Lithium is skyrocketing amid the global EV boom, will graphite follow suit?

2022.02.21

While it’s too early to declare lithium as the winning commodity of the year, chances are we won’t see a repeat of the lithium rally of 2017, when prices eventually cooled off as miners ramped up production.

This time, the lithium boom is here to stay.

The reason is straightforward: demand for the EV battery ingredient is rising so fast that we could see years and even decades of supply shortage, causing prices to stay elevated.

Fastmarkets’ price assessment for battery-grade lithium carbonate in China has risen by nearly 50% year to date, and is eight times higher than it was since the beginning of 2021.

Of course, lithium had an explosive run some five years ago as well, but back then, we barely noticed any electric vehicles on the road (Tesla’s Model 3, its first mass-market car and now the best-selling EV, had just been launched).

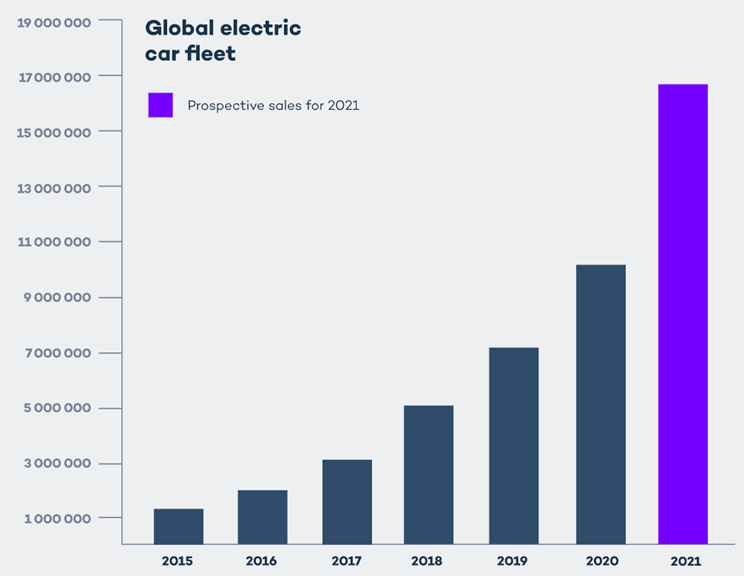

Today, there are at least 15 million cars in the global EV fleet, 6.5 million of which were sold in the last calendar year alone, representing a 109% growth over 2020, according to market research firm Canalys.

For reference, the total global passenger car market only grew 4% in 2021, Canalys estimates, meaning that the EV market is growing at more than 25 times the pace of the overall car market.

Although the EV market share remains tiny compared to the traditional ICE vehicles, that is likely to change in the coming years as major economies transition away from fossil fuels and move into clean energy.

US President Joe Biden has already signed an executive order requiring that half of all new vehicle sales be electric by 2030. China, the world’s biggest EV market, has a similar mandate that requires electric cars to make up 40% of all sales. The European Union is also seeking to have at least 30 million zero-emission vehicles on its roads by then.

According to the IEA’s Global Electric Vehicle Outlook, if governments worldwide are able to ramp up their efforts to meet international energy and climate goals, the global electric vehicle fleet could reach as high as 230 million by the end of the decade.

And with more electric cars comes the need for more raw materials like lithium to build batteries. The IEA believes mineral demand for use in EVs and battery storage must grow at least 30 times by 2040 to meet various climate goals.

Fastmarkets forecast that EV sales will experience a compound annual growth rate of 40% per year through 2025, when EV penetration is expected to reach 15%. After that, EV penetration is expected to rise even further, reaching 35% by 2030.

