Quebec becoming a battery metals hub with support from industry and government

- Home

- Articles

- Metals Battery Metals

- Quebec becoming a battery metals hub with support from industry and government

2022.03.31

Meeting new emissions targets being set by countries like Canada, the US, Britain, and Japan, will mean large-scale deployment of electric vehicles, renewable power, and electrical transmission, all of which will require copious metal content.

With an abundance of battery metals and cheap hydroelectric power, particularly in British Columbia and Quebec, Canada is uniquely positioned to become an EV leader, from the mining and processing of metal ores, all the way up to the manufacture and assembly of electric and hybrid vehicles.

Up to now, Europe and China have dominated EV sales and battery-manufacturing plants, but that is starting to change.

A North American EV supply chain, from mine-site to showroom, is still in its infancy, but progress is being made. One year ago CNBC reported that General Motors and South Korean battery-maker LG Chem will invest over $2.3 billion in a second EV battery plant, in Tennessee.

Other large automakers and battery companies are jumping on the EV train, including Ford Motor Co. and SK Innovation, another South Korean battery manufacturer. The latter and LG Chem struck a $1.8 billion deal in 2021 to end a trade dispute between them, allowing SK to finish building a lithium-ion battery plant in Georgia, that will supply batteries to Ford and Volkswagen.

US, Canadian initiatives

Climate change and associated spending has become a key priority under Joe Biden’s presidency, a significant departure from the previous White House under Trump.

The Biden administration allocated $6 billion as part of a huge infrastructure bill aimed at developing a US battery supply chain and weaning the auto industry off its reliance on China. In a July 2021 report, the White House said the number of mineral commodities for which the US is reliant on imports for more than a quarter of demand, has jumped to 58 from 21 in 1954.

According to Bloomberg, copper is largely seen as the most critical metal by volume needed to power electric vehicles and the energy transition, and for good reason. Electrification literally does not happen without the red metal, which is heading towards a multi-year structural supply deficit as early as 2025. Copper prices have more than doubled in the past two years and there is a lot more copper in an EV than any of the battery metals, including lithium, nickel, cobalt, manganese and aluminum. It’s in the motor, the wiring, and the charging stations.

An average EV contains 20.7 kg of lithium, 15.7 kg of nickel, 12 kg of cobalt and 31 kg of graphite. Copper usage per EV is 83 kg.

Biden is reportedly poised to invoke, as soon as this week, Cold War powers to encourage domestic production of critical minerals for batteries. White House discussions involve adding battery materials to the 1950 Defense Production Act, previously used by President Harry Truman to make steel for the Korean War, and by President Trump to spur production of masks during the pandemic.

An un-named source told Bloomberg that adding minerals like lithium, nickel, graphite, cobalt and manganese to the list could help mining companies access $750 million under the act. The presidential directive would fund production at current mining operations, productivity and safety upgrades, and feasibility studies.

North of the border in Canada, the Liberal government under Prime Minister Justin Trudeau recently said it is planning on spending CAD$400 million to build 50,000 electric vehicle charging stations, on top of half a billion Canadian dollars for charging infrastructure through the Canada Investment Bank and CAD$1.7 billion to extend an incentive program for EV purchasers.

According to the president of the Canadian Vehicle Manufacturers Association, Canada will need 4 million charging stations by 2050, 80 times higher than the 50,000 currently targeted.

The large spending package is part of the government’s plan to require that 20% of new light-vehicle sales in Canada be zero-emissions by 2026. After 2026, the government’s mandate will require that at least 60% of sales are zero-emission by 2030 and 100% by 2035. Trudeau’s stated goal is to phase out gasoline-powered cars by 2040.

Another important part of the government’s Climate Plan is to cut oil and gas emissions by 42%, as it seeks to meet its emissions-reduction goal: 40% less emissions from 2005 levels by 2030.

According to the Financial Times, the two countries are working to create a regional electric vehicle supply chain that has the potential to transform mining in Canada and loosen China’s grip on the mining and processing of battery minerals.

