Under the Spotlight – Mills, Aelicks: Getchell Gold Corp

2022.03.30

Rick Mills: Joining me today is Brad Aelicks. Brad is a geologist, founded B&D Capital Partners, a merchant bank that helped his clients raise over $650 million and now manages Pyfera Growth Capital Corp., a private equity investment corporation.

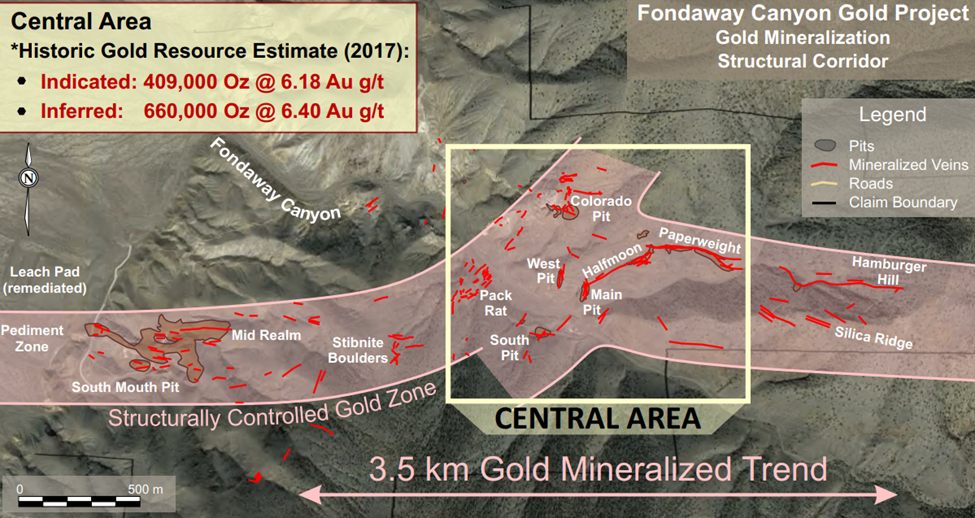

Brad, Getchell Gold (CSE:GTCH, OTC:GGLDF) got their Fondaway Canyon property from Canarc Resource Corp., now Canagold Resources Ltd in January 2020, Fondaway came with a lot of drill holes, a lot of data, and a 2017 technical report with an historical resource of indicated 409,000 oz of gold and an inferred resource of 660,000 of gold. This was hosted in 5.2 million tonnes at an average grade of over 6 grams per tonne. That’s quite a starting point for a company and being in Nevada as well.

Brad Aelicks: It really is Rick, and it’s one of the reasons that captivated my interest in Getchell. You don’t often see that kind of grade as 6 grams is exceptionally high grade anywhere in the world in this day and age. Also most deposits in Nevada are in the 1 gram or sub-1 gram range, while Fondaway Canyon has seven or eight different zones that are all carrying really significant grade into a central mineralized area, so it’s pretty exciting.

RM: Management took all of the data and spent some time studying it, working out a model and they then drilled 16 holes over 2020 and 2021. Now all the results are in. I’m going to say both drill programs are among the most successful drill programs I’ve ever read about.

BA: It really kicked off with a bang, all the work they did studying the enormous amount of data and working up their exploration/ drilling programs has paid off. We had that significant resource you mentioned to start with, and the company also thought they had those numerous zones to grind away on. But in 2020 they had the discovery of three new mineralized zones within the Central Area which included Colorado SW, a really high-grade zone close to surface called the Juniper Zone, and now with the discovery of the North Fork Zone, the last hole that was released in the 2021 program, has just blown away everything that we’ve previously seen on the property, with a spectacular intercept.

RM: The resource is a global resource, it’s mostly in three areas, one of the objectives of the drill programs was continuity of the resource, and of course to increase the size of the resource. Looking at these drill holes and the new high-grade areas do you think they’ve achieved their objectives?

BA: I think they’ve over-achieved on everything that they set out to do Rick.

They started out wanting to expand and tie some of these zones together, the Colorado to Pack Rat as an example, and discovered the Colorado SW. At that same time, at the upper sections of those holes, right at the very surface they discovered the Juniper Zone. And then working over at the Half Moon area, which is just a couple hundred meters to the east of Colorado, following some of the other localized shear zones into this area which includes Silica Ridge, Hamburger Hill, Paperweight, all these high-grade structures coming into the central area, they discover the North Fork Zone with really meaningful intercepts.