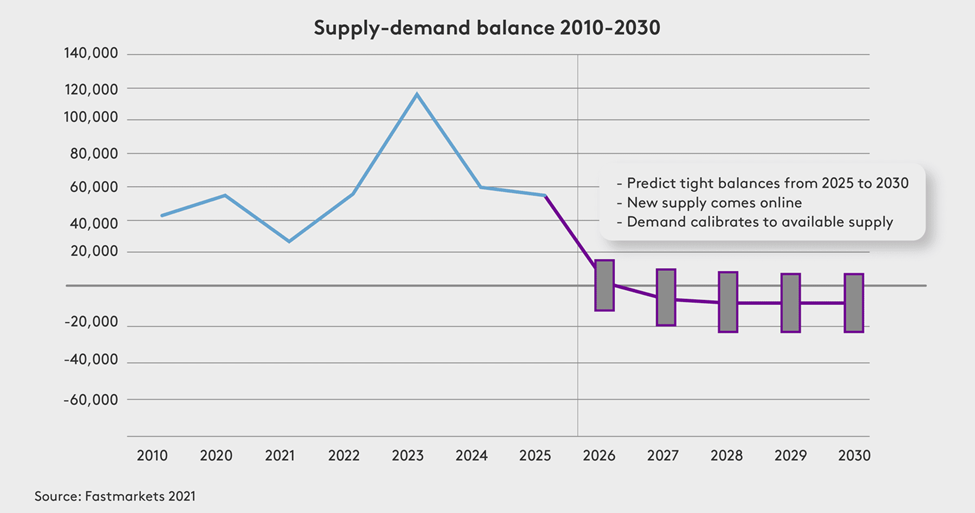

From 2025 to 2030, Fastmarkets is predicting tight balances in the lithium market on the back of healthy demand for the battery metal.

A years-long market deficit may already be unfolding before our eyes, as several banks, research agencies and analysts are already predicting long periods of lithium shortage leading up to 2030 as demand outpaces supply growth.

S&P Global’s recent forecast has the global lithium shortage continuing in 2022, with 641,000 tonnes of LCE demanded versus a projected supply of 636,000 tonnes. This gives an estimated deficit of 5,000 tonnes, compared with a surplus of 66,000 tonnes in 2020 and an estimated deficit of 8,000 tonnes last year.

Similarly, Australian investment bank Macquarie expects the lithium market deficit to rise from 2,900 tonnes last year to 20,200 tonnes in 2022, with the shortfall widening further to 61,000 tonnes in 2023.

Fastmarkets analyst Will Adams pegs the likely shortfall this year at around 60,000 tonnes, while battery metals consultancy Benchmark Mineral Intelligence (BMI) thinks the gap will be smaller at 26,000 tonnes. Citigroup’s forecast lies somewhere in the middle at 36,000 tonnes.

And while lithium producers are ramping up output in the short term, beyond that, questions remain whether they can expand fast enough to avoid a prolonged market squeeze given the positive outlook for EV penetration.

“The EV market faces many decades of strong, compound growth. For any supply chain that relies on getting raw materials out of the ground, it is going to be a supreme challenge to keep up with year after year of high compound growth,” Fastmarkets says.

“Lithium production must quadruple between 2020 and 2030 to meet growing demand, from 345,000 tonnes in 2020 to 2 million tonnes in 2030,” the commodity price reporting agency adds.

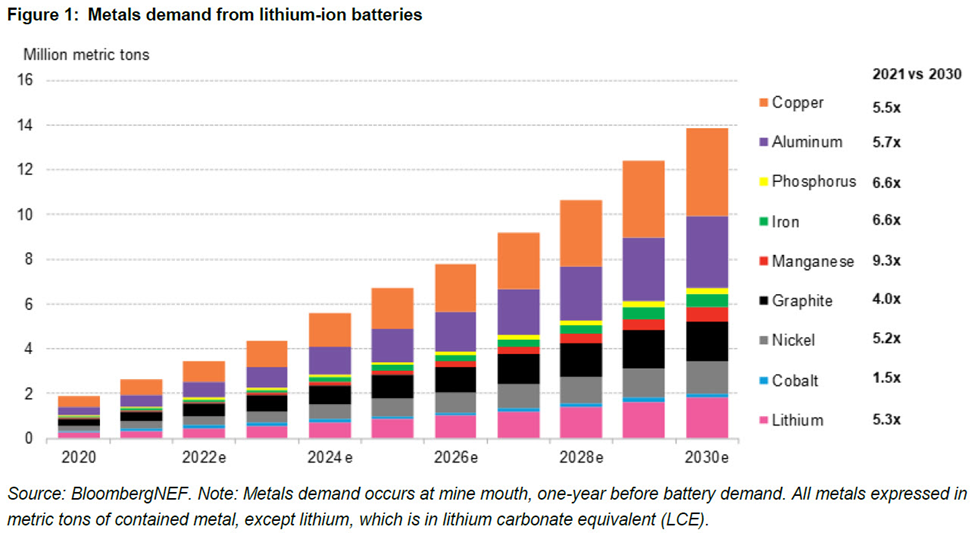

BloombergNEF estimates that, by 2030, the clean energy transition will drive consumption of lithium to at least five times current levels.

