Gold’s run shows interest rate hikes not coming soon

2021.11.10

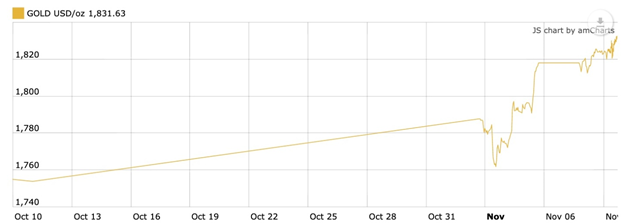

Gold continued to rally on Tuesday, as investors and metal traders priced in expectations that central banks will keep interest rates low until late 2022 at the earliest.

At time of writing spot gold and gold futures were both changing hands at about USD$1,833/oz.

The precious metal brushed up against a two-month high Friday of $1,795/oz, following a surprise decision by the Bank of England to keep its current bank rate at 0.1%, despite the US Federal Reserve’s decision last week to begin tapering its $120 billion per month bond purchases.

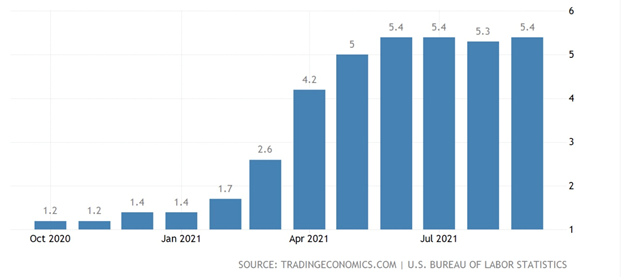

The US central bank had been telegraphing a hike in interest rates to reduce inflation which is currently well beyond its 2% target.

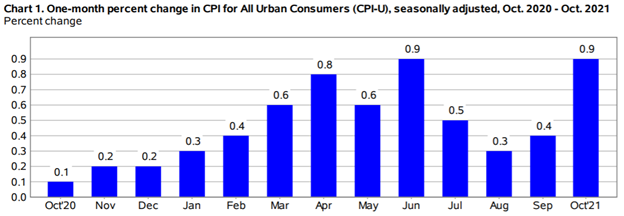

US inflation hit a 30 year high in October, rising at a 6.2% annual rate.

However the hawkish tone has recently turned dovish, with a top Fed official predicting that the economic conditions for raising interest rates beyond current near-zero levels would likely not be met until the end of next year.

The Financial Times quoted Fed vice-chair Richard Clarida stating on Monday that while the Fed is “clearly a ways away from considering raising interest rates”, the “necessary conditions” for interest rates to rise from current near-zero levels will be met by the end of next year should the economy progress as expected…

Clarida said he expected the labour market to have healed sufficiently to warrant tighter monetary policy by the end of next year, if the unemployment rate drops to 3.8 per cent from its current level of 4.6 per cent, as projections suggest.

Fed officials have said rate hikes won’t be on the table until the bond-buying program ends, likely next June. But investors are projecting more than two quarter-point increases by early 2023, Bloomberg wrote on Nov. 2.

How realistic is that? And why are these investors swallowing the Fed’s propaganda regarding rate hikes?

The US Federal Reserve is severely constrained in how much it can raise interest rates, to quell rising inflation, due to ballooning debt. The national debt is closing in on $29 trillion, and heading higher, much higher. The Fed can telegraph its intentions all it wants, the fact remains that at such unsustainably high debt levels, the interest payments will eventually cripple the federal government. More on that below.

For now we need to talk about inflation. Inflation is a gold investor’s best friend and a traditional investor’s worst enemy. This is because when inflation rises, it chips away at real savings and investment returns. If your yield on a bond is 1.5%, and inflation is running at 2%, your “real return” is negative 0.5%!

Gold and silver are the best defensive commodities to own when goods and services start to become more dear. The yellow metal is the ultimate store of value, proven to have held its worth over time, unlike fiat currencies which are subject to inflationary pressures and over the years, lose their value.

The fear of inflation continues to keep gold prices buoyant, with gold seen as the perfect inflation hedge. The only thing preventing them from going higher is the looming threat of interest rate hikes, which are seen as the antidote to inflation, but are poison to gold prices, since gold does not offer a yield and therefore loses to income-generating assets like bonds.

(Some are predicting that we ain’t seen nothing yet, that we might be heading for stagflation, where high inflation is accompanied by low economic growth. Analysts expect inflation will rise to 5.8% in October when the consumer price index figures are released on Wednesday)

Indeed a vigorous debate is raging in the financial press concerning whether inflation is “transitory” or “sticky”. The answer is important as it will guide the Fed’s timing of an interest rate hike, or series of hikes.