While the country has an abundance of nickel, cobalt, graphite and lithium, it has little domestic production of lithium-ion batteries. That, however is beginning to change.

Three of the world’s largest car companies have announced they are investing in Ontario, Canada’s auto sector hub.

General Motors said it will spend close to $1 billion to produce electric commercial vans in Ingersoll, while Ford will invest C$1.2 billion to start building five battery-powered car models in Oakville from 2025. In 2020, the governments of Ontario and Canada announced they would each spend $295 million to help Ford upgrade its Oakville assembly plant in its transition to EV production. The company thinks electrics will out-sell its traditional models within the next decade.

Not to be outdone, Fiat Chrysler expects to shell out as much as $1.5 billion in creating its electric vehicle platform in Ontario.

Quebec: #6 for Investment Attractiveness

The next-door province of Quebec has also attracted EV investment. Quebec-based Lion Electric announced it will build a battery pack manufacturing plant in its home province. The $185 million factory, funded by the Quebec and federal governments who each committed $50 million, will build lithium-ion battery packs capable of electrifying 14,000 medium and heavy-duty vehicles annually.

“The opportunity is immense,” Bloomberg quotes Scott Bell, CEO of GM Canada, regarding the potential market for electric vehicles in Canada, especially considering that under 3% of new vehicles sold here are currently electric, leaving huge upside: “We certainly see the opportunity to transform that entire fleet to electrification over time.”

The same goes for mining in Quebec. The province was ranked 6th for Investment Attractiveness, in the latest (2020) Fraser Institute Annual Survey of Mining Companies.

Earlier this month General Motors and South Korea’s Posco Chemical announced an agreement to build a plant in Becancour, QC, to produce cathode active materials (CAM) for GM’s Ultium batteries.

CAM consisting of processed nickel, lithium and other materials will help to power EVs including Chevy’s Silverado and GMC’s Hummer.

According to GM Canada’s David Peterson, via Global News, the company chose Quebec as the location for the new US$400 million facility due to its low-cost hydroelectricity, along with “great logistics links and a well-educated workforce.”

Also this month, and also in Becancour, German company BASF SE announced it has secured land for a planned battery materials facility, that would produce and recycle CAM starting in 2025.

BASF already has a partnership with Japan’s Toda Kogyo Corp to produce CAM at plants in Ohio and Michigan, including nickel cobalt aluminum oxide and nickel cobalt manganese oxide.

A media report says Quebec government officials have been talking to electric car companies including market leader Tesla to facilitate building battery cells in the province.

“Quebec has a lot to offer for the supply chain for [electric vehicles]. We’ll start with the minerals – we have lithium, nickel, graphite,” Quebec’s Economy Minister Pierre Fitzgibbon said in an interview with BNN Bloomberg, last November.

The minister confirmed he has had discussions with Tesla executives about potentially supporting the automaker’s battery production.

Battery/ energy metals demand is moving at such a break-neck speed, that supply will be challenged to keep up. Without a major push by producers and junior miners to find and develop new mineral deposits, glaring supply deficits are going to beset the industry for some time.

BloombergNEF estimates that in 20 years, the world’s copper miners must double the amount of global production — from the current 20 million tonnes annually to 40 million tonnes — just to match the demand for a 30% penetration rate of electric vehicles.

This is a tough ask considering some of the world’s largest mines are seeing depleted copper reserves and lower ore grades, so it would be difficult for global production to even maintain a 20-million-tonne-per-year pace.

CRU estimates that without new capital investments, global copper mined production will drop below 12 million tonnes in 2034, leading to a supply shortfall of more than 15 million tonnes.