The EV sector will account for about 80% of total lithium demand in 2030, compared with the existing 40% to 45% level, according to Fitch Solutions.

This is why, unlike the last lithium rally, prices could stay high for years as market tightness continues to be the main theme.

Back in November, Fitch revised its 2022 lithium carbonate prices to average at $21,000/t, compared with the previous projection of $15,025/t. But that target has been shattered since prices have already broken through the $40,000/t barrier this year.

As price continues to rise, Citi this month almost doubled its 2022 price forecast for battery-grade lithium carbonate to as high as $60,000/t.

“Extreme lithium pricing was likely to be required to defer or destroy demand, as EV inventories continue to experience a backlog in the face of global supply chain gluts,” the bank said.

Graphite to Follow Suit?

What’s happening in the lithium market shows that the “great battery race” has perhaps unpacked another super-cycle for commodities.

Other raw minerals constantly linked with clean energy, including nickel, cobalt and copper, have also reached multi-year highs (in copper’s case, record high) based off bullish fundamentals.

One mineral that has been overlooked but is also an essential part of the vehicle electrification is graphite.

At AOTH, we believe graphite represents a “backdoor entrance” to the market opportunity brought by the clean energy transition. This is for several reasons:

Graphite as anode material

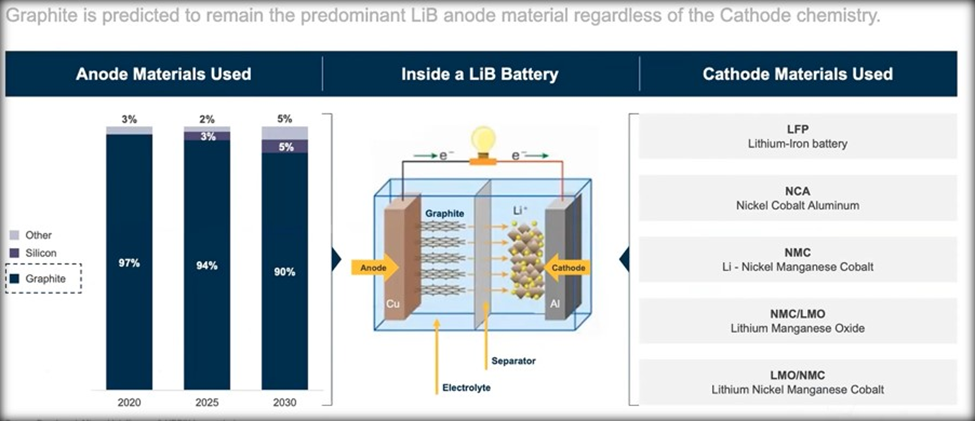

The lithium-ion battery used to power electric vehicles is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. At the moment, graphite is the only material that can be used in the anode, and there are no substitutes.

This is due to the fact that, with high natural strength and stiffness, graphite is an excellent conductor of heat and electricity. Being the only other natural form of carbon besides diamonds, it is also stable over a wide range of temperatures.

The cathode is where metals like lithium, nickel, manganese and cobalt are being used, and depending on the battery chemistry, there are different options available to battery makers (see below).

So, graphite can be considered indispensable to the global shift towards electric vehicles. It is also the largest component in lithium-ion batteries by weight, with each battery containing 20-30% graphite. But due to losses in the manufacturing process, it actually takes 30 times more graphite than lithium to make the batteries.

According to the World Bank, graphite accounts for nearly 53.8% of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4% of total demand.

An electric car contains more than 200 pounds (>90 kg) of coated spherical graphite (CSPG), meaning it takes 10 to 15 times more graphite than lithium to make a Li-ion battery.

Demand overflow

The anode material, called spherical graphite, is manufactured from either flake graphite concentrates produced by graphite mines, or from synthetic/artificial graphite. Only flake graphite upgraded to 99.95% purity can be used.

