Victory Resources’ drilling at Smokey points to potential lithium-bearing system

2022.03.10

Lithium is without question one of the most sought-after commodities right now, and for good reason too: the metal is a crucial component in batteries that power the modern electric vehicle.

Even years of rising global production, including a record-setting 100,000 tonnes produced last year, may not be enough to satisfy strong demand. Data from the US Geological Survey shows that the 2021 output, already 21% higher than 2020, was just enough to cover the 93,000 tonnes demanded (up 33% from 2020), leaving a surplus of only 7,000 tonnes.

S&P Global forecasts that this year, further demand growth could push the lithium market towards a deficit in 2022 as increased use of the material outstrips production and depletes stockpiles.

Supply of Lithium carbonate equivalent is forecast to jump again to 636,000 tonnes in 2022, up from an estimated 497,000 in 2021 — but demand will jump even higher to 641,000 tonnes, from an estimated 504,000, S&P said in its December 2021 report.

So far in 2022, lithium prices have continued to reflect the looming demand-supply imbalance. In China, the biggest EV market, lithium carbonate prices are already up nearly 500% dating back to this time last year.

This uptrend in lithium (and other EV battery metals) is only going to continue, according to those within the battery metals industry.

Caspar Rawles, chief data officer at Benchmark Mineral Intelligence, the world’s leading lithium price reporting agency and EV supply chain data provider, notes that the early transactions from 2022 suggest that “lots of legs” are left in this rally.

Gavin Montgomery, research director for battery raw materials at Wood Mackenzie, recently said in a Financial Times article that lithium prices are unlikely to crash, as they did in previous cycles.

“We’re entering a sort of new era in terms of lithium pricing over the next few years because the growth will be so strong,” he added.

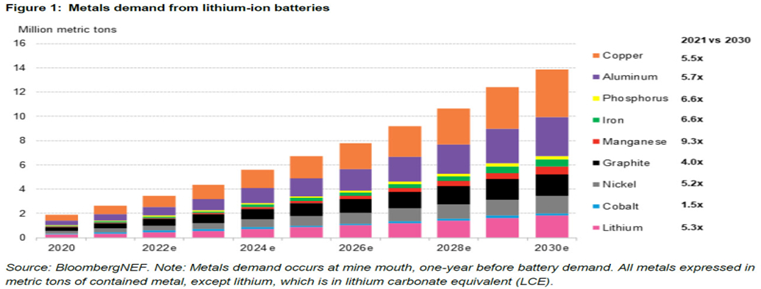

Driven by fresh demand for raw materials from the EV sector, Bloomberg New Energy Finance (NEF) estimates that global consumption of lithium will be at least five times current levels (see below).

According to Benchmark Mineral Intelligence, EV growth will be responsible for more than 90% of the global demand for lithium by 2030. The UK-based consultancy forecasts that demand is set to triple by 2025, rising to 1 million tonnes and outpacing supply by 200,000 tonnes.

Unlocking More Supply

Chances are, given the positive outlook for battery metals, this lithium rally is most likely the real deal.

Lithium prices are expected to remain elevated as long as demand remains strong, which could be years and even decades. As we’ve seen in 2021, even double-digit growths resulting in a record year of production have done little to subdue prices.

Thus, a lot more lithium — at least more than the current projected supply — is needed to steer the market away from a severe supply shortage.

According to Benchmark Mineral Intelligence (BMI), global lithium output is expected to roughly double from 2021 to 2025, but that would still not be enough to keep up with demand.

“There’s a complete overoptimism about the responsiveness of supply in the lithium market,” Bloomberg quoted Andrew Miller, BMI’s chief operating officer. “It’s very hard to see how it’s going to accelerate at the speed that the battery market and electric vehicles are accelerating.”

Bloomberg notes the relatively small size of the lithium market, compared to say, copper or iron ore, is preventing the major mining companies from getting into the lithium game, for fear of overwhelming supply and crushing prices like what happened a few years ago.

Rio Tinto is the only major miner that has been tempted to move into the battery metal, and so far, that looks to be a miscalculated move. Due to environmental protests, its Jadar lithium project in Serbia is now in limbo.

