Dolly Varden Silver highlights 46.31 g/t gold and 70 g/t silver over 25m, including 1,145 g/t Au and 826 g/t Ag over 0.48m, at Homestake Ridge – Richard Mills

2023.01.31

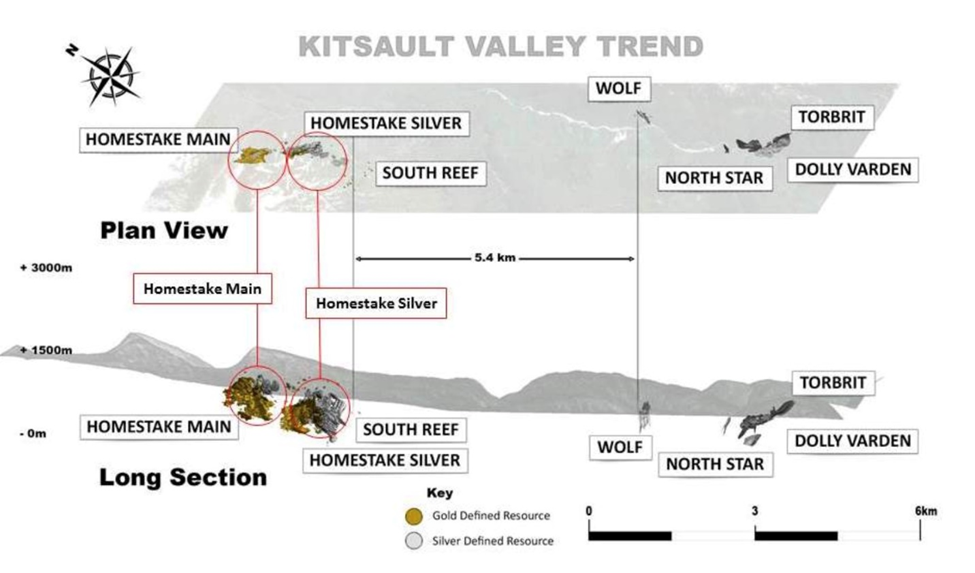

Dolly Varden Silver (TSXV:DV, OTC:DOLLF) has come up with more high-grade gold and silver results from its Kitsault Valley project located in the southern part of British Columbia’s Golden Triangle.

The Vancouver-based company on Jan. 30 announced assays from its Homestake Main and Homestake Silver deposits.

The 163-square-km property is an amalgamation of Dolly Varden’s namesake project, and the Homestake Ridge project that DV acquired from Fury Gold Mines back in February, 2022.

The combined mineral resource of 34.7Moz silver and 166,000 oz gold (indicated), and 29.3Moz silver and 817,000 oz gold inferred, within multiple outcropping deposits, makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in Western Canada.

