Global energy crisis highlights a growing need for EV battery minerals like lithium, graphite

2021.10.02

Many believe the outcome of our fight against climate change depends on how quickly and effectively we can transition away from the use of fossil fuels towards renewable energy like wind, solar and nuclear.

The major energy crisis now happening in China (and other parts of the world) highlights the downfall of having an economy reliant on fossil fuels while also setting climate goals that restrict the non-renewable energy supply.

China is the world’s top consumer of coal, the dirtiest fossil fuel, and relies on the power plant fuel for 56% of its energy. But its stockpile of coal is sitting low against a soaring electricity demand.

As a result, coal prices have more than doubled year to date, and thermal coal futures in China have recently hit a record high.

Meanwhile, the UK is going through a massive gasoline and diesel fuel shortage, which, according to Inside EVs, has significantly boosted consumer interest in electric vehicles.

Alex Beard, the former Glencore exec billed as the ‘king of oil’, this week said he plans to raise funds to build a portfolio of strategic battery sites across the UK to support the nation’s renewable energy industry.

Electrification

While this energy crisis offers a reminder of the current state of global energy consumption and its inherent problems, it may also serve as an opportunity for governments to further commit to batteries and other forms of energy storage.

The modernization and electrification of infrastructure will be a prerequisite in achieving the various climate goals set by countries like Canada, US, Britain, China and Japan. This would mean large-scale deployment of electric vehicles, renewable power and electrical transmission in the coming years.

A brand-new report from Bloomberg NEF pointed out that the transition from fossil fuels to clean energy could require as much as $173 trillion in energy supply and infrastructure investment over the next three decades.

Establishing a transportation system dominated by electric vehicles is a key tenet of many climate action plans.

In the US, the Biden Administration has called for 100% clean electricity by 2035, and is aiming to have at least half of all new passenger vehicles sold to be electric by 2030.

To achieve such goals, the government has pledged significant funding to battery-dependent sectors, including $174 billion to “win the EV market.”

Canada, too, has a zero-emission mandate of 50% EVs set for 2030, and with the latest election results, the government’s commitment to significant clean energy infrastructure funding will likely stay intact.

Other similar climate targets have been set to electrify the global transportation system. In its electric car forecast to 2040, Wood Mackenzie estimates that EV sales are expected to reach 45 million units per year in the next two decades, with a total global EV stock of 323 million.

For perspective, global EV sales in 2019 were only 2.1 million, with a stock of 7.2 million cars, according to Global EV Outlook.

Battery Metals Shortage

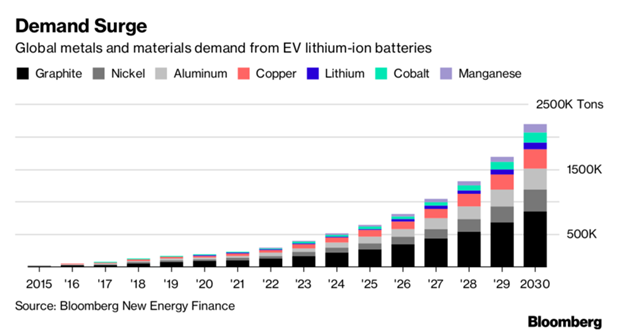

The upward trajectory of EV demand requires the world to keep up its production of lithium-ion batteries to power these vehicles. In turn, there is an increasing need for key battery ingredients like lithium, nickel and graphite.

Globally, the amount of lithium carbonate equivalent deployed in newly sold vehicles in H2 2020 jumped 96% to 57,300 tonnes over the same period the previous year, according to a recent study by Adamas Intelligence. Nickel deployed in world battery production also climbed 69%, every million EVs, which is only about 1% of the new car market, requires in the order of 75,000 tonnes of natural graphite.

Due to surging demand for clean energy metals, many of the key battery minerals are now running towards structural deficits.

For example, Bloomberg NEF predicts that demand for Class 1 “battery-grade” nickel is expected to outstrip supply within five years, fueled by rising consumption by EV battery suppliers. Roskill forecasts battery-grade lithium to enter a supply deficit in the coming years and expects total graphite demand over the next 10 years to grow around 5 to 6% per year.

A little-known fact is that graphite is also the second-largest battery component by weight, and each EV battery is said to contain 10 to 15 times more graphite than lithium. Thus, the electrification of vehicles would require a much larger tonnage of graphite relative to most metals. It’s thought that the increased use of lithium-ion batteries could gobble up well over 1.6 million tonnes of flake graphite per year (out of a total 2020 market, all uses, of 1.1Mt) — only flake graphite, upgraded to 99.9% purity, and synthetic graphite (made from petroleum coke, a very expensive process) can be used in lithium-ion batteries. The USGS believes that large-scale fuel cell applications are being developed that could consume as much graphite as all other uses combined.