The Fed’s official line is that inflation is “transitory” based on supply chain disruptions resulting from the pandemic.

We don’t buy it.

Sticky inflation

Sure, we accept the idea that high demand for products and services in countries coming out of the pandemic has led to supply shortages and higher prices in a number of industries. But there are several inflation manifestations that simply cannot be called temporary or transitory. We have reported on most, if not all of them.

To recap, an energy crunch has pushed coal and natural gas prices to record highs. In China, emergency power rationing is triggering concerns that households and factories could be left without power just as winter sets in. In Europe, a colder-than normal last winter depleted natural gas inventories, causing electricity prices to soar, as demand from rebounding economies surged too fast for supplies to match. The price of NG is currently six times higher than last year and about four times higher than it was in the spring.

We also have energy inflation because of too massive a shift to renewables and a de-investment in fossil fuels, before renewable energy is ready to take the place of oil, natural gas and coal. The problem isn’t about to sort itself out anytime soon, because even though solar and wind power are getting less expensive, many parts of the world still depend on coal and natural gas as a primary source, or as a backup. The obvious example is the United States. With 40% of the country’s electricity now generated by NG, higher gas prices will inevitably push up electricity and heating bills. US natural gas futures have already more than doubled this year. Meanwhile power consumption is projected to increase 60% by 2050, according to Bloomberg New Energy Finance, driven by continued economic and population growth. Transitory inflation? Yeah, right.

New research from Dalhousie University’s Agri-Food Analytics Lab, quoted by BNN Bloomberg, shows that food inflation in Canada is close to 5%, well above the normal 1-2%. Among food categories, meat prices stand out as rising the most, with Stats Canada noting a 10% increase for these products over the past six months. Nearly half of Canadians say they have reduced their purchases of Alberta meat.

A similar trend is happening in the United States. In September food prices jumped 0.9% with the largest rise since April 2020 driven by a surge in meat costs.

It isn’t only retail food shoppers that are feeling the pinch of climbing prices. Recently the Green Markets North American Fertilizer Index hit a record high, rising 7.9% to US$996.32 per ton, and blasting past its 2008 peak. Higher fertilizer prices must often be passed onto the end user, the buyer of grains, fruits, vegetables and meats, for the grower/ farmer/ rancher to preserve his profit margin. This is precisely what we see happening right now.

One of the most important factors driving food inflation is climate change. Global warming is obviously not a temporary phenomenon.

Scientists say that record heat waves lasting longer than a week, such as the “heat dome” that enveloped residents of western Canada and the United States this past summer, will be two to seven times more likely — creating the conditions that spark wildfires, cause droughts/ water shortages, and increase the frequency of extreme weather events that often ravage farmland and disrupt supply chains around the world, forcing food prices to rise year after year.

Is drought-caused food inflation transitory? I don’t think so.

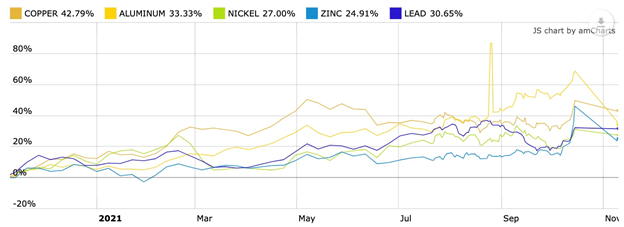

Climate change is affecting not only the prices of agricultural commodities and food, but the entire commodities complex. As global temperatures warm, practically everything that is grown or mined is impacted. The prices of a number of industrial metals, including copper, zinc, nickel and aluminum, have seen healthy gains this year due to a constellation of factors, including robust demand from top commodities buyer China.

Finally, an overabundance of jobs versus jobseekers in the United States is fueling wage inflation. The US economy faces a shortage of workers, driving wages and salaries higher. Republicans blame the Biden administration’s enhanced unemployment benefits, including a $300 weekly check, for providing a disincentive for returning to work. The same thing is happening in Canada with the overly generous CERB/ EI benefits.

Despite all of these examples of sticky inflation, of price increases looking to be a permanent fixture of the global economy, the Fed continues to maintain that inflation is transitory. We don’t accept that, and neither, it appears, do American shoppers.