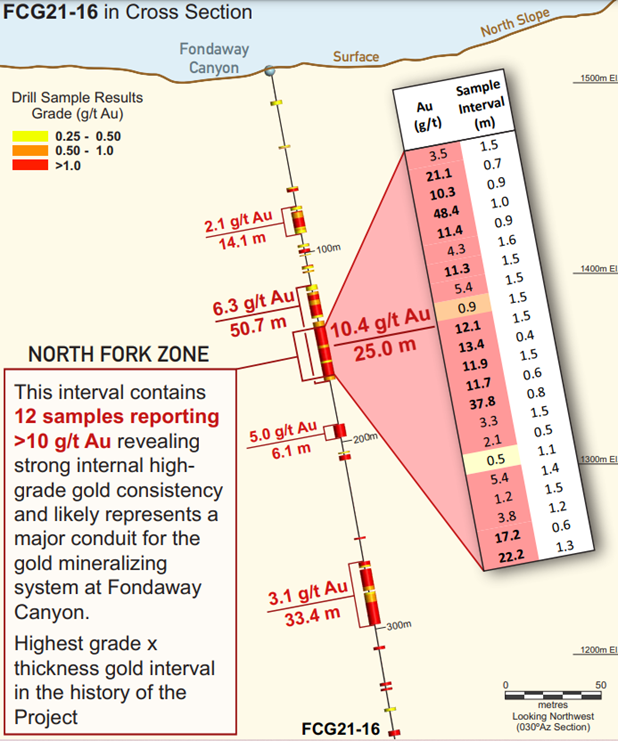

And to top all of that off they follow up with Hole 21-16, the last one in the program, and it had 6.3 grams over 50.7 meters. No matter where you are in the world that is a spectacular intercept and within that there was 10.4 grams over 25m.

What’s so exciting here is this mineral system just keeps on delivering more and more positive surprises all the time, you know when I first looked at it, I hoped to see a pathway to a minimum of 2 million ounces of gold, I thought there was a very clear pathway towards that. Then they came out with all this great news.

Now I think this has a high probability of developing into a Tier 1 asset which would be 3-5Moz potential as they continue to push forward on expanding each of these zones.

RM: Getchell has executed two very successful drill programs in 2020-21, and they’ve secured two drill rigs for the entirety of the 2022 drill program. We are going to get concurrent drill programs at Fondaway Canyon and the Star project, then they are coming back to Fondaway Canyon to accelerate the exploration on that project after the Star’s maiden drill program is completed. Let’s talk about the 2022 program at Fondaway, what we’re trying to accomplish there and then we’ll get into Star.

BA: Ok, so the plan for 2022 at Fondaway is basically to follow up the biggest area of interest currently which is the intercepts on North Fork, these are world-class intercepts, and the area is wide open for expansion.

There’s a couple of things about that intercept that are highly intriguing. The first thing is the top of this zone is only 117m from surface and you’re pulling a 50m intercept of 6.3 grams. Above that there was an additional 14m of 2.1 grams gold. We need to understand what are the controlling structures that have delivered that kind of grade 6.3 grams gold over 50.7 meters.

It appears that this could be some of the first intercepts where the Silica Ridge structure coming in from the east has influenced these higher grades within the central core area, and as we follow that back to the east it gives us a whole new targeted area that we really haven’t even thought about prioritizing for drilling.

The second priority would be expanding the high grade at surface Juniper Zone, and there’s just still so much opportunity for development of further ounces at Colorado SW. So that’s going to remain a major focus.

So main priorities would be tightening up each of these zones in both of those core areas, the North Fork and Colorado SW, in order to prepare our technical teams to be able to deliver an upcoming new resource estimate that is going to, I think, surprise a lot of people once they can see the grade and the magnitude of what’s developing here.

RM: We have to talk about a new resource estimate and open-pit potential almost in the same breath, they are so incredibly intertwined.

BA: Well part of the process that the technical team at Getchell is going through is they’re not just trying to expand a global resource anymore because once they got into the data and started looking at how significant a bunch of these zones are and how cohesive the mineralization is sticking together, it generated a lot of optimism that they can prove an open-pit model. Having these super high-grade intercepts that are so thick, and close to surface, and so many intercepts from all the different zones all coming together into this central core area, it really started to build a compelling case for open-pit potential.

The programs as we move forward are not only going to be increasing the number of ounces that we’re looking for, but they’re also tightening up spacing in between some of these areas that are just going to deliver more and more intercepts of mineralization that is going to fill in the gaps between existing drill holes to be able to deliver a comprehensive package to the engineers.

When they’re getting to the stage where we’re releasing the next resource estimate we’re going to have a lot clearer data on not just grade and tonnes but potential mining techniques that are going to push this thing toward things like preliminary economic assessments and feasibility studies.

RM: When do you think we can expect Getchell’s very first maiden resource estimate?

BA: I don’t have a guidance on that yet Rick, so I’m not going to throw out dates. I do know they’re in discussions with several groups to initiate that process.