The International Energy Agency forecasts that the electric mobility and low-carbon energy sectors will demand 25 times more graphite per year by 2040 than today.

Lomiko Metals Inc.

With demand for clean energy metals taking off and potentially leading to a global supply crunch, the world’s need to raise its mine supply has never been greater.

In North America, the quest to establish a secure supply of battery materials has already begun, with the US and Canadian governments each drawing a list of critical minerals that are deemed to be building blocks for the clean and digitized economy. Included in these lists are the aforementioned battery metals (lithium, graphite, etc.).

Major emphasis is now being placed on mining projects with exposure to these important battery components, as much of the supply is dependent on foreign imports (for example, China is responsible for over 60% of the world’s graphite mining and processing).

One company that has committed itself to serving the EV industry and other green energy applications in the coming years is Lomiko Metals Inc. (TSXV: LMR) (OTC: LMRMF) (FSE: DH8C), which is simultaneously working on two exploration projects within the mineral-rich regions of Quebec, Canada.

La Loutre Graphite Property

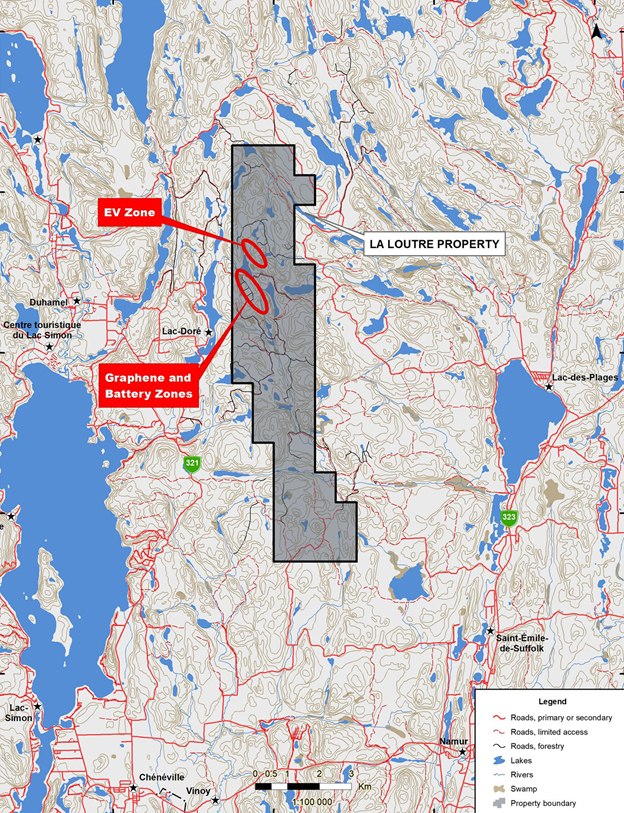

Lomiko Metals currently holds a 100% interest in its La Loutre graphite development in southern Quebec, consisting of one large, continuous block with 42 minerals claims totalling 2,509 hectares.

The property is located approximately 117 km northwest of the city of Montréal and 53 km east of the Imerys Carbon and Graphite’s Lac des Iles mine. Farther out, Nouveau Monde Graphite and its high-purity mineral reserve at Matawinie are located 230 km to the north.

La Loutre was originally explored for base and precious metals in the late 1980s. However, historical reports have also pointed to graphite being present in different lithologies on the property.

Recent sampling by Lomiko has confirmed a graphite-bearing structure covering an area approximately 7 kilometers by 1 kilometer with results of up to 22.04% graphite in multiple parallel zones of 30-50 meters wide.

Another area has also been identified covering approximately 2 kilometers by 1 kilometer in multiple parallel zones of 20-50 meters wide which include results up to 18% graphite.

The two mineralized areas on the property were later named the Electric Vehicle (EV) zone and the Graphene-Battery zone respectively for the potential applications of the graphite material contained in each.

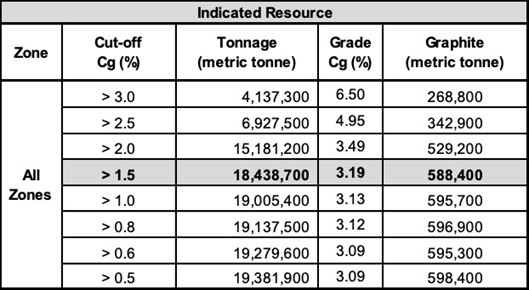

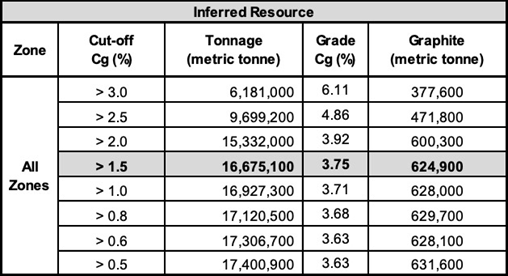

The project’s first resource estimate (2016) was obtained from only the Graphene-Battery zone (see below), containing a pit-constrained 18.4 million tonnes of 3.19% graphitic carbon (Cg) indicated and 16.7 million tonnes at 3.75% Cg inferred.

