combination of a pickup in demand after covid restrictions were lifted, as well as production cuts in Europe resulting from high energy prices, and in China last year because of power shortages.

The International Lead and Zinc Study Group (ILZSG) forecasts the zinc market to be in a 297,000 tonnes deficit in 2022 and a 150,000 tonnes deficit in 2023.

As the push to electricity the global transportation system gathers pace, and to transition to renewable energy systems requiring reliable storage, we expect zinc to be among the metals most likely to benefit.

The base metal is uniquely placed for its utility in both “blacktop” infrastructure programs requiring large amounts of galvanized steel, and “green” infrastructure projects that in future may require zinc batteries en masse. Combine these attributes with strong supply-demand fundamentals, and there appears to be no stopping zinc’s upward price movement, making it a strong candidate for investment.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.