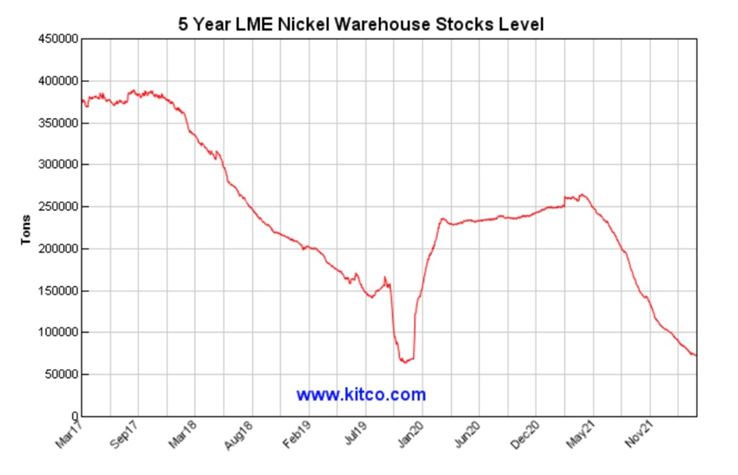

A report by UBS indicates that a deficit in nickel will come into play as soon as this year. By the end of the decade, UBS forecasts a large deficit of 2.2 million tonnes for the battery metal.

A more conservative estimate from Rystad Energy shows that demand for high-grade nickel used in EV batteries will outstrip supply by 2024. By then, global demand will climb to 3.4Mt, compared to 2.5Mt this year, while supply will grow to 3.2Mt.

The gap will then widen quickly to a deficit of 0.56Mt by 2026, driven by surging demand from the battery sector.

That is excellent news for companies on the hunt for minerals that support the electrification of the transportation system, the decarbonization of energy sources, and new spending on infrastructure, both green and traditional/ blacktop.

Renforth Resources

As one of the few junior miners racing towards the next nickel discovery in Canada, Renforth Resources (CSE:RFR, OTCQB:RFHR, FSE:9RR) has the right metals at the right time, embodied in its Surimeau polymetallic project in Quebec.

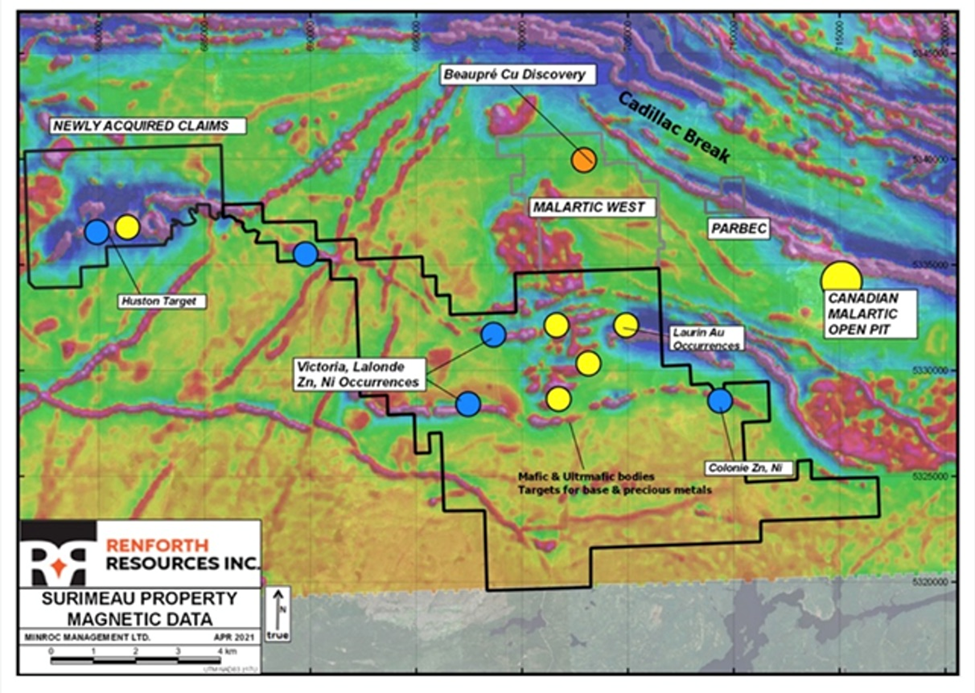

The 330 square-kilometer property (it was recently expanded to include Malartic West, prospective for copper-silver at the Beaupre discovery) hosts several target areas for gold and industrial metals (nickel, copper, zinc, cobalt, silver) located south of the Cadillac Break, a major regional gold structure.

