Renforth begins 2022 fieldwork at Surimeau

2022.05.14

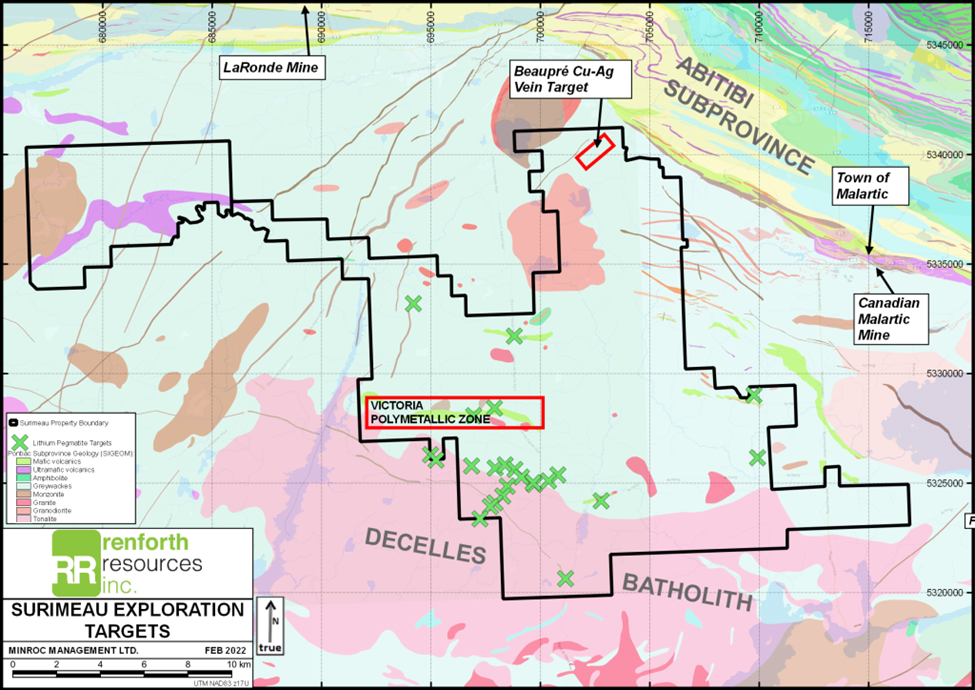

Renforth Resources Inc. (CSE: RFR) (OTCQB: RFHRF) (FSE: 9RR) has begun its 2022 field program on the Surimeau district property in Quebec, following up on a comprehensive list of targets previously identified along the mineralized Victoria structure (~20km long), with an emphasis on lithium mineralization present on the property.

2022 Fieldwork

The 2022 field program will focus on prospecting the extent of the mineralized Victoria structure that is proven mineralized at its western end (Victoria West) and its eastern end (Colonie), with specific attention paid to the utms for the coincident EM anomalies, looking for outcropping mineralization.

Up until now, Renforth has mainly focused on the polymetallic “battery metals” package of nickel, cobalt, copper, zinc, platinum and palladium that is present in six known areas of the property. This time, the company is looking to broaden its exploration efforts at Surimeau by including lithium.

To do this, it will first reassess samples on hand that returned above background lithium values as part of standard testing of samples. Several of these samples, including from the north of the property and the Victoria West area, will be assayed with a lithium-specific assay package.

Samples from last year’s stripping program at Victoria West returned consistent surface nickel/cobalt/copper/zinc mineralization in assay, but were not analyzed for lithium. An inspection of core from the 2021 drilling at Surimeau gave Li values >250ppm (see below).

The Renforth team will then visit known lithium and pegmatite occurrences at Surimeau, including at Colonie where surface sampling returned 191 ppm Li in a prospecting grab sample taken for survey purposes. This area, plus other new areas, will be investigated.

