Core Assets’ Blue project: A potentially massive CRD deposit in northwestern BC

2022.01.29

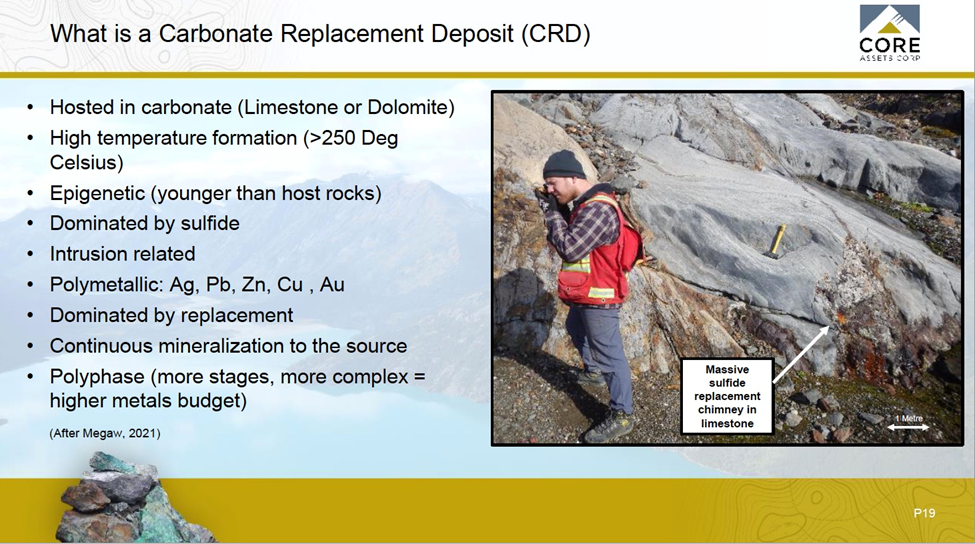

Carbonate replacement deposits (CRD) are some of the most interesting assemblages of mineralization found in the mining world today.

CRDs are large orebodies that extend over long distances, and they typically have mine lives lasting for decades, containing significant amounts of metals, including copper, gold, silver, lead, manganese and zinc.

These deposits are also known as temperature carbonate-hosted gold-lead-zinc deposits because their formation requires high temperatures over 250 degrees C. The orebody is formed by the replacement of sedimentary, usually carbonate rock, by minerals-laden solutions found near porphyry intrusion.

This replacement process results in the formation of deposits that are remarkably similar in terms of their mineralogy (how the minerals are spread throughout the deposit) as well as in the formation of crystals.

Examples of CRD discoveries based on this model include:

- Bingham Canyon in Utah, a long-running open-pit mine that extracts a huge porphyry copper deposit containing 17 million tonnes of copper, 23 million ounces of gold, 190Moz of silver and 850 million pounds of molybdenum.

- MAG Silver’s Cinco de Mayo property in Chihuahua state, Mexico; Arizona Mining’s Taylor deposit which South 32 bought for $1.8 billion.

- RC Consortium’s Resolution Copper deposit estimated to contain enough copper to produce 40 billion pounds over 40 years.

- Newmont Goldcorp’s Penasquito mine in Mexico, which is the fifth largest silver mine in the world @ 17.8 million ounces of gold and 1.08 billion ounces of silver.

Besides their common formation, all CRD deposits are polymetallic, meaning they have various metals in them including precious (gold, silver) and base metals (copper, lead, zinc). The mineralization may extend up to seven or eight kilometers from the intrusive stock, the porphyry, and the mineralogy changes as you move out from the core.

They are especially important for mining because of their large scale and high grades, containing between 10 and 150 million tons of economically mineable minerals. Moreover, they can be closely related and proximal to large porphyry systems.

Unlike deposits types found at surface, which are typically mined in open pits occupying a large environmental footprint, CRDs environmental footprints are much smaller because its high-grade underground mining.

Core Assets Corp.

At AOTH, we have come across CRD deposits before, but none of them have offered the thrill of making a major discovery, thus exciting the market and delivering rich shareholder gains, quite like Core Assets Corp. (CSE:CC, OTC.QB:CCOOF, Frankfurt: 5RJ).

Trading on the Canadian Stock Exchange under the symbol CC, Core Assets has been formed with the intention of developing its flagship Blue property in northwestern British Columbia.