Exploration focus is currently on the sulfide-nickel-rich targets, in particular the Victoria West prospect.

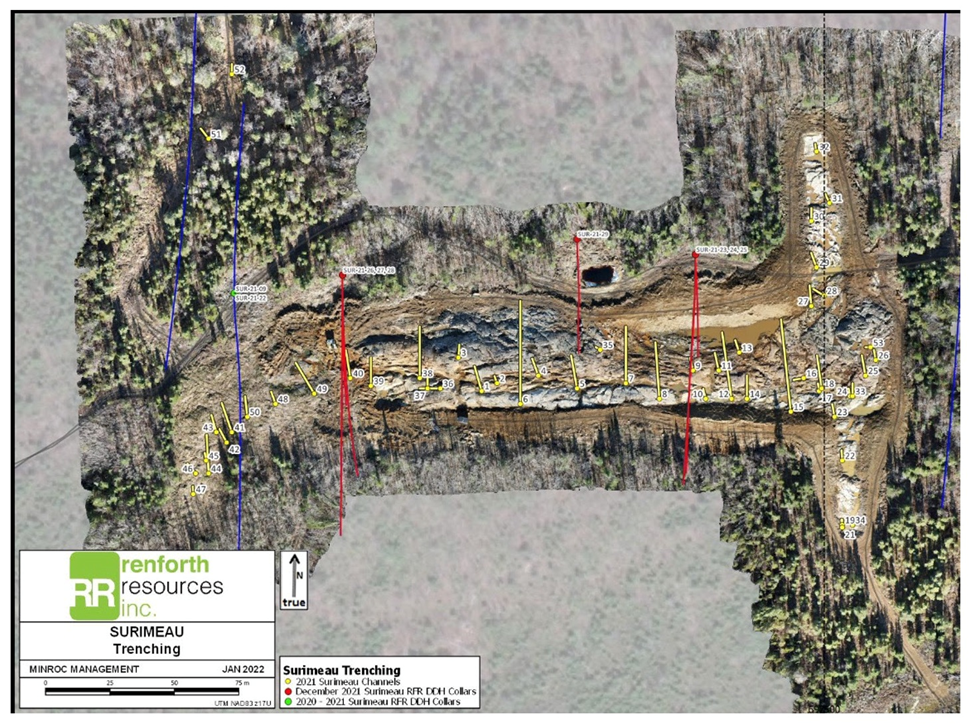

According to Renforth, information gleaned from drilling and trenching Victoria West, along with surface sampling, creates an area of interest that includes about 6 km of strike on the western end of a 20-km magnetic anomaly.

In a recent interview with Renforth’s CEO Nicole Brewster she had this to say regarding Surimeau:

NB: Surimeau is big it’s just over 330 square km including the former Malartic West property. We incorporated Malartic West into the Surimeau property, simply because they share a border.

I staked five different areas of a historic polymetallic nature, copper-nickel mineralization. In Victoria West we know we have, in the ultramafic, nickel and cobalt. and then in the VMS we have copper-zinc. The ultramafic also carries platinum group elements.

In addition there’s areas of gold on the property, we have historic gold results and our own results, and then because we consolidated Malartic West into Surimeau we have the copper-silver discovery we made at Beaupre, in the northeastern corner of the property.

What’s exciting about Surimeau is the polymetallic nature, but let’s not forget it’s road accessible, it shares a border again with the Canadian Malartic Mine, we’re just outside of the town of Malartic, just south of the town of Cadillac and we have hydroelectric power lines from the Rapide-2 and Rapide-7 power generating stations to the south of us running across the property.