An average plug-in EV has 70 kg of graphite, or 10 kg for a hybrid. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10% increase in flake graphite demand.

By estimates, at least 125 million EVs are expected to be mobile by 2030. That’s more than 8 million tonnes of additional battery-ready graphite needed this decade, considering the mining industry is able to supply 1.1 million tonnes.

According to BMI, the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand could easily outstrip supply in a few years.

BloombergNEF expects demand for key battery minerals to remain robust through 2030, with graphite demand increasing by four-fold.

As vehicle electrification continues, it is estimated that the natural flake graphite market could reach a deficit as early as 2023, with few new sources being developed around the world.

Lack of diverse supply

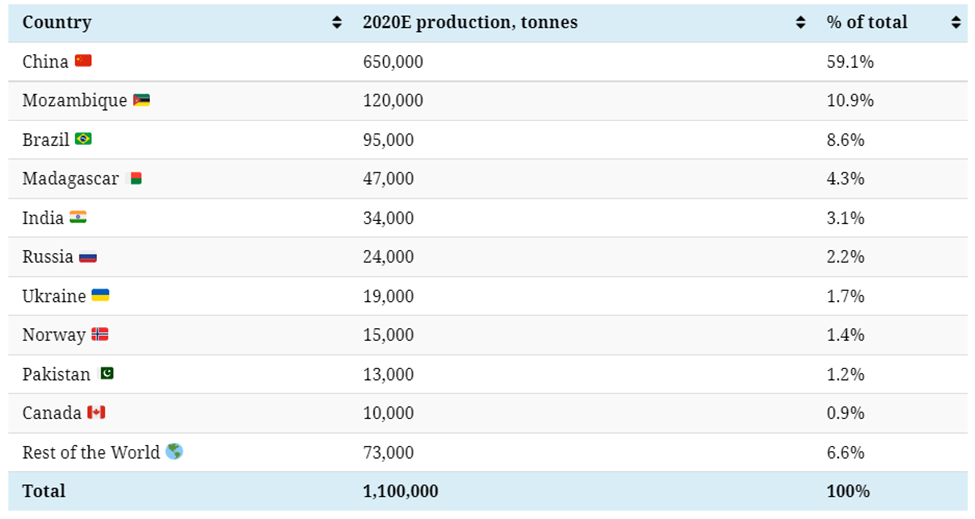

Almost all graphite processing today takes place in China because of the ready availability of graphite there, weak environmental standards and low costs. Nearly 60% of the world’s mined production last year also came from China, making it a dominant player in every stage of the supply chain.

After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US does not produce any natural graphite, and therefore must rely solely on imports to satisfy domestic demand.

The level of foreign dependence has increased over the years. The US imported 38,900 tonnes of graphite in 2016, then peaking at 70,700 tonnes in 2018.

Latest publication from the USGS shows that imports in 2020 dropped to 42,000 tonnes, of which 71% was high-purity flake graphite, 28% was amorphous, and 1% was lump and chip graphite. The top importers were China (33%), Mexico (23%), Canada (17%) and India (9%).

Since China controls all the spherical graphite processing, the US is not actually 33% dependent on China for its battery-grade graphite, but 100%.

This is why the US government has included graphite among the 35 minerals that it deems “critical to its national security and economy.”

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

Potential US Graphite Source

Since there is no substitute for graphite in an EV battery, and given its total dependence on foreign imports, the time is now for the US to begin creating a reliable and sustainable graphite supply chain.

Fortunately, there is plenty of graphite available for local consumption, if industry and government can find the collective will to make it happen.

The Kigluaik Mountains on Alaska’s Seward Peninsula hosts a deposit with the size and grade to meet the nation’s growing need for graphite in Li-ion batteries.

The Federal Permitting Improvement Steering Committee (FPISC) last year granted High-Priority Infrastructure Project (HPIP) status to Graphite One Inc. (TSXV:GPH, OTCQX:GPHOF), which aims to be America’s first high-grade producer of coated spherical graphite (CSG), integrated with a domestic graphite resource.

The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

The company’s Graphite Creek resource near Nome, Alaska, is currently the highest-grade and largest known flake graphite deposit in North America, spanning a distance of 18 km.