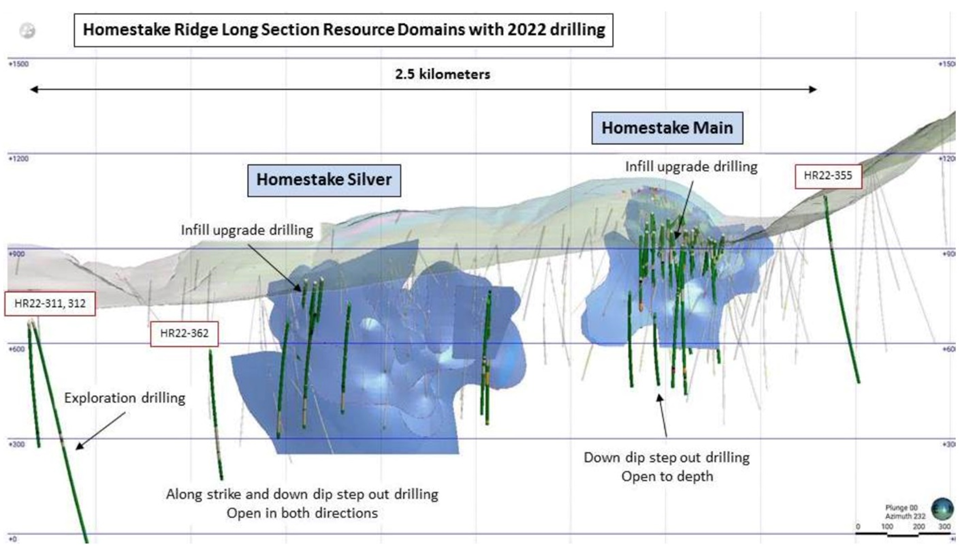

The objective of 2022 drilling was to expanded multiple sub-parallel mineralized zones and to upgrade inferred resources at these deposits. Forty-one holes and 10,472 meters were completed at Homestake Main, 12 holes (6,076 meters) were drilled at Homestake Silver, and three holes were sunk along the Homestake Ridge trend.

The highlights from a batch of drill results included:

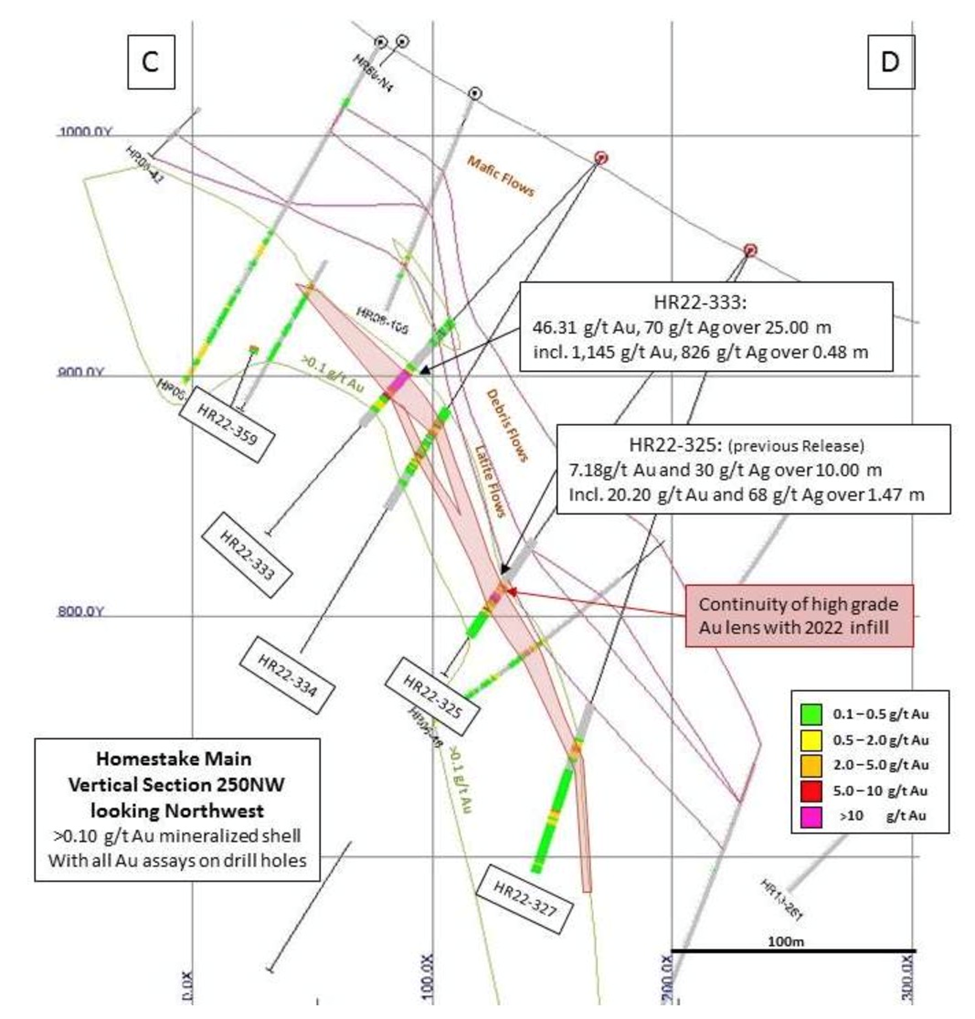

- From Homestake Main, 46.31 g/t Au, 70 g/t Ag and 0.19% Cu over 25.00 meters in hole HR22-333, including 1,145 g/t Au, 826 g/t Ag and 0.51% Cu over 0.48 meters;

