Getchell returns ‘stunning result’ at North Fork Zone, as gold nears 3-month high

2022.02.17

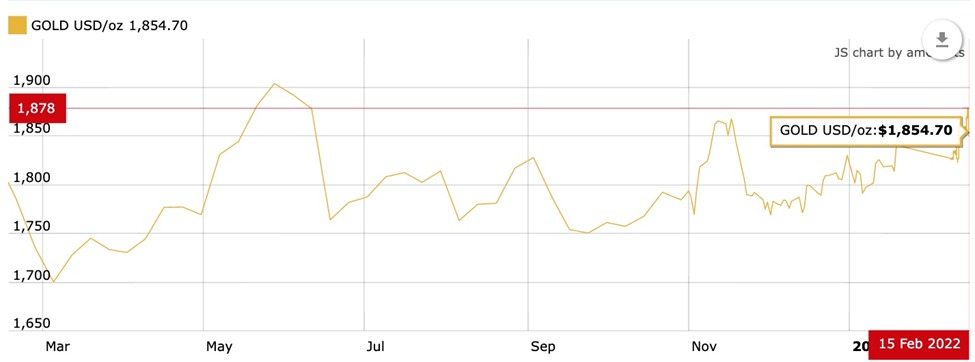

Geopolitical tensions on the Russia-Ukraine border pushed gold to its highest in almost three months, Monday.

Gold extended last week’s gains as rising concerns over the Russia-Ukraine conflict boosted its safe-haven appeal — notching $1,862 around noon eastern time, the highest since mid-November.

The precious metal shed a few dollars Tuesday on news of tensions easing; spot gold was finding support at $1,854, at the close of trading in New York.

The market was reacting to warnings from US officials on Sunday that a Russian invasion of Ukraine could be imminent. However the Kremlin dismissed that as “hysteria” and on Tuesday Russian President Vladimir Putin said he is ready for security talks with the United States and NATO. Adding to the calming, Russia’s military announced a partial withdrawal of the 130,000 troops stationed near Ukraine.

CTV News reported Putin saying he doesn’t want war and is calling for peaceful discussions over Ukraine’s bid to join NATO, which Moscow sees as a major threat.

The possibility of war with Ukraine, and other geopolitical hot spots including North Korean missile tests and poor relations between the US and China over Taiwan, is bringing investors over to gold, despite expectations the US Federal Reserve will raise interest rates to counter the highest inflation in 40 years.

Top diplomats from Japan, South Korea and the US reportedly declared their unity against North Korea Saturday, following a series of ballistic missile launches from Pyongyang, including the longest-distance projectile the North has tested since 2017, capable of reaching the US territory of Guam.

In January the South China Morning Post reported a China foreign relations expert saying that the risk of war with Taiwan is the highest since 1996 — when China intimidated the breakaway republic with missile tests in the Taiwan Strait, between the island and the Chinese mainland.

Last fall US President Joe Biden angered the Chinese leadership when he said unequivocally the US would come to Taiwan’s aid if attacked by China — considered a diplomatic faux-pas.

Apart from geopolitical concerns, inflation is another factor in gold’s favor right now. Investors often buy gold because it is a hedge against inflation, either when the prices of goods and services are rising, or they think inflation is going to occur.

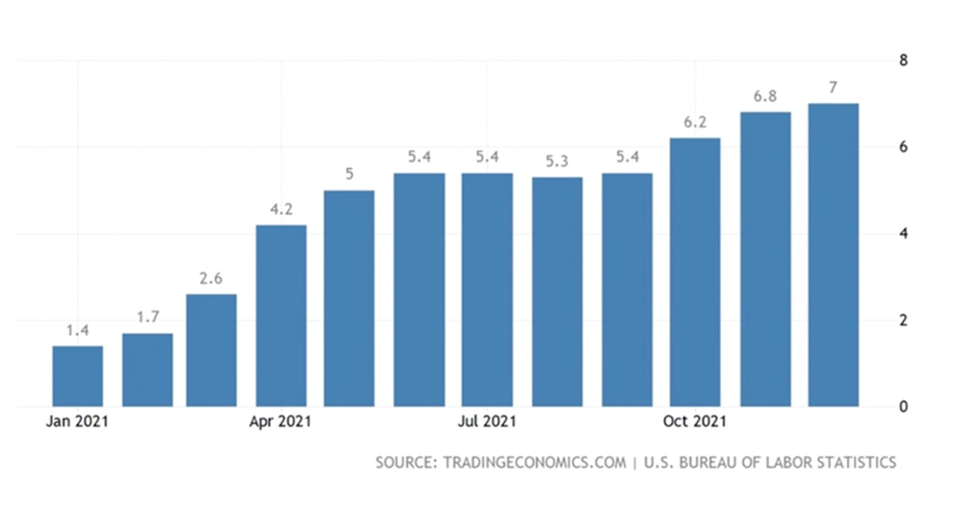

The Consumer Price Index (CPI) is currently at a four-decade-high 7%; inflation at that level has not been seen since 1982.