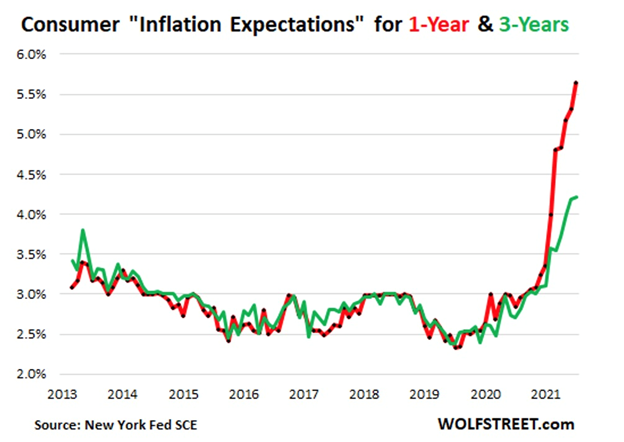

Wolf Street reported this week on the New York Fed’s Survey of Consumer Expectations, a key metric used by the Federal Reserve based upon the theory that inflation is partly psychological. The idea being that if people think that prices are going up, they are more likely to defer purchases, which contributes to higher inflation.

Of interest is the chart below by Wolfstreet.com and the New York Fed. The red line shows inflation expectations one year from now rising to 5.7%, while the three-year inflation expectations in green is 4.2%.

That seems about right, given the US Consumer Price Index currently sits at 5.4%. However when a more granular approach is taken, it reveals a different result. Although the median one-year inflation expectation is 5.7%, when rent, food, gasoline, health care and college tuition are examined separately, they show inflation expectations for these items is close to 10%! I.e.:

- Rent: +10.0% (new record)

- Food prices: +9.1% (new record)

- Gasoline prices: +9.4%

- Health care: +9.4%

- College education: +7.4%.

Wolf Richter @ Wolf Street writes:

The Fed keeps saying in its FOMC statements that it wants “longer‑term inflation expectations” to remain “well anchored” at 2%. And they’re now totally unanchored and spiking to high heaven..

Now, as actual prices have surged, consumers can see where this is going, and they can see that even the Fed is starting to back off its mantra that this red-hot inflation is just “temporary,” and they’re not fooled by some Fed officials’ efforts to redefine “temporary” to mean the opposite of temporary.

It’s at the point when consumers think inflation will remain high that they change their behavior and contribute to even higher inflation.

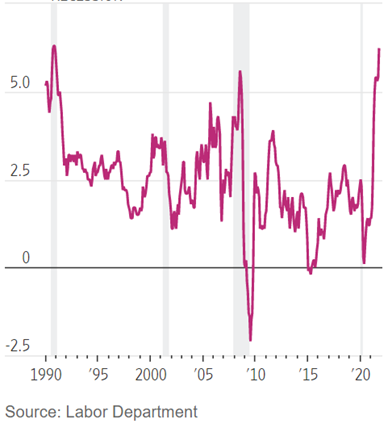

And they’re supported by unspent stimulus money, repressed interest rates, cash-out refis, magnificent asset price inflation that they can leverage, and by wages that are surging in all industries at the highest rates in two decades.

There is now nothing standing in the way of inflation spiraling higher: Consumers are flush with money, and the Fed still has its foot all the way on the gas, including near-0% short-term interest rates and printing $120 billion a month to repress long-term interest rates despite actual inflation that has been above 5% four months in a row. The Fed will now back off slowly from its money printing mania, but that means that it will blow through the red lights at the next bunch of intersections at slightly lower speeds, but it’ll still blow through red lights, and consumers can see that.

The limitations of debt

The Fed can slow or even stop its monthly asset purchases currently at $105 billion (They ‘Tapered bond purchases by $15B), what I like to call “quantifornication,” but that won’t do anything to limit inflation. QE in 2008-09 was expected to be result in inflation but it didn’t happen because the trillions printed by the Fed were given to banks but never made their way out of the financial system into the hands of average Americans.

The same thing is happening with QE2.0. Consider: between March 2020 and February 2021, just the billionaires in the United States have grown their wealth by $1.3 trillion. They now hold two-thirds more in wealth than the bottom half of the US population according to a current PBS Frontline documentary titled ‘The Power of the Fed’.

Lower interest rates and massive asset purchases by central banks are the monetary tools of choice when it comes to restoring shocked financial systems. The idea being that making the cost of borrowing cheap for individuals and businesses will entice them to spend, spend, spend.

The downside of “quantitative easing”, QE for short, is a major accumulation of global debt, of which there are three kinds: government, corporate and household.