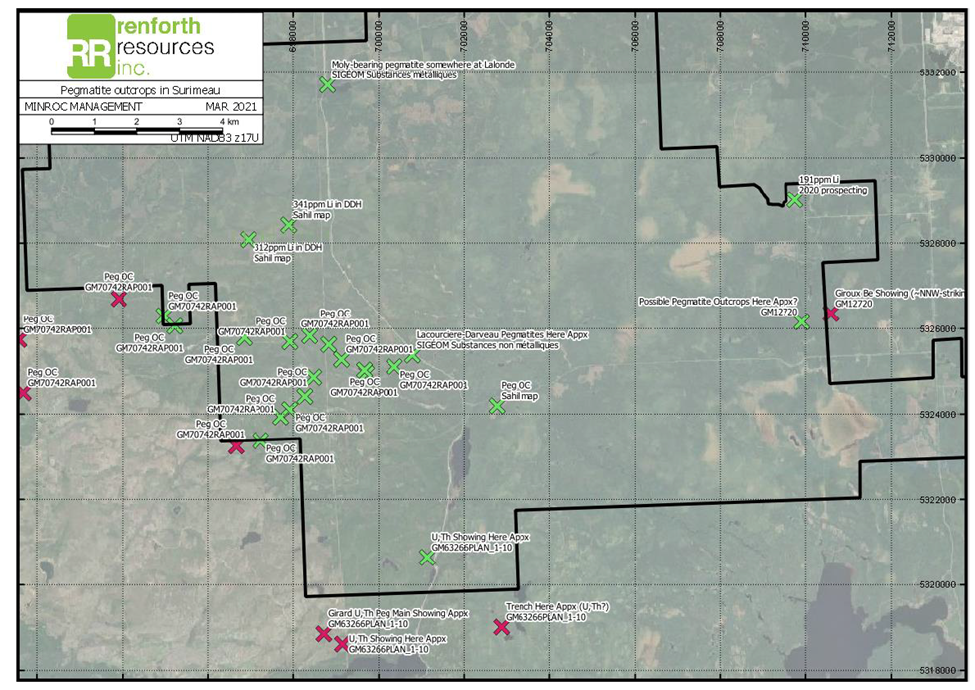

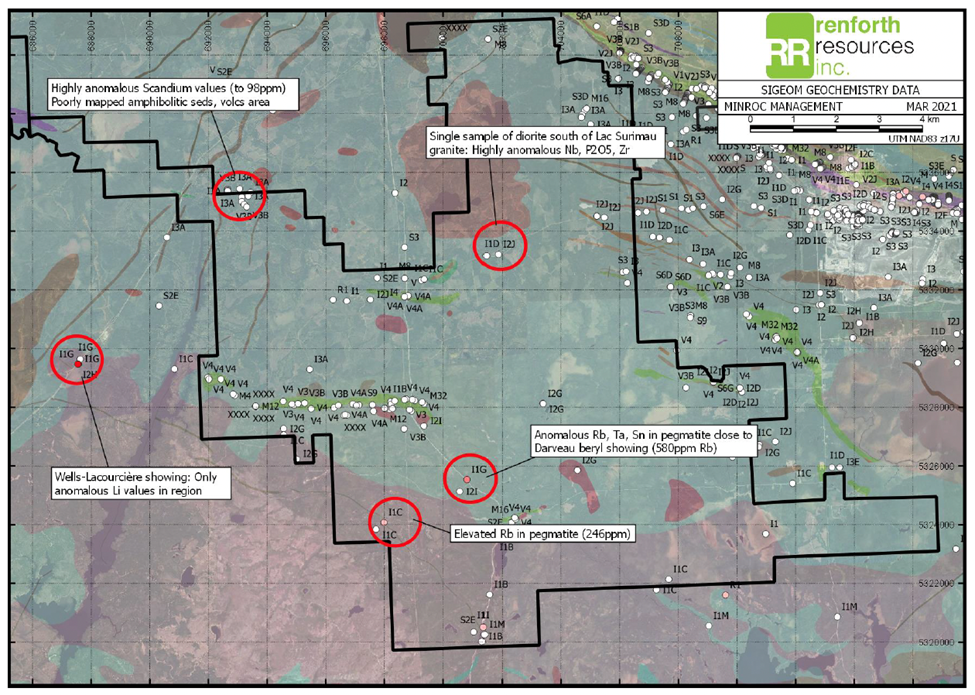

As shown above, the Surimeau district property hosts numerous pegmatites, as historically documented and identified by the Renforth geological team in the field. In several instances, lithium is also present in the same location.

In a recent AOTH interview, Renforth CEO Nicole Brewster confirmed that “Our own geologists have logged the pegmatites, the pegmatites have also been historically logged, and then we have a new director, Ms. Aline Leclerc, who did a lot of the work for the government in the 80s on the property and she’s aware of pegmatites, but at the time nobody was looking for lithium.

“We have the Decelles batholith in the southern part of the property. The batholith is where there’s a lot of documented pegmatites, it is very prospective ground; it’s where they would typically occur in Quebec, in the margins of batholiths, so once the snow is off the ground we can go down there and prospect those pegmatites and look at other areas where nobody’s bothered to look,” she added.

“So, we will be visiting that area as well as some documented pegmatites in the north and we’ll be revisiting the core that we’ve already drilled at Surimeau because we’re getting lithium numbers in our own drilling, and the guys have noted magnetic occurrences and such.”

On top of lithium, Renforth will also look for rare earth elements by following up on various geochemical anomalies in the SIGEOM system to determine if they are pegmatites and/or REE occurrences. This includes a highly anomalous scandium value in the NW portion of the property that is 3x higher than any other scandium value in the dataset. At this location, the REEs dysprosium and neodymium also gave unusually high values.

In addition to this unique occurrence, other geochemical anomalies at Surimeau will be investigated including the Lac Surimeau diorite, which is associated with known gold occurrences at Surimeau (see below).