There’s also the strong possibility that supply could lag due to the mining industry’s reputation for missing targets. In fact, McKinsey & Co estimates that more than 80% of projects come in late and over budget. Hence, any supply projections at this moment are presumably overstated.

Facing a tight market that’s very sensitive to supply disruptions, the biggest players in the global EV industry are all looking to secure their own lithium mineral to gain an advantage.

“Lithium supply security has become a top priority for technology companies in Asia, Europe, and the United States,” the USGS said in its latest report.

Contemporary Amperex Technology Ltd. (CATL), the world’s biggest EV battery maker, recently urged the Chinese government to strengthen its lithium supply chain, given the risk of shortages of the key ingredient.

According to S&P Global Platts, the Chinese lithium market is set to face tightening supplies throughout 2022 as the demand-supply mismatch widens.

While it has dominated all next-stage processes that refine lithium and other raw materials into chemicals used in EV batteries, China still relies heavily on imports from countries including Australia, Chile and Democratic Republic of Congo as the nation currently lacks lithium mines.

Supply Opportunities in US

A potential lithium supply shortage in China presents an opening for the US to become a crucial figure in the global battery metals supply chain, which China has dominated for years.

The US has made no secret that it wants to be the world’s #1 market, but to do that, it needs to shed its reliance on foreign imports of battery minerals.

Over 80% of the world’s raw lithium is currently mined in Australia, Chile and China. Moreover, China controls more than half of the world’s processing and refining, and has three-fourths of the lithium-ion battery megafactories in the world, according to the IEA.

The US, meanwhile, mines and processes only 1% of the world’s lithium, according to the US Geological Survey. There is only one lithium mine in operation, Albemarle’s Silver Peak, which extracts lithium from brine outside of Tonopah, Nevada, outputting a paltry 5,000 tonnes of lithium carbonate a year.

However, this is not to say we can rule out the US as a major producer of lithium, dubbed “white gold” for its vital role in rechargeable batteries and high demand.

The US had been the leading producer of the metal until the 1990s, so scarcity is not a problem.

Within its borders are almost 8 million tonnes of lithium in reserve, ranking it among the top five countries in the world, according to the USGS.

So, with the right amount of investment, a burgeoning domestic “mine to battery to EV” supply chain is certainly within reach. Several projects are already in the works across the states of Nevada, North Carolina, California and Arkansas.

Nevada looks to be the focal point of the next “white gold rush” given the abundance of lithium-rich brines and clays, plus its history of lithium production dating back to the 1960s. It currently hosts the only US lithium mine, for now.

A new large-scale lithium mine is being developed at the Thacker Pass project in Humboldt County, held by Vancouver-based Lithium Americas. This project was approved by the US Bureau of Land Management in January of last year.

Thacker Pass is considered the largest known lithium resource in the country, and the open-pit mine could produce as much as 60,000 tonnes of lithium carbonate annually.

Another Nevada project that could begin as soon as 2024 is the Rhyolite Ridge lithium-boron project, with an estimated annual production of over 22,000 tonnes Li₂CO₃ in its first three years.

Tesla’s $5 billion Gigafactory, the world’s biggest EV battery plant by volume, is also conveniently located in Nevada, with Elon Musk’s company even looking to mine lithium near its site.

Hence, it feels almost inevitable that the state mostly known for its gold and silver could soon become a hotbed for lithium mining.

Victory Resources

Leveraging Nevada’s favorable geology and rich mining history, several companies have begun exploring its claystones and brines over recent years, with the goal of developing the next US lithium source for the EV battery supply chain.

Among the lithium explorers in Nevada, we are particularly intrigued by Victory Resources Corporation (CSE: VR) (FWB: VR61) (OTC: VRCFF), which is anticipating further advancement on its Smokey lithium project in the near term to benefit from the EV revolution.

Victory’s Smokey lithium project is located about 35 km west of Tonopah, Nevada, within the famous Big Smokey Valley that traverses three counties across the state.

Esmeralda County — where the project is situated — is one of the world’s most prolific regions for lithium clay deposits (Noram, Cypress, American Lithium, Spearmint, Enertopia, Jindalee). These deposits all have proven large tonnages with acceptable lithium grades in excess of 900 ppm.

