Pampa Metals’ surface geological work at Block 4 property leads to intense porphyry-related quartz-vein stockwork zone

2021.10.25

Pampa Metals Corp. (CSE: PM) (FSE: FIRA) (OTCQX: PMMCF) continues to make significant progress in its quest to find greenfield porphyry discoveries along the mineral-rich belts of Chile’s Atacama region.

This week, the junior miner provided an update regarding its Block 4 project, where the company recently completed detailed surface geological reconnaissance together with a ground magnetic geophysical survey of the 4,200-hectare project area.

Block 4 Project Overview

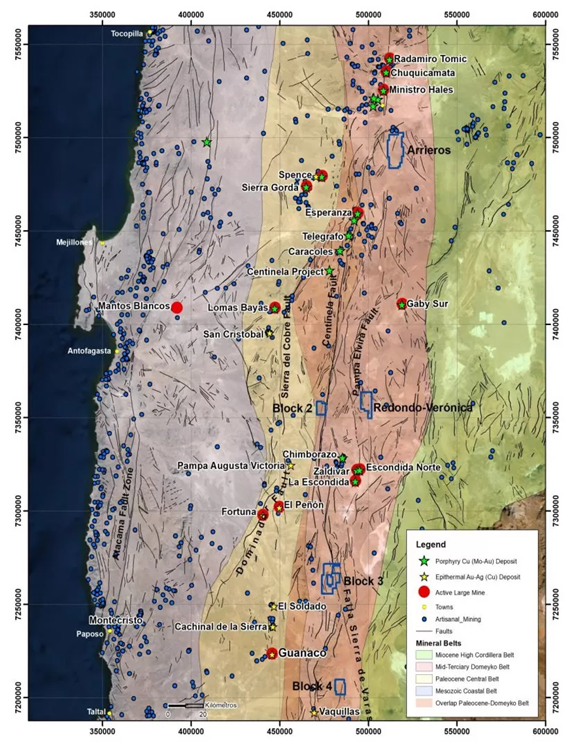

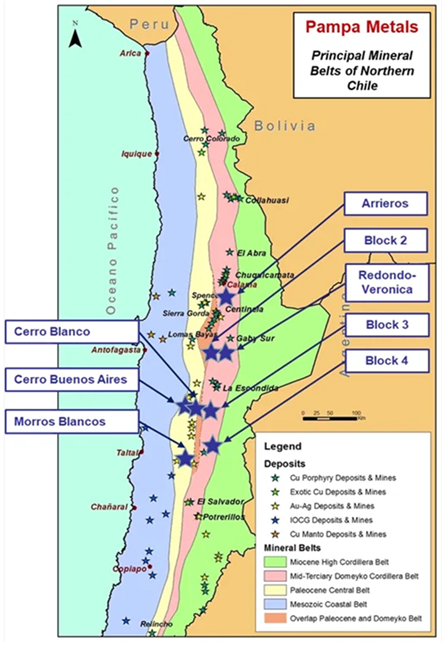

Pampa Metals’ Block 4 project is located along the Cordillera de Domeyko porphyry copper belt in northern Chile, which is host to some of the world’s largest copper deposits and mines.

The property is located along a highly prolific segment of this Andean mineral belt, centered along trend some 110 km south of the giant La Escondida – Zaldivar copper mining district and 115 km north-northeast of the El Salvador copper mine (see map below).

Significant portions of the Block 4 project area are characterized by post-mineral Miocene to recent alluvial and volcanic cover, particularly to the north and east within the property boundary, where the underlying geology is obscured.

Elevated sierras around the western and southern margins of the property expose basement rocks that include Palaeozoic felsic volcanics and intrusions, and Mid to Late Triassic andesites, sediments and andesite-dacite porphyries.

According to Pampa Metals, these basement rocks are limited to the east by a series of north-south to north-northeast faults, which to the north have continuity with the Escondida fault that cuts the La Escondida – Zaldivar mining district.

Old reports and regional data indicate that Jurassic sediments are intruded by Lower Tertiary dioritic rocks under the gravels to the east of the north-south fault system.

Palaeozoic felsic volcanic rocks in the central-northeastern part of the property display copper-oxide mineralization at surface associated with hydrothermal alteration with quartz veins and veinlets, the relationship of which to porphyry systems has been tested in the past by 11 RC drill holes identified on this portion of the property, the results of which are still unknown.

Felsic basement rocks in the central part of the project area are cut by a possibly Lower to Mid- Tertiary porphyry of fine, dacitic composition that is poorly exposed over an approximate area of 600m x 300m. This shows strong evidence of porphyry-type development with phyllic alteration and narrow and thick veinlets of “A” type quartz veinlets together with sinuous, banded grey quartz veinlets (see photo below).

This veinlet style is typical of some gold-rich porphyry systems in northern Chile. Limited samples (due to the lack of outcrop) have been submitted for chemical analysis, with results pending.

