Cypress pilot plant completion right on time, as lithium market continues to sizzle

2021.10.14

Demand for lithium carbonate is expected to rise at a compound annual growth rate (CAGR) of 10-14% until 2027, while lithium hydroxide demand is seen climbing at a 25-29% CAGR. That change in demand, according to Argus Media, is prompting producers to expand their lithium hydroxide output and shifting mining projects towards developing lithium hydroxide production rather than lithium carbonate.

Resource companies like Cypress Development Corp. (TSXV:CYP, OTCQB:CYDVF, Frankfurt:C1Z1) discussed further on, which have sizeable lithium deposits and the ability to make lithium hydroxide, are therefore poised to do well. They see themselves profiting from a lithium market segment that is expected to see high demand and potential shortfalls in coming years, especially in North America as the production of battery cells and electric vehicles ramps up.

Lithium demand, supply and pricing

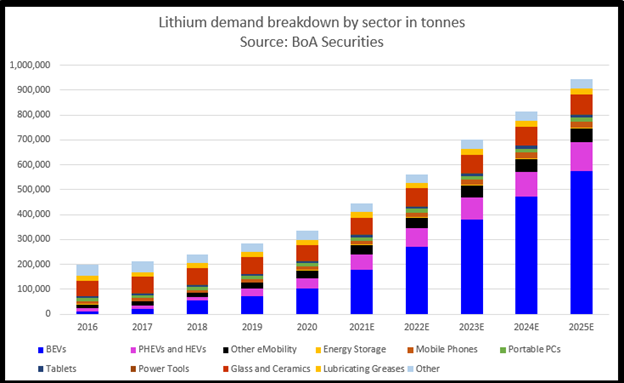

Industry analysts are forecasting drastic increases in demand for lithium, a key ingredient for EV batteries and renewable energy storage, over the next decade and beyond.

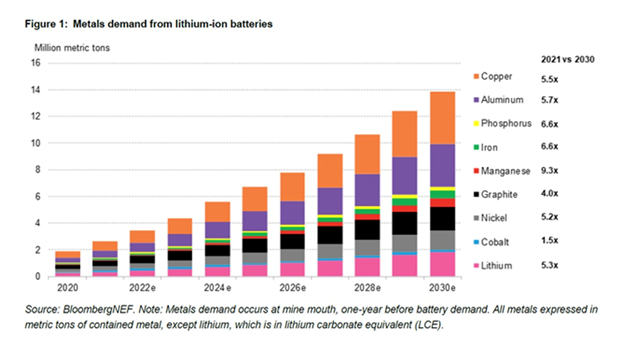

A recent study by BloombergNEF shows that 5.3 times more lithium will be in demand by 2030 compared to current year levels.

Fitch Solutions predicts EV sales to reach over 4.6 million units in 2021. That is 50% more than 2020 which in turn was 36.8% higher than 2019. (despite total passenger vehicle sales falling last year by 20% due to the pandemic)

Australian bank Macquarie forecasts a global EV penetration rate of 16% by 2025 (battery electric vehicles and plug-in hybrids combined), and by 2030, 30% globally and 41% in China — a scenario that would push spodumene (hard rock) prices above $720 a tonne, lithium carbonate above $13,000/t, and lithium hydroxide over $16,000/t.

Utility-scale batteries that store renewable energy, and portable electronics will also contribute to demand, with China top of the heap for battery manufacturing and Germany and the US increasing battery production capacity in the coming years, says Fitch.

By 2025 installed battery production capacity is expected to increase by over 300%, mainly due to the acceleration of vehicle electrification in Europe.

