Competition for US dollar intensifying

2022.08.08

The US dollar is the most important unit of account for international trade, the main medium of exchange for settling international transactions, and the store of value for central banks.

In the 1960s, French politician Valéry d’Estaing complained that the United States enjoyed an “exorbitant privilege” due to the dollar’s status as the world’s reserve currency. His point was well-made.

Because of the dollar’s position, the US can borrow money cheaply, American companies can conveniently transact business using their own currency, and when there is geopolitical tension, central banks and investors buy US Treasuries, keeping the dollar high and the United States insulated from the conflict. A government that borrows in a foreign currency can go bankrupt; not so when it borrows from abroad in its own currency i.e. through foreign purchases of US Treasury bills.

Lately though, “de-dollarization” is being pursued by countries with agendas at odds with the US, including Russia, China, Saudi Arabia and Iran.

As the target of US economic sanctions (for annexing Crimea, interfering in its election, and now, invading Ukraine), Russia sees diversification from the dollar and into gold and other currencies, as a way of skirting trade restrictions.

In 2021, China trimmed its holdings of US Treasuries for four straight months, in what analysts called a move to prevent potential adverse impact from escalating China-US tensions.

China really started to move away from the dollar in 2014. China agreed with Brazil on a $29 billion currency swap, to promote the Chinese yuan as a reserve currency. The Chinese and Russian central banks signed an agreement on yuan-rouble swaps to double trade between the two countries. The $150 billion deal is a way for Russia to move away from US dollar-dominated settlements.

A few years ago China came up with a new crude oil futures contract, priced in yuan and convertible into gold. The Shanghai-based contract allows oil exporters like Russia and Iran to dodge US sanctions against them by trading oil in yuan rather than US dollars.

More evidence of Chinese and Russian de-dollarization concerns the SWIFT system of international banking transactions. In 2014 after Russia annexed Crimea, there were calls to cut Russia off from SWIFT. In response the Kremlin developed its own financial communications platform, SPFS. In December 2021, SPFS had 38 participants from nine countries. As of March, the system had 399 users. Russia is currently negotiating with China to join SPFS.

China has also developed an alternative to SWIFT, in 2015 launching the Cross-Border Interbank Payment System (CPS) to help internationalize the yuan.

Vladimir Putin’s invasion of Ukraine has resulted in the West’s (the US and its allies) attempt to isolate Russia through economic sanctions. But the plan has backfired. Not only have the sanctions failed to stop Russian aggression, the high energy prices resulting from the war, have boosted the ruble so that it is now the best-performing currency against the dollar. Russia’s energy exports may have declined due to Western sanctions but their value has increased. As buyers of Russian oil and gas lessen, others are stepping into the breach, including India. More importantly, the sanctions are pushing Russia closer to China, American’s main economic, political and military adversary.

Russia and China have both made moves to de-dollarize and set up new platforms for banking transactions outside of SWIFT that skirt US sanctions. The two nations share the same strategy of diversifying their foreign exchange reserves, encouraging more transactions in their own currencies, and reforming the global currency system through the IMF.

As Foreign Affairs puts it, “Deteriorating U.S.-Chinese relations incentivize Beijing to join with Moscow in building a credible global financial system that excludes the United States.”

Without taking action to reverse this trend, Washington will see its global standing weaken.

Since 2018, the Bank of Russia has substantially reduced the share of dollars in its foreign exchange reserves, through purchases of gold, euros and yuan. As of March, 2022, Russia was the fourth largest holder of gold bullion, behind the US at no. 1, Germany, Italy and France. The country’s gold holdings have tripled since the first Russo-Ukraine war in 2014, and are estimated at around 20% of the BoR’s total reserves.

China and Russia have drastically reduced dollar usage in conducting trade. In 2015 about 90% of transactions used the dollar. After the trade war between the US and China broke out, the figure by 2019 had dropped to 51%. And that was before the war in Ukraine.

