5 reasons why Silver47 should be on your watch list

2025.03.08

Located 100 kilometers south of Fairbanks, Alaska, Silver47’s (TSXV:AGA) Red Mountain is situated on Alaskan state-managed lands, free from Bureau of Land Management (BLM) or indigenous claims, covering approximately 620 square kilometers of highly prospective stratigraphy with highways, railway, and power within 30-80 km.

Silver47 owns 942 mineral claims and one mining lease, providing extensive exploration opportunities over a 60-km trend in a mining-friendly region near infrastructure.

The company says there are over 5,000 permitted drill sites on multiple untested geochemical and geophysical anomalies, which should indicate to potential investors a high potential for new discoveries.

The area is host to several world-class deposits and mines, including Fort Knox due west, and Pogo Northern Star to the south.

In particular, Silver47’s Red Mountain Project is nestled among several multi-million-ounce volcanogenic massive sulfide (VMS) and sedimentary exhalative (SEDEX) deposits, all located within the North American Cordillera, the mountain chain running along the Pacific coast of the Americas.

As seen on the map below, this includes Teck Resources’ Red Dog mine in Alaska, Barrick Gold’s former Eskay Creek mine in northwestern British Columbia now being developed by Skeena Resources, Windy Craggy, Macmillan Pass, Myra Falls, Sullivan, Trixie and Jerome.

Below are five reasons why Silver47 should be on your watch list.

1/ Silver breakout

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty.

However, much of silver’s value is derived from its industrial demand. It’s estimated around 60% of silver is utilized in industrial applications, like solar and electronics, leaving only 40% for investing.

The lustrous metal has a multitude of industrial applications. This includes solar power, the automotive industry, brazing and soldering, 5G, and printed and flexible electronics.

A report by Oxford Economics commissioned by the Silver Institute found that demand for industrial applications, jewelry production and silverware fabrication is forecast to increase by 42% between 2023 and 2033.

The Silver Institute expected demand to grow by 2% in 2024, led by an anticipated 20% gain in the solar PV market.

Silver’s application in solid-state batteries is a future usage that could mean significant new silver uptake. The batteries are seen not just as the future of electric vehicles but also as a game changer in energy solutions due to their superior safety, energy and longevity compared to traditional lithium-ion batteries, according to Citizen Watch Report.

Undervalued silver poised for explosive move higher – Richard Mills

Samsung has reportedly developed a solid-state battery that can deliver a 600-mile range on a 9-minute charge, and a lifespan up to 20 years. The battery incorporates a silver-carbon composite layer for the anode.

Each battery cell uses about 5 grams of silver and a standard 100kWh EV battery pack would potentially require 1 kg of silver. Applications aren’t confined to automotive; solid state batteries could be fitted into consumer electronics and energy storage systems.

Estimates quoted by Citizen Watch Report suggest that if only 20% of global car production adopts solid-state batteries, the annual demand for silver could reach 16,000 tonnes, compared to 25,000 tonnes of global mine production currently.

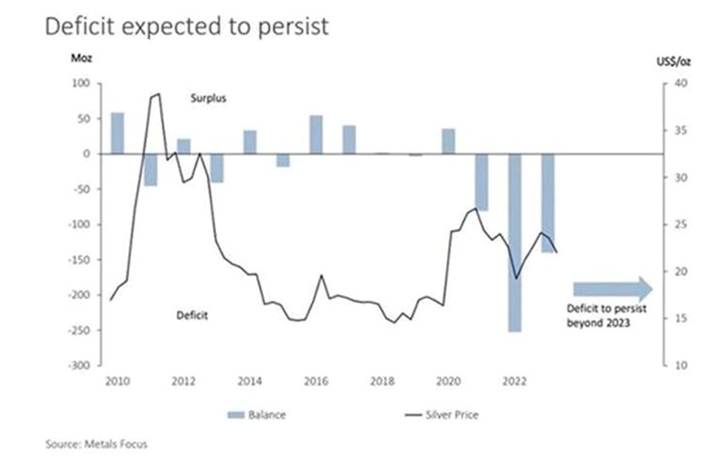

Total silver supply should decrease by 1%, meaning 2024 should see another deficit, amounting to 215.3Moz, the second largest in more than 20 years.

In fact it’s the fourth year in a row that the silver market would be in a structural supply deficit.

As for what’s in store for silver in 2025, UBS financial markets strategist Julian Wee says that silver could enjoy a spillover effect from gold.

He suggested stronger industrial demand could propel silver higher, especially if China lowers interest rates, sparking a recovery in global manufacturing. The People’s Bank of China lowered its benchmark lending rates by 25 basis points in October.

