Dolly Varden intersects 50.2 meters of 414 g/t silver in step-out drilling at Kitsol Vein

2022.08.12

Dolly Varden Silver (TSXV:DV, OTC:DOLLF) has returned a set of impressive drill results from its Kitsol Vein target, located near the historic Torbrit Mine on the company’s Kitsault Valley Project in northwestern British Columbia.

The sprawling 163-square-km property is an amalgamation of Dolly Varden’s namesake project, and the Homestake Ridge Project that DV acquired from Fury Gold Mines back in February.

The combined mineral resource of 34.7Moz silver and 166,000 oz gold (indicated), and 29.3Moz silver and 817,000 oz gold inferred, within multiple outcropping deposits, makes Kitsault Valley one of the largest high-grade, undeveloped precious metal assets in Western Canada.

The company is in the midst of a 30,000-meter drill program, utilizing three diamond drill rigs with 99 drill holes planned in the Phase I program. To date, over 18,000m of drilling has been completed.

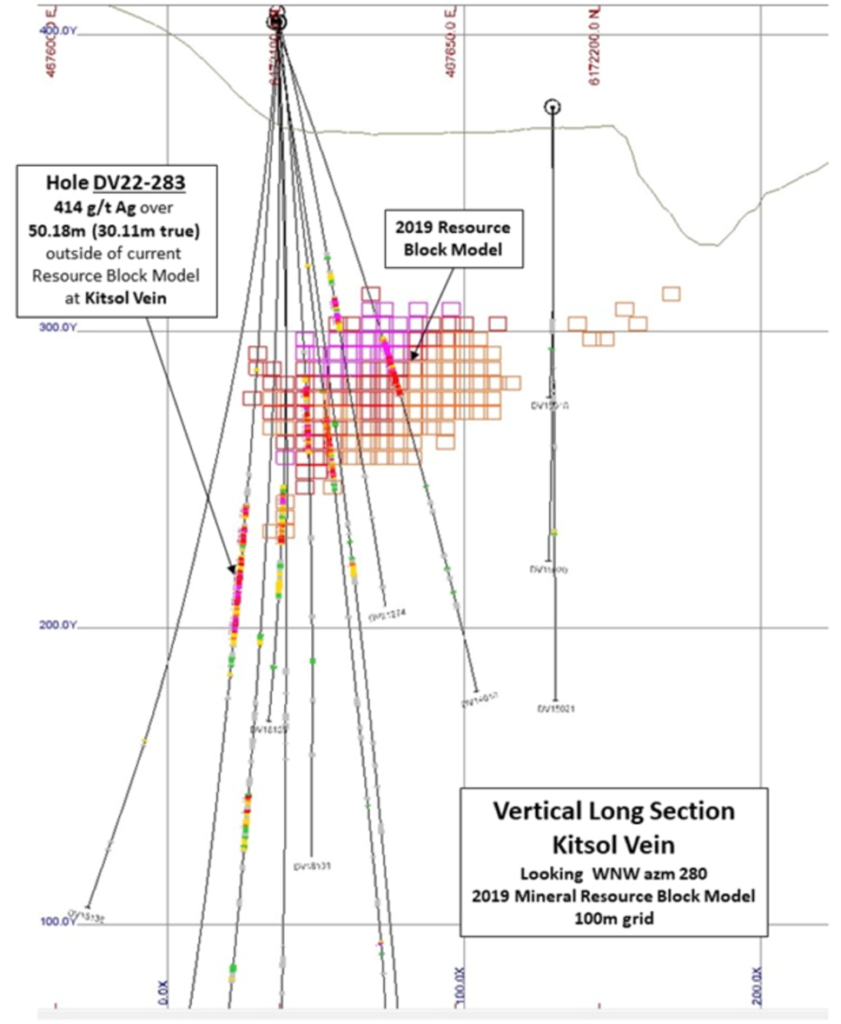

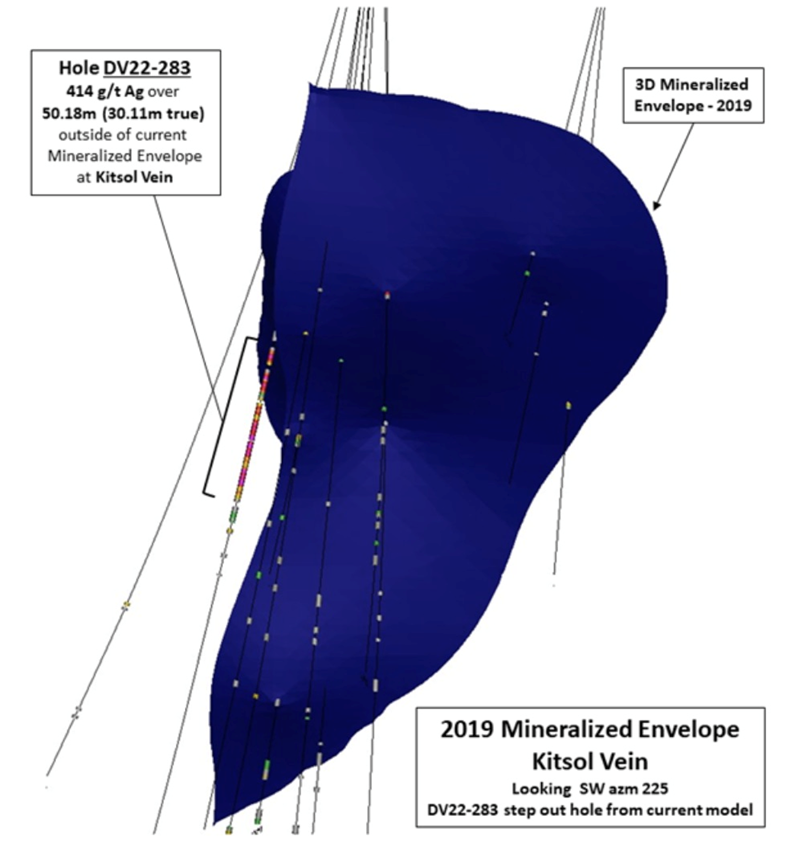

At the Kitsol Vein, drill hole DV22-283 was a 25-meter step-out along strike and down dip of high-grade silver mineralization. Results suggest that the vein’s thickness and grade increase at depth.

An 18-meter interval at an average 414 grams per tonne silver, included 15m averaging 646 g/t Ag (4.29m true width); 74m averaging 658 g/t Ag (7.04m true width), and 34m averaging 801 g/t Ag (3.20m true width).

Anytime a precious metals junior can come up with $200-some dollar rock, in my book is a damn good result.

Some of the assays were even higher, as shown in the table below. Within the 18-meter mineralized interval, three half-meter-long samples assayed 2,910 g/t Ag, 2,390 g/t Ag and 2,500 g/t respectively!

“As one of the widest and highest grade drill holes on the Dolly Varden property, we will be prioritizing additional step out drilling at the Kitsol Vein area. We are targeting potentially underground bulk-mineable mineralization and this certainly meets our criteria. In addition to the ongoing drilling at priority exploration targets including the Wolf Mine and at Homestake Ridge, we are thrilled with these results and look forward to receiving additional assays soon,” said Shawn Khunkhun, President and CEO of Dolly Varden Silver.

At AOTH, we interpret the results from hole DV22-283 in a few ways. First, we note from the news release, that The Kitsol Structure is a vein-hosted, high-grade silver system located immediately west of the Torbrit Mineral Resource and historic mine. Mineralization consists of multiple, overlapping epithermal vein and brecciation events along a northeast striking, steep westerly dipping zone.

I’ve bolded the key words.