Bilateral currency swaps between Russia’s and China’s central banks helped Russia to bypass US sanctions in 2014. A three-year currency swap worth $24.5 billion, enabled each country to access the other’s currency without having to buy it on the foreign exchange market.

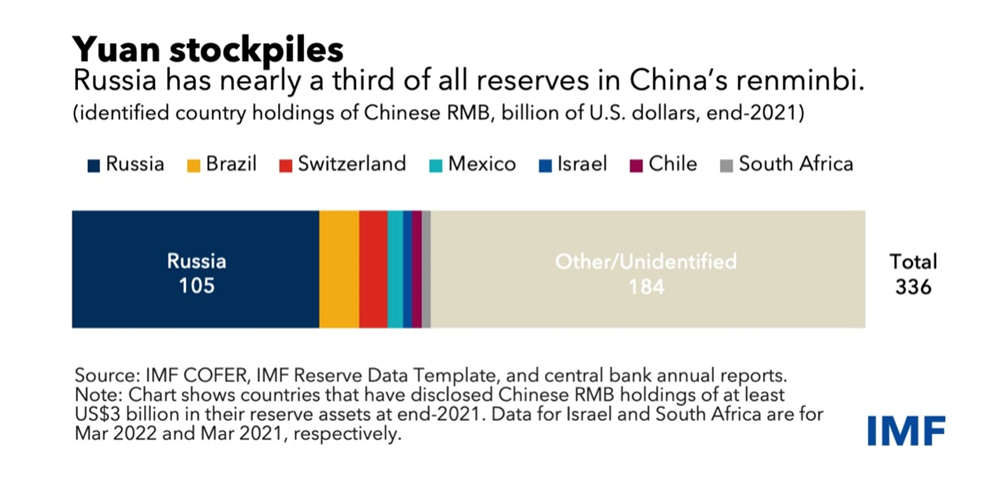

The Bank of Russia in early 2019 purchased $44 billion worth of Chinese yuan, tripling its share of Russia’s foreign exchange reserves from 5 to 15%. Russia’s yuan holdings are about 10 times the global average; it currently has nearly a third of all reserves in China’s renminbi/ yuan.

Major Russian energy companies including Gazprom and Rosneft have stopped using the US dollar, with the euro now the primary vehicle of trade between Russia and China. At the end of 2020 more than 83% of Russian exports to China were settled in euros.

Rise of US debt

A large part of the reason China and Russia want to become less dependent on US dollars, is America’s declining status. This not only has to do with Uncle Sam’s waning influence in global affairs, such as its impotence in stopping the slaughter of civilians in the Syrian civil war, and the withdrawal of US troops from Afghanistan, but its mounting pile of debt.

A country as highly leveraged as the United States risks defaulting on its debt, as Russia did in June, after Western sanctions shut down payment routes to overseas creditors.