- From Homestake Silver, 2,500 g/t Ag, 15.04 g/t Au and 0.17% Cu over 1.20m in hole HR22-361; and

- 469 g/t Ag over 2.70m including 1,040 g/t Ag over 0.65m in hole HR22-365.

Other stand-out intersections from Homestake Main:

- HR22-324: 4.32 g/t Au and 76 g/t Ag over 22.50 meters including 19.42 g/t Au and 375 g/t Ag over 4.50m;

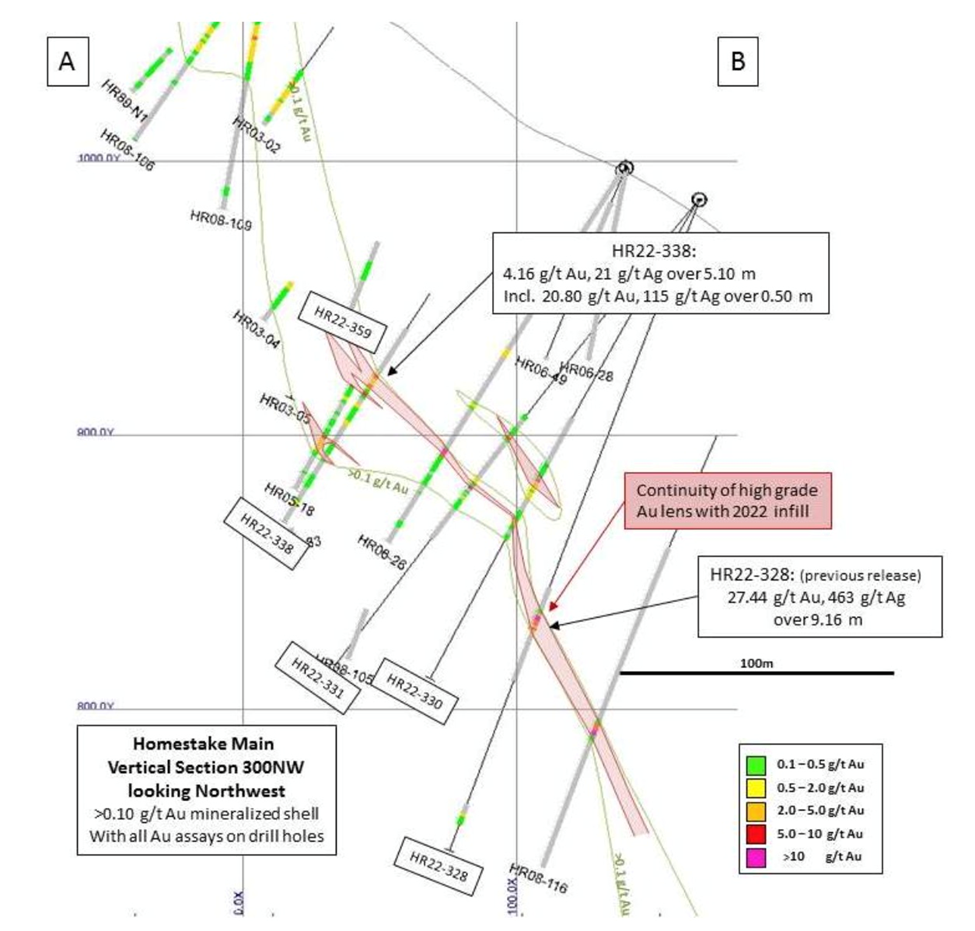

- HR22-336: 6.19 g/t Au and 1,844 g/t Ag over 3.90m and 6.37 g/t Au, 29 g/t Ag and 1.51% Cu over 6.00m;