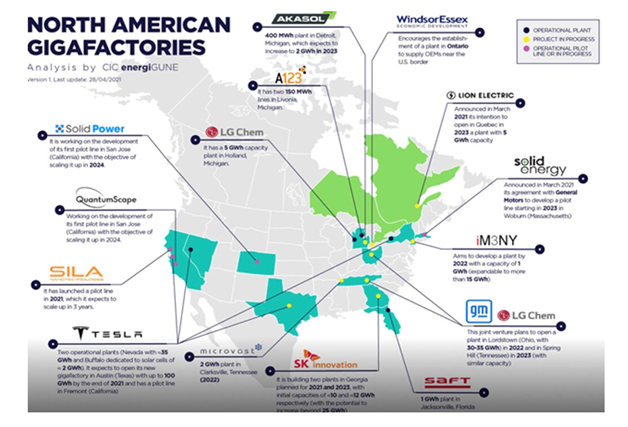

In the United States, there are a number of battery plants in the works to join Tesla, whose first gigafactory in Nevada started production of battery cells in 2017. The company has a plant in Buffalo, New York, and plans to open a third (US plant) in Texas by the end of this year. Tesla also has a “pilot line” at its facility in Fremont, California, for R&D technologies.

In 2020 General Motors announced plans to install its first battery cell factory in Ohio, a project called Ultium Cells launched with its Korean partner LG Chem. The latter opened a plant in Holland, Michigan in 2013.

Another South Korean company, SK Innovation, is planning on opening the first of two battery plants in Georgia early next year; the company is a supplier to Volkswagen and Ford.

The latter along with American auto icon GM have big plans to electrify their fleets. Ford announced plans to boost spending on electrification by more than a third, and aims to have 40% of its global volume electric by 2030, which translates to more than 1.5 million EVs based on last year’s sales.

GM reportedly aspires to halt all sales of gas-powered vehicles by 2035, with plans to invest $27 billion in electric and autonomous vehicles over the next five years.

There are currently 11 EV start-ups racing to catch up with market leader Tesla, fueled by money from Wall Street. They include Rivian out of Irvine, California, Lucid Motors based in Newark, CA, Lordstown Motors from Ohio, Nikola Corp (Phoenix), Fisker (Los Angeles), Faraday & Future (Los Angeles), Canoo (Torrance), NIO, Li Auto and XPing from China, and Arrival, based in London.

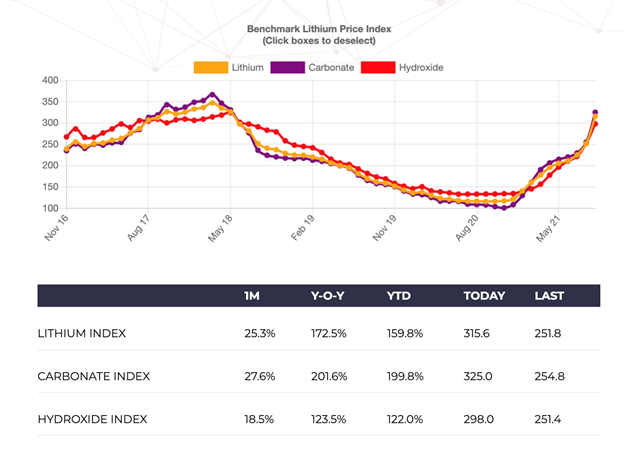

The surge in demand, combined with tight supply, has sent lithium prices on a tear. According to Asian Metal Inc. data, China lithium carbonate has almost doubled in just two months, and lithium hydroxide is up more than 70% over the same period. Both lithium products are used in the lithium-ion battery cathode. At Pilbara Minerals’ recent auction of spodumene concentrate — a party-processed form of the material — the top bid for a cargo of 8,000 tons was $2,240 per ton, up from $1,250/t in July.

Lithium miners are struggling to meet demand, analogous to catching a runaway train. A lengthy slump following lithium’s 2018 price peak meant investment in the sector slowed.

“The financing for lithium projects is still too little, too late,” BNN Bloomberg quoted Cameron Perks, an analyst at Benchmark Mineral Intelligence, a trusted battery metals research firm. “The market deficit is already occurring.”

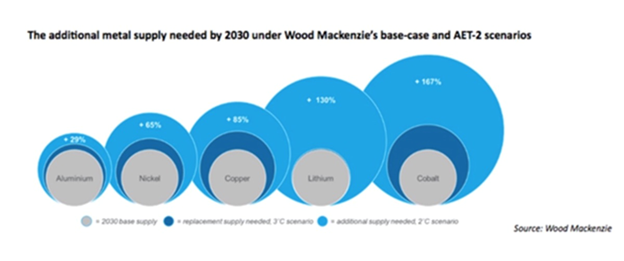

A Wood Mackenzie report earlier this year predicts that 130% more lithium supply needs to be found and extracted, either through hard rock mining, brine operations or clays.

