Renewable energy will not replace fossil fuels and nuclear

2021.12.22

An especially cold fall and an even colder blast of winter on the way has many pondering why Europe’s switch to renewable energy has been a flop.

Shutting down coal-fired power plants that provided cheap electricity when renewables can’t do the job, and every country chasing natural gas at the same time, has caused natural gas prices to soar, causing a continent-wide energy crisis.

Gas prices in Germany and France are already at record highs while the weather is relatively mild; the forecast calls for colder than normal for the rest of December and into January.

Nuclear energy should be a viable alternative but after the 2011 partial meltdowns in Japan’s Fukushima Daiichi nuclear complex, Angela Merkel’s government immediately shut down almost half of the country’s nuclear power. Germany, overnight, decided 40% of its nuclear power capacity would be eliminated, and removed 8,800 megawatts (MW) from the grid; the remaining 12,700 MW of nuclear-supplied electricity will be gone by 2022.

The country rapidly approaching that deadline, Germany has moved to shut down six nuclear plants or 8.5 gigawatts (1GW = 1,000MW) by the end of next year. Three of its newest plants are due to close in just over a month, removing 4.05GW, equivalent to the average electricity consumption of Denmark, from northern Europe’s power grid.

Germany also plans to take all its natural gas plants offline by 2038.

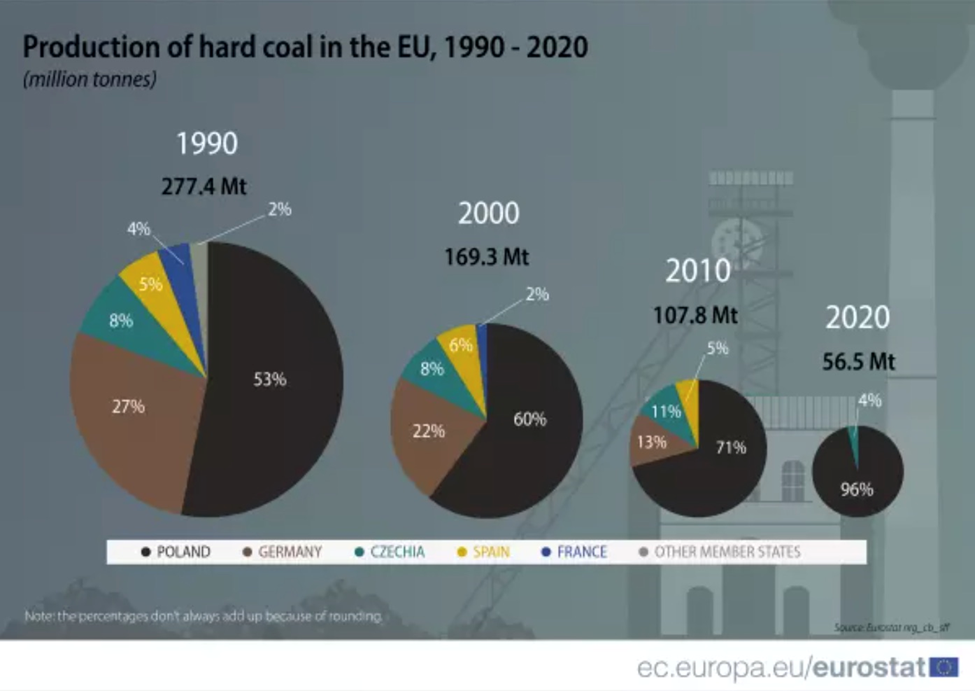

Coal, the bad boy of power generation, is for good reasons being shunned by the European Union, where the number of member states producing it fell from 12 in 1990 to just two, the Czech Republic and Poland, in 2020.

Production of hard coal, or anthracite, dropped 80% to 56 million tonnes during that same time frame, as countries switched to natural gas and renewables.

In November Portugal shut down the last of its remaining coal plants, becoming the fourth EU country to stop using the fossil fuel to generate electricity.

But here’s the rub. Despite Germany’s professed intention of generating most of its power from renewable energy, so-called “Energiewiende”, the country’s production of solar and wind power has failed expectations, with the gap between supply and demand having to be met by nuclear and coal, and consumers faced with horrendous power bills.