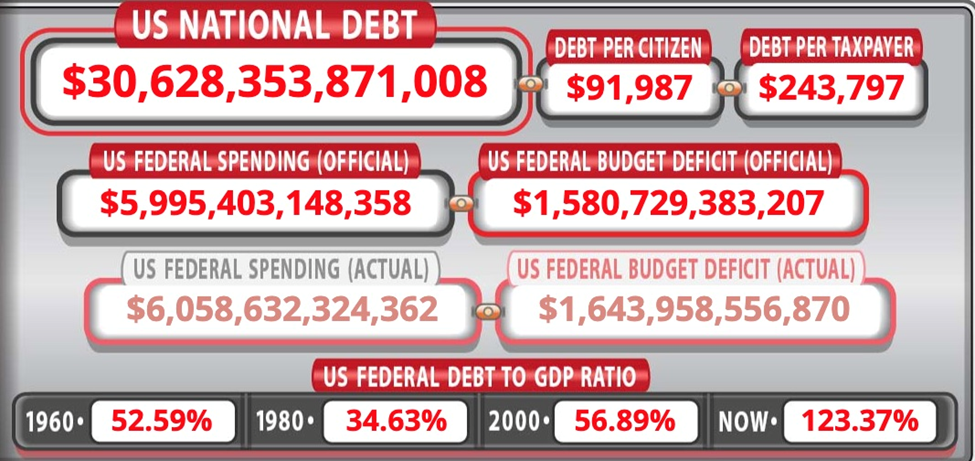

The national debt currently sits at $30.6 trillion, with interest payments amounting to nearly $600 billion. Each interest rate rise means the federal government must spend more on interest. Higher debt servicing costs take away from other spending that that will have to be cut, as the government tries to keep its annual budget deficit under control.

In the second quarter of 2022, the amount of household debt topped $16 trillion for the first time, as 40-year-high inflation pushed many Americans into using credit cards for purchases and existing debt obligations increased due to higher interest rates. The debt gains were reportedly focused on mortgages and car payments.

Credit card balances increased by $46 billion and were 13% higher than a year ago, which Fed researchers said was the largest gain in more than 20 years. According to Freddie Mac, after four Federal Reserve interest rate hikes this year, 30-year mortgage rates have risen to 5.4%, up more than 2 percentage points since the beginning of the year. The most highly-leveraged homeowners are in danger of falling behind on their payments, or at worst, having their banks foreclose.

The Congressional Budget Office has warned that US federal debt is expected to hit 185% of GDP within the next 30 years, which seems entirely possible, given the current debt to GDP ratio is 123%.

As explained above, China and Russia have both indicated their disinterest in holding US Treasury debt, and have sold substantial amounts of their dollar-denominated holdings.

At the beginning of 2018, Russia held almost $100 billion worth of US Treasury bonds, but by early 2020, that figure had fallen to about $10 billion. As of April 2022, its Treasury holdings were just $2 billion.

Dollar alternatives

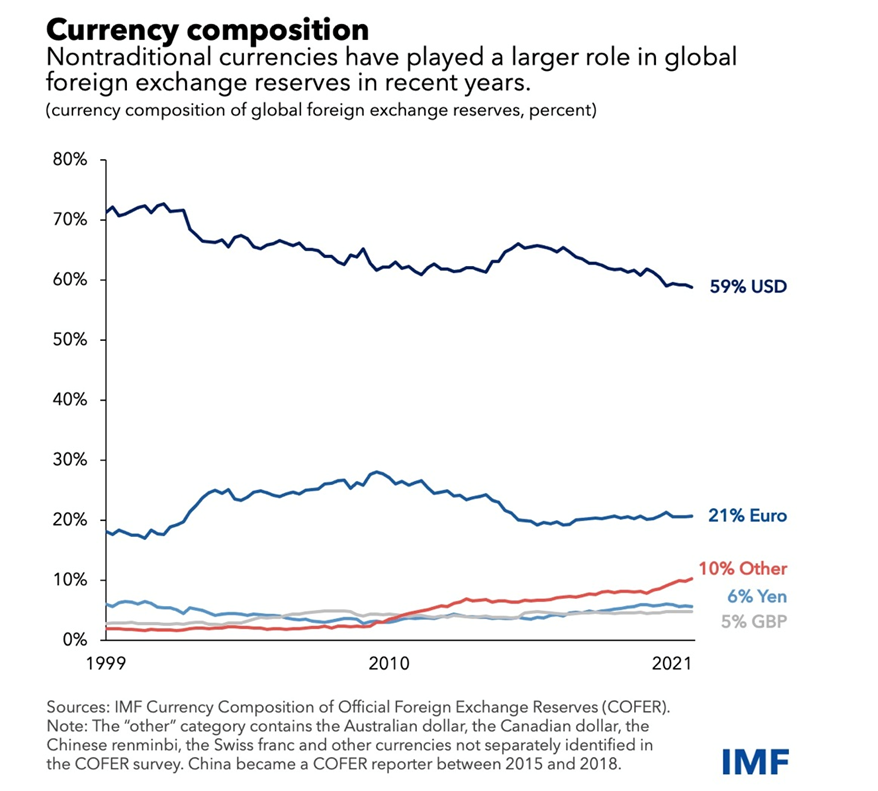

According to the International Monetary Fund, as of the first quarter of 2022, 59% of global foreign exchange reserves were denominated in dollars, followed by the euro in second place at 20%.