When Fastmarkets surveyed market participants in the battery supply chain, a majority of respondents flagged lithium as the metal most difficult to secure in the near term.

“The supply of lithium is tight at the moment, as the expansions in South America have taken longer to come on stream,” Will Adams, the head of Fastmarkets’ battery raw materials research team, said. “And even though this new capacity will shortly be ramped up, it will still take six to eighteen months for the material to be qualified.”

The global lithium market is estimated to reach a deficit of 12,000 tonnes of lithium carbonate in 2022, compared with a surplus of 3,000 tonnes in 2021, in Fastmarkets’ estimation.

As prices increase, with no end in sight due partly to the pandemic’s impact on supply chains, there is even the risk that a shortage of mined lithium could slow the global EV roll-out. According to Bloomberg New Energy Finance analyst James Frith, after a decade of battery price declines, an important measure in gauging when EVs will reach price parity with gas vehicles, that trend may stall as raw material costs climb.

The mining industry has been headlined by several major deals involving lithium firms over the past week.

This should be of no surprise as the battery metal has been trending up since the beginning of the year. Following a second rally at the onset of the third quarter, lithium prices have shot up to their highest since 2018.

In China, the #1 electric vehicle market globally, lithium carbonate prices have shot up nearly five-fold over the past year and are trading near record highs.

Price of the key battery ingredient held around 165,000 yuan (~$25,000) per tonne in October, not far from the all-time high of 177,000 hit in late September, due to tight supply and stable battery demand.

Year-to-date, lithium prices are up a stunning 160%, based on the price index (including lithium carbonate and hydroxide) tracked by Benchmark Mineral Intelligence (BMI), the world’s leading battery supply chain researcher and price reporting agency.

The rally comes amid a global push for less polluting energy sources, which has automakers and battery manufacturers racing to secure supplies of so-called ‘future-facing commodities’ such as lithium.

China’s Lithium Buy Spree

China in particular has been actively and aggressively pursuing deals to secure battery materials as it looks to establish a dominant position in the global EV supply chain.

The nation’s top battery maker, Contemporary Amperex Technology Co. (CATL), recently outbid Ganfeng Lithium to acquire Canadian miner Millennial Lithium Corp., which holds lithium assets in Argentina.

As China’s largest lithium compounds producer and the world’s biggest lithium company by market value, Ganfeng has gone on an acquisition spree over the years, having invested in several lithium projects in Argentina (Caucharí-Olaroz, Mariana), Australia and China.

In August, Ganfeng proceeded with a takeover of Mexico-focused lithium developer Bacanora, and in the same month, inked a four-year supply deal with Australia’s Core Lithium for 300,000 tonnes of spodumene concentrate, a partly processed form of the battery material.

“We have and will continue to see the Chinese looking to buy lithium,” Matthew Hind, head of global mining at Bank of Nova Scotia’s investment banking division, said in a recent Reuters report, adding that “there will also be small-cap consolidation as well as EV companies buying stakes in mines with strategic partners in order to secure supply.”

It didn’t take long for Hind’s prediction to come true either.

In somewhat of a surprise move, China’s Zijin Mining Group Co., known for its status as a major gold and copper producer, announced last week its first foray into the lithium sector with a $770 million purchase of Neo Lithium Corp., outbidding many other Chinese bidders.

Neo Lithium’s main asset is a high-grade brine operation in Argentina, with CATL already being one of its backers.

“As Zijin is a gold-copper producer and Neo Lithium is still some years from commercial production, this deal exemplifies how hot the market is for independent lithium assets, and how eager the Chinese are,” Chris Berry, president of House Mountain Partners, a Washington-based industry consultancy, told Bloomberg.

In total, Bloomberg Intelligence analyst Christopher Perrella estimates five companies essentially control the $4 billion global lithium market, two of which are Chinese.