A recent analysis by Verivox found that Germany’s US$0.45 per kilowatt hour is the third-highest-priced electricity in the European Union (behind the Czech Republic and Romania) and more expensive that all the other G20 countries.

In 2021, due to unfavorable weather conditions, the country’s production of wind and solar power for the first three quarters plummeted compared to the same period in 2020, with onshore wind producing 18% less, 14% less from offshore plants, and solar energy producing only half as much.

The irony is, notwithstanding the country’s disdain for fossil fuels and nuclear energy, if it wasn’t for these traditional base-load sources, deployed to make up for the failure of solar and wind to deliver as expected, Germany would have been facing black-outs.

In fact parts of the country could still be plunged into darkness if Germany’s ill-conceived plan to retire three nuclear power plants in the middle of winter without a reliable source of replacement power comes to pass.

In Portugal, even though 60-70% of the country’s electricity comes from renewable sources, it still relies heavily on imported fossil fuels to meet its total energy needs. According to Euronews, Despite the early shift to coal-free power, there are concerns the Pego plant, run by the privately held group Tejo Energia, might now be converted to burn wood pellets.

Which is worse for the environment, burning coal or wood? We don’t know but it’s an indication of how far Europe, and the rest of the world, is from beating its addiction to fossil fuels and getting 100% of its power from renewable sources.

Coal use in the United States has dropped considerably over the years but it still burned 477 million tons in 2020, representing a tenth of total energy consumption, according to the US Energy Information Administration (EIA).

In Canada, despite a plan by the federal government to quit burning and exporting thermal coal by 2030, requests have been made by two provinces to keep their coal plants operational for another decade. Global News reported in September that Nova Scotia is negotiating an agreement in principle with Ottawa to keep its coal-fired electricity plants open until 2040. In July the province of New Brunswick made a similar request of the feds. Coal is also burned for power in Alberta and Saskatchewan, although Alberta is on track to phase it out by 2023, Global News said.

According to new data from the International Energy Agency (IEA), global power generation from coal this year is forecast to soar 9%, to an all-time high of 10,350 terawatt-hours. Coal use is being driven by a huge increase in natural gas prices, with power plants sourcing coal as a cheaper alternative.

“The rebound is being driven by this year’s rapid economic recovery, which has pushed up electricity demand much faster than low-carbon supplies can keep up,” the IEA said, via Mining Weekly.

The organization notes that energy-intensive industries like cement and steel are expected to increase coal demand by 6% in 2021, and says a new record high could be set in 2022.

Asia dominates the global coal market with China and India accounting for two-thirds of demand.

About a year ago we covered a report from British Petroleum declaring that “peak oil demand” was reached in 2019. According to the oil major’s 2020 outlook, global oil demand could soon fall rapidly, due to stronger climate action by countries, by at least 10% over the next 10 years, and up to 50% by 2040.

The up-shot, according to BP, is that oil, coal and natural gas will be dead in 20 years. Coal will die before oil, which will run out prior to the end of natural gas, seen by many as a transition fuel to renewable energy sources.

If we accept that the end of fossil fuels is nigh, the next question is, what will replace them? For BP, the answer is clearly renewables. The company expects that renewables will supply more than four times their output in 2019 by 2030, similar to current supplies from gas. By 2040, renewables more than double again, to an amount equivalent to the current total from coal and gas combined.

Really? The table below from the IEA’s ‘Global Energy Review 2019’ shows global electricity generation in 2019 dominated by fossil fuels, with coal and gas representing 59% of the total 26,951 terrawatt hours (TWh) generated. Solar and wind accounted for just over 2,000 TWh.

So BP is telling us that in <20 years, these renewables energy systems, which are not suitable as base-load power because their plants cannot run continuously (they can only make electricity when the sun shines or the wind blows) are going to jump from 2,000 TWh, to 16,000 TWh, an 8-fold increase?

The IEA report states that, while renewable energy is certainly gaining market share, it remains a relatively low 12% of total electricity generation (just 12% including solar, wind, biomass & waste), which is still dominated by coal and natural gas.