Wee said on the supply side, mining output should remain constrained in 2025. “We thus expect prices to reach USD$36-38/oz in 2025, and advise investors to stay long the metal or use it for yield pickup opportunities,” he said via Kitco.

In fact there is evidence to suggest that silver could be on the verge of its biggest breakout in history, with projections of $50 an ounce by mid-year.

2/ VMS

VMS deposits are some of the largest and richest in the world.

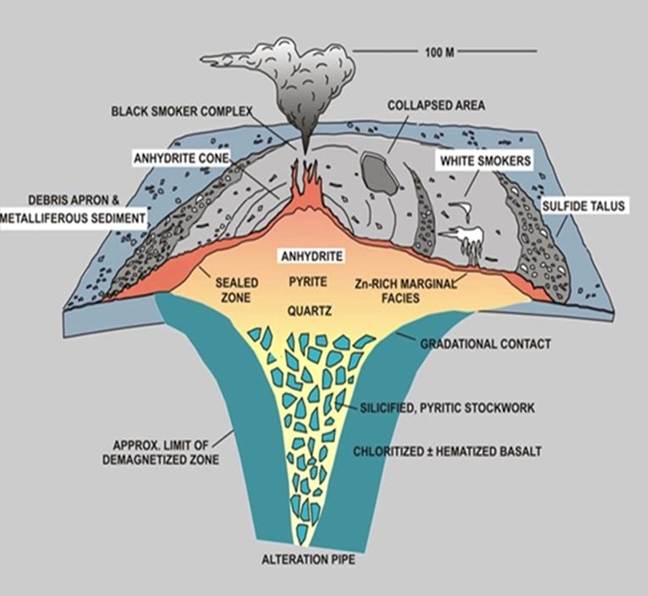

Volcanogenic massive sulfides are created by volcanic-associated hydrothermal events in submarine environments. They are predominantly stratiform accumulations of sulfide minerals that precipitate from hydrothermal fluids on or below the seafloor. These deposits are one of the richest sources of zinc, copper, and lead, with gold and silver as byproducts.

Source: Foran Mining.

VMS deposits are the primary source for many of the materials used to mold the modern world. These include zinc, lead, and copper.

VMS deposits exhibit distinctive characteristics that set them apart from other mineral formations. Typically, they feature a massive sulfide cap formed directly on the seafloor, with underlying stringer zones rich in copper-bearing minerals. These deposits often display vertical metal zoning, with copper concentrations near the vent transitioning to zinc and lead-rich zones in more distal areas. (Discovery Alert)

At Ahead of the Herd we believe there are many reasons a junior that comes upon a VMS deposit will be the belle of the ball as far as attracting investors, company suitors looking for a partner, a property, or an acquisition.

Due to the usual clusters of deposits, or ore lenses, in close proximity to the initial discovery, and the polymetallic nature of the ore, VMS deposits have immense potential for scalable high grade, long-term production.

Typically, several deposits feed a central mill so VMS mine production can be scaled up to produce high metal volumes for many years. Also, the byproduct credits generated from production of different metals can help miners enhance their cash profile – one or two of the metals considered a byproduct might cover a portion, or all mining costs.

And, because of their polymetallic content, they continue to be one of the most desirable types of deposit because of the security offered against fluctuating prices of different metals.

You have rich base-metal content and often precious metals to boot. Usually when gold and silver prices are up, the economy isn’t doing so well and base metals prices are down. The reverse happens during economic booms. VMS mines are winners through all the ups and downs of economic cycles.

All of these reasons are why VMS deposits have long been recognized, by both majors and juniors, as potential “elephant” country.

Some of the largest VMS deposits in Canada include the Flin Flon mine (62Mt), the Kidd Creek mine (+100Mt) and the Bathurst No. 12 mine (+100Mt).

3/ Critical metals

China has recently announced the halt of shipments of five critical metals to the United States. These elements include antimony, gallium, germanium, tungsten and indium. VMS deposits often carry critical metals in trace amounts. Prices since the halt of exports have soared, making previously uneconomic amounts potentially economic.

“The identification of gallium and antimony, among other critical minerals, within the resource zones has the potential to add significant value to our Red Mountain project. While we are focused on growing the silver-gold and base metals resource at Red Mountain, further assessment of these critical minerals, which are used in a myriad of high-tech applications, is planned to better understand the potential contribution that they may have on the project, says Silver North’s CEO Gary Thompson.