The company is led by Blues discoverer CC President & CEO Nick Rodway, a registered professional geologist with over 10 years experience working with Canadian exploration companies including as founder and president of Exploits Gold Corp., the fore-runner of Exploits Discovery Corp., drilling for gold in Newfoundland.

VP Exploration Monica Barrington is an Atlin-based exploration geologist specializing in the Golden Triangle and the Atlin Mining Camp of northwestern BC. She previously worked for Brixton Metals, where she focused on advancing their porphyry-epithermal and orogenic gold targets, as well as planning and managing regional exploration programs, logistics, permitting, and mine compliance for their Thorn and Atlin Goldfields projects.

CC is tightly structured with 58.2 million shares outstanding (77.1 million fully diluted), of which management and directors own 36%. Earlier this month, Core Assets completed a $1.597 million financing @ CAD$0.24 per unit, which includes one common share and one warrant, exercisable for two years at $0.39. Crescat Portfolio Management LLC was responsible for the bulk of the non-brokered private placement, investing approximately $1.275 million.

Blue project

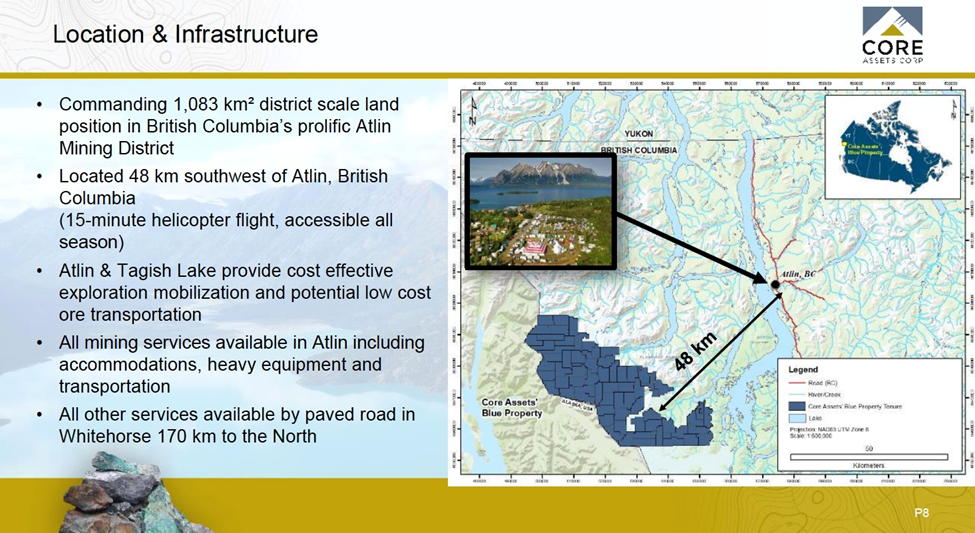

Located 48 kilometers southwest of Atlin, about a 15-minute helicopter ride and accessible all seasons, the Blue property commands an 1,083 square-kilometer land position within BC’s prolific Atlin Mining District.

Mining services including accommodations, heavy equipment and transportation are available in Atlin, with all other services located in Whitehorse, 170 km to the north via paved road.