The Graphite One project is envisioned as a vertically integrated enterprise to mine, process and manufacture high-quality CSPG for the lithium-ion electric vehicle battery market. The company aims to become the first US vertically integrated domestic producer to do so.

The latest resource estimate (March 2019) for Graphite Creek showed 10.95 million tonnes of measured and indicated resources at a graphite grade of 7.8% Cg (graphitic carbon), for some 850,000 tonnes of contained graphite. Another 91.9 million tonnes were tagged as inferred resources, with an average grade of 8.0% Cg containing 7.3 million tonnes.

A Preliminary Economic Assessment (PEA) supports a 40-year operation with a mineral processing plant capable of producing 60,000 tonnes of graphite concentrate (at 95% purity) per year.

On a pre-tax basis, the project has a net present value of $1.03 billion using a 10% discount rate, with an internal rate of return (IRR) of 27%.

Once in full production, Graphite One’s proposed graphite products manufacturing plant — the second link in its proposed supply chain strategy — is expected to turn graphite concentrates into 41,850 tonnes of battery-grade coated spherical graphite and 13,500 tonnes of graphite powders per year. A location in the Pacific Northwest is being considered.

Additional Opportunities for Graphite One

Outside of the renewable energy sector, the graphite resource also has potential for other advanced material opportunities. This week, Graphite One reached a milestone in test work completed for foam fire suppression at the US Navy’s Naval Air Weapons Station China Lake in California.

In the test work, conducted by a team of firefighting professionals at the Fire Science and Technology Office, Combustion Sciences & Propulsion Branch, a composite blend of material from Graphite One’s Graphite Creek deposit (including +80-mesh fraction) was formulated into a pigment component of an innovative biodegradable fire retardant foam, intended to replace the current Military Specification (MilSpec) Aqueous Film Forming Foams (AFFF).

Results of experiments performed by the US government indicate that the foam formulation that contains Graphite Creek material can extinguish Class B fires, and therefore could meet the firefighting standards defined in the MilSpec.

This development work is timely, given that the 2020 National Defense Authorization Act (NDAA) ordered that AFFF must be phased out of use by October 2024 due to the dangers the material poses to the environment and human health.

As of the 2024 deadline, AFFF agents will not be available for use in the event of an aircraft emergency involving Class B fires at any military installations or airfields.

“Until now, there has been no viable solution to AFFF chemistry that is environmentally-benign, which makes the potential of fluorine-free formulations containing expandable graphite from Graphite One such a promising alternative,” President and CEO Anthony Huston stated in the latest news update.

Conclusion

Graphite’s influence goes beyond vehicle electrification; the material has long been used in the aviation, automotive, sports, steel and plastic industries, as well as in the manufacture of bearings and lubricants.

But the world could soon run out of natural graphite supply, given explosive demand from the EV sector for years to come. Some estimate that demand for battery alone is expected to expand over ten-fold by 2030.

Allied Market Research projects that the global graphite market, which was valued at $14.3 billion in 2019, is expected to reach $21.6 billion by 2027, registering a CAGR of 5.3%.

Meanwhile, the world’s graphite production and processing are concentrated mostly in China, which, with its rising power costs and limits on energy consumption, could be hard-pressed to keep up with demand in those years. But even if it does, the volatile nature of global politics means that a reliable supply outside of China is never a guarantee.

Another key to consider: not all of the world’s graphite is used for renewable energy. In fact, as much as 90% of the 1.3-million-tonne supply is used for other applications.

It’s also hard to imagine that a lot of the major economies, in particular the US, would want to rely 100% on foreign imports (i.e. China) for their graphite, a material that is consumed by some 90 American companies.

The bottom line is that the graphite market may be in more of a “critical” state than other battery metals like lithium. Right now, most EV giants are still preoccupied with securing lithium supply around the world. Sooner or later, though, concerns of graphite shortage will surface.

As graphite demand soars in tandem with the growth in the EV market, it would be a matter of when, not if, global markets (even in China) begin to experience a “graphite squeeze”.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

Cdn$1.63, 2022.02.17

Shares Outstanding 85.5m

Market cap Cdn$139.4m

GPH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Graphite One Inc. (TSXV: GPH). GPH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.