- HR22-338: 4.16 g/t Au, 21 g/t Ag and 1.42% Cu over 5.10m including 20.80 g/t Au, 115 g/t Ag and 11.60% Cu over 0.50m;

- HR22-345: 8.73 g/t Au and 12 g/t Ag over 29.54m, including 260 g/t Au, 102 g/t Ag over 0.70m;

- HR22-359: Three higher-grade zones @ 9.49 g/t Au over 1.52m, 24.00 g/t Au over 0.70m and 46.20 g/t Au over 0.50m within a 40.50-meter interval.

And from Homestake Silver:

- HR22-349: 211 g/t Ag over 3.50m, and 688 g/t Ag over 0.80m;

- HR22-357: Three higher-grade silver intersections @ 1,185 g/t Ag over 0.50m, 816 g/t Ag over 0.50m and 1,085 g/t Ag over 0.50m within a 129-meter-wide structural corridor;

- HR22-362: 1,252 g/t Ag, 0.81 g/t Au and 0.14% Cu over 2.50 meters, including 3,330 g/t Ag, 0.75 g/t Au and 0.38% Cu over 0.75m.

“Dolly Varden Silver’s initial drilling at the Homestake Main deposit has returned consistent mineralized intervals with some of the highest grades of gold with silver reported from the property to date, but also the entire Golden Triangle during the 2022 drilling season,” said Shawn Khunkhun, Dolly Varden’s President and CEO, in the Jan. 30 news release. “Coupled with the exceptional grades and thicknesses of silver mineralization encountered in step-out holes at the Wolf and Kitsol deposits, we are demonstrating the impressive precious metal endowment and potential of the Kitsault Valley trend.”