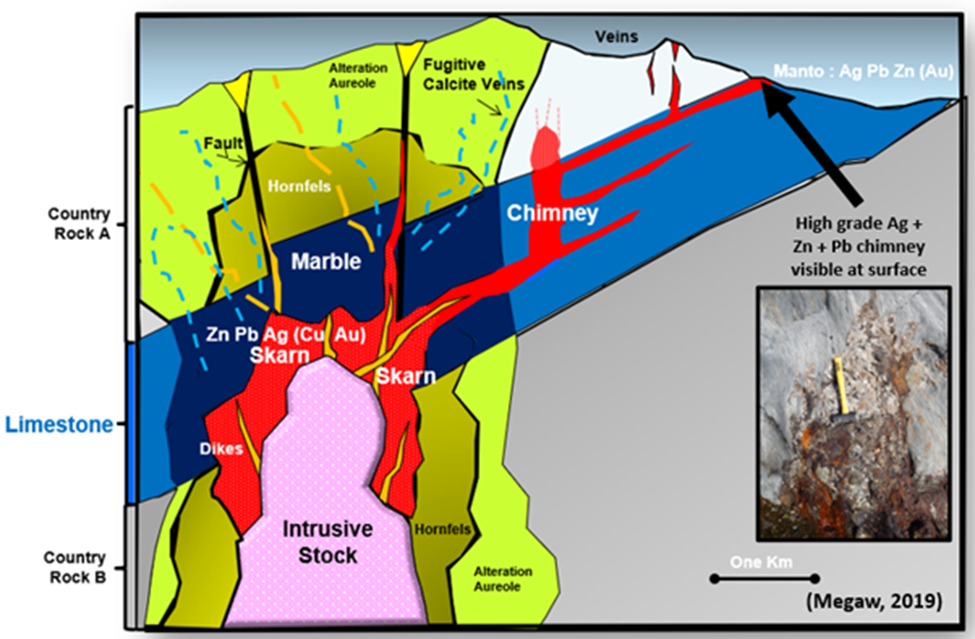

The above generic CRD deposit model schematic shows how these deposits form. Note the porphyry intrusive in pink, surrounded by skarns in red, which reach upward like long fingers, forming high-grade chimney structures that are visible at surface along with the outcropping veins.

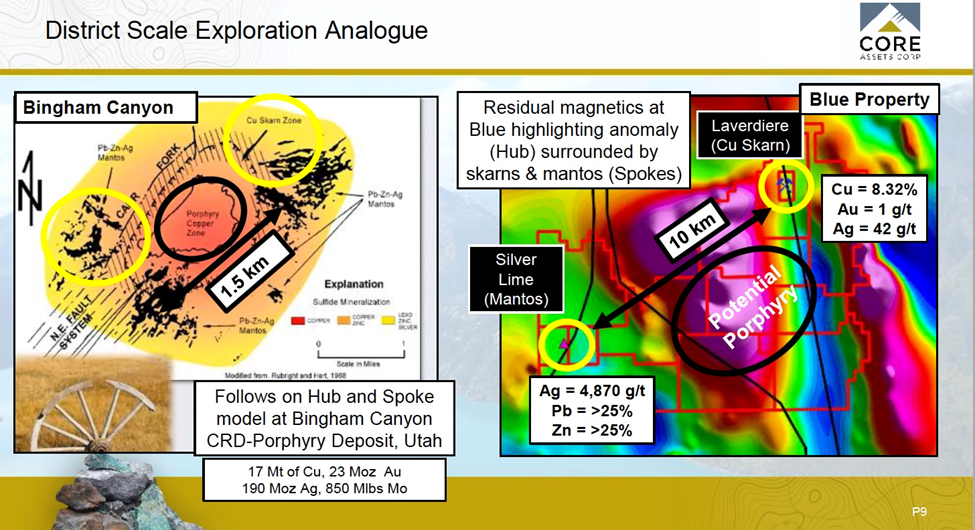

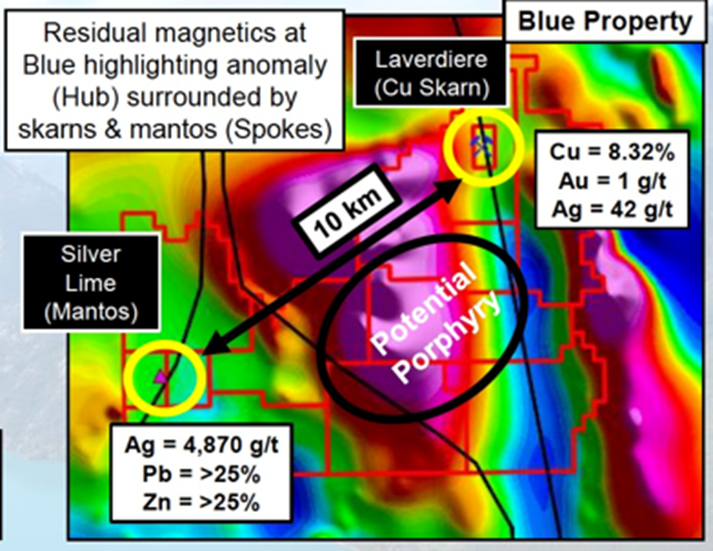

The discovery model at Blue is based on the “hub and spoke” configuration, similar to one of the largest CRD-porphyry deposits in the world, Kennecott’s Bingham Canyon copper mine in Utah.

As shown in the schematic below, Bingham’s “hub” is the porphyry copper zone in red, with the “spokes” extending out 1.5 km, to a series of Pb-Zn-Ag mantos, and a copper skarn zone.

