Getchell Gold’s drilling @ Fondaway Canyon suggests larger mineralized system than previously thought

2021.10.22

Getchell Gold (CSE: GTCH) (OTCQB: GGLDF) is spending the rest of the year in the field at its flagship Fondaway Canyon gold project, as drilling there continues to verify the geological model that the company has set out to prove.

With three holes left to report from the 4,000-meter drill program that started in June, and two more to complete, Getchell is poised to update the resource next year with new ounces added from drill campaigns over the past two years including three new zones discovered last year and expanded upon in 2021: Juniper, Colorado SW and North Fork.

“The Fondaway Canyon Gold Project is a brilliant example of drilling success, as evidenced by the 2020 and ongoing 2021 drill programs that have reported substantive and additive gold mineralization which remains open in nearly all directions. The near-term objective is to continue to expand and define the gold mineralization at Fondaway and maximize the inherent value upon which we will be starting from next year,” Getchell’s President Mike Sieb stated in the Oct. 20 news release.

Fondaway Canyon

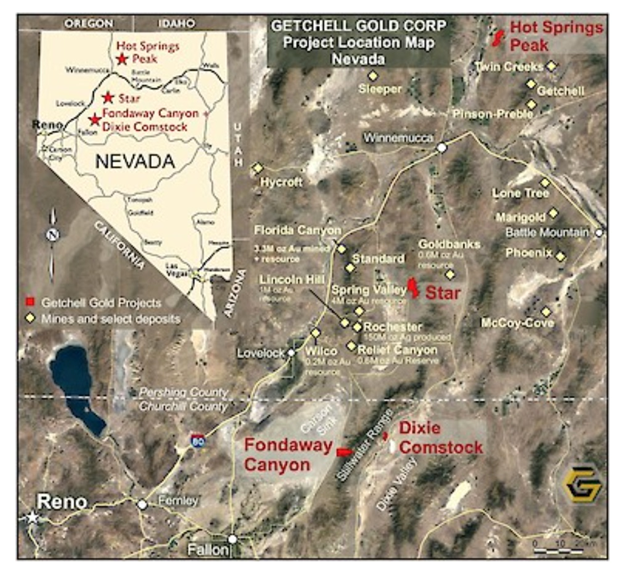

Acquired by Getchell early in 2020, Fondaway Canyon is an advanced-stage gold project comprising 170 unpatented lode claims located in Churchill County, Nevada.

The property has been the subject of multiple exploration campaigns dating back to the late 1980s and early ‘90s, with nearly 50,000 meters of drilling completed.

It covers 12 known veins, including five mineralized areas — Colorado, Halfmoon, Paperweight, Silica Ridge and Hamburger Hill.

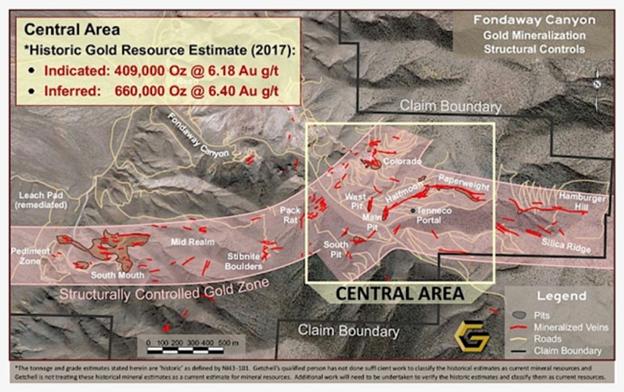

The latest technical report on Fondaway Canyon (2017) gave an estimate of 409,000 oz indicated gold resources grading 6.18 g/t Au and 660,000 oz inferred grading 6.4 g/t Au — for a combined 1.1 million oz.

Up to 80% of these ounces are within Colorado, Paperweight and Halfmoon, with the remainder found in parallel veins or splays off the main veins.

Mineralization at Fondaway Canyon is contained in a series of steeply dipping en-echelon quartz-sulfide shears outcropping at surface and extending laterally over 1,200 meters, with drill-proven depth extensions to greater than 400 meters.

2020 drilling

In an exclusive talk with AOTH, Sieb recalled how 2020 drilling was “the culmination of a lot of desktop work” wherein a detailed analysis of the historical drill data revealed that the mineralized system was larger than previously thought.

How did they arrive at that conclusion?

“In the sea of [~735] drill holes we inherited, a significant portion of that drilling was focused on certain historic occurrences and deposits,” Sieb told me over the phone, Wednesday.

“In 2002 and 2017 they started to test a little deeper so for example the Central Area encompassing an approximately 1 km x 1 km area, there was a handful of these drill holes that if you aligned them with the geology you could actually draw a line from one dot to another dot, across half a kilometer, and they lined up. Of course, that’s only two points but when you start to take into account the entire picture and those disparate intercepts that didn’t quite align with the historical thought process, and you drew new lines, you thought aha! If you redesign the geological model they all potentially line up. That’s how we arrived at the new 3D model. We picked the intervening areas between these widely spaced dots and we said, ‘there’s absolutely no drilling here, this is where we think the mineralization should be.’”