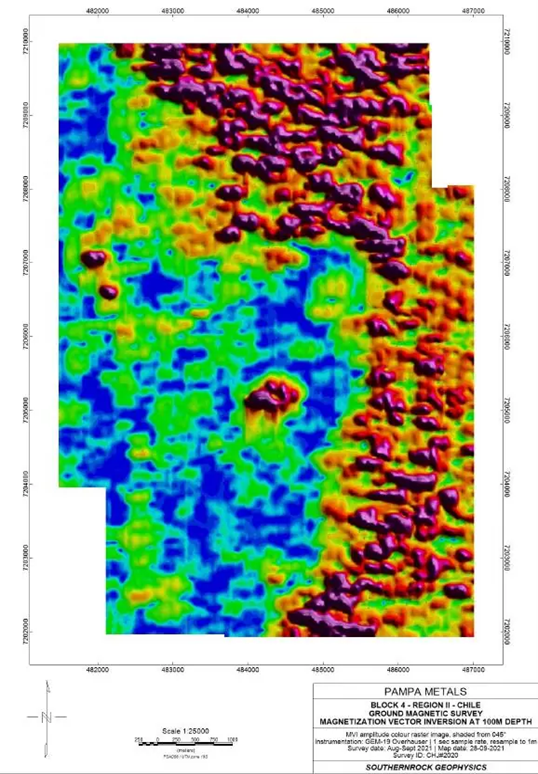

Various processed product maps from the recently completed ground magnetic geophysical survey at Block 4 consistently reveal a clear, isolated magnetic high in the central part of the property, which is coincident with the zone of quartz-veinlet stockworks.

The magnetic anomaly is about 800m x 800m in surface plan view, and depth slices of the data suggest a subvertical, conical body at least 750m in vertical extent, possibly connected to a larger intrusion to the northeast and southeast (see figure below).

The magnetic data indicate additional anomalies that may be associated with magmatic centers and/or porphyry-related hydrothermal alteration zones, with minor copper oxides occurring in the exposed zones, while others under cover are associated with north-south faults or magnetic lineaments. One of these has four historic RC drill holes on its margins, with unknown results.

Pampa Metals is continuing with the processing and interpretation of its field geological and geophysical data, including pending chemical analyses from limited sampling, to decide the next steps for the project.

These may include one or more of further geological work, limited trenching, additional geophysical surveys and reconnaissance drilling.

Project Portfolio

Block 4 is only one of several highly prospective projects that the company is actively advancing in the heart of Chile’s world-class mineral belts.

Pampa Metals has a unique portfolio of eight exploration projects covering a series of greenfield copper and gold targets within a total area of 59,000 hectares, which, in terms of land position, is almost unrivalled for a junior miner operating in Chile.

These projects (Arrieros, Block 2, Redondo-Veronica, Block 3, Block 4, Cerro Buenos Aires, Cerro Blanco and Morros Blancos) are all located along proven mineral belts of the Atacama region, including the Central Paleocene and Domeyko belts that have dominated the world’s copper production.

As shown on the map above, five of those projects are situated along the mid-Tertiary porphyry copper belt of northern Chile — the Domeyko Cordillera — that is host to three of the world’s top five copper mining districts at Collahuasi, Chuquicamata and Escondida (the world’s biggest).

The remaining three are located in the heart of the Paleocene mineral belt, which hosts a series of important porphyry copper deposits and mines such as Cerro Colorado (BHP), Spence (BHP), Sierra Gorda (KGHM & Sumitomo) and Relincho (part of Nueva Union – Teck-Goldcorp).

Note that many, but not all, porphyry deposits in Chile (and worldwide) occur in clusters, and brownfields exploration once a discovery is made can be very productive.

The northern Chilean Atacama Desert extends from the Peruvian border into Peru, down to somewhere north of Santiago; most of the principal mining districts in Chile are located in this sparsely populated, desert area. The main exceptions are the large copper mines (El Teniente, Los Bronces, Andina, Pelambres) to the east of Santiago.

The northern desert is characterized by elevated ranges of mountains, separated by relatively flat, piedmont-gravel-filled “pampas” that conceal the underlying geology. A rough estimate would suggest that at least 50% of northern Chile is covered by pampa deposits. One might consequently deduce that half of the likely mineral deposits are thus concealed by pampas.

These areas remain underexplored because they contain a layer of gravel, 30-50m thick, that was deposited after the formation of the porphyries.

Notwithstanding the important discoveries noted above, there are still very large areas of untested pampas in northern Chile that have the potential to conceal important mineral deposits.

Outcrops in the pampas are rare, however. If found, they can display similar characteristics, in terms of geology and hydrological alteration, as copper porphyry deposits. Pampa Metals’ game plan is to first conduct surveys to find the outcrops, and then sample and drill them.

2021 Drilling Plan

Since its inception in late 2020, Pampa Metals has been rapidly self-funding exploration on projects with the greatest potential for copper discoveries.

Detailed geological mapping has already been completed at the Redondo-Veronica, Cerro Buenos Aires, Block 3, Arrieros and now the Block 4 projects.