RM: It’s a large and complicated undertaking, definitely not ‘here’s some holes, how much gold we got?’

BA: Yes it’s a little more than that. The 2017 resource estimate came in at about 1.1Moz. As you broke it down, in an earlier part of the conversation, the cut-off grade used to come up with that number was 3.4 grams per tonne. If we can tighten up this data enough to look at it from a pit perspective then that 3.4 g/t cut-off is going to drop substantially.

RM: Which means more gold in the new resource estimate.

BA: Most of the 600 holes drilled at Fondaway were quite shallow, a previous operator was looking for heap-leach gold oxide deposits, and they did mine some. But remember there’s still a lot of deeper holes that are in that 100m category that have mineralization shot through it, all over the place, that are in the 0.5 – 3.0 g/t range. None of those intercepts made the 2017 resource estimate, they didn’t make the 3.4 g/t cut-off so they weren’t included in the global resource.

If we start to look at this thing from a bulk-tonnage perspective, all of those sub 3 g/t intercepts, and there’s literally thousands of them, are going to start to play a role in delivering ounces into a global resource. And so it’s not as simple as saying we’ve got X number more holes, if we stuck with the 3.4 gram cut-off we would still be delivering significant additions to the ounces, but if we really look at this thing from a bulk tonnage play there is a real workaround in the database in order to put together a new global resource.

I think there is an extremely high probability now that when the new resource estimate is completed it’s going to move Getchell’s Fondaway Canyon into the upper realms of the development plays in Nevada, I think this is gonna become one of the top projects, going into development on the whole Nevada scene.

RM: The 2017 technical report didn’t include some very significant assay results from at least seven holes drilled by Canarc, so we’re missing some significant drill hole intercepts there, perhaps we can lower our economic cut-off to within an open pit domain, we have our own 16 drill holes from 2020 and ‘21, all hit mineralization, we’ve found new zones, we’ve found higher grade, and we’re going do a major drill program in 2022, I think there’s a large potential for the market to be extremely surprised when we do put out the new resource estimate.

BA: I couldn’t agree more, everything you mentioned is going be very additive to the resource, and when you start combining those results and tying them back into this central area of mineralization it’s now building a very compelling argument that we have a much bigger system here than the 1.1Moz @ the 3.4 gram cut-off that has been described to the market previously.

But the challenge is you can’t just go into an environment like this and efficiently move a resource from a 3.4 gram cut-off to say a half-gram cut-off. We would have new gaps in the data between drill hole intercepts that weren’t previously considered important so this year filling the gaps is a primary focus.

I think the upcoming drill program and combination of the data from the last three rounds of drilling will enable us to tighten up the spacing in these other areas within a pit-constrained context to see if we can deliver a much, much bigger global resource.

It will bring the grade down obviously, but we’re going to be able to include things like 14m of 2.1 grams. Here are some highlights of some of the other intercepts that never would have been included previously.

Hole 3 last year had 2 grams over 49m, hole 5 had 1.8 grams over a 90m intercept, that included 3 grams over 45m. In hole 8 this year we had 2.8 grams over 24.5m, another intercept lower in the hole of 1.4 grams over 30m, I mean these intercepts are not just really decent grades they’re over monster-sized widths. And there’s multiple levels of mineralization throughout the system. Hole 15 is another example from this year, it had 1.2 grams over 33.6m and another intercept of 1.9 grams over 26m, so I mean you’re talking 60 meters of mineralization that would never have been included in anything in the old data set that had the 6 gram resource. Just imagine how much tonnage and ounces are being added in some of these holes.

There are many intercepts like that in the data base as well, that wouldn’t have been included within the old resource calculation, so there’s a lot of work to be done, particularly because the mineral system is so big and there’s so many drill holes.

RM: I have to bring it up that most open pits are significantly lower grade. A lot of people think about 0.4% CuEq porphyries, the average grade of gold mines in the world is just over a gram per tonne, I just want to point out that if we’re successful in delineating an open pit here, the grade’s going to be, in my opinion, extraordinary high for an open-pit.

BA: One of the compelling aspects of Fondaway Canyon is the open-pit/ grade potential.

As an example let’s look at hole 16 (Posted early in interview – Rick) where there’s four totally separate mineralized intervals that all are delivering significant, meaningful potential economic values. At the top intercept you have the 2.1 grams over 14m, then you have 6.3 grams over 50m, below that there’s 5 grams over 6m, below that, lower in the hole, there’s another 33m intercept better than 3 grams.

Look these grades are unheard of in a pit environment. It’s going to be extremely exciting to see how this thing continues to evolve program after program, I can’t wait to see what comes out in 2022.