Battery Metals Race

The race to secure battery materials is taking place outside of China as well.

Rock Tech Lithium Inc., which is backed by venture capitalist Peter Thiel, plans to locate its first battery metals smelter within a 90-minute drive of Tesla’s gigafactory under construction outside Berlin, in a bet that Germany will take the lead in Europe’s electric vehicle transition.

South Korea’s LG Energy Solution, one of the biggest EV battery makers globally, recently agreed to buy as much as 100,000 tonnes of lithium a year as part of a six-year “take-or-pay” deal with Vancouver-based Sigma Lithium Corp., which controls a hard rock lithium deposit in Brazil.

In Australia, the world’s biggest lithium exporter, Prime Minister Scott Morrison plans to establish a A$2 billion ($1.5 billion) loan facility for the development of critical minerals projects, with the mining powerhouse aiming to win a bigger market share for materials used in electric cars.

In short, demand for lithium is accelerating around the world, with sales of electric vehicles growing at a faster pace than previously thought.

According to SQM, one of the top producers of the battery ingredient, EV demand surged more than 150% in the first half of 2021 from a year ago. As a result, the Santiago-based firm estimates that global lithium demand could increase more than 40% this year, translating into a sales volume of more than 95,000 tonnes, up by 10,000 tonnes from its previous forecast.

Data from battery consultancy Rho Motion shows global EV sales were up 150% in the seven months to July to over 3 million units compared to the same period in 2020, with about 1.3 million sold in China alone. For 2021, Rho Motion expects sales to reach as high as 5.8 million.

Longer-term, BloombergNEF estimates that the green energy transition will result in a five-fold increase in global lithium consumption by the end of this decade.

In light of a global race for battery minerals, a recent World Economic Forum report forecasts that the global market for lithium-ion batteries will reach $300 billion annually by 2030.

Supply Crisis

The EV boom has naturally depleted stocks of battery materials such as lithium, causing the supply to tighten in major markets.

In China, lithium carbonate output in August rose 19% year-on-year to almost 20,000 tonnes, according to state-backed research house Antaike, but this output would be easily outstripped by demand from the EV sector.

BMI estimates that demand for lithium is expected to jump 26.1%, or about 100,000 tonnes LCE, to a total of 450,000 tonnes this year, more than enough to flip the entire market into a deficit.

Prices are already climbing across the supply chain. Pilbara Minerals Ltd.’s second auction of spodumene concentrate attracted a top bid of $2,240/tonne for a cargo of 8,000 tonnes, up from $1,250 in its inaugural tender in July.

China’s lithium carbonate has almost doubled in just two months, and lithium hydroxide is up more than 70% in the period, according to Asian Metal Inc. data.

Exacerbating the lithium supply crunch are the high production costs arising from the global energy crisis.

Ganfeng has already told customers that it is raising prices for lithium metal products by 100,000 yuan ($15,500) per tonne for the next month, partly because of China’s power supply shortages.

However, even before the reduced industrial output, BMI analyst George Miller had previously forecast an LCE deficit of 25,000 tonnes this year, with acute deficits expected in 2022 and beyond.

Given China represents more than 60% of the world’s processing capacity, the actual supply deficit is likely to exceed estimates by the end of this year.

“Unless we see significant and imminent investment into large, commercially viable lithium deposits, these shortages will extend out to the end of the decade,” Miller added.

A lengthy slump since 2018’s peak meant investment in the sector slowed, and the pandemic has since exacerbated global supply constraints.

Criticality

North America relies heavily on foreign supplies of critical minerals — the raw materials it needs to become a leader in high technology, transportation, energy, and defense. Materials like lithium, graphite and tin.

For years, the United States and Canada did not bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, let the DRC do it, let whoever do it.

Without a reliable supply chain, a country must depend on outsiders. This gives foreign suppliers incredible leverage over the United States. There is always the possibility of slowed flows or bans on strategic materials, due to politics, acts of aggression/war or trade disputes.