For example, while demand slipped 1.7% in 2019, coal continues to represent the largest source of electricity generation in the world, with a share of 36%.

Despite moves in various countries to decarbonize, oil continues to be in high demand.

A very interesting Washington Post article has Saudi Arabia’s Oil Minister, Abdulaziz bin Salman, warning of a collapse in oil supply due to falling investment in fossil fuels:

The prince warned that worldwide oil production could fall by 30 million barrels a day by the end of the decade because there is not enough being spent on the exploration for and development of new resources. That implies production of less than 70 million barrels a day.

Notwithstanding the global movement to electrification and decarbonization, Saudi Arabia does not see much of a reduction in oil demand — only around 9 million barrels of oil a day, or 9%. Even with COP26, the Saudi oil minister says the world will need about 90 million bod by 2030, leaving a shortfall of 22Mbod, more oil than was consumed by the US in 2019.

This is being allowed to happen because governments around the world wish to see a shift to renewable energy. A lot of oil and gas investment is being moved to renewables, at least partly driven by ESG concerns; we’re rushing pell mell into “green” everything without adequately replacing our fossil-fuel resources. That means not looking for enough oil, not pumping enough oil, and not putting enough into key energy infrastructure projects like pipelines.

Trouble is, we’ve been so focused on expanding renewable energy, before it can actually replace fossil fuels, that we have virtually guaranteed oil (and natural gas) prices will stay high for the foreseeable future.

As for the longterm, we obviously don’t know to what extent renewables will replace fossil fuels and nuclear power (nobody else does either), but we have a hard time believing it will exceed 40% and we don’t think it will ever reach 100%.

In a previous article we crunched the numbers, an edited version of which appears below.

Wind and solar: a pipe dream

If we get rid of all fossil fuels — oil, NG and coal — in 20 years, we need to generate an additional 134,838,220 GWh of renewable energy.

1 gigawatt hour (GWh) = 1,000.00 megawatt hours (MWh).

A large solar farm would be 500 megawatts (MW), keeping in mind that the biggest solar farm in the US, the Topaz/ Desert Sunlight, is 550MW, the biggest in the world is 1,547MW; most solar farms in the US are much smaller, less than 5MW).

Let’s say it is able to operate half the time, or 182 days. 500MW x 24 = 12,000 MWh x 182 = 2,184,000 MWh. 134,838,220,000 MWh divided by 2,184,000 = 61,739 500MW solar farms.

What does this mean for materials? We know that a 500MW solar conversion plant would cover 65 to 130 square kilometers with 17,500 tons of aluminum, a million tons of concrete, 3,750 tons of copper, 300,000 tons of steel, 37,500 tons of glass, and 750 tons of other metals such as chromium and titanium — 500 times the material needed to construct a nuclear plant of the same capacity.

According to a 2018 paper by the International Association for Energy Economics (IAEE), eight types of orebodies supply the elemental needs of PV technologies: gold, nickel, chromium, molybdenum, zinc, copper, aluminum and iron ore.

The amount of aluminum and copper needed to build that many solar farms is off the charts:

- 17,500 tons aluminum x 61,739 (500MW) solar farms = 1,080,432,500t @ 64 million tonnes (MT) global production (2019 USGS) = 1,080,432,500 tonnes aluminum required or 16x global production

- 7,500 tons copper x 61,739 (500MW) solar farms = 463,042,500t @ 20Mt global production (2019 USGS) = 463,042,500 tonnes copper required or 23x global production

But it’s not only the amount of materials, but the land, that would have to accommodate the more than 61,000 new solar farms. A study by Denholm and Margolis calculated the per capita solar footprint per person, based on the assumption that electricity needs in each state are met by solar power alone. Using an average of 200 square meters per capita, extrapolated to the population of the whole country, of 328.2 million, gives a figure of 65,640 square kilometers of land required for solar energy — a size roughly equal to the size of Nevada. Not taken into consideration is the amount of land needed to fit renewable energy storage batteries.