The southern end of Surimeau forms the northern part of a property previously bulk sampled for uranium. In the interest of fully investigating the potential of Surimeau, prospecting will be carried out with the potential presence of uranium in mind.

EM and Mag Survey Completed

Renforth recently completed a detailed airborne survey over the structure between the Victoria West polymetallic battery metals system and Colonie showing in the east. The survey covered the ~6km strike of Victoria West, the Colonie showing and the unexplored ~14km between the two mineralized areas, which are joined by the ~20km magnetic anomaly at Surimeau.

The survey also extended to the north to include the LaLonde area, where polymetallic mineralization has been drilled historically over a strike length of ~2km, verified by Renforth’s own surface sampling.

The geophysics led to the identification of EM anomalies throughout the length of the Victoria structure, as well as a considerable amount of anomalies beyond the extent of any recent drilling or trenching at LaLonde.

Results of this survey, the interpretation of which is still ongoing, will be used by the Renforth team to plan a 20,000m drill program on the Victoria trend to be carried out this fall.

About Surimeau Property

The Surimeau district property in Quebec is host to several target areas for industrial metals (nickel, copper, zinc, cobalt). The property covers 330 sqkm of area south of the Cadillac Break, a major regional gold structure.

The exploration focus at Surimeau has been the sulfide-nickel-rich VMS targets, in particular the Victoria West prospect, which has been the site of drilling for over a year.

According to Renforth, information gleaned from drilling and trenching, along with surface sampling, creates an area of interest that includes about 5km of strike on the western end of a 20km magnetic anomaly.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside, and is intermingled with, VMS-style copper-zinc mineralization. So far, only 5,626m have been drilled, yielding results that allude to the presence of a large polymetallic camp richly endowed with nickel, copper, cobalt and zinc, along with some PGEs (platinum group elements).

This basket of minerals could potentially be expanded to include lithium, REE and uranium, depending on how the spring 2022 prospecting program turns out.

Rare Style of Mineralization

To fully understand the potential scale of a mining project, it’s always helpful to make comparisons with past producers that share similar geological traits.

The Surimeau property occurs within a unique geological setting where two types of mineralization, formed from different geological processes, are “mashed together” in one distinct orebody. It is best described as a magmatic nickel sulfide deposit, juxtaposed with a copper-zinc volcanogenic massive sulfide deposit.

The first type of deposit, which may contain nickel, cobalt and platinum group elements (PGEs), is associated with ultramafic rocks. The second type, volcanogenic massive sulfides (VMS), was formed on or near the ocean floor during ancient underwater volcanic activity.

VMS deposits are sought after for mining because they usually contain a mix of base metals such as zinc, lead, copper, and sometimes precious metals including silver and gold. The minerals usually form massive sulfide mounds or layers, making them relatively easy to extract.

Surimeau’s mixed style of mineralization is rare, however, it is known to occur in the Outokumpu district of eastern Finland.

Outokumpu contains sulfide deposits with economic grades of copper, zinc, cobalt, nickel, silver and gold. Mining took place from 1913 to 1988, and involved the exploration of three deposits — Outokumpu, Vuonos and Luikonlahti. Approximately 50 million tonnes of ore, averaging 2.8% Cu, 1% Zn and 0.2% Co, along with traces of Ni and Au, were mined.

Geologists believe that Outokompu’s unconventional deposit type originated through deposition of copper-rich ore on the seafloor around 1,950 Ma. Some 40 Ma later, disseminated nickel sulfides formed through chemical interaction between massifs (blocks of rock) and adjacent black schists.

A 2007 geological paper states that the mixing of these two “end-member” sulfides (i.e. the primary Cu-rich proto-ore and the secondary Ni sulfide disseminations) resulted in the uncommon metal combination of the Outokumpu-type sulfides. Late tectonic solid-state remobilization, related to the duplexing of the ore by isoclinal folding, upgraded the sulfides into economic deposits.

As for how closely Renforth’s Surimeau deposit resembles the size and qualities of the Outokumpu district, it’s too early to say. Nevertheless, the scale of this district is encouraging.

Moreover, the Finnish deposit contains a confluence of elements that yields a large suite of base metals. If Renforth can delineate a similar mix, there is a good chance they can be mined as a single unit like at Outokumpu, and processed into separate concentrates.

Conclusion

Setting aside its unique geological setting and prospective scale, what’s truly appealing about Renforth’s Surimeau deposit is that it is essentially a polymetallic system containing almost every essential mineral needed for the clean energy transition.

Borrowing a quote from Renforth’s chief executive Nicole Brewster, this represents a “complete basket of metals you need for electrification, for the storage of energy.”

With the 2022 fieldwork at Surimeau now underway, focusing specifically on the key battery metal lithium, we could be looking at further development opportunities on this district-scale property.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.055; 2022.05.11

Shares Outstanding 262.3m

Market cap Cdn$14.4m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.