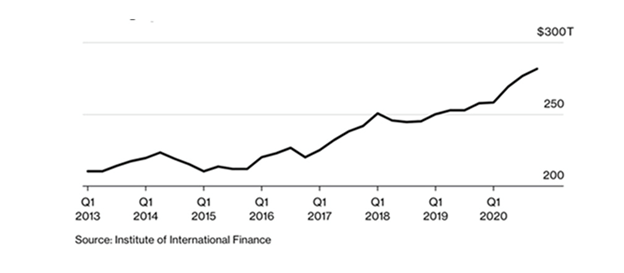

Global debt more than doubled from US$116 trillion in 2007 to $244 trillion in 2019.

The Institute of International Finance (IIF) found that governments, companies and households borrowed $24 trillion last year to offset the pandemic’s economic toll, bringing total global debt to an all-time high, at the end of 2020, of $281 trillion.

The IIF estimates that governments with large budget deficits are expected to add another $10 trillion in 2021.

Global corporate debt hit 86% of GDP in 2020, the largest increase since 2007 and the first annual rise since 2016.

In the United States, consumer spending makes up nearly 70% of GDP, meaning the ability of households to spend, and to handle debt burdens, is of utmost importance. Globally the figure is similar.

In its recent report, RBC notes that in some countries, household debt is of greater concern than government debt. In other countries the reverse is true. For example in the decade following the financial crisis, Canada’s household debt rose from 93% of GDP to 106%, compared to federal debt falling from 47% to 40%; whereas in the US, government debt has surpassed household debt and continues to swell.

The United States is the obvious poster child of excessive debt accumulation.

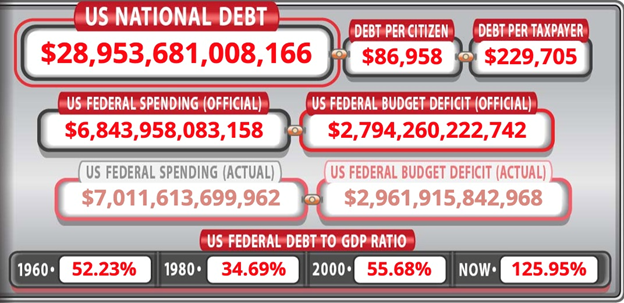

According to usdebtclock.org, the current national debt sits at $28.9 trillion, and it is increasing every minute.

The next round of government spending involves President Joe Biden’s $1.1 trillion infrastructure bill, just passed by Congress after a months-long debate, and a $1.75 trillion anti-poverty and climate plan Democrats hope to get passed this fall.

Debt is clearly a major limitation on a growing economy.

According to the World Bank, if the debt to GDP ratio exceeds 77% for an extended period of time, every percentage point of debt above this level costs a country 0.017 percentage points in economic growth. The US is currently at 125.9%, so that is 48.7 basis points multiplied by 0.017 = 0.82, nearly a full percentage point of economic growth!

The now-almost $29 trillion national debt doesn’t include what the Biden administration has already spent on pandemic relief ($1.9T). It doesn’t include the infrastructure bill and the social spending/ climate bill, total $2.8T, and it also excludes the $3T deficit on Biden’s proposed $6 trillion budget.

The Congressional Budget Office (CBO) is projecting that with all of this year’s spending, the national debt in 2021 could balloon to $35 trillion!

By the end of 2022 the national debt, presuming all of the spending commitments use borrowed (or printed) money, will be approaching $44 trillion.

The Fed won’t raise interest rates on $29T worth of debt, yet they tell us they will raise interest rates on $44 trillion of debt?

According to the Committee for a Responsible Federal Budget:

“This year, the federal government will spend $300 billion on interest payments on the national debt. This is the equivalent of nearly 9 percent of all federal revenue collection and over $2,400 per household. The federal government spends more on interest than on science, space, and technology; transportation; and education combined. The household share of federal interest is larger than average household spending on many typical expenditures, including gas, clothing, education, or personal care.

Despite historically low interest rates, this significant interest cost is the result of high levels of debt. This cost could be even worse if interest rates rise. Each one percent rise in the interest rate would increase FY 2021 interest spending by roughly $225 billion at today’s debt levels.”

On a per-household basis, a 1% interest rate hike would increase interest costs by $1,805, to $4,210.

US consumer debt rose to nearly $14.6 trillion at the end of 2020, driven by a record-breaking increase in mortgages, which in February totaled over $10 trillion, as home buyers took advantage of low mortgage rates. Mortgage debt in Q4 2020 increased 1.4%, or $206 billion, making it the fastest fourth-quarter rise since 2006.

