Lower copper price due to Chinese lockdowns is only temporary

- Home

- Articles

- Metals Battery Metals

- Lower copper price due to Chinese lockdowns is only temporary

2022.05.24

Copper is one of our most important metals with more than 20 million tonnes consumed each year across a variety of industries, including building construction (wiring & piping,) power generation/ transmission, and electronic product manufacturing. The red metal is also a key component in transportation; electric vehicles use about four times as much copper as regular internal combustion engine vehicles.

A combination of supply disruptions, historically low copper stockpiles and higher energy costs, propelled copper to a new all-time high of $4.94/lb on Friday, March 4.

Since then, the base metal has lost momentum mostly because of lower demand in China, the world’s biggest consumer of copper end products.

The latest data shows China’s copper imports fell 4% in April, year on year, as the return of covid-19 forced lockdowns of several Chinese cities including Shanghai, hurting manufacturing and consumption.

Lower Chinese demand on account of Beijing’s “zero-covid” policy saw copper futures slide to an 8-month low of $4.06/lb on May 12. Also weighing on prices is the strength of the US dollar. The USD Index (DXY) is currently sitting at 102.96, having started the year at 96.21, as higher interest rates designed to fight inflation, combined with recession fears, fuel demand for the safe-haven currency and dollar-denominated investments. A higher buck makes all commodities priced in dollars, including copper, more expensive for holders of other currencies.

Despite this bad news, copper futures bounced to $4.28, Tuesday, on expectations that China will ease restrictions. Below we dive deep into copper’s recent price slippage, while keeping an eye on the bigger market picture, which in our view, is inherently bullish.

Demand in focus

The Globe and Mail reports that funds started raising bear bets on the CME copper contract around the third week in April. Despite protests at two of Peru’s biggest copper mines (more on that later) knocking out a fifth of the country’s production capacity, the focus rapidly turned to the demand side of the copper equation, namely the continuing war in Ukraine and the lockdowns in China braking demand for the metal.

China locks down

As The Guardian reports, The full lockdown of Shanghai and Covid curbs on hundreds of millions of consumers and workers in dozens of other cities have hurt retail sales, industrial production and employment, adding to fears the economy could shrink in the second quarter.

In April the Caixin Manufacturing PMI sank to a two-year low, falling to 46 from 48.1 in March, which is the steepest decline since the pandemic started in March, 2020. The Caixin PMI is the leading indicator of Chinese economic strength.

Also last month, China’s jobless rate rose to 6.1%, almost matching the 6.2% figure seen in the early days of the pandemic. Official figures show retailers and manufacturers have been hit hard. Retail sales in April fell 11.1%, year on year, worse than March’s 3.5% drop and the biggest contraction since March 2020. Industrial production slowed by 2.9% compared to a year earlier, as measures to stop the spread of the virus impacted supply chains.

“The ongoing lockdowns will make it more challenging for China to meet its 5.5% economic growth target for 2022, especially since the current quarter appears likely to be weak, with some economists saying a negative gross domestic product number is a possibility,” wrote Reuters metals columnist Clyde Russell, in early May.

And eases

Yet there is light at the end of this tunnel, and no, it isn’t a train. On Monday Shanghai set out plans for a return to a more normal life, with the city’s mayor saying the opening will be carried out in stages.

The announcement came after three straight days of no covid infections, the government’s prerequisite to start easing the harshest elements of the lockdown and broadly resume business activity.

Movement curbs are expected to be eased on May 21, with full production by mid to late June.

The more interesting question is how easing restrictions will play into Chinese President Xi Jinping’s efforts to win a third term in office. China’s zero-covid strategy has drawn rare criticism from the director general of the World Health Organization who said it was not sustainable in the face of the highly transmissible omicron variant.

As NBC News reports, His comments came after President Xi Jinping reaffirmed his commitment to China’s Covid strategy, which has kept cases and deaths far below those in the United States and other countries. A shift in course could threaten his plan to secure an unprecedented third term at a Chinese Communist Party congress later this year, analysts say.

In other words, Xi must walk a tightrope between opening up China’s economy and potentially losing face over zero-covid by accepting more cases, hospitalizations and deaths, or further crimping economic growth by allowing the lockdowns to continue.

Signalling which side he is leaning towards, China this week lowered the mortgage rate for first-time homebuyers. The central bank on Sunday cut the lower range of rates from 4.6 to 4.4%, in what Bloomberg described as “one of China’s most significant nationwide efforts yet to boost the ailing housing market.”

Seasonality

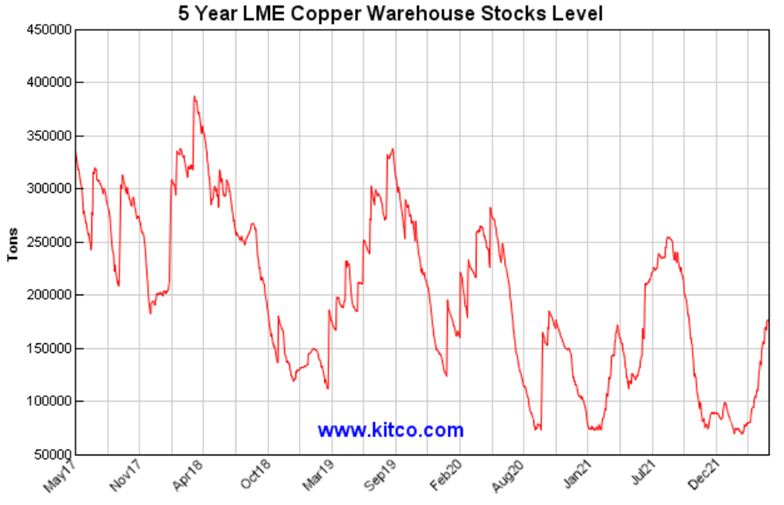

Back to the copper market, bears are pointing to the restocking of London Metal Exchange warehouses as connected to price weakness. The 5-year chart below does indeed show the reversal of a downward trend that has lasted several months, but experienced copper market observers know that this happens every year.