The drill program they came up with was designed to test the “more expansive mineralization” thesis with a set of widely spaced holes.

Drilling by Getchell in 2020 identified the presence of a thick zone of gold mineralization, interpreted as a down-dip continuation of surface mineralization, and high-grade mineralized structures with notable widths.

Six holes totalling nearly 2,000 meters were drilled as part of that program, five of which intersected significant gold intercepts within the Central Area, considered to be the “nexus for the gold-mineralizing system” observed at Fondaway. The target area represents a 1,000 x 700m highly mineralized NE-SW extensional zone within the central portion of the 3.5 km long Fondaway Canyon gold-mineralized corridor (see below).

“All five of [the step-out drill holes] hit quite substantive intersections where they demonstrated that the mineralized system was 100-meters thick in places so that’s how we finished 2020,” Sieb summarized last year’s drill program.

2021 drilling

Following up on their success, the company is putting the finishing touches on a 2021 drill program twice the size — 4,000m.

The program’s goal was to do sufficient infill drilling to confirm the new geological model, thus elevating the resource estimate beyond the current 1.1Moz. Getchell is also continuing to step out from known gold intercepts to expand the geological model.

“We’ve been proving the continuity amongst the drilling as well as continuing to expand upon our discoveries in 2020, so every drill hole is adding to the picture and that was the objective in 2021 — to truly understand and interpret the orientation of the geological as well as the mineralization model,” Sieb said during our talk.

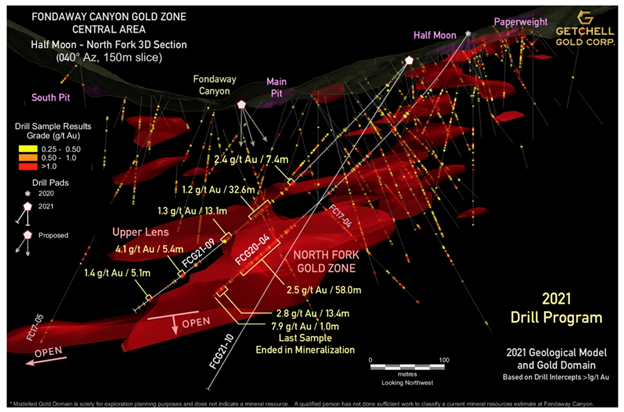

A key finding is a better understanding of the three new zones discovered during the 2020 drill program.

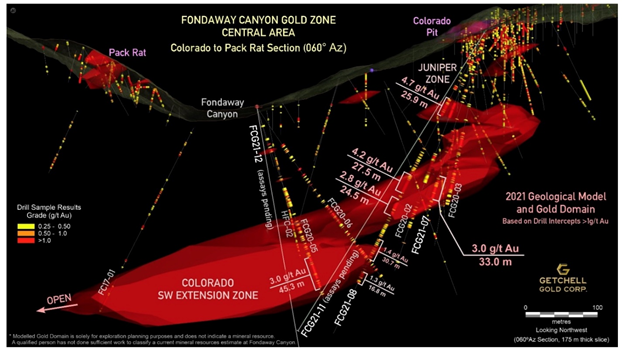

The Juniper Zone looks to be a high-grade, thick swath of near-surface mineralization that is open in most directions. The best intercept from 2020 was 4.7 grams per tonne gold over 25.9m, including 11.4 g/t Au over 5.5, within 100m of surface.

The Colorado SW and North Fork zones run directly underneath the canyon floor and down-dip gently for about 800 meters. So far they remain open on strike and at depth. “Some of the furthest holes on that trend, the mineralization does not appear to be weakening,” says Sieb. “That’s a key attribute, as we drill we haven’t determined the extent of it yet.”

A discussion of 2021 drilling would be incomplete without a mention of hole FC21-08, the best so far at Fondaway Canyon.

Hole 8 is the seventh consecutive hole drilled into the Central Area to hit substantive gold mineralization. “It produced one of the best cumulative gold intercepts on the property, in an area that was not infill drilling but extending the mineralization. That is extremely significant,” Sieb told me.

The hole intersected the Colorado SW zone for over 200 meters, with mineralized intervals that included 4.2 g/t Au over 27.5m, 2.8 g/t Au over 24.5m, 1.4 g/t over 30.7m and 1.3 g/t Au over 16.8m.

It also pierced the Juniper Zone, returning 4.7 g/t Au over 25.9m, including 11.4 g/t Au over 5.5m, within 100 meters of surface.

Hole 8 is the most northwesterly of those drilled in the area, meaning the zone remains open to the NW.