Is wind power any more feasible? The 10 largest wind farms in the world range from 630 megawatts to 20 gigawatts. Taking a 500MW wind farm, to facilitate a comparison between solar and wind, the Manhattan Institute estimates that replacing the output from a single 100MW natural gas-fired turbine, would require at least 20 wind turbines, each about the size of the Washington Monument, occupying 25 square kilometers of land. Upsizing that to 500MW would thus require 100 wind turbines, on 125 square km. That’s just for one one wind farm equivalent in size to a natural gas or solar plant.

How many wind farms would be required to produce 134,838,220 GWh of electricity, the amount needed to replace fossil fuels? A 2MW wind turbine with a 25% capacity factor (the actual output over a period of time as a proportion of a wind turbine’s capacity), due to intermittency, can produce 4,380 MWh in a year. Upsizing this to 500MW = 1,095,000 MWh. 134,838,220,000 MWh divided by 1,095,000 MWh = 123,139 wind farms @ 500MW each.

To replace about 20% of Canada’s power generation that is still from combustible fuel sources, the country would need four times as many wind farms as today. Finding space for that many, a total of 46,800MW of nameplate capacity, would require 26,676 square kilometers. This is the size of five Prince Edward Islands, or around half of Nova Scotia. Remember this is just to replace 20% of Canada’s electricity still generated from fossil fuels.

Consider that in the United States, around 63% of its power still comes from coal, oil or natural gas. According to the EIA, replacing the 966 TWh generated from coal in 2019, would require 344.6 GW of wind farm capacity, spread over 200,000 square kilometers! (about the size of Nebraska)

How about materials? According to a report from the National Renewable Energy Laboratory, wind turbines are predominantly made of steel, fiberglass, resin or plastic (11-16%), iron or cast iron (5- 17%), copper (1%), and aluminum (0-2%). This isn’t counting the electrical system, which uses copper and rare earths such as dysprosium and neodymium.

A single 2MW wind turbine weighing 1,688 tons, comprises 1,300 tons of concrete, 295 tons of steel, 48 tons iron ore, 24 tons fiberglass, 4 tons each of copper and neodymium, and .065 tons of dysprosium. (Guezuraga 2012; USGS 2011).

The Manhattan Institute estimates that building a 100MW wind farm would require 30,000 tons of iron ore and 50,000 tons of concrete, along with 900 tons of non-recyclable plastics for the large blades. The organization says that for solar hardware, the tonnage in cement, steel and glass is 150% greater than for wind, to get the same energy output.

According to The Institute for Sustainable Futures at the University of Technology Sydney, Australia analyzed 14 metals essential to building clean tech machines, concluding that the supply of elements such as nickel, dysprosium, and tellurium will need to increase 200–600%.

If BP is correct in its outlook that in two decades, renewables are going to supply the equivalent amount of electricity currently generated by coal and gas combined, we have a problem, Houston. First of all, just replacing the current amount of energy demanded by coal and natural gas, let alone the inevitably higher figure in 2040, with solar and wind would be nothing short of miraculous. Our research shows that it would mean over 60,000 solar farms and more than 120,000 wind farms. In all it’s about a 450% increase in renewables.

Of course, solar and wind farms can’t be located just anywhere. They need to be in the right locations, where the winds are strong and frequent, areas that get a lot of sunshine, and close enough to power lines to be economical.

We already know that we don’t have enough copper for more than a 30% market penetration by electrical vehicles. Building renewable energy capacity is over and above supplying the ever-growing marketplace for EVs. How are we going to get enough solar and wind to produce a minimum of 134,838,220 GWh (that’s for 2019, it could be double by 2040), if we are to replace fossil fuels in 20 years?

And even if we could, how are we going to find the raw materials? For solar power we are talking about finding 16 times the current annual production of aluminum, and 23 times the current global output of copper. Up to six times the current production levels of nickel, dysprosium and tellurium are expected to be required for building clean-tech machinery. Good luck!

Even if the mining industry could identify and produce this amount of metals to meet the world’s goal of 100% decarbonization, the supply shortages guaranteed to hit the markets for each would make them prohibitively expensive. It’s just supply and demand.

