With inflation pressure not going away, gold miners are the “value play”

2021-11-11

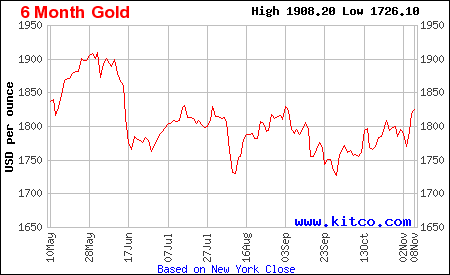

Quietly, the gold market has enjoyed a period of revival, having recently climbed to its highest in 2 months as inflationary pressures keep on piling up.

Economic indicators such as the latest US jobs and payroll data have barely changed the view of policymakers. The US Federal Reserve still views this inflation as transitory, thus won’t accelerate its rate hike. The Bank of England, too, seems to be following suit.

But many analysts beg to differ. Some even think the central banks have lost control of inflation, leaving the market to fend for itself for the time being.

This is backed by investors’ willingness to buy into more gold as a hedge since September, evidenced by the movement of gold prices over the past few weeks.

There is still room to go higher, according to those keeping tabs on the situation, citing gold as a “value play” once investors realize inflation has kicked into gear and is not transitory.

Also value plays are the junior gold exploration/ development/ mining companies, which could very well be the biggest beneficiaries of another rally like 2020.

Recently, two of the biggest figures in the mining industry predicted that investors will soon catch on that global inflationary pressures are far more intense than suggested, which could possibly send gold prices to $3,000/oz.

While there are ample junior miners holding gold projects, AOTH has zoomed in on those located within the top gold mining jurisdictions in the world with high growth upside.

Emerging Ontario Gold Explorer

It’s hard to ignore Ontario when discussing the world’s biggest gold hunting grounds.

The Canadian province has at least 20 mines in operation, producing more than 73,000 oz of gold on an annual basis, the most in the country. Gold mining is active in all parts of the province, including major camps such as Timmins, Red Lake and Kirkland Lake.

Still, the gold exploration potential in many areas of Ontario remains untapped, some even with multi-million ounce upside.

Earlier in the year, Goldshore Resources Inc. (TSXV: GSHR) (OTC: GSHRF) (FRA:8X00) took on the Moss Lake gold project from Wesdome Gold Mines Ltd., following Goldshore’s reverse takeover transaction with Sierra Madre Developments Inc.

The Moss Lake property, comprising 282 mining claims covering 14,292 hectares of land, is located near Thunder Bay, within an excellent jurisdiction situated between the Red Lake and Marathon camps.

A number of major gold deposits are found nearby, including Detour (Kirkland Lake Gold) with 15.7Moz in gold reserves (proven and probable) at 0.82 g/t Au, New Gold’s Rainy River with 2.6Moz gold reserves at 1.06 g/t Au, and Côté (IAMGOLD & Sumitomo) with 7.3Moz gold reserves at 1.0 g/t Au.

Moss Lake itself hosts a number of gold and base metal rich deposits, including the Moss Lake deposit, the East Coldstream deposit, the past-producing North Coldstream mine and the Hamlin zone, all of which occur over a mineralized trend exceeding 20 km in length (see below).

The property has seen extensive historical exploration since the late 1800s.

Prospecting resulted in the discovery of multiple high-grade gold occurrences and the North Coldstream copper-gold-silver deposit, from which 2.7 million tonnes was mined up to 1950 at 1.89% Cu, 0.56 g/t Au and 5.59 g/t Ag.

Gold exploration intensified during the 1970s with Falconbridge and exploration of the Snodgrass Lake prospect. The original Moss Lake showing was stripped and washed by the Tandem/Storimin joint venture in 1985.

Between 1986 and 1990, extensive drilling and 1,000m of underground development work were completed by several groups, along with the first resource estimates and metallurgical work.

During the 1990s, Moss Lake Gold Mines continued exploration with several modest drill campaigns and further geochemical/ geophysical surface programs, along with an updated resource estimate in 2010.

A PEA was completed by Moss Lake Gold Mines in 2013, ownership was amalgamated by Wesdome Gold Mines in 2014, and the Coldstream and Hamlin properties were acquired in 2016.

More exploration and drill programs in 2016 and 2017 confirmed extensions of mineralization along strike.

In acquiring the Moss Lake project from Wesdome in January 2021, Goldshore has inherited a significant historical resource (2013) estimated at 1.47Moz indicated and 2.51Moz inferred, for a combined 4Moz split between two deposits (Moss Lake and East Coldstream).

Despite having a number of companies’ fingerprints on it, the property remains under-drilled, as historical drilling only went down to 250m out of a possible 2 km long deposit.