A more recent CNBC story states that household debt jumped the most in 14 years in the second quarter of 2021. Though mostly driven by the housing market, credit card debt is reportedly back on the rise.

According to the Federal Reserve and the Securities Industry and Financial Markets Association (SIFA), US companies now face the highest debt levels on record, at more than $10.5 trillion. In 40 years the amount of corporate bonds outstanding has grown by over 2,000%, from 16% of US GDP in 1980, to 50% of GDP in 2020.

There has been talk of a “corporate bond bubble” triggering the next financial crisis, after the Fed took extraordinary measures at the beginning of the pandemic to buy corporate bonds — part of a $250 billion program funded by the CARES Act.

Questions emerged about why the Fed was purchasing the bonds of companies that really didn’t need their help, including such economic stalwarts as Microsoft, Visa and Home Depot. Moreover, several of them had “junk bond” as opposed to “investment-grade” status, such as Heinz, Ford and Macy’s. “The corporate bond market is hanging on right now by a very precarious string. How long can we continue to live on red ink?” asks a CNBC video on the subject.

The way we’re going, interest payments on the debt will almost certainly top $1 trillion by the end of the decade if not before.

The people supposedly represented by the government can’t afford that level of interest (they will suffer higher interest payments on their own debt), same as businesses cannot afford higher interest payments on their debt. Corporations will simply pass on the higher interest obligations to their customers, cut dividends or in the worst case scenarios, lay off staff.

This can’t go on forever. It’s not a stretch to envision a scenario whereby the world’s reserve currency, the US dollar, collapses under the weight of unmanageable debt, triggered say, by a mass offloading of US Treasuries by foreign countries, that currently own about $7 trillion of US debt. This would cause the dollar to crash, and interest rates would go through the roof, choking consumer and business borrowing. Import prices would skyrocket too, the result of a low dollar, hitting consumers in the pocketbook for everything not made in the USA. Business confidence would plummet, mass layoffs would occur, growth would stop, and the US would enter a recession.

All the countries that sold their Treasuries would then face a major slump in demand for their products from American consumers, their largest market. Eventually companies in these countries would begin to suffer, plus all other nations that trade with the US, like Canada and Mexico. Before long the recession in the US would spread like a cancer, to the rest of the world.

China is playing the long game

We can’t forget how vulnerable the US government is to China, by far the largest owner of US Treasuries. How long will it be before China, which is working hard to reduce its trade dependence on the United States and particularly the US dollar, refuses to keep financing America’s debt?

Right now it may be in the Chinese government’s interests to keep buying T-bills; doing so keeps the Chinese yuan low in comparison to the greenback which makes Chinese exports competitive. It also keeps US consumers addicted to cheap Walmart-grade products mostly made in China. What happens when China decides it doesn’t need the US anymore, when they no longer require the USD holdings of their foreign exchange reserves because they’ve locked up all the world’s resources, having paid for them with their US dollars? Well China needs the US to buy its exports, you say. Yes but only until China has developed enough of a trading orbit through its Belt and Road Initiative, which has signed up over 70 countries, that it no longer needs the United States. When that happens it is truly over for the US dollar and its exorbitant privilege, and I predict, will be the beginning of the next “golden” age when gold makes a triumphant return to the nexus of the global financial system.

Why do you think China is so interested in getting back Taiwan? Could it be because Taiwan is a competitor in a number of products including semiconductors for which it has a monopoly? While outwardly China wants to reunite the renegade province that became independent over a century ago (in 1912), I wouldn’t be at all surprised if there are economic forces involved. I say it’s highly probable that China is playing chess while the West is still learning to play checkers.

Conclusion

Excessive money-printing not only in the United States, but Britain and the EU, is continuing to devalue currencies at an alarming rate (this, by definition, is inflation, because it takes more units of currency to buy the same amount of goods as before) — for which precious metals, namely gold and silver, are the best defence.

Inflation erodes the purchasing power of fiat currencies and eventually they become worthless.

The dollar has lost 90% of its purchasing power since 1950.

By contrast, since 1972 gold has gone from $35/oz to $1,800.

The Fed can telegraph its intentions all it wants, the fact remains that at such unsustainably high, and going much higher, debt levels, the interest payments will eventually cripple the federal government, corporations and the ultimate bag holder – the consumer.

The US government is addicted to spending and Wall Street is addicted to the Fed’s easy money policies including money-printing to support government borrowing and ultra-low interest rates, both of which appear to have no end.

In this environment of excessive debt accumulation and runaway inflation there is only one way to protect one’s wealth and that is by owning gold and silver or quality junior precious metals stocks.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.