The supply chain for batteries, wind turbines, solar panels, electric motors, transmission lines, 5G — everything that is needed for a green economy— starts with metals and mining. Demand for lithium, nickel and graphite on the battery side and copper on the energy side is expected to rise rapidly.

In fact, battery/ energy metals demand is moving at such a break-neck speed, that supply will be extremely challenged to keep up. Without a major push by producers and junior miners to find and develop new mineral deposits, glaring supply deficits are going to beset the industry for some time.

According to a recent report by UBS, a deficit in nickel will come into play this year, for rare earths in 2022, for cobalt in 2023, and in 2024, for lithium and natural graphite.

Moreover, the Swiss investment bank predicts large deficits by 2030 for each of these metals: 170,000 tonnes for cobalt, equal to 42% of the cobalt market; 10.9 million tonnes of copper (about half of current global mined production), representing 31% of the market; 2.1Mt for lithium (50% market share); 3.7Mt for natural graphite and 2.2Mt for nickel (both 37%); and 48,000 tonnes for rare earths, equivalent to 47% of the market.

Structural deficits for copper and other “future-facing metals” mentioned above, including nickel, cobalt, graphite, and rare earths, are likely to be with us for some time.

In fact, we believe that structural supply deficits will be deeper than UBS is predicting, due to all of the supply bottlenecks we outlined in a previous article titled ‘The mounting obstacles to battery/ energy metals supply parity’. These include China, covid-related supply chain disruptions, water shortages, climate change, resource nationalism, politics, ESG, an aging workforce, and a dearth of exploration spending.

Clearly need a new fuel source to supply the energy required by the coming electrification of the global transportation system, and for transforming the world energy nexus from fossil fuels to non-carbon sources.

Thorium

That fuel source is thorium.

Thorium is actually fairly common on Earth. According to Livescience it occurs in the Earth’s crust at 6 parts per million – about as much as lead and three to five times more abundant than uranium; it is the 41st most abundant element on Earth.

However it is thought to be rare because thorium is normally found as minor constituents of metals. Interestingly though, natural thorium occurs as almost pure 232Th, the most stable thorium isotope, which has a half-life comparable to the age of the universe (14 billion years), and whose radioactive decay is the largest contributor to the Earth’s internal heat. Right now it’s estimated the planet still has about 85% of the thorium present when the Earth was formed. Scientists at Los Alamos National Laboratory – where the first nuclear weapons were designed as part of the Manhattan Project – think that thorium was created in the cores of supernovae (the last stages of a star’s life), then scattered across the universe when the stars exploded.

Trace elements are found in rocks, soil, water, plants and animals, with higher concentrations contained within thorite, thorianite, monazite, allanite, and zircon. The element is mined mostly in Australia, Brazil and India. The rare earth mineral monazite contains between 6 and 12% thorium phosphate.

According to the World Nuclear Association (WNO) world thorium resources sit at 6.35 million tonnes, with India holding the most a 846,000 tonnes, followed by Brazil, Australia and the United States. A large-vein deposit of thorium and rare earth elements is located in Idaho.

Thorium content can reach up to 26% in phosphate monazite, although concentrations more frequently do not exceed 10%.

Recovering thorium from monazite involves leaching it with sodium hydroxide at 140°C followed by a process to precipitate pure ThO2. The WNO states that under 10,000 tonnes a year of monazite are extracted per year from India, Brazil, Vietnam and Malaysia, but “without commercial rare earth recovery, thorium production is not economic at present.”

A detailed breakdown of world thorium occurrences, deposits and resources was done in 2019 by the International Atomic Energy Agency (IAEA).

The report explains that thorium is often associated with uranium, and that many igneous rocks have elevated thorium content, although too low to be considered as mineable deposits.

Thorium resources are concentrated mostly in carbonatite-type deposits, which account for about 30% of the total. The rest are distributed about evenly among three deposit types, which in increasing order of abundance, are alkaline rocks, vein-type deposits and placers.

Australia’s mineral sands (placers) comprise about 70% of its known thorium resources, while in India, almost all of the country’s thorium is bound up in placer deposit with monazite, occurring at coastal areas. Thorium placers in Brazil are also found along the coast and in carbonatite present in the state of Minas Gerais, among others.