To maintain its dominance in the EV market, Chinese manufacturers need a lot of cheap lithium. That explains why its largest lithium miner, Tianqi Lithium, owns 51% of Australia’s Greenbushes spodumene mine — the world’s dominant hard-rock lithium mine. And why China bid for, and got, a 23.7% stake in Chilean state lithium miner SQM, the second largest in the world, for $4.1 billion.

China produces roughly two-thirds of the world’s lithium-ion batteries and controls most of its processing facilities.

One way to meet the threat of foreign countries restricting, or embargoing, critical minerals, is to encourage the domestic exploration and mining of these metals.

Here at AOTH we have been advocating for the creation of a “mine to magnet” electric vehicle supply chain in North America for years, something that is finally appearing on the radar screens of governments and large mining companies.

We have also recognized the vulnerability of major economies like Canada and the United States to shortages of certain metals that are going to be heavily demanded in the coming decades, far beyond their traditional uses, as nations shift their economies from fossil fuels to renewable energy sources and strive to meet more stringent emissions regulations pertaining to vehicles and industry.

US lithium constraints

Years of neglecting its critical metal supplies is catching up with the United States, as demand for the raw materials needed to build a new green economy that rejects fossil fuels gears up.

For most of the metals used in clean energy and electrification, the United States relies on imports.

Since Donald Trump’s presidency, the US has been planning to reverse its dependence on foreign rivals especially China, which currently has the largest EV market and dominates the global battery supply chain.

Under an executive order issued by Trump, a report was published by the Interior Department in 2018, highlighting 35 minerals that are critical to the US national and economic security, including lithium, 14 of which are 100% dependent on imports.

The current president, too, is aware of America’s vulnerabilities in this area.

“Today, America relies heavily on importing the inputs for fabricated advanced battery packs from abroad, exposing the nation to supply chain vulnerabilities that threaten to disrupt the availability and cost of the critical technologies that rely on them and the workforce that manufactures the. With the global lithium battery market expected to grow by a factor of five to ten by 2030, it is imperative that the United States invest immediately in scaling up a secure, diversified supply chain for high-capacity batteries here at home…,” states a White House press release in June, announcing a supply chain disruptions task force:

“That means seizing a critical opportunity to increase domestic battery manufacturing while investing to scale the full lithium battery supply chain, including the sourcing and processing of the critical minerals used in battery production all the way through to end-of-life battery collection and recycling…

“To secure a reliable, sustainable supply of critical minerals and materials, the United States must work with allies and partners to diversify supply chains away from adversarial nations and sources with unacceptable environmental and labor standards.”

President Biden has set an ambitious target to make half of new vehicles sold in 2030 zero-emissions vehicles.

His $1.2 trillion infrastructure package, passed by the Senate but not yet by the House of Representatives, includes transitioning the US transportation system to battery-powered vehicles and supporting renewable wind and solar energies over carbon-based sources like coal and natural gas.

An even larger $3.5 trillion spending package is also under consideration by the House. It includes:

- $198 billion in direct payments to utilities for hitting clean energy goals, providing consumers with rebates to make homes more energy-efficient, and financing for domestic manufacturing of clean energy and auto supply chain technologies;

- $67 billion to fund climate-friendly technologies and impose fees on emitters of methane, to reduce carbon emissions;

- $37B to electrify the federal vehicle fleet.

The nation is scheming to expand its domestic lithium sources, having listed the battery metal as a critical mineral back in 2018, to lessen its reliance on foreign production.

This would be a natural step to take should the US wish to achieve its ambitious climate goals. About 30% of an electric car’s cost goes towards its battery, which requires metals such as lithium, graphite and cobalt – all on the US critical minerals list.

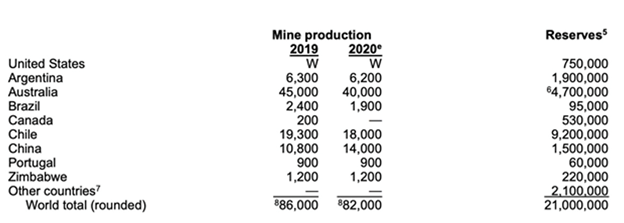

A glance at the US Geological Survey’s mine production data, shows how little of these materials the United States mines.