Similarly, residual magnetics at Blue (above to the right) show the potential porphyry “hub” in dark purple, with the “spokes,” consisting of the Silver Lime manto, returning “off the charts” channel sample grades of 4,870 grams per tonne silver, plus multiple grab samples returning up to 913 g/t silver, >25% lead and >25% zinc.

Historical exploration at Silver Lime highlighted an equally impressive 4,870 g/t Ag, 0.45% Cu and 1.3% Zn over 1m; 2,387 g/t Ag, 2.7 g/t Au, 0.15% Cu, 2.50% Pb, and 3.32% Zn over 2.2m; and 1,023 g/t Ag, 0.16% Cu, 0.57% Pb and 0.75% Zn over 1.3m.

The Laverdiere copper skarn on the other side of the buried possible porphyry returned 8.32% copper, 1 g/t gold and 42 g/t silver. Historical drilling at Laverdier highlighted 46.0m of 1.76% Cu and 175.4m of 0.27% Cu, both from surface. Fifteen of 18 grab samples returned copper values of 1.25% to 8.36%.

Using Kitco’s “Rocks in the Box” tool, the insitu value of the Silver Line (Mantos) works out to $4,993 per tonne. Granted, these are only channel and grab samples, but these are outstanding surface grades, the highest I have ever heard of, for a carbonate replacement deposit.

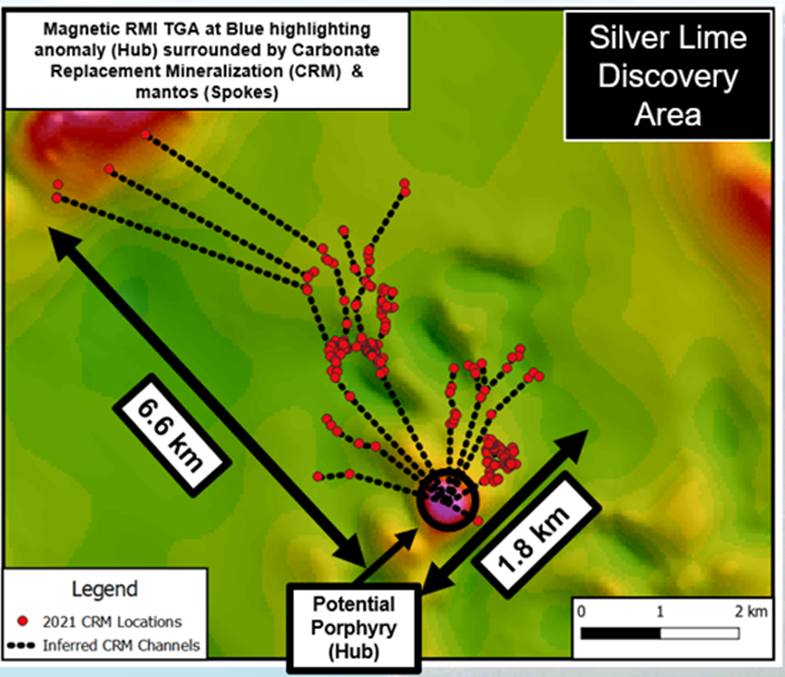

Often with CRDs the surface expressions are few and far between and maybe a cm or two thick. This one appears to be different. Blues got one manto, the Grizzly, that’s 500-meters of massive sulfide outcropping in an area extending out 6.6 km from the potential porphyry hub (the spokes are seen below as dotted black lines to the red dots). This area is almost 2 kilometers (1.8 km) wide. Extraordinary.

2021 exploration at the Silver Lime Discovery Area was able to newly define the mineralized spokes. According to Core Assets:

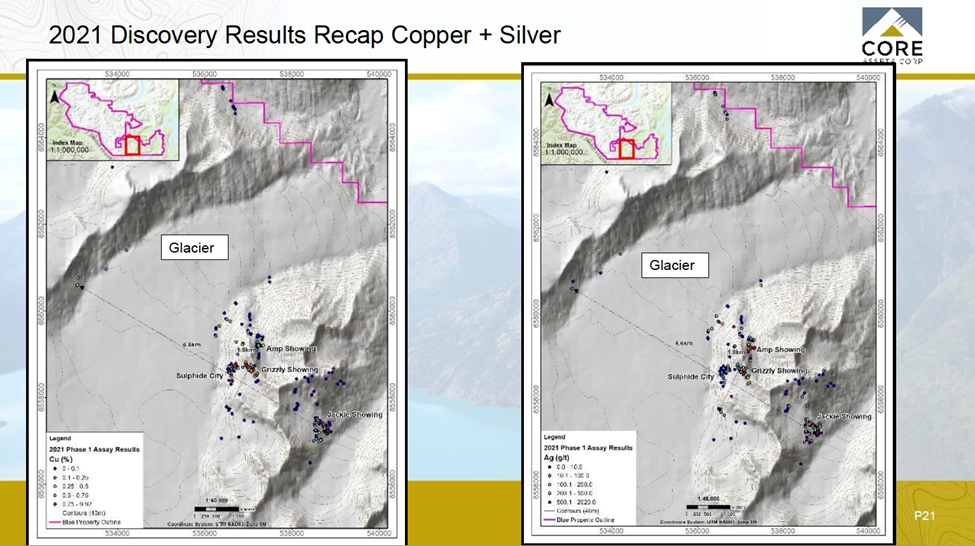

• 91 samples returned assay values from 0.20% to 9.92% Cu, with 10 samples returning >1.04% Cu;

• 58 samples returned assay values from 110 g/t to 2,020 g/t Ag with 17 samples returning >417 g/t Ag;

• 115 samples returned assay values from 1.04% to >30% Zn, with 41 of those samples returning >10.15% Zn;

• 53 samples returned assay values from 1.01% to >20% Pb with 33 samples returning >5.59% Pb; and

• 9 samples returned assay values from 1.03 to 6.75 g/t Au

The main point for this whole project and the reason for the dotted lines and the massive sulfide occurances is the following:

Unlike vein-hosted deposits, CRDs typically manifest as continuous sulphide bodies over multi-kilometre-scales that broaden with depth and demonstrate continuity back to the source. All dots should be connected in the sub surface and that’s what Core Asset aims to test next summer.

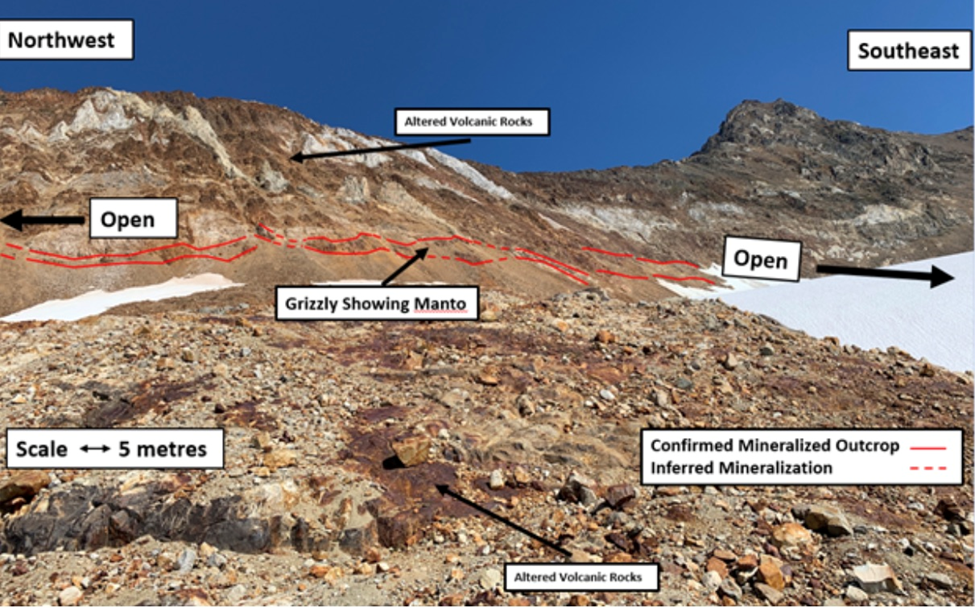

At the newly defined Grizzly Manto, two sub-parallel zinc-lead-silver-copper carbonate replacement manto zones were discovered over a strike length of >500m, with widths up to 5m.

Assay values from 44 samples returned averages of 8.2% Zn, 1.8% Pb, 0.40% Cu and 110 g/t Ag over 500m. The mineralization remains open in both directions along strike and at depth.

