Porphyry hunting in northern Chile with Pampa Metals

2021.10.02

A porphyry deposit is formed when a block of molten-rock magma cools. The cooling leads to a separation of dissolved metals into distinct zones, resulting in rich deposits of copper, molybdenum, gold, tin, zinc and lead. A porphyry is defined as a large mass of mineralized igneous rock, consisting of large-grained crystals such as quartz and feldspar.

Porphyry deposits are usually low-grade but large and bulk-mineable, making them attractive targets for mineral explorers. Porphyry orebodies typically contain between 0.4 and 1% copper, with smaller amounts of other metals such as gold, molybdenum and silver.

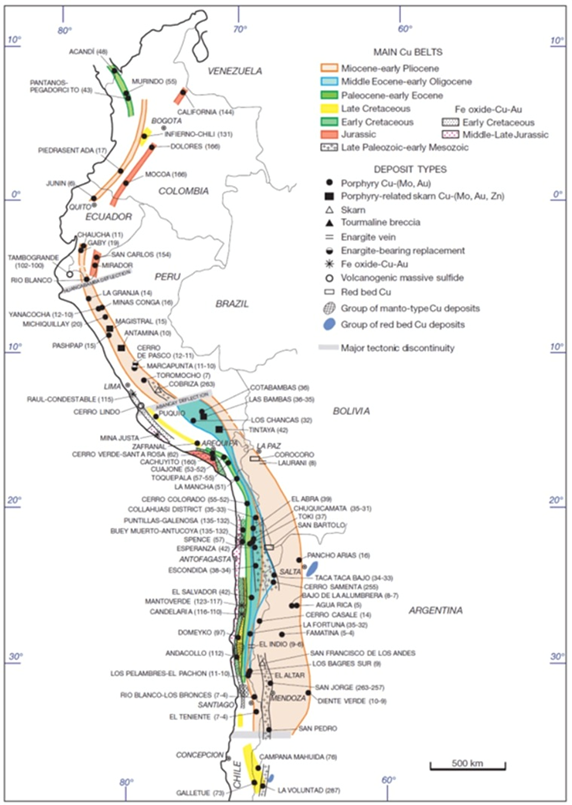

Most porphyry copper deposits occur close to subduction zones around the Ring of Fire — the horseshoe-shaped Pacific Ocean basin where regular and sometimes dangerous earthquakes and volcanic eruptions occur. The Ring of Fire stretches 40,000 kilometers from the southern tip of South America, up the North and South American coasts to the Aleutian Islands, down the East and Southeast coasts of Asia, and ending in a boomerang-shaped arc off the eastern coast of Australia.

Copper porphyries were the first metallic deposits to be mined in open pits, starting in 1905 with the Bingham Canyon mine in Utah. Since 1970 over 95% of US copper production has come from porphyry deposits, and more than 60% of world annual copper production.

Chilean copper

Around 80% of Chilean copper production comes from copper-gold porphyry deposits, with most situated in northern Chile. These porphyries, which are also rich in molybdenum with silver by-products, provide the ore for some of the world’s most prolific and highest-grade copper mines.

Among the largest are Chuquicamata, Escondida and El Salvador.

Chile is an ideal “elephant” copper deposit hunting ground for the big-name mining companies. Boasting the biggest copper reserves worldwide, at 200 million tonnes, means Chile’s dominance isn’t waning anytime soon.

Northern Chile has some of the largest copper and gold deposits in the world, formed from a combination of factors, but generally associated with intrusive-extrusive magmatism and tectonic activity on the western boundary of the South American plate.

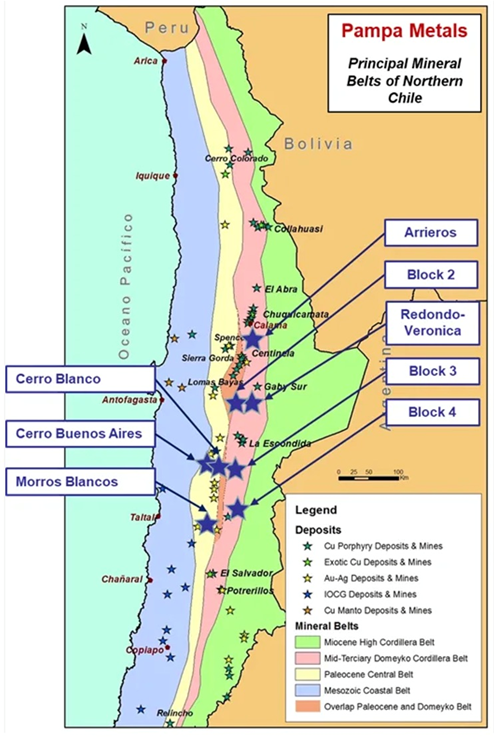

Several metallogenic belts developed, reflecting changes in the tectonic setting and igneous activity. They include the Miocene High Cordillera Belt, the Mid-Terciary Domeyko Cordillera Belt, the Paleocene Central Belt, the Mesozoic Coastal Belt and the Overlap Paleocene and Domeyko Belt.