This begs the question, if the US dollar were to be replaced, or made to compete with, another currency, what would it be? There is increasing evidence of a plan by the BRICS countries (Brazil, Russia, India, China, South Africa), to substitute the USD with a new global reserve currency.

At the 14th BRICS summit in June, Russian President Vladimir Putin said “The issue of creating an international reserve currency based on a basket of currencies of our countries is being worked out.”

Further details are purely speculative, but in a recent Toronto Star column, well-known mining CEO and financier Frank Giustra predicts that, This new currency would be used solely for settling trades between nations as opposed to a reserve currency that central banks normally use for diversification.

Another commentator, ING’s global head of markets Chris Turner, believes that Russia’s move to create a global currency to challenge the US dollar, came after Western sanctions over the Ukraine war all but cut the country out of the global financial system, curtailing its access to dollars.

(The United States and its allies froze the Central Bank of Russia’s reserves, a war chest worth almost $630 billion. This removed the country’s means of stabilizing its currency by purchasing rubles with dollars. The Kremlin then moved quickly to protect the ruble by raising interest rates to 20% and imposing capital controls. It then demanded that all “non-friendlies”, meaning the West, could only use rubles or gold to buy its oil, by far Russia’s largest export commodity.)

“The speed with which western nations and its allies sanctioned Russian FX reserves (freezing around half) no doubt shocked Russian authorities,” Markets Insider quoted Turner saying.

He suggests the sanctions likely encouraged Moscow and Beijing to work on an alternative to the IMF’s “special drawing rights”. SDRs are based on a basket of currencies made up of the US dollar, the euro, the British pound, the yen and the yuan. Turner says a BRICS currency basket could attract the reserves not just of the group’s members, but also countries already in their range of influence, including nations in South Asia and the Middle East.

Meanwhile, according to the IMF, central banks are looking to diversify their holdings into currencies like the Chinese yuan, as well as non-traditional areas like the Swedish krona, the Canadian dollar and the South Korean won.

Commodity-backed currency

Over the past five years that Russia has been dumping US dollars, it has also been accumulating gold. The buying spree began in 2014, after Russia annexed Ukraine making it public enemy number 1. According to the World Gold Council, Russia’s gold holdings have gone from around 1,000 tonnes in 2014, to 2,302 in the first quarter of 2022.

Currencies have long been tied to commodities, including the gold-backed British pound, and the US dollar, which became the world’s reserve currency at the Bretton Woods conference of 1944. There, 44 Allied nations agreed on a new international monetary system, whereby their currencies would be pegged to the dollar, which in turn would be pegged to gold at a rate of $35 per ounce.

The system worked reasonably well until 1971, when US President Richard Nixon decoupled the dollar from gold, effectively plunging the nation into default. The move would have devasted the US economy if it wasn’t for the move to create the “petrodollar”. Under an agreement between the United States and Saudi Arabia, the latter agreed to sell its oil in exchange for dollars and a guarantee of US security, thus creating an endless demand for greenbacks.

But as Frank Giustra argues in his column,

The world has changed a lot since 1971. China’s emergence as a global economic power rivalling the U.S. (and the rise of BRIC countries in general), America’s profligacy, its fiscal and monetary irresponsibility (especially after the 2008 crisis), the fact at that central banks’ credibility has been laid to waste and now the end of the globalization experiment, to name a few. Global trade relationships are evolving as well. (Trade between the Russian Federation and the BRICS countries increased by 38 per cent to reach $45 billion in the first three months of 2022.)