According to Goldshore, the 20 km mineralized trend at Moss Lake contains multiple zones and targets that are ready for follow-up, with both infill and expansion drilling considered necessary.

The company’s belief was recently validated by assays from the first three holes of its 10,000m program at the Moss Lake deposit. Not only did the results show evidence of gold mineralization, but they also gave indications of a well-mineralized system that is much wider and deeper than previously known.

This signified the beginning of what promises to be a wide-ranging, lengthy drill program that would extend into Q2 2022.

Goldshore’s executive team is led by CEO Brett Richards, who has over 34 years of experience in the mining industry. He previously held executive roles with Roxgold (TSX: ROXG), Katanga Mining (TSX: KAT) and Kinross Gold (TSX: K).

High-Grade Silver Company

Like gold, silver also stands to benefit from investors’ flight to safe-haven assets.

Furthermore, the metal’s key role in several industrial applications means that demand would remain elevated during the global energy transition, bolstering the value of silver projects.

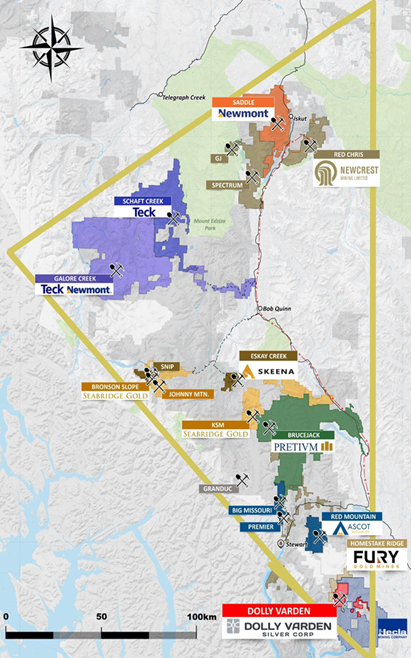

While most of the world’s silver is mined in Latin America and China, Canada should not be overlooked as a future silver producer. In particular, the western province of British Columbia is endowed with one of the richest mineralized regions on the planet: the Golden Triangle.

With over a century of mining history, this region has been the site of three gold rushes and some of Canada’s greatest mines, including Premier, Snip and Eskay Creek. Other significant and well-known deposits include Brucejack, Galore Creek, Copper Canyon, Schaft Creek, KSM, Granduc and Red Chris.

The Golden Triangle takes its name from a 500 km belt of mineralization that stretches from the British Columbia-Yukon border in the north to the town of Kitsault, just southeast of the port of Stewart. The Kitsault area is historically associated with molybdenum and silver production.

It’s in the southern part of the triangle where we find Dolly Varden Silver Corp. (TSXV: DV) (OTC: DOLLF), whose flagship silver project covers 88 sqkm of land in the Stewart Complex, an area well-known for its base and precious metals deposits.

The entire property hosts four historically active silver mines: Dolly Varden (which the project is named after), Torbrit, North Star and Wolf. These all have parts that remain unexplored to this day.

As shown in the map above, Dolly Varden’s project lies to the west of Hecla Mining’s (NYSE: HL) Kinskuch project and borders Fury Gold Mines’ (TSX: FURY) Homestake Ridge.

Kinskuch is an early-stage project with the potential for discovery of epithermal silver-gold, gold-rich porphyry and VMS deposits. At Homestake Ridge, the project’s PEA study has envisioned a 13-year mine with peak annual production of just over 88,000 gold-equivalent ounces.

However, unlike most in the region, the Dolly Varden project is a volcanogenic massive sulfide (VMS) and epithermal-style pure silver deposit in nature, which is extremely rare in the mining industry.

Mining activity on the property can be dated back to 1910, when the original Dolly Varden mine was discovered by Scandinavian prospectors.

Nearly ten years later, the Dolly Varden mine came into production and quickly established itself as one of the British Empire’s richest silver mines. It was also in the same year when the property expanded further with the discovery of another deposit nearby.

This deposit, named Torbrit, later contributed to most of the historical production at Dolly Varden. At its peak, it was considered the third-largest silver producer in all of Canada.

Historical records show that the Torbrit mine produced 18.5 million ounces of silver at an average recovered grade of 13.58 oz per tonne between 1949-1959, while the Dolly Varden mine had 1.5 million ounces at an average grade of 35.7 oz per tonne in the early 1920s.

Altogether, about 20 million ounces of silver were produced from the two historical mines over a 40-year period, with assays of ore as high as 2,200 oz (over 72 kg) per tonne.