Encouraged by the initial estimates, Lomiko pursued further exploration drilling at La Loutre, including the EV zone, to boost its resource base. The latest drill program in 2019 returned positive results, which had high-grade intercepts of 87.9 m of 7.14% Cg, including 21 m of 15.48% flake graphite; and 116.9 m of 4.80% Cg, including 15.2 m of 18.04% flake graphite.

These results allowed the company to expand the resource, as shown in the PEA, to an estimated 23.2 million tonnes indicated grading 4.51% Cg (for 1.04 million tonnes of contained graphite), plus 46.8 million tonnes inferred grading 4.01% Cg (for 1.9 million tonnes of graphite).

Bourier Lithium Project

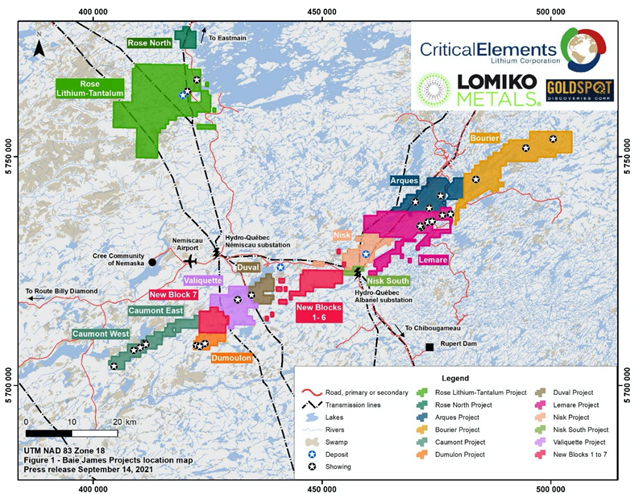

In addition, Lomiko has a joint venture option to earn 70% of the Bourier project from Critical Elements Lithium Corp. by funding exploration activities and other considerations.

The Bourier property consists of 203 claims for a total ground position of 10,252 hectares, in a region of Quebec that boasts other lithium deposits and known lithium mineralization (as shown below).

Bourier is located in the northeastern part of what is known as the Superior geological province, and more specifically, in the northeastern part of the Lac des Montagnes Formation. The Lac des Montagnes volcano-sedimentary belt is a sequence of aluminous metasediments and amphibolites containing basalts and ultramafic sills.

The lithium pegmatites in this area tend to occur in swarms in the volcano-sedimentary units. The Bourier property covers a large part of this regional volcano-sedimentary unit, which is also host to Nemaska Lithium’s Whabouchi deposit and Critical Elements’ Lemare showing.

Initial exploration at Lemare was undertaken in 2012 by Monarques Resources Inc., which resulted in the discovery of a “granite pegmatite dyke containing a considerable amount of spodumene.”

The Bourier property lies adjacent and northeast to the Lemare property, where drilling conducted between 2016 and 2018 yielded results that included 41.5 m at 1.71% lithium oxide (Li2O), including 15 m at 2.18% Li2O and 6 m at 3.6% Li2O.

The pegmatite ranges in apparent thickness from 4.8 to 14.2 metres and was followed for close to 200 metres in length on surface. Further exploration will confirm whether similar mineralization exists at the Bourier property.

Although there has been little exploration for lithium undertaken at Bourier so far, based on other lithium deposits around the world, it is a common occurrence for pegmatites to exist in “swarms.”

An NI 43-101 compliant technical report (2012) by Monarques concluded that drilling and analysis conducted at the Bourier property at that time yielded results that were sufficient to recommend additional exploration.

Lithium Target Generation

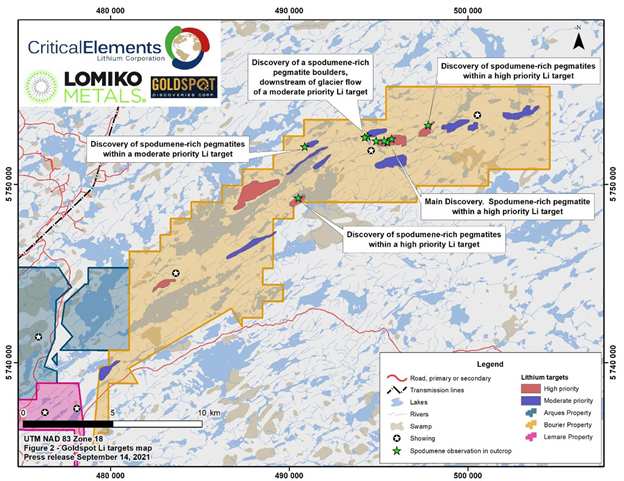

Recently, the company and its JV partner Critical Elements mandated GoldSpot Discoveries Corp. to conduct a remote targeting process for lithium on its Bourier claims within the Nemiscau belt.