We’re also approximately an hour away from the Horne smelter which is Canada’s only copper-nickel smelter

RM: That’s been your focus, Surimeau’s polymetallic battery metals package. But last summer you added another piece to the project, Surimeau holds various pegmatites. It’s interesting that you’re able to add, potentially, lithium to your battery metals package. It kind of makes a complete list.

NB: It certainly does, we’re the complete basket of metals you need for electrification, for the storage of energy.

We know we have pegmatites, in fact we know we have lithium.

The company interprets this anomaly to be a nickel-bearing ultramafic sequence unit, which occurs alongside and is intermingled with VMS-style copper-zinc mineralization.”

Drilling to date has affirmed the presence of a large polymetallic camp richly endowed with nickel, copper, cobalt and zinc, along with some PGEs (platinum group elements).

Assays for the 21 holes drilled at Victoria West were reported last November, with each hole hitting mineralization as expected, and the four deeper holes demonstrating an increase in grade.

Since then, seven new holes (1,203m) have been completed within an approximate 275m strike length, with assays announced this week.

Among the highlights, hole SUR-21-28 assayed 3.46% nickel and 491 parts per million (ppm) cobalt over 1.5 meters, between 196.5 and 198m down hole. The high-grade intercept was within a broader mineralized zone of 170.55m, which averaged 0.16% Ni and 100.2 ppm Co.

A 12 meter-long zone, between 187.5 and 199.5m down hole, averaged 0.54% Ni and 138.7 ppm Co.

According to Renforth, The exceptional 3.46% Ni value points to the high grade potential present at Victoria West, which has only seen 5,626m of drilling by Renforth over 2.2km of strike within the known 6km strike length of Victoria West, in the western end of a 20km long magnetic feature also mineralized at its eastern end.

“I am very happy with these results, they support our interest in Surimeau, an interest which only continues to grow,” Renforth’s President and CEO Nicole Brewster stated in the March 29 news release. “We will soon drill again as we work to define not “whether” there are battery metals within the 6km km long Victoria West area, but instead, answer the question of just how well endowed with battery metals this “hiding in plain sight” discovery really is.”

The company will also be prospecting, following up on the presence of lithium and rare earth elements documented at Surimeau.

In a note to shareholders, Brewster added, “the potential, in terms of size has always been significant. Now, with the results released today, the potential in terms of grade has increased.”

To that I would add the following, for context:

Resource investors are less familiar with nickel grades, measured in percentages, than gold grades which are reported in grams (or ounces) per tonne. If we compare Renforth’s 3.46% Ni hit to gold mineralization of similar value, we get quite an astonishing result.

Using Kitco’s handy “Rocks in the Box” tool, which evaluates the in-situ value of rock based on the grades per mineral plugged in:

3.46% Ni over 1.5m = $1,145.72/tonne = 18.5 g/t gold

We are aware that the current war/ sanction nickel price of $15.02/lb does not reflect normal market reality. So, if we reduce it to $10/lb, roughly what nickel was before the start of the Russia-Ukraine war, in January, we get:

3.46% Ni over 1.5m is equivalent to 12.5 g/t gold over 1.5m.

From this I hope you can see these are quite impressive nickel grades.

Renforth’s Nicole Brewster is right in saying “Today’s news raises the bar for what the rest of Victoria West, and the magnetic anomaly, may contain. And we have the team, time and money to do the work to find out.”

The company has over a million dollars in its treasury, enough to pay for this year’s exploration without having to go to the market for more funds.

I’m anticipating a busy field season at Surimeau and at Renforth’s other main project, Parbec, where the company is developing an open-pit high-grade gold deposit in the vicinity of Canada’s largest open-pit gold mine, Canadian Malartic.

Renforth Resources

CSE:RFR, OTCQB:RFHRF, FSE:9RR

Cdn$0.075; 2022.03.30

Shares Outstanding 262.3m

Market cap Cdn$19.6m

RFR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Renforth Resources (CSE:RFR). RFR is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.