Hole 9 tracked along the upper limits of the North Fork Zone and reported several mineralized intervals, including 1.3 g/t Au over 13.1m and 4.1 g/t Au over 5.4m. A broad section of gold mineralization grading 1.2 g/t Au over 32.6m was found at a higher elevation than projected.

As previously stated there are assays pending from three holes on three extremely promising targets.

Hole 10 tested the North Fork Zone up-dip from hole 9; the zone remains open in most directions and warrants follow-up. Sieb said a drill is likely to be stationed there next year, to further delineate the mineralized body.

Hole 11 targeted the Colorado SW and Juniper zones with a down-dip step-out of hole 8’s impressive gold intercepts.

Finally, hole 12 is a down-dip step-out of hole 5’s substantive intercept grading 1.8 g/t Au over 90m, including a higher-grade core of 3 g/t Au over 35m.

Hole 13 is currently being drilled into the Colorado SW Zone, where Getchell is hoping to confirm the continuity of the mineralization to surface. Drilling there will continue as long as weather conditions allow, at which point the crew will move out of the canyon and mobilize to the pediment area, another exciting drill target.

Visualize the pediment as a flat plain, the Carson Sink, that fronts the hills and valleys where the rest of the targets are dotted throughout. Underlying the plain is about 25 meters of alluvial (gravel-bed) cover, making for easy overburden removal.

In 2002, two holes drilled 180m apart, in the pediment west of the South Mouth pit, each pulled up significant mineralization — one hole had 0.74 grams per tonne gold over 30 meters; the other was 0.6 g/t Au. While those grades aren’t enough to energize gold investors, there is a possibility that the deposits found in the mountains are just the “smoke” from a major gold system that originates underneath the pediment.

In 2020 Getchell tried to revisit the area, however the drill hole encountered a fault right before the target zone and had to be abandoned. That’s unfortunate, because according to Sieb, “the gold values were ticking up right before the drill hole failed. That was very similar to the mineralization that we saw in the 2002 drill holes so there’s every indication that the Pediment Target zone is there, we just didn’t penetrate it.”

“This planned last drill hole [of 2021] testing the Pediment Target zone is going to be quite telling.” Sieb notes the pediment area “is completely untested” apart from the two holes in 2002 that hit Carlin-style mineralization, referring to the disseminated gold common in Nevada. “It’s potentially a whole new target area.”

Having solidified the mineralization model that is expected to allow Getchell to undertake a new resource estimate, next year the company is moving forward with “a more aggressive, bigger and better program,” according to Sieb. Two drills are expected to be turning 24/7 “to really attack the area”.

“Fondaway Canyon really warrants a major drill program and a major usage of funds to continue to expand and basically tell the world how good the project is,” he said.

Conclusion

Having covered Getchell Gold since early 2020, I have watched the company develop a new geological model for the project and then go about steadily proving it. The exciting thing about Fondaway Canyon is the system just keeps getting bigger and bigger with every hole, and there appears to be, so far at least, no limitations on the extent of it, in the Central Area that has been the focus of Getchell’s drilling. Step-out and infill drilling continue to hit solid gold values. Hole 8 was the seventh consecutive hole to hit substantive mineralization, and in fact was the best hole drilled to date at the Colorado SW Zone and one of the best cumulative gold intercepts on the property.

As a testament to Getchell’s success at the drill-bit, consider: the company has only drilled 13 holes since acquiring the property in early 2020, yet every hole but one has come up with the goods. That’s impressive. It shows a very strong aptitude for drill targeting especially considering that GTCH started out with a data base of over 700 historical drill holes from which they had to “separate the wheat from the chaff.”

And they’re not finished yet. The three holes left to report, along with hole 13 underway and the hole still to be drilled into the pediment, promise a continuation of news flow through to the end of the year and into 2022, allowing Getchell to build on the momentum it has managed to generate in 2021 with a string of successful assay results.

I know it’s too early to say, but I’m going to go out on a limb and predict that when Getchell updates the resource estimate at Fondaway Canyon, it will be significantly higher than the existing 1.1 million-ounce resource, which encapsulated the high-grade areas but not the lower-grade lenses enveloping the mineralization. It also does not include data from 2017 and it does not include the two successful drill campaigns completed by GTCH, that are expected to add significant ounces.

The last word on Getchell for the moment, until we get the next set of assays, goes to Mike Sieb, who stated: “At the end of this year it’s not just ourselves that’ll know where this project is going, everybody will. There’s going to be more eyes on the project and the company, and that’s going to be beneficial to ourselves and our shareholders. We’re setting it up in such a way that the news flow’s going to be continuous, over the cusp of this year and into next year, until we can then launch a bigger and better drill campaign to of course make a bigger and better story for Fondaway Canyon and Getchell.”

Getchell Gold

CSE:GTCH, OTCQB:GGLDF

Cdn$0.53, 2021.10.21

Shares Outstanding 74m

Market cap Cdn$44.5m

GTCH website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.