Naturally, given northern Chile’s copper riches, some of the mining industry’s largest red-metal producers have flocked to the region. Chilean state-owned Codelco operates El Teniente, the world’s largest underground copper mine, along with Chuquicamata, the second deepest copper mine on Earth and one of the largest open-pit mines.

Other major copper miners, who have undertaken significant exploration and production, include BHP, Freeport McMoran, Rio Tinto and Antofagasta Minerals. The latter has four operating mines in Chile including its flagship Los Pelambres in the Coquimbo region.

Escondida, owned by BHP, Rio Tinto and a Japanese consortium headed by Mitsubishi, is the largest copper mine in the world (and the largest producer of copper cathodes and concentrates) while Collahuasi, another top Chilean copper mine, is jointly owned by Anglo American, Glencore and Mitsui.

Pampa Metals

In recent years, there has also been an influx of junior miners looking for the next big copper discovery in Chile.

One of the most promising is Pampa Metals (CSE:PM, FSE:FIRA), which controls a 100% interest in eight exploration projects prospective for copper and gold in northern Chile.

These projects (Arrieros, Block 2, Redondo-Veronica, Block 3, Block 4, Cerro Buenos Aires, Cerro Blanco and Morros Blancos) are all located along proven mineral belts of the Atacama region, including the Central Paleocene and Domeyko belts that have dominated the world’s copper production.

As shown on the map above, five of the projects are situated along the mid-Tertiary porphyry copper belt of northern Chile — the Domeyko Cordillera — that is host to three of the world’s top five copper mining districts at Collahuasi, Chuquicamata and Escondida (the world’s biggest).

The remaining three are located in the heart of the Paleocene mineral belt, which hosts a series of important porphyry copper deposits and mines such as Cerro Colorado (BHP), Spence (BHP), Sierra Gorda (KGHM & Sumitomo) and Relincho (part of Nueva Union – Teck-Goldcorp).

The Chilean Atacama Desert is characterized by elevated ranges of mountains, separated by relatively flat, piedmont-gravel-filled “pampas” that conceal the underlying geology.

These areas remain underexplored because they contain a layer of gravel, 30-50m thick, that was deposited after the formation of the porphyries. A rough estimate suggests at least 50% of northern Chile is covered by pampas, meaning that half of the region’s undiscovered mineral deposits may be concealed by a thick gravel cap.

Notwithstanding the important discoveries noted above, there are still very large areas of untested pampas in northern Chile that have the potential to conceal significant mineral deposits.

Outcrops in the pampas are rare, however if found, they can display similar characteristics, in terms of geology and hydrological alteration, as copper porphyry deposits. Pampa Metals’ game plan is to first conduct surveys to find the outcrops, and then sample and drill them.

2021 exploration

Redondo-Veronica and Cerro Buenos Aires are the focus of a 4,000-meter reverse circulation (RC) drill program that began in June. (RC drilling is different from diamond drilling in that it uses compressed air to produce small rock chips at the bottom of the hole which get flushed up to surface for sampling, versus diamond drilling where a diamond drill bit pierces the rock and produces drill core for assaying.)

Surface signatures at both projects have turned up evidence of a potential copper porphyry system at depth. If more drilling can verify this theory, it would instantly pop Pampa Metals’ stock price and trigger a flurry of interest from potential acquirers, given Pampa’s proximity to some of the world’s largest copper mines and deposits.

Redondo-Veronica

The Redondo-Veronica portion of drilling was completed in late July, with a total of 1,956 meters drilled in seven holes testing several targets that are characterized by a combination of geological, hydrothermal alteration and geophysical features interpreted to be representative of porphyry copper systems.

Two of the seven widely spaced RC holes were drilled at Cerro Redondo North, four were drilled at Redondo Southwest and one hole was sunk into Redondo Extreme North.

Assay results received at the end of September point towards potentially deep porphyry copper mineralization across two of the three target areas that were tested, at Cerro Redondo North and Redondo Southwest.

At the latter, four widely spaced drill holes showed hydrothermal alteration and minerals indicative of the outer margins of a deep copper porphyry. Values up to 117.5 parts per million (ppm) molybdenum, returned from hole 5, are considered indicators of a fertile porphyry system.

At Cerro Redondo North, copper contents together with anomalous arsenic values were found, which according to the company, also indicate the upper parts of a porphyry. Assay results from hole 1 showed up to 0.16% Cu between 100m and 330m depth.