For example, in 2020 (and earlier) the only lithium production in the United States was from Albemarle’s Silver Peak brine operation in Nevada. While the actual amount was withheld by the company, it certainly comes nowhere close to the top three producers, Australia (40,000 tonnes), Chile (18,000t) and China (14,000t). As for current identified lithium resources, the USGS notes these have increased substantially due to continuing exploration, but out of the 86-million-ton total, only 7.9Mt has been found in the US, and 2.9Mt in Canada.

It’s hard to imagine the US being able to fulfill its new clean energy agenda without either a significant increase in critical metal imports that frankly may not be possible in current market conditions or executing a home-grown strategy to explore for and mine them in North America.

Cypress Development Corp

Fortunately there is a company we at AOTH have been closely following, with the ability to step into the breach and help to alleviate the US dependence on foreign imports of lithium, that is only going to get worse if elevated US demand is not met with increased domestic supply.

Cypress Development Corp’s (TSXV:CYP, OTCQB:CYDVF, Frankfurt:C1Z1) Clayton Valley Lithium Project covers 5,430 acres and is located immediately east of Albemarle’s Silver Peak mine. North America’s only lithium brine operation has been in continuous operation since 1966.

Exploration and development by Cypress led to the discovery of a world-class resource of lithium-bearing claystone adjacent to the brine field to the east and south of Angel Island, an outcrop of Paleozoic carbonates protruding up through the lakebed sediments.

In a pre-feasibility study (PFS) released in 2020, it is estimated that the Clayton Valley project could produce on average 27,400 tonnes of lithium carbonate equivalent (LCE) per year, at a mining and processing rate of 15,000 tpd of mill feed.

The production figure is based on probable mineral reserves of 213 Mt averaging 1,129 ppm Li (1.28 Mt LCE). Reserves and production plan are derived from an indicated mineral resource of 1,304 Mt averaging 905 ppm Li (6.28 Mt LCE).

Mineral resources and reserves for the PFS are derived from only a portion of the initial pit, showing a mine life of 40-plus years. All resources and reserves are pit-constrained by property and geological boundaries.

The large size — combined with its surface exposure and flat-lying nature — is a key feature of claystone deposits. This would allow mining with a negligible strip ratio of 0.29:1 due to minimal overburden, and no drilling or blasting.

As such, the Clayton Valley project has the potential to be a sustainable, low-cost lithium producer.

The company is currently working towards a feasibility study and permitting of a mine and metallurgical facility for its large deposit of lithium-bearing claystone.

Should everything go according to plan, Clayton Valley would become a viable source of high-purity lithium hydroxide (LiOH) suitable for EV battery usage for decades.

In March, Cypress took a vital step in advancing the Clayton Valley project towards production by announcing the development of a lithium extraction pilot plant for the lithium-bearing claystone.

The pilot plant is located at a metallurgical facility 100 miles south of Beatty, Nevada, owned and operated by del Sol Refining Inc., which is permitted under the State of Nevada for chemicals use with permits in place with the US Environmental Protection Agency (EPA).

The initial operation of the pilot plant will focus on chloride-based leaching to confirm the results of the company’s scoping study on lithium extraction.

The pilot plant is planned to operate at a rate of one tonne/day and will be designed for correct interaction and testing of the major components within the extraction process and assessment of the resulting lithium products.

According to Cypress, the program will provide essential data for a planned feasibility study and enable the company to produce marketing samples to support negotiations with potential offtake and strategic partners.

Pilot plant completed

On Wednesday the company said the plant has been assembled and is ready to start operating, with test extraction of lithium from sample material slated to begin next week.

The pilot plant is configured to use chloride-based leaching to liberate the lithium from the project’s claystone. This was based on results from a scoping study completed in January 2021, which determined that using a chloride-based rather than a sulfate-based leaching process would confer benefits in terms of economics, process and the environment.