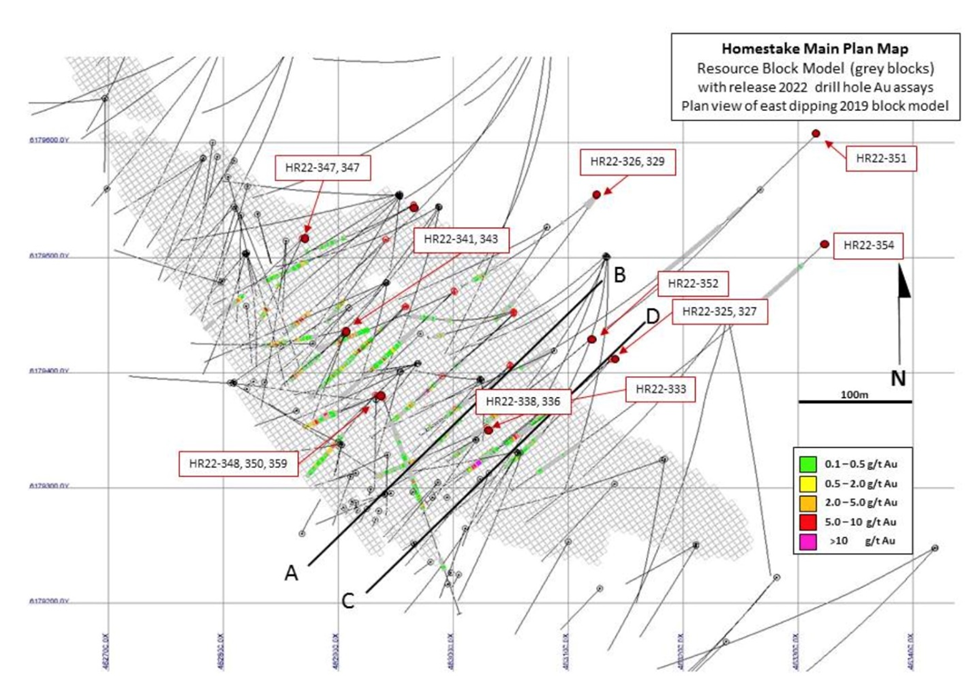

According to Dolly Varden, the Homestake Ridge deposits are interpreted as structurally-controlled, multi-phase epithermal vein and breccia systems hosted in early Jurassic-age Hazelton Group volcanic rocks. Mineralization consists primarily of pyrite and chalcopyrite in a breccia matrix within a silica breccia vein system, locally with native gold, silver and electrum. (Figure 3). The northwestern strike of the main Homestake structural trend hosts multiple sub-parallel structures that are interpreted to form the controls for high-grade gold shoots within a broader interval of mineralization at the Homestake Main deposit. The main structural corridor dips steeply to the northeast ( Figures 4 to 6).

Homestake Main

The results from the Homestake Main deposit are primarily infill drilling from areas of current inferred resources, and suggest the higher-grade gold-silver shoots may be more extensive than previously thought. The drilling has also generated new targets down dip, along the projected plunge of the higher-grade shoots, that are wide open for expansion.

Four of the drill holes at Homestake Main were drilled below the mineral resource domains to test for down dip extensions. Holes HR22-326, 329, 351 and 354 all intersected the structures that host gold mineralization below the resource.

One step out drill hole, HR22-355, was drilled along trend about 250m north of Homestake Main. Alteration associated with the main deposit was encountered, with minor brecciation returning anomalous pathfinder elements, as seen in the upper levels of the mineralization system at the Homestake Main deposit. This indicates the system continues to the north.