Now, under Dolly Varden’s control, the path to restoring these silver mines back to production has begun, much like how Skeena Resources is reawakening the Eskay Creek mine up north.

Eskay Creek, which shares a similar style of VMS mineralization, was once considered to be the highest-grade gold mine in the world, producing 3.3Moz gold and 160Moz silver at 45/g/t Au and 2,224 g/t Ag from 1994 to 2008.

But first, Dolly Varden plans to unlock more silver resources from the historical deposits through drilling. According to the company, only about 3% of the property has been explored in detail.

An updated NI 43-101 resource estimate completed by the company in 2019 revealed 32.9Moz silver in indicated resources and 11.477Moz inferred, for a total of 44Moz silver, adjacent to the historical deposits.

An aggressive two-year drilling campaign is already underway to expand these resources. Last year’s drilling returned consistent intervals of high-grade silver mineralization at the Torbrit silver deposit, which Dolly Varden believes has the potential to support economically attractive underground bulk-mining.

The company also didn’t rule out a gold discovery consistent with the plus million-ounce resource at the adjacent Homestake property, in addition to the potential for another Torbrit-like silver discovery.

Gold Producer in Mexico

One company that has already been successful in restarting a historic mine is Magna Gold (TSXV: MGR) (OTCQB: MGLQF), whose flagship San Francisco project in Sonora, Mexico, resumed production in Q3 2020 and achieved full-scale commercial production on schedule earlier this year.

Located 150 km north of Hermosillo, this 47,395-hectare property consists of two previously mined open pits (San Francisco and Chicharra) and associated heap leaching facilities.

The mine was previously operated by Geomaque from 1995 through 2000. During that time, approximately 13.5 million tonnes of ore at a grade of 1.13 g/t Au were treated by heap leaching, and 300,834 ounces of gold were recovered.

Mining operations ceased in 2001 as a result of low gold prices, although leaching and rinsing of the heap continued for approximately one year after this.

In 2005, Timmins Gold (now Alio Gold) acquired the mine and processing equipment and began commercial operations in 2010. Since then, the mine has produced more than 820,000 ounces of gold, making it one of Mexico’s most successful gold mining operations in recent history.

Looking to re-establish San Francisco as a profitable mine, in March 2020, Magna agreed to take on the project, with a long-term view of improving the mine operation.

“We have a simple business model; it starts with growing organically. We only acquire properties in near-term production that were either mismanaged or forgotten in previous years,” Magna’s president and CEO, Arturo Bonillas, who served a 10-year tenure as president of Timmins Gold, said in an interview last year.

An updated Pre-Feasibility Study (PFS) on the property last September showed total proven and probable reserves of 47.6 million tonnes, graded at 0.495 g/t Au, leaving 758,000 ounces of contained gold.

“The numbers were great. The study shows that we have 1.5 million oz of resources in the ground. We have close to 800,000 oz of gold that we’re going to extract from the mine over the next seven years, at a rate of 70,000 oz per year,” Bonillas said at the time.

Now at full capacity, the San Francisco mine is capable of producing as much as 90,000 ounces annually,

There is also ample room for resource expansion, he added, citing an estimated upside of 3Moz gold and 50Moz silver.

Meanwhile, Magna has also been advancing several of its other highly prospective precious metals assets across Mexico.

The next area of exploration focus is Chihuahua, where its newly acquired Margarita silver project is situated. The project is a low-intermediate sulphidation epithermal Ag-Pb-Zn system, which can be traced to many of Mexico’s producing silver mines.

Drilling programs are also planned at the San Judas and Veta Tierra gold projects, and the La Pima silver project.

Sprott-Backed Gold Project

While Mexico and Canada are considered prime gold mining destinations, it is the US that produces the most gold on the continent.

Alaska has long been ranked among the world’s best gold mining jurisdictions and is one of the top producing states. Nearly all of the large and many of the small placer gold mines currently operating in the country are found in Alaska.

One project there that has caught the attention of Sprott Mining portfolio manager Conor O’Brien, business partner and confidente of billionaire resource investor Eric Sprott, is the Golden Summit property held by Freegold Ventures Ltd. (FVL: TSX) (OTCQX: FGOVF). Eric Sprott currently owns about 26% of the company’s outstanding shares.

Golden Summit is a large, bulk-tonnage project located just a 30-minute drive from Fairbanks, Alaska’s second-largest city. The Fairbanks mining district is host to several multi-million-ounce projects.

To date, over 80 gold occurrences have been documented within the project boundaries. Historical records show that 6.75 million ounces of placer gold have been produced from the streams draining the property.

Freegold acquired an interest in the project in mid-1991 and subsequently conducted various exploration programs, including over 53,000m of drilling over an 18-year period.

