Nickel Market Update

2022.02.15

The nickel market is currently experiencing its biggest squeeze in recent memory.

Aggressive pledges to fight climate change have precipitated a buying spree of metals that are key to the clean energy transition. Nickel, a key ingredient in EV batteries, is undoubtedly near the top of every shopping list.

Inventories of the metal have been dwindling across the world, given the relentless demand from the EV sector, and it appears some are even willing to pay “whatever it takes” to snap up the battery mineral before others can.

This week, the cash three-month spread on nickel notched a new record. Contracts for immediate delivery traded at a premium of $570/t to those in three months, the highest such premium since the historic squeeze of 2007.

Similar happened in January, but for near-dated contracts. Cash contracts on the LME reached a $90/t premium on Jan. 18 to those expiring a day later, the highest since 2010 and nearing levels seen in 2007. This prompted the bourse to step up its monitoring measures, the third time it had to do so in 12 months.

The latest nickel squeeze, though, has much bigger implications, seeing the market is now pricing in tighter nickel supplies for longer periods amid strong demand from battery manufacturers.

For instance, the spread between February and March contracts has more than doubled in the past week; so has the spread between March and April contracts.

Since April 2021, LME stock has declined by nearly two-thirds, from approximately 261,000 tonnes to roughly 88,100 tonnes in January 2022.

All this reveals that the world may quickly run out of available nickel for clean energy applications, especially with the break-neck speed at which demand is moving.

A report by UBS indicates that a deficit in nickel will come into play as soon as this year. By the end of the decade, UBS forecasts a large deficit of 2.2 million tonnes for the battery metal.

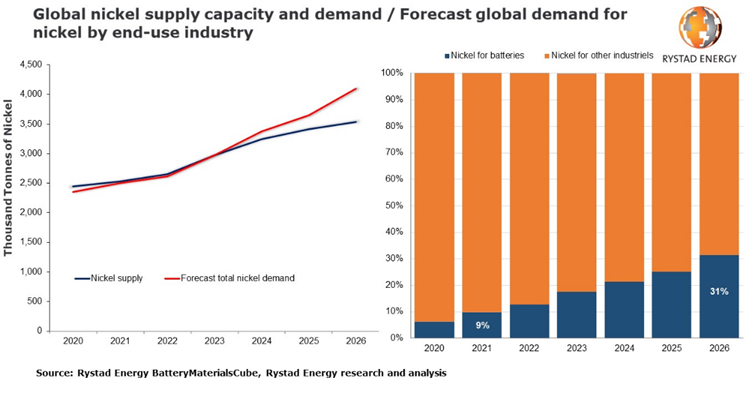

A more conservative estimate from Rystad Energy shows that demand for high-grade nickel used in EV batteries will outstrip supply by 2024. By then, global demand will climb to 3.4Mt, compared to 2.5Mt this year, while supply will grow to 3.2Mt.

The gap will then widen quickly to a deficit of 0.56Mt by 2026, driven by surging demand from the battery sector.

While EV battery is not the dominant end-user for nickel, that being stainless steel, EV’s share of nickel demand has been growing at a faster rate and is expected to trend up.

Wood Mackenzie analyst Andrew Mitchell estimates that of the 2.8 million tonnes demanded last year, 69% was used to make stainless steel and 11% to make batteries, up from 71% and 7% respectively in 2020. Mitchell expects batteries’ share of demand to rise to 13% in 2022.

According to Rystad’s latest report, nickel demand from the stainless steel industry is expected to grow at about 5% per year, while the market for batteries is poised to explode. “In an unconstrained supply scenario, batteries could require more than 1Mt of nickel metal by 2030, quadrupling from the current demand of 0.25Mt,” the energy research firm said.

An explosive demand has also propelled nickel prices to levels last seen over a decade ago. In late January, nickel reached $24,435/t, representing the highest since August 2011.

Analysts believe that high prices could become the norm for many years as long as the supply shortage problem remains unsolved.

Commodities such as nickel may stay high for decades, according to BlackRock’s Evy Hambro, as mining companies struggle to keep up with the demand created from the switch to a “greener world”.

In a Bloomberg interview, the firm’s global head of thematic and sector-based investing said: “What we’re likely to see is strong demand that will keep prices at very very good levels for the producers for many years into the future, and that could be decades.”

These views were shared by Goldman Sachs Group, which also pointed to a commodity supercycle that has the potential to last for at least a decade.

The bullish market forces that are swirling in preparation for what many are calling the next commodities supercycle are excellent news for companies on the hunt for raw minerals to feed the energy revolution.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.