It’s normal for buildups to occur in January and February, because of relatively low winter demand, weather-related port closures and the Chinese New Year, also known as the annual Spring Festival, when a lot of business activity grinds to a halt. This year it fell on the calendar between January 31 and February 6.

There may be other reasons for rising copper warehouse levels. Andy Home, the Reuters metals columnist, noted in April “It’s possible that consumer reluctance to accept Russian brands is behind the recent inflow of metal to LME warehouses.”

Either way, there’s no getting around the fact that copper supply, or more specifically, the lack of it, is ultimately driving the copper price, more so than demand. The former is structural, the latter is temporary.

Supply woes

Copper’s current price strength is underpinned by how tight the copper market is, and is expected to be in future.

Much more copper is required for the mining industry to avoid a supply crisis that is all but guaranteed within a few years.

In March, the head of base metals supply at CRU, a leading authority on copper, said the global copper industry needs to spend more than $100 billion to build mines able to close a projected annual deficit of 4.5 million tonnes by 2030. The next decade, the supply gap widens to 6Mt.

Other analysts think the supply crunch will come much sooner.

S&P Global Market Intelligence predicts that due to a shortage of projects, copper supply will lag demand starting as early as 2025, with global mine production dropping from last year’s 21Mt to roughly 15.9Mt in 2030.

In fact, the coming supply crisis is manifesting as we write, with some of the world’s largest copper miners proving unable to produce as much as they said they would. BHP, Rio Tinto, Anglo American, First Quantum Minerals and Glencore have all pared back production forecasts, blaming higher costs for their lower output figures.

Following a 14% drop in copper production in Q1, Glencore cut its 2022 guidance by 3% or 40,000 tonnes.

“Supply disruptions in various locations are putting production at risk,” Morgan Stanley analyst Amy Sergeant told Bloomberg earlier this month. “Risks to supply are rising in the near term, which could keep the copper market tighter in the second quarter.”

Peru is currently the best example of a jurisdiction where supply is under significant threat. The world’s second largest copper producer behind Chile, could reportedly lose out on up to $53 billion in mining investment, if protests that are denting mine output continue.

The Andean nation has been wracked by social unrest since socialist President Pedro Castillo was elected last July. Communities feeling left out from the country’s vast mineral wealth are rising up, emboldened by Castillo’s election pledge to redistribute state revenues from mines.

According to investment bank RBC, the protests could stall future projects representing up to 12% of world’s copper supply. A central bank report shows investment dipping 1% this year and 15% in 2023.

Among the affected mines, Southern Copper’s Cuajone mine was shut down for almost two months earlier this year; Las Bambas owned by China’s MMG suspended operations in April after an invasion of the mine by communities demanding what they called ancestral lands; and major projects worth billions like Southern Copper’s Tia María, Michiquillay and Los Chancas, Buenaventura’s Trapiche, and Rio Tinto’s La Granja remain up in the air.

In neighboring Chile, the world’s top copper producer, some good news recently came to the industry, after the country’s constitutional assembly rejected a proposal from an environmental committee seeking to tighten rules related to natural resource protection.

The committee has until July to complete the draft of a new constitution that Chileans will vote on Sept. 4.

Conclusion

The copper price is down from a record high set in March, but this is hardly surprising given current stock market palpitations, concerns over global growth due to widespread inflation and accompanying interest rate hikes, and the unfortunate return of covid-19 to China, that has resulted in lockdowns of major cities, sucking the wind out of the sails of copper demand, that up to a few weeks ago, was blowing hard.

Look, copper prices usually retreat this time of year on account of seasonal warehouse stockpiling. Inventories normally build up in the first two months of the year due to low winter demand, weather-related port closures and the Chinese New Year. Most of the downward price pressure is due to seasonality and what’s been happening with covid-related movement restrictions in China, that are now being lifted.

As business activity ramps up over the next few weeks, we expect the focus to shift from copper demand back to supply, in particular the protests in Peru and lower than expected mine output. So far this year, forecasts have disappointed, mainly due to higher costs, i.e., inflation.

When the copper bull market resumes, we’ll be keeping a close eye on our two favorite copper juniors, Max Resource Corp (TSXV:MAX, OTC:MXROF, Frankfurt:M1D2) and Pampa Metals (CSE:PM, FSE:FIRA).

Pampa has a 100% interest in eight exploration projects prospective for copper and gold in northern Chile. At its Block 4 project in March, Pampa reported assay results up to 0.26% copper, including 24 meters @ 0.14% Cu, and up to 0.64 grams per tonne gold, including 24m @ 0.25 g/t.

This was followed by the announcement of a large-scale soil sampling program at the Buenavista target, together with a plan for a first-pass drill program.

For over the past two years, Max has not only been discovering high-grade copper zones on its flagship CESAR property, but expanding these areas, moving ever closer to confirming the existence of a massive sediment-hosted system.

We’re expecting plenty of news flow from both companies over the coming weeks.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Pampa Metals (CSE:PM). PM is a paid sponsor of his site aheadoftheherd.com

Richard owns shares of Max Resource Corp (TSXV:MAX). MAX is a paid sponsor of his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.