The Grizzly Manto and its 500-meter-long strike, compares favorably to other recognized CRD deposits, including Naica in Mexico with a strike of just 75m (the deposit contains over 45 million tonnes zinc, lead and silver) and the Santa Eulalia deposit, also in Mexico, with a surface expression of just 40 meters and a metallic content of 35Mt Zn + Pb + Ag.

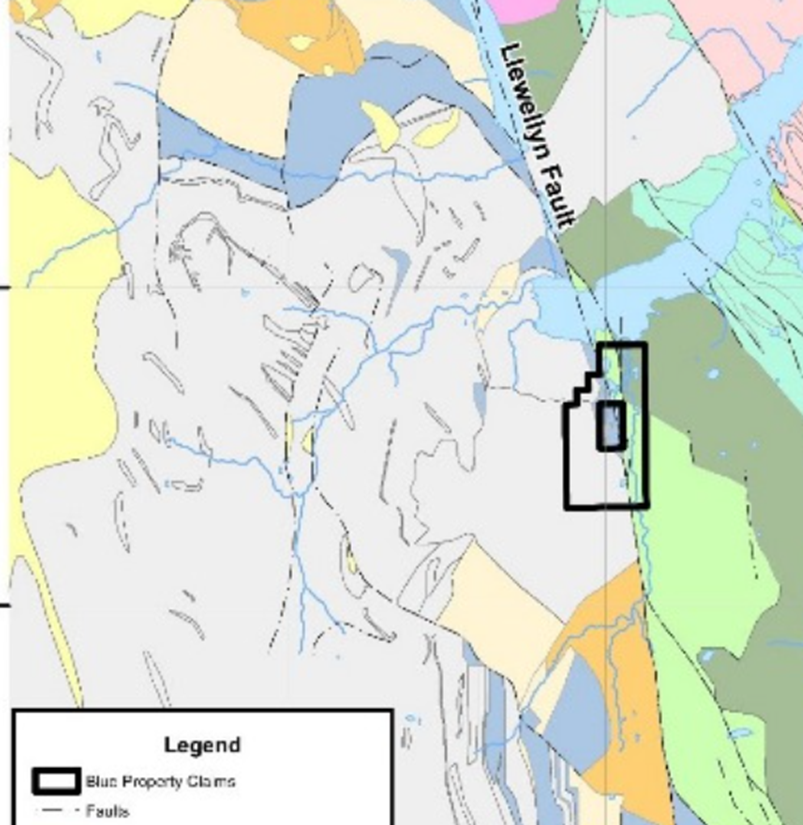

A northwest fault system, the Llewelyn fault, cuts across the mining area. Locations sampled 500m apart along the Llewelyn fault yielded gold assays averaging 1.0 g/t Au with Ag as high as 42.0 g/t.

The exploration plan at the Blue property is to trace the CRD mineralization seen at surface, back to the source. According to Core Assets, the newly defined high-grade district-scale (6.6 km x 1.8km) CRD Ag-Pb-Zn-Au alternation assemblages indicate potential for a nearby Cu-Mo porphyry discovery using a proven exploration deposit model.

Channel sampling assay results and geophysical interpretation from 2021’s exploration program is pending.

