Pipe Dreams and Ponzi Schemes

- Home

- Articles

- Uncategorized

- Pipe Dreams and Ponzi Schemes

2021.12.29

CRESCAT CAPITAL

Normally, as part of the creative destruction process in economic downturns, the financial system gets purged of excesses. In the subsequent recovery, the health of the economy is restored in a natural way as new leadership arises from sectors and industries that are inherently different from those of the prior expansion. In the wake of some of the biggest profligacies, the disorderly unwinding of pipe dreams and Ponzi schemes coincides with the economic contraction and results in the permanent loss of capital for those caught up in them. As Warren Buffett says, “Only when the tide goes out, do you discover who’s been swimming naked”.

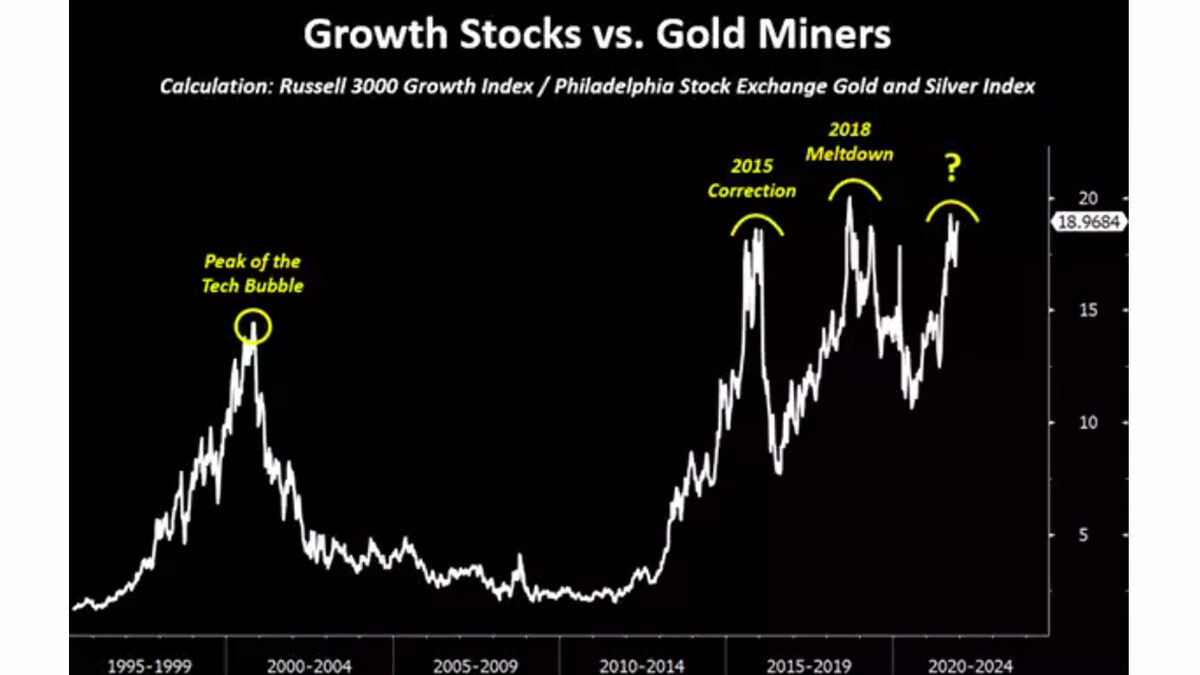

A universal problem with every business cycle as it advances to its later stage is that investors tend to extrapolate recent success of strong performing industries and asset types driving further momentum and speculative frenzy. With unrealistic future growth assumptions, prices and valuations of underlying businesses become completely detached from underlying fundamentals. Among the drivers of price misalignments today are unrealistic discount rates that assume the cost of capital will remain forever low.

Implicit in today’s valuations is the assumption that the Fed can sustain simultaneous high liquidity and low inflation endlessly, which is impossible. There is a business cycle after all. Too much liquidity creates inflation which crimps the real economy. Too much inflation demands removal of liquidity which further catalyzes economic downturns.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.