Real “on the ground” inflation is even higher. CPI’s less known but more accurate cousin is the Producer Prices Index (PPI).

The latest PPI data point clocked in at 9.7% for 2021 — close to double-digit inflation, the biggest calendar-year increase since data was first calculated in 2010.

Last week the U.S. Labor Department said its PPI rose 1% in January, higher than December’s 0.4% increase, and double economists’ expectations of 0.5%. Zero Hedge points out this was the 21st straight month of inflation rate increases, with energy and food prices being the biggest drivers.

The historic price increases are mostly due to strong demand for goods and services exceeding available supplies in an economy still hampered by coronavirus pandemic restrictions. However, those hoping supply-chain disruptions will soon be ironed out and inflation heads back down, will be disappointed. Higher prices will, imo, stay with us for a long time due to persistent food inflation, wage/ salary increases due to a shortage of workers, a ragged energy transition from fossil fuels to renewables that has led to record-high natural gas prices, and climate change which has a negative effect on crops, meaning higher prices for agricultural commodities.

The New York Times cites data from the United Nations showing global food prices in January hit their highest level since 2010. Between April 2020 and December 2021, the price of soybeans climbed 52%, and corn and wheat both grew 80%. Coffee prices increased 70% due mostly to droughts and frost in Brazil.

Food prices in the United States rose 6.3% in December, year on year, with the prices of meat, poultry, fish and eggs all jumping 12.5%, according to the Bureau of Labor Statistics.

The BLS calculated that energy prices were a whopping 1,009% higher in 2021 compared to 1957. Between these years, energy inflation averaged 3.83% per annum. Energy costing $20 in the 1957 would cost $221.98 in 2021 for an equivalent purchase.

A repeat of last year’s drought conditions in the American West seems likely, judging from a news story on Tuesday from CBC. The article says the region’s “megadrought” deepened so much in 2021 that it is now the driest it’s been in 1,200 years. A study in the journal ‘Nature Climate Change’ finds the dry conditions are unlikely to ease in the near future.

Savvy investors understand that gold is much better at holding its value than assets denominated in fiat currencies, especially when inflation is eroding their purchasing power.

Gold is also in high demand from ETF investors and central banks. According to Kitco, gold exchange traded funds saw inflows for four weeks straight, while hedge funds trading gold on the Comex boosted their bullish bets in the week through Tuesday.

The World Gold Council released data showing that, as of September 2021, the amount of gold held in central bank reserves exceeded 36,000 tons for the first time since 1990.

Some gold investors like to buy ETFs, preferring the flexibility of “paper gold”, others prefer physical bullion (bars and coins), but we at AOTH are most partial to junior gold stocks, which offer superior leverage to a rising gold price.

(Supporting the idea of higher gold prices going forward, ex-Goldcorp chairman Ian Telfer recently said “peak gold” has been achieved, and because of that, the price will not retrace $1,200 an ounce in our lifetimes. All the deposits that can make money under $3,000 gold, says Telfer, have been found)

One of our favorites is Getchell Gold, whose drill program at Fondaway Canyon, Nevada, continues to impress.