4/ Resource estimate

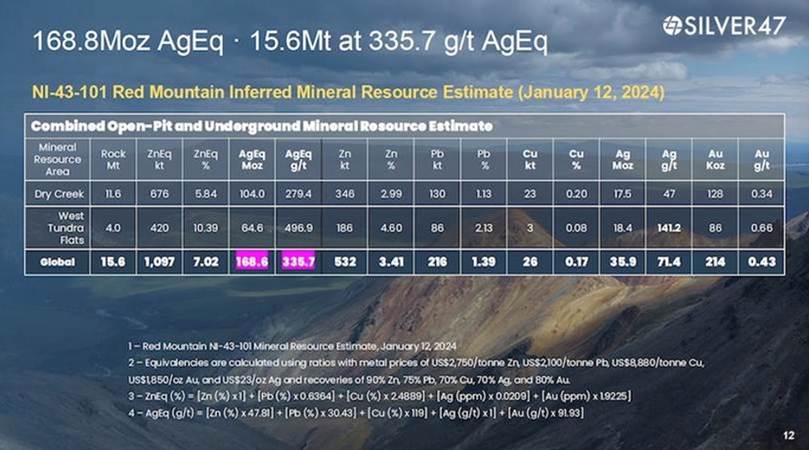

On Jan. 12, 2024, Silver47 came out with a mineral resource estimate for Red Mountain. The combined open-pit/ underground inferred resource amounts to 15.6 million tonnes at 335.7 g/t silver-equivalent (AgEq), containing 168.6Moz AgEq.

5/ Expansion potential

Both Dry Creek and West Tundra Flats are open for expansion and it is estimated that $10M in drilling may add 8-12 million tonnes of underground material, in my view a better-than-fair trade off between further dilution and in-situ increased shareholder value.

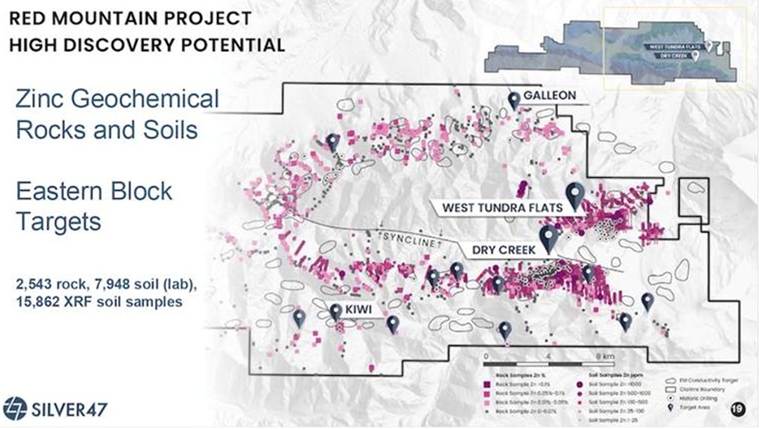

The high discovery potential is illustrated by the three maps below showing silver, copper and zinc showings in rocks and soils, gleaned from geochemical surveys. A total of 2,543 rock, 7,948 soil (lab) and 15,862 XRF soil samples were taken.

Galleon is a high-grade silver target, with silver samples up to 1,265 g/t Ag, 2.1 g/t Au and 5% Pb+Zn. Historical work includes mapping, trenching and prospecting, with drilling planned for this year. A 3.9-km IP geophysical survey identified two anomalies dipping south and striking east-west, consistent with local geology.

Another 2025 drill target is Horseshoe. The 2020 Keevy Trend SEDEX discovery contains semi-massive sulfides and 50-200m of mineralized stratigraphy, based on 2024 rock/ soil geochemistry.

The third priority target is Sheep Creek, also a SEDEX discovery. The strata-bound Ag-Zn-Sn massive sulfide occurrence features rock grabs up to 306 g/t Ag, XRF soils up to 60 g/t Ag, and up to 1.2% Sn (tin) over 2m reported from 1977 drilling. Silver47 is planning to map the area and to conduct dense soil XRF (X-ray fluorescence) to locate the extent of the mineralized horizons, thus aiding drill targeting.

I expect lots more news flow once Silver47 starts drilling its targets.

Silver47 Exploration Corp.

TSXV:AGA

Cdn$0.57 2025.03.06

Shares Outstanding 50m

Market cap Cdn$28.5m

AGA website

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Share Your Insights and Join the Conversation!

When participating in the comments section, please be considerate and respectful to others. Share your insights and opinions thoughtfully, avoiding personal attacks or offensive language. Strive to provide accurate and reliable information by double-checking facts before posting. Constructive discussions help everyone learn and make better decisions. Thank you for contributing positively to our community!

1 Comment

Leave a Reply Cancel reply

You must be logged in to post a comment.

#Silver #Criticalmetals