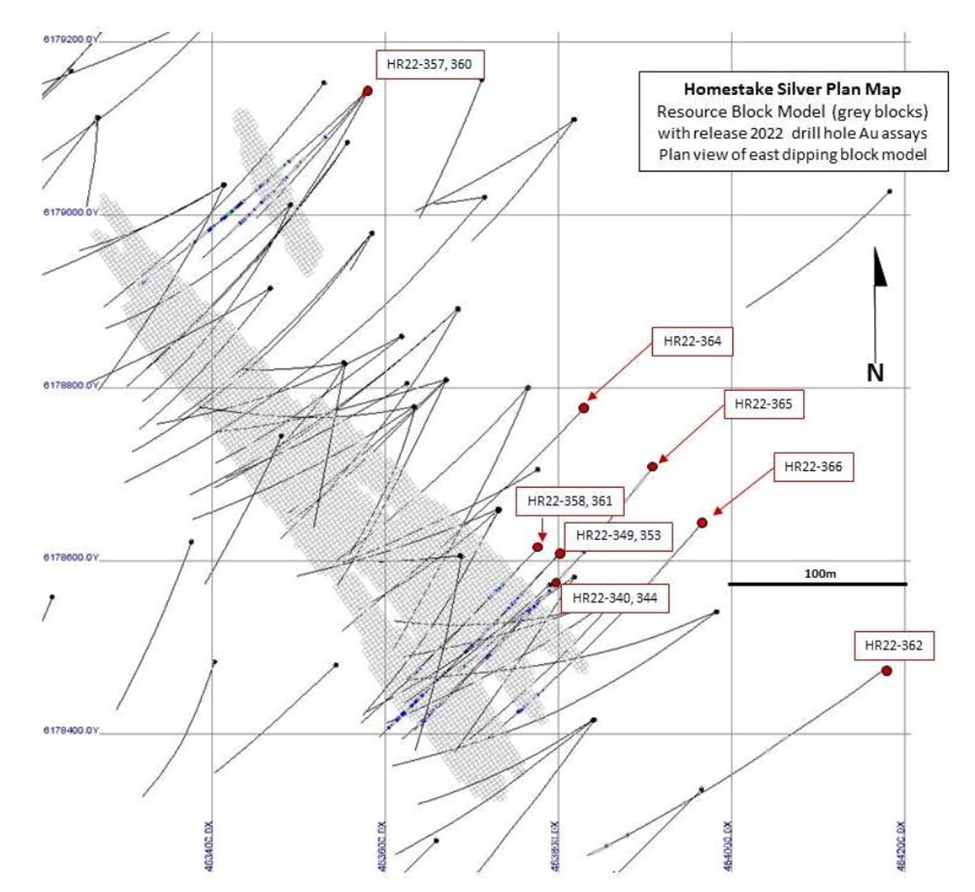

Homestake Silver

2022 drilling at the Homestake Silver deposit was a combination of step out holes below the inferred resource, as well as some infill drilling designed to convert inferred resources to indicated. Six infill drill holes, HR22-340, 344, 349, 353, 358 and 361, were collared off three drill pads at the southern end of the deposit (Figure 8). According to Dolly Varden, the mineralization encountered in these holes is consistent with previous drilling.

Expansion holes HR22-364, 365 and 366 targeted the southern end while HR22-357 and 360 in the northern end of Homestake Silver tested below several of the resource domains. Drilling intersected silver mineralization (Figure 4) within multiple vein stockwork zones, extending the zones to depth. These areas remain open down dip.

Step out drill hole HR22-362, located approximately 200m down dip and along the targeted projection of a Homestake Silver resource domain intersected vein breccia over a 2.50m core length, grading 1,252 g/t Ag, including 0.75m g@ 3,330 g/t Ag. Relatively little drilling has been completed at Homestake Silver and with these step out mineralized intersections the expansion potential to depth and along strike has been demonstrated.

Two new areas within the Homestake trend were tested with three drill holes, however no significant mineralization was encountered.

Conclusion

Dolly Varden is one of only a few junior resource companies putting out excellent drill results in a difficult market. DV was up 11% on Monday’s news, to $1.00 a share. Since Sept. 27 the stock has nearly tripled in value.

Dolly Varden had always said that it effectively follows a two-pronged approach to increasing shareholder value. Not only was it aiming to grow its resource base through more drilling, but the company was also eyeing properties surrounding its original land package, which led to the Homestake Ridge acquisition and subsequent formation of the Kitsault Valley property.

The goal, according to Dolly Varden’s president and CEO Shawn Khunkhun, is to “dramatically grow and upgrade the resource at our current deposits, setting the company up to be the next development project in the Golden Triangle.”

Now holding onto what is considered one of the largest high-grade, undeveloped precious metal assets in Western Canada, with a total of seven deposits located along a combined 15 km strike length within a 163 km2 consolidated land package, Dolly Varden has certainly proven its strategies have worked.

Dolly Varden is one of only a few junior resource companies that conducted drill programs this past summer, in a difficult market. 37,000 meters is a large drill campaign, and I was looking forward to seeing it bear fruit, as the first assays trickled in.

The 2022 exploration program was balanced between mineral resource expansion and upgrading at five of the deposits that comprise the Kitsault Valley Project, and exploration work focusing on the discovery of new silver and gold deposits. The objective of infill drilling was to convert inferred mineral resources to the measured and indicated categories, with an emphasis on inferred resources at the recently acquired Homestake Ridge area. Concurrent with the diamond drilling, geological and geophysical work along the Kitsault Valley trend was ongoing to help refine existing targets and discover new ones.

Dolly Varden Silver continues to return high-grade silver results from the southern end of the highly mineralized Golden Triangle — one of only a few pure-play silver districts in the world, and the largest such project in all of Canada. We know the market is soft but there are always 5 to 10% of companies that will stand out from the others; we believe DV is one of those and we continue to regard Dolly Varden as among the best exploration companies in the sector.

The 2022 exploration drill program on the Kitsault Valley trend completed 37,061 meters in 108 drill holes, with four rigs. Drilling wrapped up in mid-October with results from approximately 20 holes remaining to be released. Also, ground-based geophysics, surface mapping and prospecting work were completed, evaluating historical prospects and identifying new silver and gold occurrences.

Shareholders can expect the news flow to continue well into 2023.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$1.00, 2023.01.30

Shares Outstanding 230m

Market cap Cdn$253.4m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.