Getchell Gold

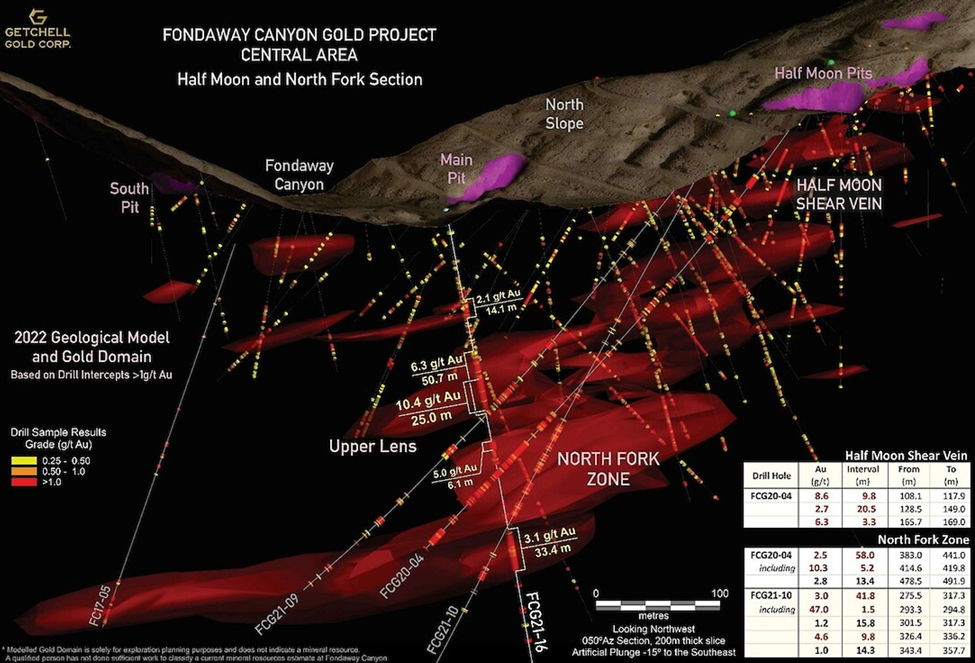

The subject of multiple exploration campaigns, with nearly 50,000m of drilling completed, Getchell Gold’s (CSE:GTCH, OTCQB:GGLDF) Fondaway Canyon covers 12 known veins and five mineralized areas — Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill.

A 2017 technical report estimated 409,000 oz indicated gold resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au, for a combined 1.1 million oz. Up to 80% of these ounces are within the Colorado, Paperweight and Halfmoon zones, with the remainder found in parallel veins or splays off the main veins.

Ten holes were drilled in 2021, all of which have now reported assay results. All 10, or 3,874 meters, were sunk into the Central Area, and followed up on the Colorado SW, Juniper and North Fork gold zones, discovered in 2020.

2022’s exploration program is expected to double last year’s drilling capacity with the addition of a second drill rig.