Within the two large alteration systems unearthed by 2021 drilling at Redondo-Veronica, was evidence of quartz veinlets, an important porphyry indicator. Remember from the first paragraph, porphyries are mineralized igneous rock consisting of large-grained crystals such as quartz and feldspar.

Moreover, it appears from 3D modeling done on the geophysical data, that there is considerable potential at Redondo-Veronica for continued mineralization at depth:

Pampa Metals is continuing the process of integrating all the data collected from the project. Further 3D modelling of the geophysical data, with integrated drill data, is considered essential as a next step. The first pass of RC drilling has been very successful in showing that the Redondo-Veronica project has the potential to host deep porphyry copper style mineralisation, which will require diamond drill follow-up due to the limitations that the less- expensive RC drilling technique has faced with depth, the Sept. 28 news release states.

While Pampa Metals has yet to give the green light to drill deeper, beyond the limits of the current drill holes, doing so would reveal if there are ore-grade intercepts, and might also add credibility to the copper-porphyry system hypothesis.

Cerro Buenos Aires

Drilling at Cerro Buenos Aires has also been completed, with nine RC holes totaling 2,738 meters. Results so far have shown “highly encouraging indications of a porphyry system,” the company revealed. Analytical results are pending.

“Drill hole evidence suggests that the drilling to the north of Cerro Chiquitin is at the periphery of the principal area of interest and reveals quartz veinlets in the pyritic, propylitic halo to the alteration system. Most of the area of interest to the south of Cerro Chiquitin is covered by 40m to 85m of post-mineral gravel cover where the underlying geology is not exposed,” Julian Bavin, CEO of Pampa Metals, commented in the Sept. 15 news release, adding that further work is required to focus in on this target area.

Could the outcrop at Cerro Buenos Aires, described as a small hill about 500 meters across, be the tip of the iceberg of a large porphyry underneath? Drilling some deeper holes should reveal more about the geology and mineralization.

Interpretation

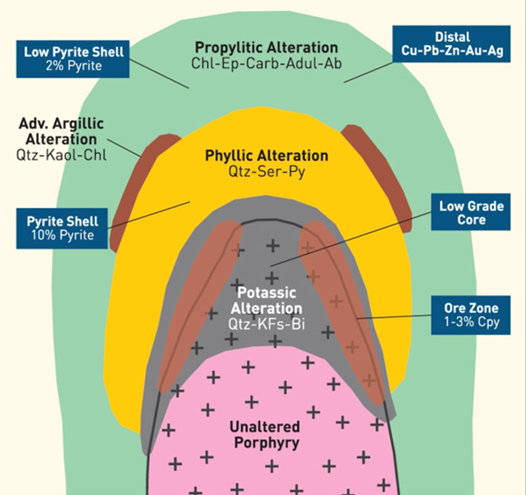

Porphyry systems are zoned from the mineralized core outwards and upwards, as shown on the diagram below.

Depending on the level of erosion, the outer parts of a system can be quite poorly mineralized/ low-grade. Nevertheless, it’s easy enough for skilled geologists to spot changes in the geology (aka hydrothermal alteration), which indicates they are in the vicinity of a highly mineralized copper center. In porphyry exploration, hitting the target means drilling into the potassic-altered copper-rich core — the source of the system.

The latter is precisely what Pampa Metals is looking for at Cerro Buenos Aires and Redondo-Veronica. Obviously they aren’t there yet, but the results from first-pass RC drilling are very encouraging. The fact that Pampa appears to have found the outer margins of a porphyry system, at not one but two projects, tells us there must be a porphyry somewhere in the area; otherwise, all the tell-tell characteristics of hydrothermal alteration — where boiling-hot fluids carrying mineralized fluids upwards created a porphyritic intrusion — would not be present.

Unfortunately, not everybody understands the nature of porphyry mineralization and exploration, thus there is the potential for a mis-representation of drill results. When Pampa this week sent its press release to Stockwatch, the equity news service ran with the following headline:

‘Pampa Metals drills up to 0.16% Cu at Redondo-Veronica’.

Anyone who read that headline would be misled into thinking that the drill results from Redondo-Veronica bombed, and act accordingly. Indeed PM dropped 10% on the news. Sure, 0.16% Cu is low-grade, but, considering all the indications of porphyry mineralization, including the fact that the outer parts of a system are often poorly mineralized, the news release was a big win.

Another key point to remember about porphyries is they sometimes aren’t that big, yet they are so richly mineralized, they can drive an entire mining operation. Also, it’s relatively easy for a mining company, even a major, to miss a porphyry because they dismissed the initial low-grade results.

That is exactly what happened to BHP when it started developing the massive Oyu Tolgoi copper-gold-silver complex in Mongolia.