A comprehensive property compilation in 2010 identified the potential to delineate a resource in what is known as the Dolphin area.

A ground-based geophysical survey was also undertaken during that time, which indicated that the alteration in the Dolphin area is well defined by a low resistivity feature. This resistivity survey, in conjunction with soil geochemistry and re-interpretation of previous drill results, provided guidance for resource definition and expansion.

An extensive drilling campaign was carried out by Freegold during 2011-2013, from which the company was able to delineate and upgrade the mineral resource through successive drilling in and around the Dolphin area.

Based on the most recent resource estimate of 61.46Mt indicated at 0.69 g/t Au (1.36Moz) and 71.5Mt inferred at 0.69 g/t Au (1.58Moz), a Preliminary Economic Assessment (PEA) for the Golden Summit project was subsequently released in 2016.

The study envisions a 24-year mining operation with peak annual gold production of 158,000 oz and average annual gold production of 96,000 oz, producing 2,358,000 oz of doré over the life of mine.

While the bulk of the current resource is hosted by the Dolphin intrusive, its true extent is not yet known.

Drilling in 2017 north of the current resource area demonstrated the potential for expansion of the current oxide resource at Golden Summit, with the majority of holes returning average grades above the internal cut-off (0.3 g/t Au) used in the PEA.

In 2019, following an extensive data review of past drilling and in conjunction with the resource model and block model level plans, Freegold identified what it believed to be the potential for a higher-grade corridor of mineralization extending from the area of the old Cleary Hill mine workings towards Dolphin.

This hypothesis was supported by results of the 2020 drilling program, including a high-grade discovery from the altered sedimentary host rocks that surround the Dolphin intrusive.

Drilling this year continued to confirm Freegold’s revised interpretation of a potential higher-grade corridor extending from the old Cleary Hill mine workings towards the Dolphin intrusive.

Should this high-grade system end up being proven, Sprott Mining’s O’Brien believes Freegold could become a natural acquisition target for Kinross, whose Fort Knox mine is located just 8 km away from Golden Summit.

Sizable Resource in Nevada

Like Alaska, the state of Nevada is another prominent producer of gold in the US. It is home to nearly 30 mines, producing about 5Moz of gold on an annual basis.

About 170 km northeast of Reno, Nevada, Getchell Gold (CSE: GTCH) (OTCQB: GGLDF) is in the midst of a drill campaign at the advanced-stage Fondaway Canyon project, comprising 170 unpatented lode claims in Churchill County.

The property has been the subject of multiple exploration campaigns dating back to the late 1980s and early ‘90s, with nearly 50,000m of drilling completed. It covers 12 known veins, including five mineralized areas — Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill.

The latest technical report on Fondaway Canyon (2017) provided an estimate of 409,000 oz indicated gold resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au, for a combined 1.1 million oz.

Up to 80% of these ounces are within Colorado, Paperweight and Halfmoon, with the remainder found in parallel veins or splays off the main veins.

Mineralization is contained in a series of steeply dipping en-echelon quartz-sulfide shears outcropping at surface and extending laterally over 1,200m, with drill-proven depth extensions to greater than 400m.

A detailed analysis of the historical drill data revealed that the mineralized system at Fondaway may be larger than previously thought.

Drilling by Getchell in 2020 identified the presence of a thick zone of gold mineralization, interpreted as a downdip continuation of surface mineralization, and high-grade mineralized structures with notable widths within the mineralized system.

Five of the six holes drilled as part of a 2,000m program intersected significant gold intercepts within the Central Area, which is considered by company management to be the “nexus for the gold-mineralizing system” observed at Fondaway.

Following up on the drilling success, which Getchell says “blew the potential of the project wide open” by producing a revised geological interpretation for Fondaway that extrapolated the continuity of the gold mineralization over extensive distances, the company decided to proceed with a drill program twice the size this year.

The 2021 program is designed to complete sufficient infill drilling to confirm this new geological model, thus elevating the resource estimate from the current 1.1Moz. Getchell will also continue stepping out from known gold intercepts to expand the geological model.

The results so far have been promising, with the latest drill hole returning one of the best cumulative series of gold intercepts in the project’s 45-year history. This was also the seventh consecutive hole to hit substantive mineralization, with more results still to come.

When Getchell first acquired this project, chair and CEO William Wagener said these properties would “dramatically transform and elevate” the company in prominence given that they boast significant gold in the ground and are located in a top gold-mining jurisdiction.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks.

Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Freegold Ventures Ltd. (FVL: TSX).

Richard owns shares of Getchell Gold (CSE: GTCH)

GSHR, DV, MGR, GTCH are paid advertisers on Richard’s site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.