In Europe, resource estimates totaling about 1 million tonnes have been calculated in Finland, Greenland, Norway and Turkey, although only 10% is estimated to be economically viable assuming by-product recovery.

According to the Royal Society of Chemistry, thorium’s benefits include:

- Thorium is three to four times more abundant than uranium. There is estimated to be enough thorium on the planet to last 10,000 years.

- Thorium is more easily extracted than uranium.

- Liquid fluoride thorium reactors (LFTR) – a type of molten salt reactor – have very little waste compared with reactors powered by uranium.

- It is more efficient. One tonne of thorium delivers the same amount of energy as 250 tonnes of uranium.

- LFTRs run at atmospheric pressure instead of 150 to 160 times atmospheric pressure currently needed for water cooled reactors.

- Thorium is less radioactive than uranium.

The 2011 Fukushima disaster in Japan soured the world on nuclear, and started scientists looking more closely at thorium as a “greener” alternative. While conventional nuclear plants are only able to extract 3-5% of the energy in uranium fuel rods, in molten salt reactors favored by thorium proponents, nearly all the fuel is consumed. Where radioactive waste from uranium-based reactors lasts up to 10,000 years, residues from the thorium reaction will become inert within 500. Lastly, because plutonium is not created as a waste product in a thorium reactor, it cannot be separated from the waste and used to make nuclear weapons.

As far as disadvantages, thorium takes extremely high temperatures to produce nuclear fuel (550 degrees higher than uranium dioxide), meaning thorium dioxide is expensive to make. Second, irradiated thorium is dangerously radioactive in the short-term. Detractors also say the thorium fuel cycle is less advanced than uranium-plutonium and could take decades to perfect; by that time, renewable energies could make the cost of thorium reactors cost-prohibitive. The International Nuclear Agency predicts that the thorium cycle won’t be commercially viable while uranium is still readily available.

Developing thorium resources to compete with uranium, against which it has several advantages, is a case of the chicken and the egg. While around 6 million tonnes of resources are available planet-wide, much of it is uneconomic as a by-product of other minerals because thorium has yet to be commercially viable. Without a demand driver there is obviously no economic reason to extract it.

Yet there is reason for optimism. Some scientists believe thorium is key to developing a new version of cleaner, safer nuclear power.

Examples of companies and countries that are testing thorium’s viability as a nuclear fuel keep growing. In 2017 a Dutch nuclear institute started experimenting with MSRs. NRG, the name of the facility, on the North Sea coast of the Netherlands, launched the Salt Irradiation Experiment in collaboration with the EU. New Scientist reports the researchers will use thorium as the nuclear fuel for the reactor where both the reactor fuel and the coolant are a mixture of molten salt. The experiment will also examine how to deal with the nuclear waste.

In Norway, Thor Energy started producing power from thorium at its Halden test reactor in 2013, with help from Westinghouse. The third phase of a five-year thorium trial operation got underway in 2018.

India’s thorium program is well advanced. The country envisions meeting 30% of its electricity demands through thorium-based reactors by 2050. With large quantities of thorium and little uranium, India wants to use thorium for large-scale energy production. It plans to construct and commission a fleet of 500 sodium-cooled fast reactors – which burn spent uranium and plutonium – in order to breed plutonium to be used in its advanced heavy water reactors that employ thorium as the nuclear fuel.

Indonesia, which has a large amount of thorium contained within monazite, signed an agreement with US company ThorCon Power, to develop molten salt reactors. A 1,000-megawatt thorium-based reactor would be used for base-load power and produce 5 gigawatts a year. The country wants around 20% of its energy mix to come from thorium molten salt reactors by 2050.

In the United States, the Department of Energy is partnering with TerraPower, Vanderbilt and the Oak Ridge National Lab, among others, to build a molten chloride fast reactor — a type of MSR — Oilprice.com reported. Southern Company in 2016 was the second firm to receive a grant from the DOE.

China, seemingly always on the leading edge of new energy, has put aside US$3.3 billion to build two molten salt reactors in the Gobi Desert, the South China Morning Post said. The reactors could spawn new uses for the radioactive element, including applications in warships and drones.