GoldSpot is a mining technology services company renowned for its use of cutting-edge technology and geoscientific expertise to mitigate exploration risks and make mineral discoveries across Canada.

“We are confident that continued exploration, benefitting from the deployment of GoldSpot’s AI analysis and our joint geoscientific expertise, will continue to reveal the considerable potential of the Bourier property,” Jean-Sébastien Lavallée, CEO of the Critical Elements, said in the latest press release.

A. Paul Gill, Lomiko Metals CEO, added that: “The results indicate Bourier requires extensive attention. Combined with Lomiko’s La Loutre project, which has already reported a PEA on July 29, 2021, Lomiko has had the best summer of its history.”

Using GoldSpot’s proprietary approach of Artificial Intelligence (AI) and geological interpretation, a total of 15 high to moderate prospectivity lithium targets were identified on the Bourier claims, highlighting the lithium potential of the project.

The AI-driven data analysis also helped to reduce the area of investigation to approximately 9.5% of the total claim holding, which will result in time and cost savings during field exploration.

An exploration crew composed of Critical Elements and GoldSpot geoscientists subsequently conducted a 20-day prospecting program on the property, with a focus on the lithium targets generated by GoldSpot.

The highlights of this program include the discovery of five new sectors of spodumene-rich (Li) pegmatite (laboratory analysis results are pending). These discoveries were made within, or the extension, of GoldSpot’s targets.

The main discovery, located about 11 km NE of the Bourier Lake, consists of muscovite and garnet pegmatites showing 1-5% of centimetric-size spodumene crystals (see below), over an outcropping area of 40 x 30 m.

Additional spodumene-rich pegmatites were sporadically found within a 1 km trend from the main discovery, highlighting the potential for a wider mineralization system. Four other spodumene-rich pegmatites zones were found elsewhere on the property.

Conclusion

While there’s no shortage of miners in North America aiming to serve the EV battery market, a company like Lomiko Metals that offers investors exposure to both lithium and graphite is hard to find.

The La Loutre property looks especially promising so far, with a Preliminary Economic Assessment (PEA) on the project showing potential to become the next large-scale graphite mine in Canada.

According to the study, the open-pit project will produce 1.4 million tonnes of graphite spanning 15 years, for average annual production of 97,400 tonnes. For the first 5-6 years, the target is to reach 105,000 tonnes per year, focusing mainly on the North American and European markets.

La Loutre’s net present value (NPV) was estimated to be C$186 million with an internal rate of return (IRR) of 21.5% — using an 8% discount rate and $916/tonne Cg (graphitic carbon) sale price.

But it is the low-cost nature of the project, at attractive cash costs of $386/tonne Cg and all-in sustaining costs (AISC) of $406/tonne Cg, that makes it extra appealing. Both of these cost figures are already at the lower end of the industry spectrum, and combined with a capex of C$236.1 million, La Loutre is setting up to be a highly profitable graphite mine within one of the most prolific producing regions in Canada.

This notion was seconded in a recent report by Far East Capital Ltd., which specializes in the junior end of the resource market. In its weekly commentary, the Australian investment bank said it believes Lomiko is “very cheap” at current prices, citing the company’s C$22.5 million market cap compared with a direct comparable like Nouveau Monde Graphite (C$386 million).

It also noted that many graphite projects in other parts of the world (Mozambique, Tanzania) have yet to deliver due to various issues, so upcoming mine projects like La Loutre stand to benefit from a surge in demand from EVs and alternative energy storage.

Not to mention, graphite projects in Canada tend to boast greater production and better economics, which is a considerable advantage over those in Africa.

The next step for Lomiko is to follow up the positive PEA results with a Prefeasibility Study (PFS) and then the final Feasibility Study (FS), by which time we’ll have a better picture of the graphite market and how La Loutre would fit into the equation.

The company will also look to continue its exploration efforts on the Bourier lithium project. The new discoveries from targets generated by GoldSpot are an indication that Lomiko may have brought another exciting EV battery play into the fold.

Lomiko Metals Inc.

TSXV:LMR, OTC:LMRMF, Frankfurt:DH8C

Cdn$0.095, 2021.09.30

Shares Outstanding 215m

Market cap Cdn$20.42m

LMR website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Lomiko Metals (TSX.V:LMR). LMR is a paid advertiser on his site aheadoftheherd.com.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.