RM: In addition to what could be an extremely exciting year at Fondaway, we’ve got what I consider one of the better copper exploration projects held by any company in the sector, and that’s the Star project.

Now the Star project has two main mineralized occurrences, the Star Point copper mine, the former producer, and the Star South copper-gold-silver prospect just a few km to the south (the Star project is just northeast of Fondaway).

This is one very exciting project and we are going to have a drill on it in the spring. Could you tell us about this one?

BA: Yes this project has been in Getchell since its inception, it’s been a monster target that we’ve continued to slowly work up over the years, with bits and pieces of data.

The intriguing part about what we’re seeing on surface is that there is what I would refer to as leakage from what appears to be a very powerful system.

The leakage has been mined just in small adits at the Star Point area, what was being mined was pretty high-grade copper with lovely silver credits, and really nice gold credits. So this is a multi-element system that has leakages, every open structure that you walk across on the property has signs of mineralization, and what intrigued me most when I first visited this project was seeing the contact between the upper plate and the lower plate rocks, sedimentary sequences, in Nevada. This is a really critical contact that you see in most of the big mines in Nevada, is the contact between the upper plate and lower plate.

At Star we’re seeing that contact coming right to surface, and as you walk along the contact there are maybe 20 or more old-time pits and adits that have really dug into the hillside and has mined these high-grade, 2%, 3% copper grades in connection with 100-gram silver and some good gold credits in the 1-3 grams.

This structure is pretty tight, it’s only 1-3 meters wide, it does not appear to me to be the main target. We always believed that there is a huge heat source somewhere close by that’s driven these multi-element metals into the outlying fracture systems. They were historically prospected and mined on a small scale by the old-timers.

The challenge for us is not to be distracted by all these “rat holes” and to really step back and look at the project on a broader scale to see if we can find the heat source, and ultimately believe that there is a gold-copper porphyry system that would be driving these metals.

Over time we’ve done multiple geophysical surveys, we’ve done resampling, looked at alteration, we finally have this project worked up to the point where two years ago we did a deep penetrating IP survey, came up with four really good targets that looked like they could all be a cluster of parts of a system that can be driving the mineralization here.

The idea this year is to go in there and test the top two priority targets. We’re looking at being able to put drill holes through these areas where we have leakage coming up to surface in structures, we’re not going to be drilling the actual contact zone, because Star Point itself is not on the contact, it sits out further in the valley from where the contact is exposed in the hillside, but there’s a structural setting there that is also carrying high grades, that is not the contact zone between the upper plate and lower plate, these are steep-standing structures.

Right below these steep-standing structures we’re getting a very good signature by both a resistivity low target and the chargeability highs, which is what we were able to see with a sulfidized porphyry system or heat driver.

So two of those targets will be tested, both of them are going to pass below some known mineralization, going to trend deeper into these chargeability highs, I just can’t wait to learn more about what the potential here is.

Somewhere in here there’s a big driving system and we hope we get lucky this year.

RM: Fondaway is exciting and I think Star offers exploration upside, so you’ve got discovery potential and resource expansion, and the possibility of a high-grade open pit, all in Nevada. It seems like a play that people should have on their radar screen. Anything you want to add Brad?

BA: I think if I was to add one thing Rick it would be when we were talking about a potential resource and the work that needs to be done, I think a good summary there would be that Fondaway Canyon really delivers one of the best gold optionality plays that I’ve seen. By optionality I mean what we have here is an exceptional grade deposit that has the potential to be looked at from two different mining probabilities. As we build the grade or the number of ounces we’re seeing stuff here that you can chase, this 2- to 10-gram material at depth as an underground development anywhere in the world, let alone Nevada which is probably the best place in the world to be.

But having that optionality, if the price of gold is right, and your deposit holds together on some of this lower-grade material to look at it from a large, open-pit system, is really something that a lot of deposits just don’t have the potential for.

In a case like Fondaway, the size of the high-grade resource and the closeness of it to surface, really gives you strong optionality to be able to look at, at least a portion of it from a pit perspective. In addition many of these ounces, everything that you see in these holes that’s over 2 grams with the price of gold where it is, may be underground mineable so you have that opportunity to be able to look at the potential for a combined open pit-underground environment for years to come.

We didn’t talk really about a lot of the other zones, they’re not going be drilled this year but I think it’s important that people don’t forget about the fact that we still have Pack Rat, Hamburger Hill, Paperweight, Silica Ridge, the South Mouth area, all of those zones have the potential to deliver hundreds of thousands of ounces into the equation. We’re definitely not going to get to some of those this year but the blue-sky potential at Fondaway Canyon is still wide open, everywhere.

RM: Thanks Brad.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Rick and Brad both own shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on Richards site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.