Couple those changes with the frequent weaponization of the U.S. dollar through sanctions and the SWIFT system, and you can see why certain countries have been desperately looking for U.S. dollar alternatives. In short, the U.S. dollar feels like a lame-duck currency.

Moscow and Beijing have been quick to pounce on any weakness. As mentioned, in response to Western sanctions, Russia forced European countries dependent on Russian gas exports to pay in rubles or gold.

In asking whether a new commodity-backed global reserve currency backed by China and Russia could become a reality, the Epoch Times notes that trade between Russia and the BRIC nations during the first quarter of 2022 increased 38% to $45 billion. Russia recently edged Saudi Arabia to become China’s biggest oil supplier. The Saudis and Iran have begun accepting Chinese yuan instead of dollars for their oil.

Giustra also addresses the question, noting that Putin has started making noises about a gold-backed ruble. In fact “The writing is on the wall that some kind of change is imminent,” he writes, adding that according to Credit Suisse, this new economic order will revolve around commodity-based currencies and that such currencies will weaken the euro-dollar system.

We’ve already quoted experts who say that a new global currency could either be an alternative to the IMF’s special drawing rights (SDRs), or be used only for settling trades between nations as opposed to a reserve currency used by central banks.

Epoch Times argues that For this currency to have real value it needs to be backed by more than the credit of the governments of BRIC nations. It must be backed by commodity reserves.

The publication also notes that, As political and social foundations are uprooted and challenged around the world and if inflation continues to exacerbate, a new reserve currency backed by gold and oil — in other words, real assets — could be formidable.

The end of the dollar?

Despite all that is happening to challenge the dollar, I personally don’t believe the end is nigh for the all-important buck. Some believe the Chinese yuan will emerge as a successor, but color me skeptical. The yuan only represents 2% of global exchange reserves, largely due to capital controls imposed by the Chinese government.

The more likely scenario is a BRICS-based basket of currencies anchored to say gold and oil that competes with the dollar without replacing it. This new currency would probably be used to settle trades between countries, rather than as a reserve currency bought and sold by central banks — a role the dollar would maintain.

The result might be a less stable international order, since it presumes a world divided between free-market economies, that continue to follow the dollar, and countries that align with authoritarian regimes, such as Russia, China, Saudi Arabia and Iran, that have pursued, and probably will continue to chase, an alternative global currency. For more on the emergence of a two-bloc world and “friend-shoring” click here

A couple more of Giustra’s points are worth mentioning. First is the fact that all global reserve currencies have a shelf life. Presumably the dollar is no exception:

For 400 years, global reserve currencies have come and gone. The reserve currencies of Spain, the Netherlands, and Britain (to name a few) typically have a lifespan of, give or take, 100 years.

Second is how a gold-backed currency could actually work. Giustra references economist Jim Rickards, who explained to him that a currency doesn’t have to be fully backed by gold, it could be partially backed. For example, when the British pound was backed by gold 100 years ago, all the currency in circulation and the money kept in UK bank reserves was only 20% backed by gold. The upshot is that two countries, i.e., Russia and China, could conceivably create a settlement trading currency (different than a reserve currency), that would require a lot less gold. It’s interesting to note that if China went to a currency 40% backed by gold, based on an M0 money supply of $1.4 trillion, it would need $560 billion worth of gold, which is around the same amount, 8,200 tons, that the US holds in its official reserves.

To be sure, the United States will not easily give up the dollar’s role as both the reserve currency and as the monetary unit in which trade payments are settled. Wars have been fought over less and I expect that any serious threats to USD hegemony will be seriously resisted.

On the other hand, I agree with Giustra that, In the end, market forces might dramatically reduce the number of U.S. dollars needed and its value would decline accordingly.

I’ll leave you with one tantalizing fact: If the US went back to a gold standard, even at a 20% gold backing of its M0 money supply, gold would have to be revalued to $7,500 an ounce.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.