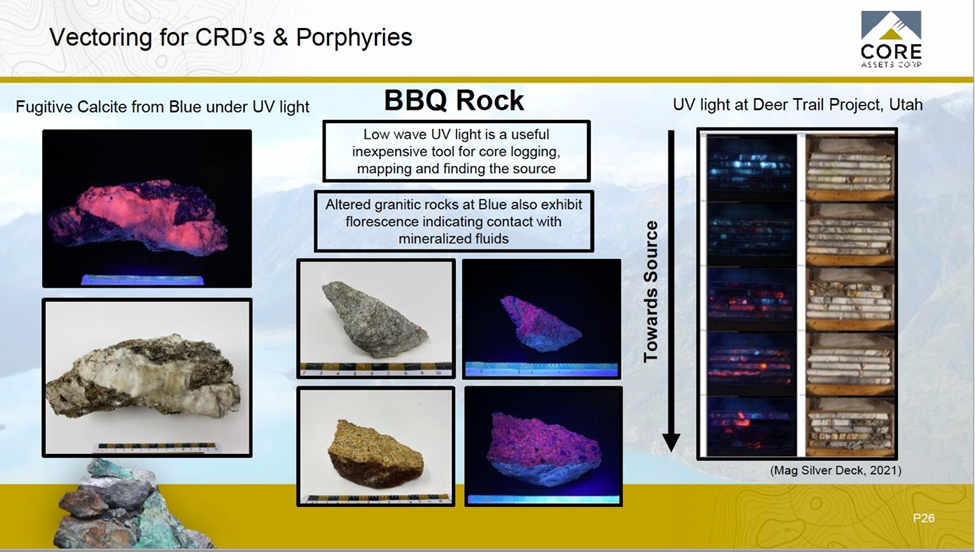

A particularly interesting aspect of the work program going forward is an ability to vector into CRD mineralization and the intrusive by using ultraviolet light.

The UV light makes contact with the mineralized fluids in the rock and glows, like red-hot coals in a barbecue. Low-wave light is considered to be a useful and inexpensive tool for logging drill core, mapping and vectoring to the source of mineralization.

As you move towards the source of mineralization (the intrusive) above right, the UV light appears to increase the cores ‘glowing coals’ appearance

Conclusion

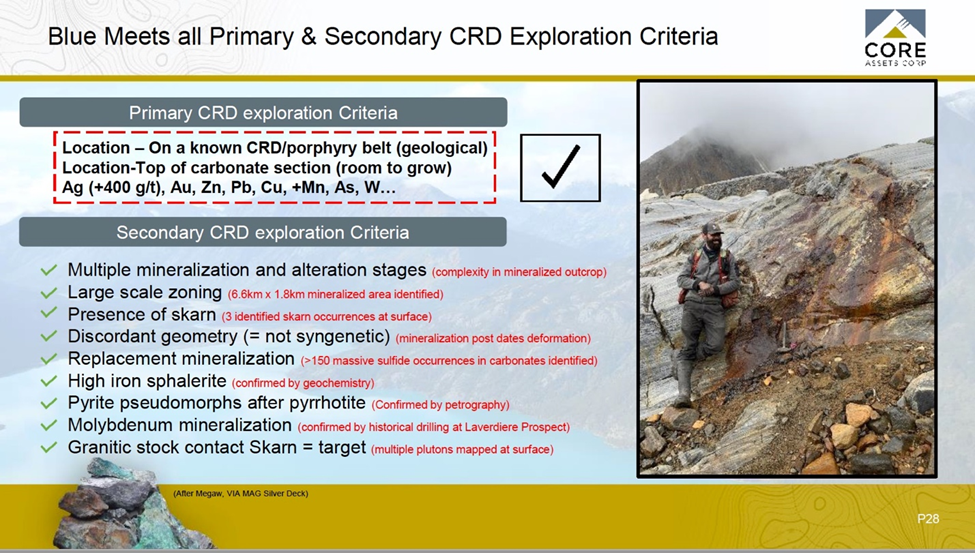

The Blue property appears to meet all primary and secondary criteria for being a CRD deposit, and one with extraordinary exploration upside to boot.

Blue is located on a known CRD/porphyry belt, at the top of a carbonate section, with room to grow. It has the right minerals, including Ag (+400 g/t), Au, Zn, Pb and Cu, plus others.

There are multiple mineralization and alteration stages (complexity in mineralized outcrop), large-scale zoning (6.6 km x 1.8 km mineralized area identified), and the presence of skarns (three identified skarn occurrences at surface).

In fact, Blue exhibits mineralization across the entire spectrum of CRD-porphyry deposits, as seen in the diagram below.

Only Bingham Canyon and Sunnyside Taylor, both Arizona deposits, match Blues polymetallic range. The fact that the deposit model being followed for Core Assets Blue Project – Bingham Canyon’s hub & spoke model – is so similar is also encouraging, and exciting, and makes Blue, imo, a world class exploration target

Core Assets appears to have a truly district-scale opportunity here — on a massive land package that they 100% control, with no outstanding royalties and no outstanding option payments.

Click a picture for larger images

The company is following a proven CRD-porphyry continuum model that looks very promising. We look forward to the news flow this winter as CC goes about unveiling this potential CRD monster to shareholders and junior resource investors.

Core Assets Corp.

CSE:CC, OTC.QB: CCOOF, Frankfurt: 5RJ

Cdn.$0.59, 2022.01.28

Shares Outstanding 58.2m

Market cap Cdn$34.1m

CC website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Core Assets Corp. (CSE:CC) CC is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.