The Smokey lithium property lies approximately 35 km north of Clayton Valley, adjacent to and possibly on trend with the Clayton North project (930 ppm Li) held by Australia’s Jindalee Resources Ltd.

Farther away, Noram’s Zeus lithium project (900 ppm Li) is about 25 km to the southeast, while 35 km to the northeast is American Lithium’s flagship Tonopah Lithium Claims property (1,000 ppm Li).

In this prolific lithium region hosting, Victory’s Smokey project covers a total of 350 claims covering 7,000 acres of land with excellent access and relatively flat ground.

The property shares similar geologic settings to the Clayton Valley and the many exploration projects nearby. It is located in the Walker Lane trans tensional corridor on the western margin of the Basin and Range province.

The property’s geology consists of Miocene – Pliocene tuff deposits, claystones and siliciclastic beds (Esmeralda Formation) with overlying younger alluvium deposits and desert pavement formation. The claystone, which can carry high lithium concentrations, is observed as highly weathered light grey to tan mounds of unconsolidated clay from 0.10-1.50m thick.

The flat-lying nature of the claystones, together with the frequent occurrence of transported cover, requires drilling to fully validate and assess the Smokey project’s lithium potential as indicated by last summer’s surface sampling, which returned values up to 630 ppm Li.

2022 Drilling Program

Based on extensive exploration work and analysis conducted to date, Victory’s exploration team has identified several drill targets that will determine whether a relationship exists to the high lithium zone on the adjacent Jindalee property.

After obtaining its drill permit in December 2021, the company embarked on a 15-hole drill program last month, with the initial three holes aimed to prove its geologic concept by testing along the Jindalee boundary margins, nearest to the fault line. This would reduce the depths required to reach clays and attempt to capture the full thickness of the claystone, in order to discover the grade and thickness of an intercept.

The remaining 12 holes will be utilized for locating extensions of the clay mineralization, test depths of clays and overburden and ultimately provide data for purposes of resource modeling and follow-up drilling.

Progress to date indicates “significant potential lithium-bearing claystone” in the first three holes drilled, according to the Victory’s latest update on March 3. This conclusion was based on visual assessment from the exploration team. Samples are now being prepared for assay.

Specifically, the first hole was completed to a total depth of 417 feet, and upon visual results, gave management confidence toward its theory that the down dropped clay presents an opportunity to locate the extension of the lithium clays ‘buried at depth’.

Deposits ‘buried at depth’ are anticipated to be preserved from surface erosion and weathering, which help to maintain grade and total thickness, Victory says.

“Results from the first hole have guided decision making on the second and third hole locations, and the company will provide progress on the overall drilling program as we progress,” Mark Ireton, Victory’s president and CEO, stated in the news release.

“Preliminary indications, upon visual analysis, are encouraging in terms of the clay intersects and information our geo team is analyzing toward the proof of theory around the potential deposit at Smokey Lithium,” he added.

Conclusion

Lithium is expected to be the driving force of modern economy for at least the next two decades, but supply of this key battery metal is unlikely to keep pace with rising demand. Prices have exploded since the start of 2021 with no signs of slowing down, creating a favorable market environment to invest in lithium mines of the future.

Major miners led by Glencore and BHP are already looking at battery metals opportunities across the globe, with many favoring joint ventures with junior explorers as they offer more geographical reach without full exposure to risky mining jurisdictions.

But ideally, joint ventures in mining-friendly regions (i.e. United States) are much more desirable. US President Biden has repeatedly voiced his support for American production of minerals used to make electric vehicles and other renewable energy products. The nation already boasts an abundance of resources, with the state of Nevada considered to be the next potential lithium mining hub after Chile’s Atacama.

Seeing that many others have previously found exploration success in Nevada, it’s very possible that with more drilling results, Victory could benefit from the current market and emerge “victorious” in securing interest from the big players in the EV space.

Results so far are already promising, with indications of a lithium-bearing system buried deep by weathering events.

Victory Resources Corp.

CSE: VR | FWB: VR61 | OTC: VRCFF

Cdn$0.055, 2022.03.08

Shares Outstanding 110.2m

Market cap Cdn$6.1m

VR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Victory Resources Corp. (CSE: VR). VR is an advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.