Phase 1 drilling on the Redondo-Veronica and Cerro Buenos Aires properties has also been completed, with more drilling planned on both properties in the coming months, along with initial drilling at Block 3 and Block 4. These four projects will be Pampa Metals’ near-term exploration focus.

Results so far from just the Cerro Buenos Aires portion drilling have shown “highly encouraging indications of a porphyry system,“ the company recently revealed.

Could the outcrop at Cerro Buenos Aires be the tip of the iceberg of a large porphyry underneath? Further drilling should reveal more about the geology and mineralization.

Meanwhile, Pampa Metals is also leveraging third-party funding from major shareholder Austral Gold Ltd. to expedite exploration activities on the Cerro Blanco and Morros Blancos properties.

Cerro Blanco and Morros Blancos are considered two of the three “lithocap” projects within Pampa Metals’ eight-project exploration portfolio. Lithocap targets geologically represent the upper portions of potential porphyry copper systems, and, according to the company, often have significant precious metals potential.

Historical results to date at both projects suggest good potential for near-surface gold-silver mineralization possibly associated with deeper copper mineralization.

Copper Squeeze

Pampa Metals’ hunt for the next big porphyry discovery in Chile comes amid a historic copper bull market.

Copper is a major component of motors, batteries, inverters, wiring and charging stations for EVs, and as such, is essential to the global drive towards low-carbon technologies.

Data analytics firm Fitch Solutions estimates that demand for “green” copper alone could reach 1.4 million tonnes in 2021, then rising to 5.4 million tonnes in 2030 at an average growth rate of 13% year-on-year.

An influx of infrastructure spending to reinvigorate economies during the Covid pandemic has also jolted the commodities market, sending copper prices to a record high earlier this year.

However, a copper bull market poses widespread challenges to the global supply chain. Due to a lack of new projects and booming demand, we’re seeing a supply deficit that is rapidly growing on a yearly basis.

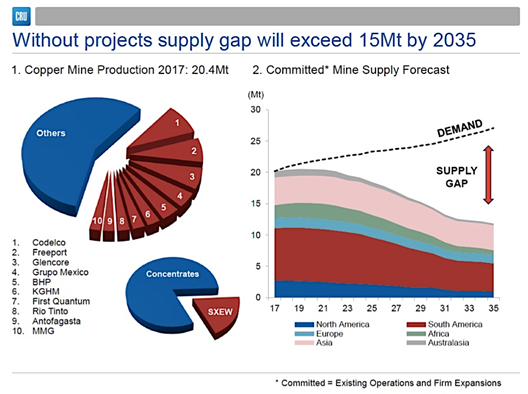

A report by CRU Group had predicted earlier this year that the world will face a massive copper shortfall within a decade, with the annual supply deficit estimated at 4.7 million tonnes by 2030.

Without new projects, the global copper supply gap could reach as high as 15 million tonnes by 2035, CRU says.

To close the gap, the world will need at least 10 million tonnes of copper, according to CRU, requiring upwards of $100 billion in total spending.

Global commodities trader Trafigura went even further, anticipating a significant deficit in the region of 10 million tonnes by then.

Exacerbating the issue is the surging power costs in parts of the world that have caused factory slowdowns, imperiling the production of smelters worldwide.

Last week, the London Metal Exchange began to experience a critical shortfall in its copper inventories, with the metal available for withdrawal hitting its lowest levels since 1974.

Bank of America Corp. recently said a copper price of $20,000/tonne — which is almost double its all-time high — could be possible if major supply-side issues arose simultaneously.

The short-term headwinds, combined with escalating copper demand, illustrate why it is imperative for miners to quickly develop new projects in time to catch the upcoming rally.

Conclusion

Out of all copper explorers, what really works to Pampa Metals’ advantage is its considerable land position within Chile, the #1 copper-producing nation, accounting for over 25% of the global output.

Three of the world’s top 5 copper mining districts in the northern desert area, where all eight of Pampa Metals’ projects are located. Some of the biggest copper mines, such as El Teniente, Chuquicamata and Escondida (the world’s largest), are all found within this region.

The company’s executive team has also accumulated years of experience at global majors like BHP, Rio Tinto and Anglo American; these mining giants have all undertaken significant exploration and production in this particular part of Chile.

The Pampa Metals’ team, too, has significant experience within the Atacama Desert in northern Chile, having helped to bring BHP’s large-scale Spence copper mine online.

As we’ve previously discussed, recent drilling at both the Cerro Buenos Aires and Redondo-Veronica properties has given the company early indications that they are in the vicinity of a highly mineralized porphyry copper system.

Further drilling would be needed for confirmation, but given the success of those who have explored for copper here in the past, PM’s large land position, and experienced management, there’s no reason why Pampa Metals can’t be as successful

Pampa Metals Corp.

CSE:PM, FSE:FIRA

Cdn$0.42, 2021.10.21

Shares Outstanding 46.4m

Market cap Cdn$19.3m

PM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Pampa Metals Corp. (CSE:PM). Pampa is a paid advertiser on his site aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.