“The testing ahead will be one of the larger piloting efforts to extract lithium from clay in the world, and the only one based on a chloride approach to leaching,” said CEO Willoughby in the Oct. 13 news release. “While the ultimate goal is to demonstrate the production of lithium hydroxide from our claystone resource on a larger scale, the results from the various areas within the plant, from leaching and tailings handling, to solution treatment and recycling, chemical usage and water balance, will provide the data necessary to carry the project forward to the feasibility level.”

The pilot plant has four main sections, with two additional processing steps conducted off-site at NORAM Engineering and Constructors laboratory in Richmond, British Columbia, just outside of Vancouver:

- The leaching section will work to improve leach conditions and confirm lithium extraction into pregnant leach solution (PLS).

- The tailings handling section will utilize a counter current decantation arrangement of thickener settlers and flocculant mixing, with the objective of determining materials handling, moisture content and water consumption.

- The PLS treatment section will remove impurities prior to introduction into the DLE process through two-stage neutralization and filtration; a tertiary stage will follow the DLE process prior to recycling of solution back to leaching.

- The DLE section consists of Chemionex’s—Lionex DLE technology and will test compatibility of the PLS to be further concentrated with this process. Cypress was granted an option, upon completion of the pilot plant program, to license this process for commercial use at its project.

- The final two off-site steps will treat the concentrated lithium solution from the DLE portion of the pilot plant to produce lithium hydroxide and test the stripped leach solution for compatibility for recycling to the leaching section of the plant.

Conclusion

Lithium supply concerns have increased in response to the booming EV market, and projects like Cypress’ world-class claystone deposit will be vital in restoring the market balance.

Cypress’ Nevada mine would produce enough lithium to supply roughly 5% of the global market. All of the planned 27,400 tonnes of annual lithium carbonate equivalent (LCE) could go to North American end users, thus fulfilling the US government’s stated objective of securing “a reliable, sustainable supply of critical minerals and materials.”

This is a long time coming. The United States has been dependent on foreign suppliers of critical metals like lithium and graphite for decades. Only now, with the US playing catch-up to China, the dominant player in the lithium battery supply chain, is the problem getting the ear of government.

Arguably the White House wants to have its cake and eat it too. It wants to break free of foreign dependence yet the country has virtually no lithium production besides Silver Peak. Automakers and battery manufacturers are flocking to the United States to take advantage of battery materials demand, yet there is no domestic supply chain. Unless a North American miner emerges in the short term, these companies will have no choice but to get their lithium products from Asia.

Despite the fact that there is a huge untapped lithium claystone deposit right beside the only US lithium miner, Albemarle. Why isn’t Nevada shouting this from the rooftops? In the absence of government support, beyond lip service, companies like Cypress are going it alone.

Since acquiring the lithium claims back in early 2016, Cypress has made tremendous progress in bringing the Clayton Valley Lithium Project closer to production, with sampling, drilling and metallurgical testing leading to a positive PFS.

As shown in the study, a potential +40-year operation capable of producing 27,400 tonnes of LCE at an industry-low cash cost of $3,400 per tonne could be a game-changer.

Only a handful of lithium projects in the world are comparable in terms of size and cost-efficiency.

The fact that the world’s biggest lithium producer, Albemarle, is right next door, with plans to double its output, means Cypress and its low-cost operation make a compelling target for the world’s largest lithium miner. It would also make sense for a major automaker like Tesla or Volkswagen to partner with CYP.

The market has been good to Cypress and Cypress has been good to Ahead of the Herd. My entry point was $0.11 a share and I rode the CYP wave all the way to $1.87/sh before selling all my shares. I was back in at $1.00 and the market, after digesting the news of the pilot plant completion, rewarded Cypress with a 17-cent increase to close at $1.71, Wednesday, for a one-day gain of 11% and an impressive YTD performance of +71%.

Cypress is one of the few bright spots in a tough junior resource market and I expect the good times to keep rolling. The story “has legs”, well imo, at least until a buyer takes out CYP.

Cypress Development Corp.

TSXV:CYP, OTCQB:CYDVF, Frankfurt:C1Z1

Cdn$1.71, 2021.10.13

Shares Outstanding 126.6m

Market cap Cdn$214.6m

CYP website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Cypress Development Corp. (TSXV:CYP).

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.