The original deposit outcropped at surface but it was relatively low-grade, causing BHP to walk away from it. Eventually the world’s largest mining company ceded control of the project to Rio Tinto and Ivanhoe Mines, which after a lot of geophysics and many drill holes, found the Hugo Dummett deposit that was to become the largest and highest-grade deposit at Oyu Tolgoi. As of July 2020, probable ore reserves at Hugo Dummett North and Hugo Dummett North Extension total 459 million tonnes 1.4% Cu + 0.36g/t Au + 3.3g/t Ag. Resources are pegged at 87Mt.

The interesting thing about Hugo Dummett is it is buried about a kilometer below surface. Geophysics only goes so far in delineating a porphyry; the rest must be accomplished through drilling. In the case of Hugo Dummett, an induced polarization (IP) anomaly showed a huge area, 5 km by 2 km, but the Hugo Dummett deposit is only around 750m across. In other words, easy to miss.

Something similar occurred at Chile’s Escondida, the largest copper mine in the world, when BHP tried to find additional mineralization around the deposit, known in industry jargon as “brownfield” exploration (as opposed to greenfield exploration where prospecting, mapping, sampling and drilling are done in an area where no mining has yet taken place).

Escondida was discovered in the 1980s and came on stream in the 1990s. However it wasn’t until 2016 that the Pampa Escondida deposit was discovered less than a kilometer away, 26 years after production began at the initial open pit. The billion-tonne copper porphyry deposit grades 0.6 to 1% Cu.

And this was brownfield exploration. The chances of finding a porphyry in a greenfield exploration site, such as Redondo-Veronica and Cerro Buenos Aires, are even more remote, which makes Pampa’s results so far all the more remarkable.

Consider: at Redondo-Veronica the company has found two mineralized areas indicative of a porphyry about two kilometers apart. In a third area between them, Hole 5, high moly values, returned from the chip samples at the bottom of the hole, are considered “indicators of a fertile porphyry system.”

Could this third area, which on speculation, we admit, looks relatively central to a potential porphyry system lurking underneath the existing holes, be the next logical step for Pampa? In my opinion Pampa has an excellent place to start vectoring into the potential copper-rich intrusive.

Obviously more drilling is needed. The fact that important porphyries have been missed by major copper producers conducting brownfield exploration on the peripheries of existing mines, shows the risk of walking away too soon. The two closest holes at Redondo-Veronica are 1.5 km apart. A porphyry could easily fit between them.

Also consider where Pampa Metals is operating. Despite being among some of the world’s biggest copper mines and deposits, in one of the most richly mineralized regions on Earth, over 50% of northern Chile is covered by pampas, i.e., gravel cover. That leaves a lot of room for greenfield exploration.

At AOTH, we are impressed by Pampa’s success in finding instances of copper porphyry mineralization at two of its projects, after completing just 16 holes of RC drilling. Is that luck or skill? As the sports adage goes, “you’ve gotta be good to be lucky.”

Pampa has a very good lead at Redondo-Veronica and at Cerro Buenos Aires they are waiting for results. The upshot is the company has two projects with potential porphyry mineralization, and they’re vectoring in on the intrusion, or intrusions, in northern Chile, the best jurisdiction in the world for copper exploration and mining.

Pampa wasn’t going to walk onto the property and hit the source of the mineralization in its first drill program. The grades at the outer edges of the system aren’t economical but we wouldn’t expect them to be. This is how you hunt for porphyries, you do your geophysics, sample outcrops, look for evidence of porphyry mineralization, and then, only then, do you start vectoring into the intrusion. It looks to us, at AOTH, that Pampa may have already zoned in on it.

“We’ve got some real vectors now to some potential ore. That’s exciting,” Pampa Director Tim Beale, a veteran geologist with 20 years experience living and working in Chile,” told me over the phone this week.

It certainly is. The more holes that are drilled, the better the understanding of the potential porphyry, and the closer Pampa gets to the core, the more market attention it will receive.

“If we find a well-mineralized system it doesn’t really matter how many holes you have to drill, because you know you’re in a system, the market knows you’re in a system, other companies know you’re in a system, so you’ll have a lot of interest in trying to delineate the extent of that system,” Beale stated.

Put it this way: any junior that discovers a porphyry in northern Chile won’t last long, before a major comes in and snaps it up. For that reason alone, Pampa is a fascinating copper play in a hot copper market.

Pampa Metals Corp.

CSE:PM, FSE:FIRA

Cdn$0.31, 2021.10.01

Shares Outstanding 46.4m

Market cap Cdn$14.3m

PM website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Pampa Metals Corp. (CSE:PM). Pampa is a paid advertiser on his site aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.