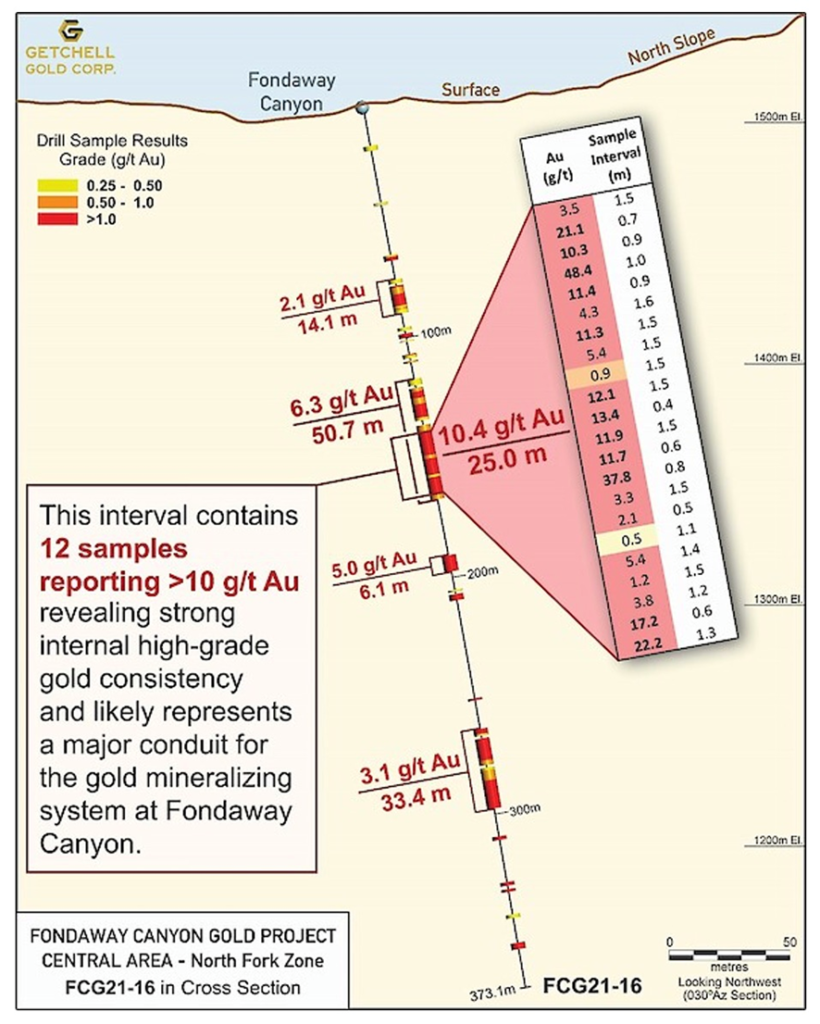

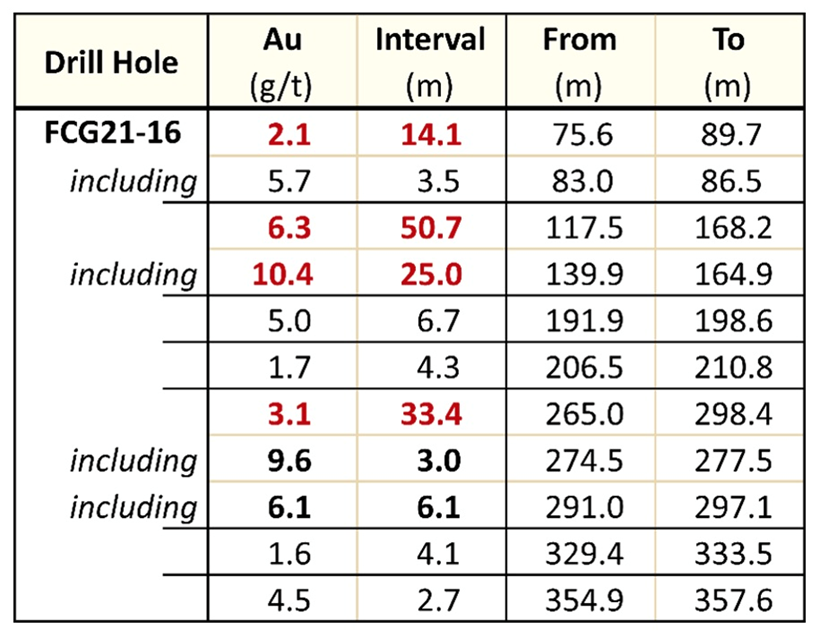

On Tuesday Getchell reported assays from the last hole of the batch, FCG21-16, which targeted the North Fork Zone.

Stationed on the canyon floor at the junction of Fondaway Canyon and North Fork, the hole was drilled steeply to the northeast as a step-out from three previously completed holes.

The drill bit intersected a shallow lens grading 2.1 grams per tonne gold over 14.1 meters, before encountering a gold interval grading 6.3 g/t over 50.7m.

The latter included a higher-grade section, of 10.4 g/t over 25.0m, with 12 samples reporting more than 10 g/t, according to Getchell, revealing strong internal high-grade gold consistency. Marking how truly exceptional this is, the FCG21-16 interval returned the greatest ‘gold grade x thickness’ value in the 40+ year history of gold exploration and mining at the Project and likely represents a major conduit for the gold mineralizing system at Fondaway Canyon.

Furthermore, the hole intersected multiple gold intercepts down hole, including 3.1 g/t over 33.4 from 265.0 to 298.4m, with two higher-grade intervals grading 9.6 g/t over 3.0m and 6.1 g/t over 6.1m. According to Getchell, This interval is situated below the previously modelled lower extent of the North Fork Zone and may represent a newly discovered zone. Additional drilling will be required to determine the extent and orientation of this mineralization.

“Drill hole FGC21-16, the last hole of the 2021 drill program, exceeded the results of any hole drilled in the greater than forty-year history of gold exploration and mining at the Project. The high concentration of gold is a clear testament to the intensity of the gold mineralizing system and raises the upside potential at Fondaway Canyon,” said Getchell Gold’s President Mike Sieb, in the Feb. 15 news release. “Obviously, further delineation of this high-grade gold zone at North Fork has been added to our priorities for the upcoming 2022 drill program.”

Conclusion

To date, the mineralization at Fondaway Canyon has been traced for 800 meters down dip from surface, and it remains open on strike and at depth.

The 10 holes drilled last year not only extended the three new discovery zones from 2020 (Colorado SW, Juniper and North Fork), they returned exceptional gold intercepts, in particular hole FG21-16 at North Fork, discussed in this article, and FG21-08 at Colorado SW, with hits of 4.2 g/t over 27.5m, 2.8 g/t over 24.5m, 1.4 g/t over 30.7m and 1.3 g/t Au over 16.8m.

The Juniper Zone was also intersected by FCG21-08, returning 4.7 g/t over 25.9m, including 11.4 g/ over 5.5m, within 100 meters from surface.

Getchell plans on doubling last year’s successful program with some fresh drilling at Fondaway Canyon. The addition of a second drill will also enable Getchell to maiden drill-test Star, a copper-gold-silver project known for historical small-scale mining of especially high-grade mineralization.

An updated resource estimate for Fondaway Canyon is expected sometime in the second half of 2022. We look forward to a steady flow of news leading up to this announcement.

Getchell Gold Corp.

CSE:GTCH, OTCQB:GGLDF

Cdn$0.53, 2022.02.15

Shares Outstanding 95.5m

Market cap Cdn$46.2m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold Corp. (CSE:GTCH). GTCH is a paid advertiser on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.