5 reasons why silver will shine long-term

2022.04.17

2022 was looking like another underwhelming year for silver, which was stuck in a wide range with no trading momentum during the first two months. The metal was only given a boost in March, when Russia’s invasion of Ukraine triggered a rush for safe havens.

Silver, like gold, is a precious metal that offers investors protection during times of economic and political uncertainty. The flight to safe haven subsequently sent silver prices past the $26/oz mark, which was last seen in August.

This silver rally proved to be a flash in the pan, however, as market-wide expectations of an aggressive rate hike campaign by the US Federal Reserve kept the safe-haven metal in check. Meanwhile, much of the attention has been on battery metals, which are leading this year’s commodity rally given the increased need to build more electric vehicles.

Still, there are multiple reasons to believe that longer term, silver will rebound — possibly returning to levels last seen during the early 2021 Reddit-fueled silver frenzy.

The potential forces behind silver’s next prolonged rally include:

- Safe Haven Demand

As things stand right now, the military conflict in Europe is likely to drag on with Russian President Vladimir Putin saying that peace talks with Ukraine have reached a “dead-end”. This means demand for safe havens will remain high in the near term.

The other major force driving up safe haven demand is the soaring inflation that is worrying the global market. In the US, consumer prices continued to rise during March, with a higher-than-expected monthly inflation rate.

And while silver has been relatively quiet, gold has been performing very well, despite facing pressure from expectations of rate increases — which will lift yields and compete with the metal — and a robust dollar. Eventually those gains could trickle down to silver, its sister metal.

- Clean Energy Transition

Unlike gold, silver isn’t just confined to serving the monetary role of a precious metal; it is also widely used as an industrial metal. Today, silver has many industrial applications, but its importance lies in the role it plays in the clean energy transition.

Silver is one of the main ingredients found in solar panels, as the metal’s high conductivity allows it to maximally convert sunlight into electricity. The average panel of approximately 2 square meters can use up to 20 grams of silver, accounting for about 6% of the total cost.

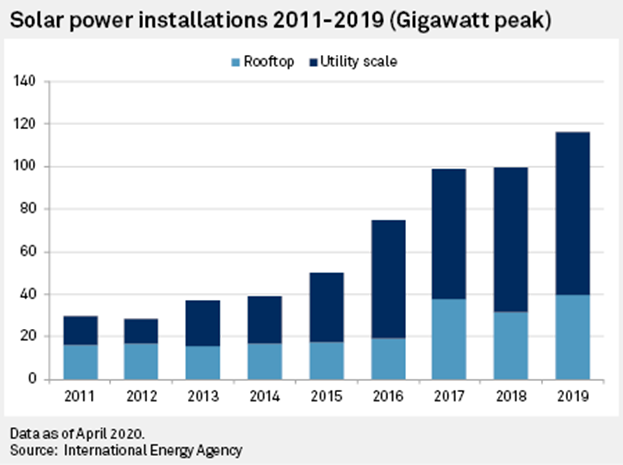

More and more silver metal is being demanded for use in solar photovoltaic (PV) cells, as countries around the world shift towards renewable energy sources. It is estimated that as much as 100 million ounces of silver are consumed per year by the solar sector.

This figure is expected to rise in the coming years, with continued growth of electricity demand, renewable energy aspirations and falling costs all pointing to rising solar power penetration.

Some projections have silver demand growing 85% to about 185 million ounces in 10 years, according to BMO Capital Markets.

- 5G Rollout

Another big driver of silver’s industrial demand is the gradual rollout of 5G technology across the world.

Among the 5G components requiring silver metal are semiconductor chips, cabling, microelectromechanical systems (MEMS) and Internet of things (IoT)-enabled devices.

The Silver Institute estimates that demand from 5G applications is expected to surge from the 7.5 million ounces currently to around 16 million ounces by 2025, then rising to as much as 23 million ounces by 2030.

The growing penetration of 5G technology in consumer electronics is expected to power a 7% increase above 2020 levels to 300 million, which is more than double the silver offtake needed by the solar power industry.

- Supply Deficit

On the other side of the equation, the supply of silver is struggling to keep up with demand, resulting in the market shifting to a deficit for the first time in six years. This is despite global mine output growing by a healthy 6% in calendar 2021.

In 2022, silver is likely to remain in a deficit, according to the Silver Institute, with global silver demand forecast to hit a record high of 1.11 billion ounces. Meanwhile, total supply, which is projected to grow 7%, will still be 20 million ounces short.

Exacerbating the supply challenge is eventually peaking of global mine supply, with the industry not investing enough in new silver projects to compensate.

- Low Relative Value

One key consideration for investing in silver is that it is relatively undervalued compared with other metal commodities. So far, we’ve already seen gold benefit from the flight to safe havens, allowing silver plenty of room to catch up after lagging behind for months.

In a recent interview with Kitco, Gainesville Coins precious metals expert Everett Millman said silver has the best chance to rise in 2022, given “it is so cheap relative to other metals and other commodities,” and figures prominently in emerging technologies and green energy.

Speaking of clean energy metals, as we’ve discussed previously, silver also tends to track closely to copper, which earlier this year set a new high after its supply was disrupted by the events that transpired in Europe.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.