Whatever produced such high silver grades at the Kitsol Vein, it happened in multiple phases, not a single mineralizing event. That means there could be many more additional mineralized offshoots, including something larger, that hasn’t yet been discovered, potentially of higher grade. Clearly there were a number of pulses that pushed mineralized fluids impregnated with silver, lead, zinc and gold, up from far underground, to as shallow as 181m below surface.

Another key point is the consistency of the mineralization, making it potentially bulk-mineable. Dolly Varden states, We are targeting potentially underground bulk-mineable mineralization.

Indeed the Kitsol Vein fits the bill, because the grade and the width is increasing down dip. Moreover, the mineralization is very consistent, it doesn’t have gaps in it. The wall rock isn’t mineralized but there’s very little wall rock between veins. Again this makes the target amenable to bulk mining methods — a mine operator doesn’t have to mine each vein individually, rather they could go in and mine the veins together as one bulk deposit. That makes the economics of mining it potentially extremely attractive.

Finally, Dolly investors and potential investors should understand that this intercept has identified fresh mineralization, given it was discovered through step-out versus in-fill drilling. This bodes well for Dolly Varden’s goal of upgrading the 2019 resource, since the results from hole DV22-283 are likely to add ounces. In short, they indicate huge exploration upside.

Conclusion

The 2022 exploration program is balanced between mineral resource expansion and upgrading at five of the deposits that comprise the Kitsault Valley Project, and exploration work focusing on the discovery of new silver and gold deposits. The objective of infill drilling is to convert inferred mineral resources to the measured and indicated categories, with an emphasis on inferred resources at the recently acquired Homestake Ridge area.

Dolly Varden is executing a large drill program, 30,000 meters. They’ve got three drills running, and have completed 18,000m so far, meaning 12,000m are left to go before the drill program is done at the end of September.

Resource upgrade and expansion drilling is underway at the Homestake Ridge Main gold zone with two drills. One drill is continuing exploration and resource expansion drilling at the silver-rich Torbrit area and at the Wolf deposit.

Concurrent with the diamond drilling, geological and geophysical work along the Kitsault Valley trend is ongoing to help refine targets for exploration drilling in the latter part of the summer.

Shareholders can expect the news flow to ramp up and continue through the fall and well into January, 2023.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.66, 2022.08.11

Shares Outstanding 230.5m

Market cap Cdn$152.1m

DV website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.