Closer to home, the New Brunswick government has committed $10 million towards building a “nuclear research cluster” that includes a demonstration Stable Salt Reactor – Wasteburner (an SSR-W is suitable for grid-scale power, between 300 megawatts and 3GW) to be powered by spent uranium. SSRs can also use thorium as the nuclear fuel. A full-sized SSR-W is planned for 2030.

Conclusion

Replacing fossil fuel-generated power — coal, oil, and natural gas — 100% with renewables is untenable. Not only are solar and wind inappropriate for base-load power, because their energy is intermittent, and must be stored in massive quantities, using battery technology that is still in development, they just don’t have anywhere near the energy intensity provided by fossil fuels, or nuclear.

Driven by the need to decarbonize due to increasingly apparent climate change, governments around the world right now are choosing to de-invest from oil and gas, and instead are plowing funds into renewable energies even though they aren’t yet ready to take the place of standard fossil-fueled baseload power, i.e., coal and natural gas.

We have seen this foolish endeavor playing out in Europe, where natural gas prices are hitting records due to gas plants being shut down as well as nuclear plants shelved, such as in Germany and France. The skyrocketing cost of electricity is being borne by ordinary citizens who had no part in this dumb policy of “premature decarbonization”.

Saudi Arabia has warned that, without re-investing in the oil industry to find more deposits, the world could be short 30 million barrels a day in just eight years.

In the current under-supplied environment, high oil and natural gas prices will be with us for the foreseeable future.

But renewables are expensive, too. Wind and solar energy do not happen without mining, and they take unbelievable amounts of metals. Just replacing the current amount of energy demanded by coal and natural gas, let alone inevitably higher figures in future, with solar and wind, we calculated it would take over 60,000 solar farms and more than 120,000 wind farms. In all it’s about a 450% increase in renewables.

Ain’t gonna happen, folks. We will run out of metals long before we reach that level of renewable energy capacity. In fact we would be surprised if we even make it to 40%. Without a concerted and global push to mine more, the prices of the required metals will keep climbing, crimping demand for them.

For example, range anxiety and sticker shock are the two biggest hurdles to electric vehicles reaching price parity and eventually overtaking sales of traditional “ICE” vehicles fueled by gasoline or, increasingly rare, diesel.

We already know that we don’t have enough copper for more than a 30% market penetration by electrical vehicles. For solar power we are talking about finding 16 times the current annual production of aluminum, and 23 times the current global output of copper. Up to six times the current production levels of nickel, dysprosium and tellurium are expected to be required for building clean-tech machinery.

Thankfully, we have a third option, and that is nuclear. One uranium pellet weighing just 6 grams produces the same amount of energy as a tonne of coal. One tonne of thorium delivers the same amount of energy as 250 tonnes of uranium. Nuclear fusion is even more efficient but requires mind-blowingly high heat.

It is encouraging to see progress being made on developing a viable nuclear fusion reactor, as well as the development of nuclear reactors that would use thorium instead of uranium as the nuclear fuel.

Nuclear has to be in the mix; renewables are not going to cut it; they simply don’t provide enough bang for the buck.

Conventional nuclear power has had a good run, but it has a lot of enemies. Despite assurances from the nuclear industry, fear of nuclear accidents is unlikely to go away. The multi-billion-dollar cost to build new water-cooled reactor plants is another mark against nuclear. As Asian countries embrace nuclear power to decarbonize their economies, Europe and North America are ditching it, which imo, is foolish.

We see smaller reactors as the way forward, especially those powered by thorium.

For now, thorium is a theoretical solution to our energy dilemma, but it could be much more than that. A concerted effort to develop thorium reactor technology could provide stable, clean, base-load power for millions, something that is not possible with renewables due to the intermittency factor and the current early stages of renewable battery storage technology. It is safer and better for the environment than uranium and can even use radioactive waste as feedstock for the nuclear reaction, thus killing two birds with one stone. The market is not yet ready for thorium, but when it is, a whole new mining sector and supply chain will be born.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.